What is Debt Ratio Formula? Definition and Overview

The debt ratio is defined as the amount of debt a company has compared to its overall assets and income.

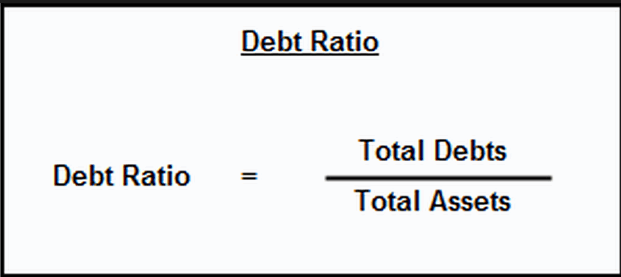

The debt ratio formula is quite straight forward.

Image Source: AdvisoryHQ

Simply put, the debt ratio formula is the total liabilities of a company, divided by its total assets.

Although the debt ratio formula is simplistic, it is still very important. It is a piece of information that is very useful to potential investors, for one.

If a company has a higher debt ratio, investors might perceive that as an unacceptable risk. A company with a lower debt ratio is normally a more stable investment – on average.

Debt Ration Formula – Additional Definition and Overview

The debt ratio formula should certainly not be used as the only tool for determining the stability of a given company.

There are some companies that have a very high debt ratio simply because of how they structure their operations.

Companies that are experiencing a strong growth rate also sometimes have a high debt ratio.

Image Source: Pexels

In essence, the debt ratio formula is a way to get a snapshot of a company’s finances.

If their ratio is low, they are not overly leveraged or at risk.

If it is very high, they may be in an over-leveraged situation, or may have particularly high operational liabilities that simply make their debt ratio appear higher.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.