What is Credit Rating?

Credit rating is defined as a professional analysis of the credit worthiness of a business, government or other institution. The purpose of a credit rating is to determine the probability that a debtor will default on loan payments.

Who determines Credit Rating?

Credit rating is provided by a credit rating agency. Although there are dozens of credit rating agencies around the world, the top three are Moody’s, Standard & Poor’s, and Fitch Ratings.

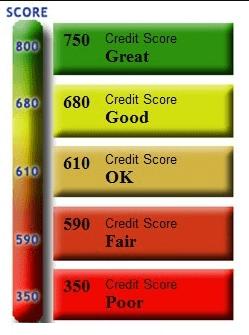

Credit rating is entirely distinct from a credit score, which pertains to an individual and is provided by a consumer credit reporting agency.

Image Source: What is Credit Rating

Who uses Credit Ratings?

Creditors such as banks and governments use credit rating to determine what type of credit, if any, they can safely extend to a given debtor. Potential investors also use credit rating to decide whether or not they should purchase bonds or other securities from a given entity.

Image Source: Credit Rating Defined

How is Credit Rating determined?

Credit rating agencies do not use pre-determined formulas to determine credit rating. Agencies have their own methods of determining an entity’s credit rating. Such methods include detailed economic studies and market analysis, which are necessary when determining the credit rating of large corporations and governments.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.