Questions (Is Wave Accounting Software Safe? How Does it Compare to QuickBooks?)

As a fast-growing financial product review media source, AdvisoryHQ has seen a lot of questions being asked about innovative financial apps, software, and platforms.

Some questions we’ve seen regarding Wave include:

- Is Wave Accounting safe to use?

- How does Wave compare to QuickBooks (see the section below titled: “Wave Accounting vs QuickBooks“)?

- Where can I find a Wave Accounting review?

- What’s so special about Wave Accounting software?

- How does Wave Accounting make money?

- Etc.

Answering These Questions About Wave Accounting (Reviews)

When it comes to selecting a business or personal accounting and finance tool, today’s consumers are sometimes overwhelmed with the sheer number of available options.

As a consumer, there are literally hundreds of different personal and business accounting tools and finance apps that you’ll need to wade through, analyze, and then pick whichever one is best for you.

So how do you decide which one to go with?

Well, that’s one main reason why AdvisoryHQ is in existence today.

Our objective is to provide free and objective reviews of financial platforms, services, and advisors.

We recently published our list of this year’s Best Personal Finance Software and also a list of this year’s Top Financial Planning Tools.

Image Source: Pixabay

Wave Accounting was included in both of these lists as a top accounting tool.

Click on the links above to view the reports and also get additional information on our selection methodology.

Below we present a more detailed review of Wave Accounting, including the many factors and features that we like about it.

Wave Accounting Review – The History of Wave

Wave Accounting was launched in 2010, and by the spring of that year had grown to a team of 7 people. In the summer of 2010, the firm released an alpha version of its Wave Accounting software, which was priced at a monthly rate of $9.95.

In November of 2010, Wave Accounting released its first major software version, which came with unlimited financial data downloads and unlimited invoicing.

By June of 2011, Wave had grown to a staff of 16 members with 20,000 customers. Five months later, it had 100,000 customers. Two years later, it surpassed 1.5 million users on its platform (a very impressive feat!).

Today, Wave Accounting is signing up 10,000+ small businesses every week, at an ever-growing growth rate.

The firm recently closed a $10 million Series C investment, which brings its total capital up to $35 million. The $10 million in new funds have been earmarked for ongoing innovation and further development of the firm’s core accounting and small business software.

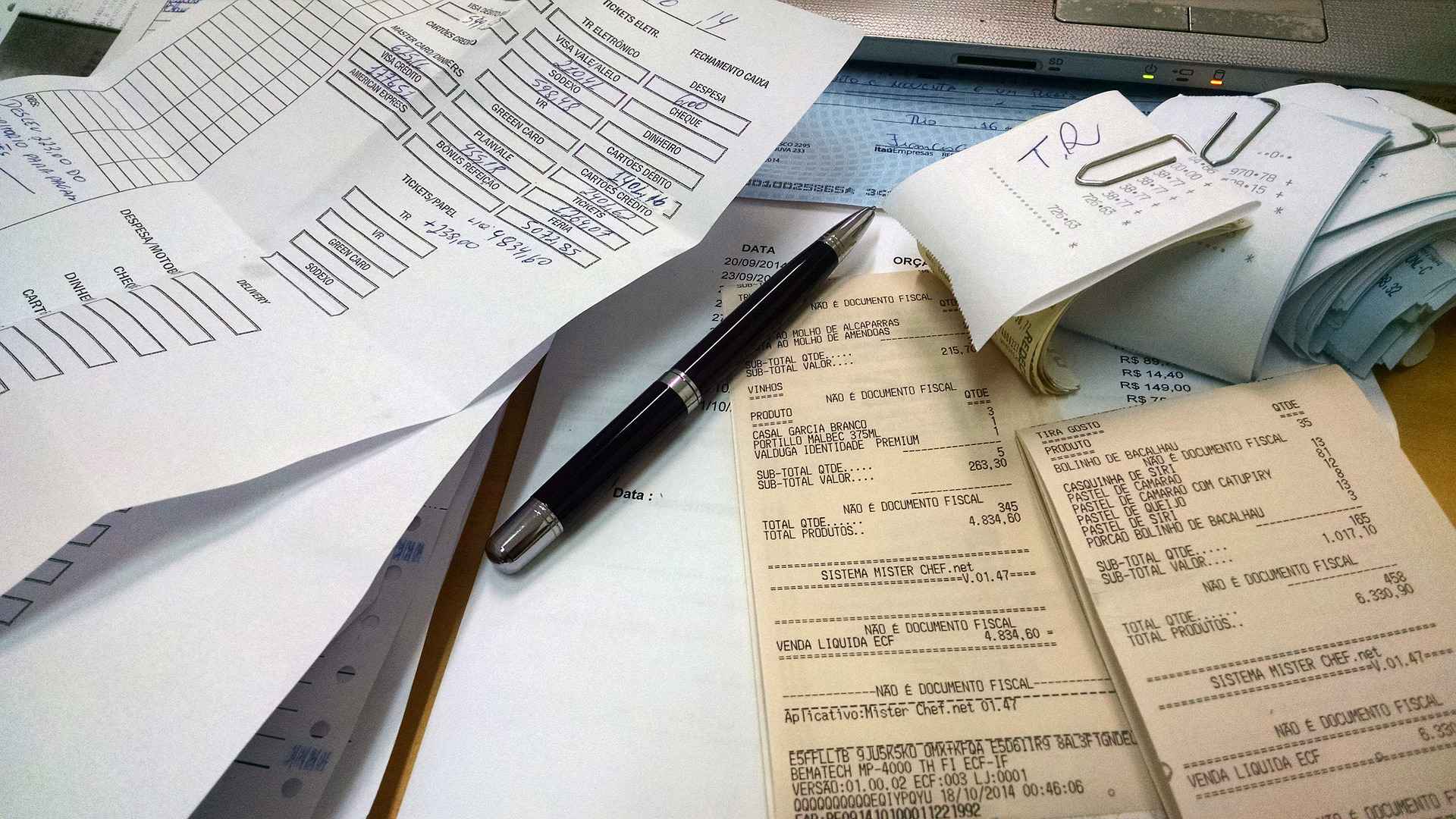

Image Source: Wave Accounting Software

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Detailed Overview – Wave Accounting Review

The Wave Accounting software is an all-inclusive integrated platform designed for small businesses and is used for managing accounting, payroll, invoicing, payments, bills, and other financial processes.

One powerful aspect of the Wave Accounting software is the integrated personal financial tool.

Having a combined business and personal financial tool has become a major attraction to the 1.5+ million small business owners and managers that currently use the Wave software.

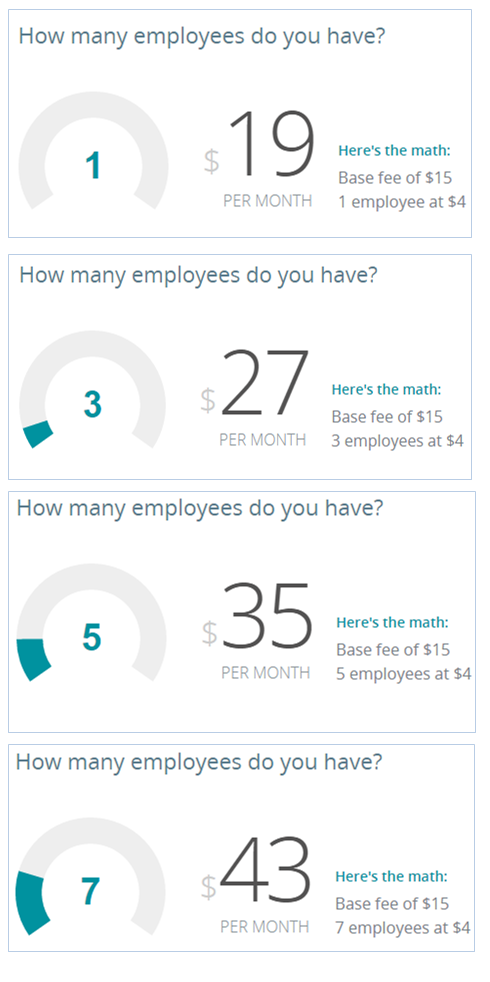

The Wave software is specifically designed for small businesses that have 9 employees or less. This includes contractors, entrepreneurs, freelancers, doctor offices, legal offices, mini store owners, mom & pop shops, IT offices, gas stations, financial advisors, planners, bloggers, and a wide range of businesses with 1-9 employees.

At its essence, the Wave Accounting tool is a top-notch accounting digital assistant for non-accountants.

The platform is very easy to use, and you can quickly link up your banking and financial accounts.

Your financial transactions will appear directly on the Wave interface dashboard in no time.

You can easily generate many different types of reports, including income statements, balance sheets, sales tax reports, accounts payable/receivable, etc., for yourself or your accountant, financial advisor, or investors.

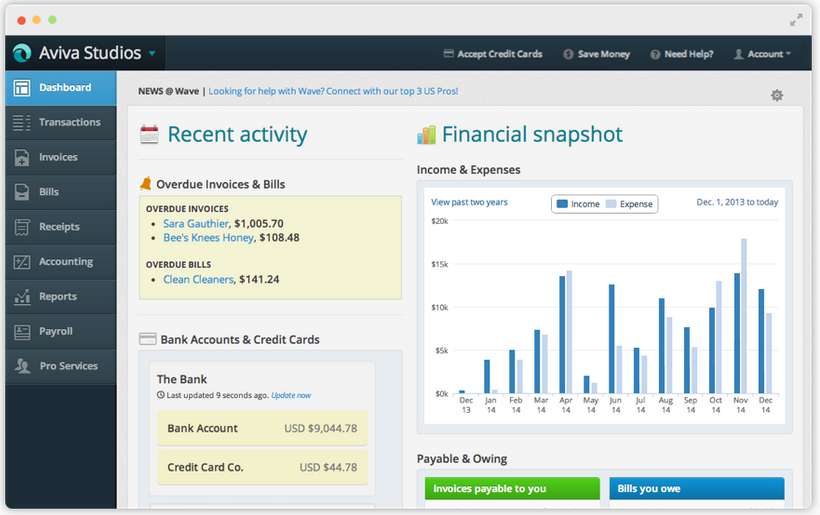

The Wave Accounting software is always 100% free.

There are no restrictions when it comes to using its many accounting tools and interfaces.

You can use the software as many times as you want. You can add as many customers as you want. You can also generate as many invoices, expenses, and reports as you need.

Unlike other accounting software that comes with a free 30-day trial, after which you are required to pay a fee to continue using it, Wave does not have a free trial. This is because Wave Accounting software and most (see exceptions below) of its integrated tools are always free, period.

Image Source: Wave Accounting Software

So, Which Integrated Tools are Not Free? (Wave Accounting Review)

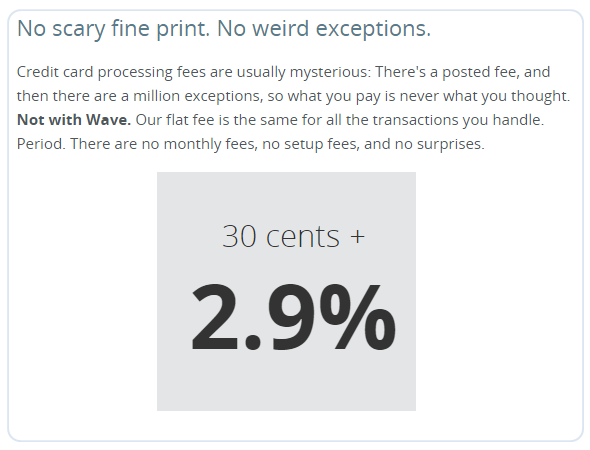

Due to associated fees that Wave has to pay for providing some services, the below tools/services in Wave come with a fee:

Wave Payroll Costs

Image Source: Wave Accounting Software

Image Source: Wave Accounting Software

Wave Payment Fees

Image Source: Wave Accounting Software

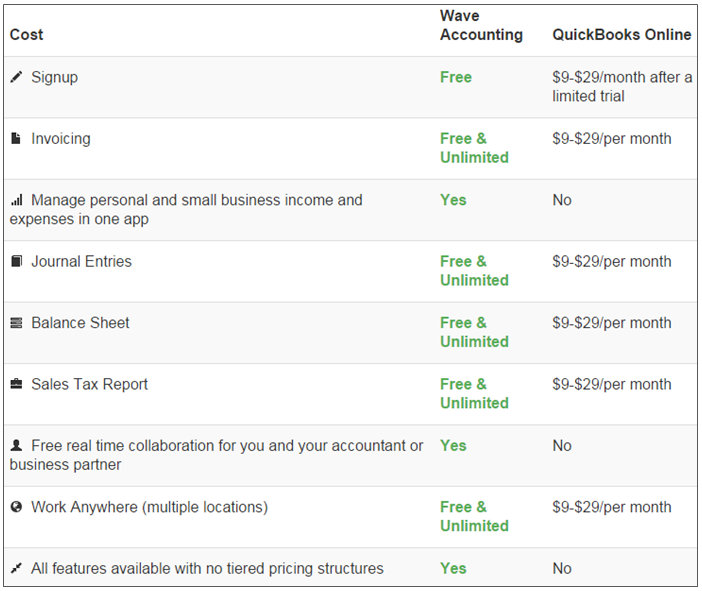

Wave Accounting vs QuickBooks

So, now to the question: “What are the differences between Wave and QuickBooks?”

For that answer, please refer to the “Wave vs. QuickBooks comparison table” below.

One major difference between these two software programs is that Wave is free, while you have to pay a fee to use QuickBooks (after the trial period).

Wave Accounting vs QuickBooks Comparison Table

Image Source: QuickBooks

So in General, How Does Wave Accounting Make Money?

Inside the Wave platform, you will notice offers from companies like Symantec, RBC, Amex, Staples, and others.

Wave refers to these offers as “Business Savings.”

The companies that provide these offers normally pay a fee to Wave in order for their offers to be shown/listed within the Wave platform.

In a way, this is a win-win situation for everyone involved.

The consumer is shown great offers that can save them money, in addition to getting free online software. Wave gets paid and uses the funds (and other externally-raised funds) to further enhance and expand its accounting platform. The companies that are listed also gain by having a presence within one of the fastest-growing financial and accounting platforms.

Conclusion

One last thing.

In case you are concerned about your information being shared with any of the companies mentioned in the above section (or with anyone in general), here is a word from Wave:

“Wave will never share personal/contact information or financial data about individual Wave customers with the companies that offer business savings.

No exceptions. Rest assured that you’ll never wind up on a 3rd-party mailing list.”

So, there you have it. This concludes our Wave Accounting review.

Best of luck in running that business of yours.

Now, go focus on what you do best, and leave the accounting complexities to your Wave Accounting digital assistant.

Oh, click here to sign up for Wave (it only takes 60 seconds) …

… then come back and read some more articles (see below and to the right of this page) or take a look at up to 40% discounted Quickbooks software here!

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.