Overview: eSmart Reviews (What You Should Know Before Signing Up with eSmart)

Whether you’re a returning customer or actively looking for new tax-filing software this season, our eSmart Tax reviews below will tell you everything you need to know before signing up!

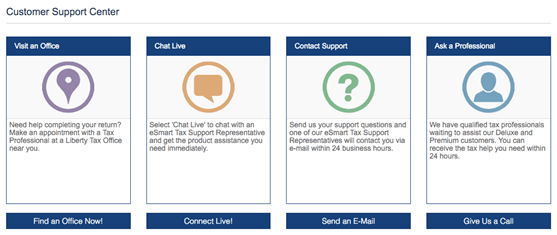

eSmart Tax, an online tax preparation software, is an economical, no-fuss method for filing both your federal and state tax returns. Backed by Liberty Tax Service, a company with more than 4,000 brick-and-mortar offices throughout North America, eSmart Tax is available in four versions designed to meet your filing needs.

The first thing our eSmart Tax review discovered is that eSmart stands out from other do-it-yourself platforms in two key areas:

- Unlike most other tax preparation software, eSmart Tax is only available online.

- eSmart Tax gives you the opportunity to receive in-person help from one of its 23,000 certified tax preparers at any of its offices in the United States or Canada.

Image Source: eSmart Tax

How Does eSmart Work?

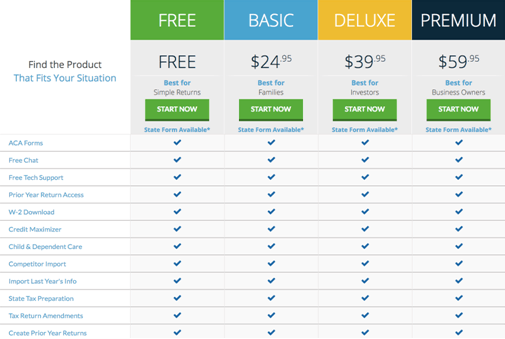

As our eSmart Tax review mentioned above, the product is only available online, so that means there’s nothing to download. You have the choice of four versions:

- eSmart Tax Free File Edition

- eSmart Tax Basic

- eSmart Tax Deluxe

- eSmart Tax Premium

A guided questionnaire is available to help you determine which of the four eSmart taxes will meet your tax filing needs. In order to complete the questionnaire, you will have to provide your previous year’s financial information.

There’s also a comparison list on its website to help you decide what’s right for you.

Image Source: eSmart Tax

All four versions use an interview “yes” or “no” question format to guide you through the process. The user-friendly interface also provides an alert if a plan upgrade would be to your benefit once you have started the filing process.

Each of the four versions includes customer support via your choice of email or live chat. All four come with a tool to assist you in downloading a W-2 form from your employer(s) for the previous year, and you even have the option to save tax returns for up to five years.

See Also: Prosper Reviews – All You Need to Know Before Using Prosper.com

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

eSmart Tax Free File Edition

The eSmart Free File Edition is made available as part of eSmart Tax’s participation in the Free File Alliance. The alliance is a non-profit coalition of some of the industry’s top leaders who’ve joined forces to help millions of Americans “prepare and e-file their taxes for free.” There are limitations to the eSmart Free File version (filing of federal returns is free, but filing of state returns costs extra), but all users of the eSmart Free File Edition can enjoy these features:

- Importing of last year’s return as a starting point, prefilling fields that haven’t changed – such as Social Insurance number/Social Security number, name, and address

- Earned income credit – if eligible, completion of a Schedule EIC is required and is supported by eSmart Free File

- Affordable Care Act forms – all forms associated with the ACA are supported by the eSmart Free File Edition

For filing a 1040WZ return, the eSmart tax free file is the best choice. If you elect to file a state return, you can do so for an additional $31.95.

eSmart Tax Basic

Basic is best suited for families with dependents as well as individuals or families with simple income from investments or stocks that can be reported using a Schedule B. Basic provides additional assistance handling health savings accounts as well as dependent deductions. You can file itemized deductions using the available Schedule A.

With eSmart Basic, federal e-filing costs $24.95. State filing is available for an additional $31.95.

Image Source: Signing Up with eSmart

eSmart Tax Deluxe

Are you a freelance business owner? An independent contractor? A sole proprietor? Do you invest? If you answered yes to any or all of these questions, then this is the version for you. With the Deluxe Edition, you get everything offered in the eSmart Tax Free File Edition, in addition to exciting extras such as the ability to:

- File additional tax credits

- Complete Schedule C (sole proprietors)

- Deduct business expenses, including home office deductions and asset depreciation

The Deluxe Edition is designed to help you maximize your business deductions. Federal e-filing using eSmart Deluxe is $39.95, with state filings available for an additional $31.95.

eSmart Tax Premium

The Premium Edition builds on everything included in the eSmart Free File Edition and Basic and Deluxe versions, but it’s geared toward small business owners with a more complicated tax situation. With the Premium Edition, you can tackle:

- Capital gains and losses (Schedule D)

- Maximize small business deductions

- Bonds

- Retirement income

- Schedule E (such as estates & trusts and certain types of partnerships)

- First-time homebuyer issues

- Rental income

- Get support for other schedules, such as K-1

You also get access to expert advice and guidance on items such as:

- Profits and losses for S corporations

- Sale of business assets

Federal e-filing with the Premium Edition runs $59.95, with an additional $31.95 for state filing.

Don’t Miss: Review of E-file Online Tax Software (E-file Reviews)

2016 Version

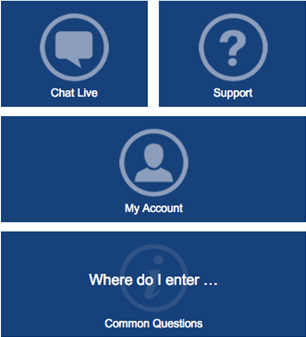

The eSmart 2016 version boasts a new interface that is more user-friendly and streamlined. Resources for determining your maximum tax deductions are somewhat limited. However, for the majority of taxpayers filing uncomplicated tax returns, eSmart Tax is a top choice.

The navigation bar at the top of the screen, available on the eSmart Free File and Basic, Deluxe, and Premium Editions, allows you to move around to specific sections of the return with ease.

Image Source: eSmart Tax

On the right-hand side of the interview screen, the help center gives specific guidance depending on your location in the return process. It also provides relevant frequently asked questions for the current section.

Image Source: eSmart Tax

The “Refund Ticker” provides an up-to-the-minute account of your refund (or, alternatively, taxes owed) as you complete your return.

Image Source: eSmart Tax

It is an especially good choice for those taxpayers who have seen little change in their return information from last year.

Additional Features:

- Connect via Social Media: Emphasizing communication without “confusing IRS-speak,” eSmart Tax encourages users to reach out with questions or comments via Facebook, Twitter or Pinterest.

- Guaranteed Price Lock: Even if eSmart Tax prices rise during the current tax season, you have its guarantee that you will not have to pay a penny more. The initial price you paid when you first opened your account and purchased your plan is locked in and protected against any cost increases.

- State by State: Whether you live in Alabama, Wisconsin or somewhere in between, eSmart Tax has a dedicated page on its website providing access to all the necessary state filing forms. The state pages also include links to general tax information, along with detailed official tax and state information.

- Maximum Refund Guarantee: eSmart Tax guarantees you the largest possible refund by using its software. If you file a return with another company identical to the one you filed using eSmart Tax and you receive a larger refund, eSmart Tax will reimburse your filing fees.

Related: TurboTax Reviews (Online, Personal, and Business Tax Filing)

Pros & Cons

Pros:

- Compatibility: eSmart Tax software is very easy to use. You can import forms from prior years from an assortment of competitors’ software programs and products. It is compatible with most other do-it-yourself tax software, such as TurboTax and H&R Block.

- Extra help: Whether it’s understanding what is really being asked on the tax form or needing clarification on the software itself, assistance is only a click away: either participate in an online chat, send off your question via email, tweet them or visit a branch of Liberty Tax in person. Multiple channels are available to access additional help if you need to reach out.

- Affordability: Regardless if you’re using the Premium version for $59.95 or the eSmart Tax Free File Edition, the software does the job for less than the price of others on the market. And while there are additional fees for state filing, at just under $32, eSmart is unquestionably cheaper than prominent competitors, like H&R Block’s and TurboTax’s $39.99 state filing fees.

- Satisfaction Guarantee: eSmart Tax is so confident in its product that it offers a “money back guarantee if you are not completely satisfied.”

Audit Assistance: eSmart Tax will help you get ready for the audit. It’ll meet with you in-person and provide additional information and explanations as to how the return was prepared. It also provides reimbursement, with no limit, if you’re hit with an IRS interest charge or penalty fee that results from an eSmart software error or miscalculation.

Cons:

- Internet dependent: Since eSmart Tax is online only, and you aren’t downloading anything to your computer, you will need to have access to a reliable Internet connection to complete your tax filing.

- Lacking Interactive Community Forum and Phone Option: The lack of an interactive online community forum can be frustrating for those who prefer that method of communication. It also doesn’t provide an option to call a customer service rep directly, but it does offer the face-to-face option in lieu.

- Static: Even with eSmart Tax’s new design, it just isn’t mobile friendly, and that’s a significant issue for those who use their phones or tablets for just about everything. There’s no app for this, and that is one area where eSmart will need to expand in order to keep up with the competition.

Overall

Our eSmart Tax reviews for of each of the four versions available determined that, overall, eSmart Tax is a good product. It does what it sets out to do: complete “accurate online tax filing” for a majority of taxpayers.

It is not, however, a replacement for navigation through the thousands of pages of nuanced complexities of the United States tax code. It is not a tax strategist. If your situation is straightforward and not too complicated, then this will walk you through the process quickly and easily.

However, if you are unsure about deductions or how to maximize personal tax savings for the long run, you may need additional assistance.

Popular Article: Best Online Tax Preparation Software for Individuals

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.