Intro – Fidelity Bank Reviews & Ranking

Fidelity Bank was recently ranked and reviewed by AdvisoryHQ as a top rated banking firm. Firms on our top-rated lists were selected after they successfully passed AdvisoryHQ’s groundbreaking, four-step banks and credit unions selection methodology.

Click here for a step-by-step breakdown of the methodology and selection process used during our Fidelity Bank review: AdvisoryHQ’s Methodology for Selecting Top Banks and Credit Unions.

The Fidelity Bank reviews below provide a detailed assessment, including some of the factors used by AdvisoryHQ in its ranking and selection of Fidelity Bank.

Fidelity Bank Review

From its roots as a single local bank in Fuquay Springs, NC, Fidelity Bank now boasts 58 locations throughout 26 counties in North Carolina and Virginia. The bank was founded in 1909 on the principals of honesty, integrity, and a passion for service.

A factor that makes this one of the top banking firms for many seeking a relationship with a local bank is that throughout its 100+ years, it has continued to be independent, profitable, and dedicated to a customer-first philosophy.

In an age where bank acquisitions happen all the time, Fidelity Bank remains staunchly independent and states on its website that it “is not for sale.” This can be a comfort to customers looking for the best banking companies that they can count on to be there for years to come.

Fidelity Bank Reviews 2020-2021

Our Fidelity review found that the bank aims to earn the loyalty of its customers to create relationships that last a lifetime or even span multiple generations, making Fidelity Bank one of the best banking companies to consider partnering with.

See Also: Top Credit Unions & Banks in Omaha

Key Factors Leading Us to Rank Fidelity Bank as One of the 2020-2021 Top Banking Firms

Upon completing our detailed reviews, Fidelity Bank was included in AdvisoryHQ’s ranking of the 2020-2021 top banking firms based on the following factors.

Fidelity Bank Reviews | Financial Security and Education

It is expected that leading banks provide security – especially online security – for their customers. Fidelity Bank is no exception; however, as one of the best banking companies, the firm goes one step further.

In an effort to ensure all customers with a Fidelity account understand how to stay secure while banking, it provides educational resources both on how to use its account services and important privacy and security topics.

You will find valuable information on how to protect yourself and your money, including tips for keeping your identity secure, how to prevent identity theft, and what phishing is and how to avoid it.

Our Fidelity review found that this help is offered in easy-to-watch educational videos for those looking for a more dynamic way to learn than text only.

Fidelity Bank Reviews | Mobile Banking

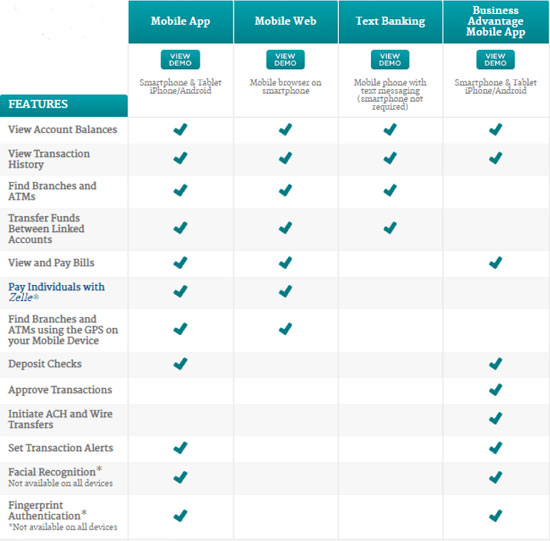

As one of the best banking companies, Fidelity Bank offers a full suite of mobile banking and Fidelity internet banking options. These provide secure access to all of your accounts. Platforms include the Fidelity Bank mobile app and mobile web browsers.

You can complete the following transactions with this convenient Fidelity internet banking service from your Apple or Android smartphone or iPad:

- View account balances

- View transaction history

- Transfer funds between accounts

- Transfer money using Zelle®

- Make bill payments

- Deposit checks

- Locate ATM and branch locations and find the nearest location near you

- Create and manage account alerts

Checks can be deposited online using the mobile app. You cannot, however, deposit checks using other Fidelity internet banking options (web, text) at this time.

Fidelity Bank also offers text banking for those with a Fidelity account, which allows you to view account balances and transaction history as well as search for ATMs and branches all by text message.

Compare and contrast the different services available via Fidelity Bank’s mobile banking platforms below.

Fidelity Bank Review

Conveniently, our Fidelity Bank review found that no fees are charged when you use its mobile banking service.

You are simply required to open a checking account, which automatically comes with Fidelity internet banking and bill payment services.

Keep in mind, however, that fees may be incurred by your mobile carrier for the usage of data and text messaging, separate from your Fidelity account.

Don’t Miss: First-Rate Raleigh, NC Banks & Credit Unions

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Fidelity Bank Reviews | Business Financing & SBA Loans

There are multiple business financing options for companies looking for loans, either for construction or just for additional capital. Being a local bank makes them among the top banking firms that small business owners go to for financing options.

This Fidelity review found that companies looking for SBA loans, can find them here. This has become especially important due to the COVID-19 stimulus package that included forgivable SBA loan options to help small businesses through a difficult time.

Our Fidelity bank review found that business owners have the following options at this bank when it comes to loans and financing:

- Business Line of Credit

- Construction loans

- SBA loans (SBA 7(a) and SBA CDC/504)

- Equipment and other fixed asset loans

- Letters of Credit

- Agricultural loans

- Commercial mortgage loans

- Business credit cards

Related: Best Colorado Springs Banks & Credit Unions

Rating Summary

The independent status of Fidelity bank enables it to always focus on serving customers first above all else. It also allows the firm to create and maintain its own mission and code of ethics.

For customers looking for top banking firms that offer modern services but still have a hometown feel, Fidelity is an excellent choice. In Fidelity bank reviews, it’s obvious that those who work for this bank continue to exemplify the community spirit the bank was founded on.

Overall, our Fidelity Bank review found a wide variety of financial services, mobile and online banking options, and educational resources, all helping to earn Fidelity Bank a 5-star rating as a top banking firm to consider in 2020-2021.

In addition to reviewing the above Fidelity Bank review, you can click on any of the links below to browse exclusive reviews of AdvisoryHQ’s top banking firms:

Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the rate table(s) displayed on this page.

Image Sources:

- https://www.fidelitybanknc.com/business/banking/checking-account-comparison/

- https://www.fidelitybanknc.com/welcome-to-the-fidelity-bank-website/resources/mobile-banking/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.