2017 Comparison Review: Fidelity Rewards Credit Card vs. TD Ameritrade Client Rewards Credit Card vs. Amex Everyday® Credit Card vs. Chase Freedom Cash Back Card

Seventy-two percent of consumers have at least one credit card. That means that over 167 million American adults have a credit card like the Fidelity cash back card or TD Ameritrade credit card.

However, it is important to note that opening a credit card is not something that can be taken lightly.

There are countless credit card issuers, and each of these issuers has multiple credit card offerings. However, when you get a card like the TD Ameritrade credit card, it is important to use it responsibly.

By mid-2016, Americans alone were approaching $1 trillion in credit card debt. With a credit card comes a credit limit that some people simply cannot afford, if they max out their card. Be sure to use your card responsibly.

By utilizing the following tips, you can continue to maintain a good credit score:

- Pay your credit card bills on time, every time

- Do not max out your credit card

- Pay more than the minimum amount due each month

- Deal with problems quickly

If you stick to these tips while using a Fidelity credit card or other card, and manage your account properly, a credit card is a great asset to have. The tricky part is then choosing a credit card that is right for you.

Throughout this article, we look at the difference between the credit cards offered by four issuers.

By breaking down the different features of each card, you can decide, based on your needs and preferences, what credit card to choose for your wallet: a Fidelity credit card, a TD Ameritrade credit card, the AMEX Everyday® Credit Card, or the Chase Freedom® cash back credit card.

See Also: Top Ways to Get the Best Free Prepaid Cards with No Monthly Fees | Guide

Why Open a Credit Card?

A credit card gives you many benefits over simply having cash in your wallet. Aside from easy access to a specified limit each month, there are pros that you may not have even considered with the Fidelity cash back card and others.

A card like the Fidelity rewards card gives you the ability to purchase items without having that exact amount of cash on you.

This is particularly beneficial when you are purchasing larger items. Walking to an appliance store with thousands of dollars of cash on you could be very unsafe, and cards like the Fidelity Rewards credit card allow you to avoid this danger.

Image Source: Pexels

Another benefit to having credit cards, such as the TD Ameritrade Client Rewards Credit Card, is that they allow you to partake in the digital world around us.

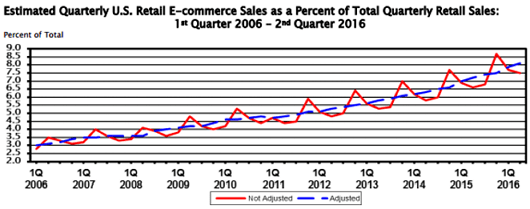

In the second quarter of 2016 alone, over $97.3 billion of E-commerce retail sales occurred. This is 8.1% of total retail sales. As this number continues to grow, the importance of having a credit card that allows you to partake in the E-commerce world does too.

Image source: U.S. Census Bureau News

Another benefit of having a card like the Fidelity cash back credit card is that you can earn rewards. There are Fidelity credit card rewards that come with the Fidelity Rewards credit card, and these can quickly add up to get you cash back. Cards like the TD Ameritrade Client Rewards Credit Card and others also offer cash back that reward you for purchases that you would make regardless.

Aside from the benefits listed above, you can also get credit cards that offer introductory APR periods, where you won’t accrue interest. There are also cards that you can use internationally with no charges.

Each card will have its own unique combination of features, and it is important to consider them as a whole.

There are plenty of benefits to opening a credit card like the Fidelity cash back credit card. The important thing when going through the selection process is to keep in mind what credit card benefits you are looking for when examining the Fidelity Bank credit card vs. TD Ameritrade credit card vs. American Express and Chase.

Don’t Miss: Best Credit Card Comparison | Guide | Best Ways to Compare Credit Cards Offers

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Fidelity Rewards Card vs. TD Ameritrade Client Rewards Credit Card vs. AMEX Everyday® Credit Card vs. Chase Freedom Cash Back Card

When comparing credit cards, it is important to consider your individual needs. The most important points to consider when comparing credit cards are:

- Fees

- APRs & Introductory Offers

- Type of Credit Needed

- Cash Back Rewards

- Sign-Up Bonus

Though we go into more detail on each of the credit card features below, it is important to take each one of these factors into consideration. Then, base your decision on your individual needs, not which credit card might appeal to the masses most.

Fees

While credit card companies make a profit through interest rates and usage, some credit card issuers also charge extra fees. This allows them to capitalize more on consumers who do not carry credit card debt and rack up interest charges.

Fees on cards like a Fidelity credit card range from annual fees, foreign transaction fees, balance transfer fees, and cash advance fees. An annual fee is charged every year on your anniversary date regardless of usage, while foreign transaction, balance transfer, and cash advance fees are only charged if you take a specific action to initiate the fee.

When it comes to annual fees, none of the credit cards in our comparison has one. This is a bonus for the cards in our comparison of the Fidelity credit card vs. the TD Ameritrade credit card vs. the AMEX Everyday® Credit Card vs. the Chase Freedom cash back. However, when comparing the Fidelity Bank credit card to the others, there is a difference when we look at the other types of fees.

At 3%, when it comes to balance transfer fees, the Fidelity credit card is the lowest on the list, tied with the AMEX Everyday® Credit Card. The TD Ameritrade Client Rewards Credit Card falls second at 4%, whereas the Chase credit card tops the list at 5%. If you are considering a credit card to transfer a balance to, the Fidelity Bank credit card or AMEX card might be a good option.

The Fidelity Bank credit card also has the lowest cash advance fee, tied with the AMEX credit card at 3%. The TD Ameritrade credit card and Chase Freedom® Credit Card have cash advance fees of 5%.

Finally, we look at foreign transaction fees. A foreign transaction fee is the percent you are charged on a purchase if you use your credit card internationally. While it is ideal to have a credit card without a foreign transaction fee, all the cards in our comparison have one.

The TD Ameritrade Client Rewards Credit Card and Chase Freedom cash back card top our list, with a 3% foreign transaction fee. At 2.7%, the AMEX card comes in second. The Fidelity credit card on our list has a foreign transaction rate of 1%, which is the lowest.

When it comes to fees, the Fidelity® Rewards Visa Signature® Card has the lowest. It doesn’t matter if you look at annual, balance transfer, cash advance, or foreign transaction fees, the Fidelity credit card is the best on our list.

Related: Best Credit Cards For Groceries & Gas | Guide | Finding Best Cards for Buying Gas & Groceries

APRs & Introductory Offers

An annual percentage rate (APR), is the annual rate charged for borrowing through a credit card. This percentage represents the yearly cost of funds borrowed over the course of a loan.

When you are considering credit cards, you want to choose a credit card that has a lower APR. This means that you will pay less interest on the money that you borrow. If you pay your bill in full every month, this may matter little to you, but for those who carry a balance on a card like a Fidelity Bank credit card, it is an important number to look at.

All the cards in our Fidelity credit card vs. TD Ameritrade credit card vs. AMEX Everyday® Credit Card vs. Chase Freedom cash back comparison, except for the Fidelity® Rewards Visa Signature® Card, have variable APRs. This means that your APR will be based on your creditworthiness. Applicants with better credit scores will be granted a lower APR, while those with lower scores may see higher APRs.

Again, standing out from the list, the Fidelity® Rewards Visa Signature® Card has a set APR of 14.24%. This means that no matter your creditworthiness, this is the APR you will be charged with the Fidelity Bank credit card.

The rest of the cards all have variable APRs. The AMEX and TD Ameritrade credit card have a variable rate from 13.24% to 23.24%, while the Chase Freedom® Credit Card has a variable APR between 14.24% and 23.24%. These numbers hold true for purchases and balance transfers.

Some credit cards also come with introductory APR periods, where an issuer will charge you 0% APR for a set period. While the Fidelity credit card and TD Ameritrade Client Rewards Credit Card do not have an introductory APR offer, the AMEX card comes with a 12-month period, and the Chase Freedom® Credit Card has a 15-month introductory 0% APR offer.

APRs are important to consider when you are choosing a credit card. This is especially true if you do not plan to pay your balance in full every month.

Popular Article: Best First Credit Card | Guide | How to Find Good Credit Cards for First-Timers

Type of Credit Needed

When considering applying for something like a Fidelity Bank credit card, it is important to look at the credit requirements. Certain cards specify that you must have a certain credit score to be approved.

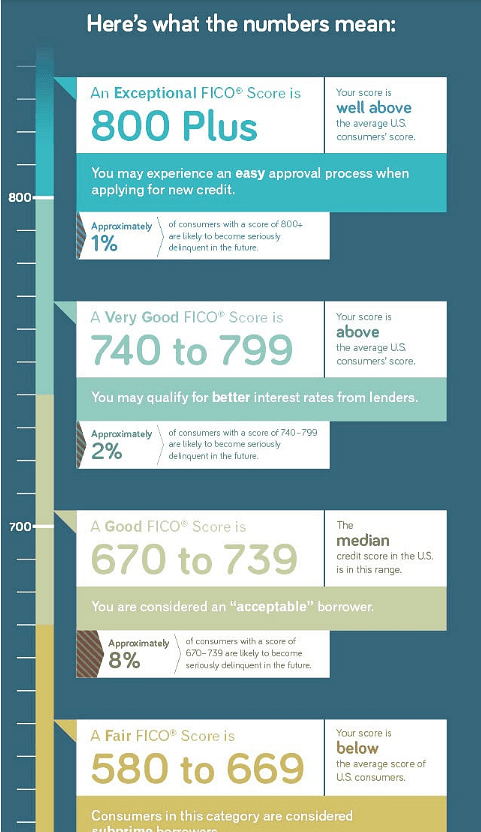

Before we get into what specific cards need, it is important to know how credit score ranges work. The chart below gives you a breakdown of FICO credit scores. Anything lower than a 579 is considered a poor score, whereas anything over a 670 is a good score.

Image source: Experian

Though the Fidelity® Rewards Visa Signature® Card has many benefits, you will need great to excellent credit to be approved. That means to get a Fidelity Bank credit card, your credit score will likely need to be at least 700.

Rest assured that even if you cannot qualify for a Fidelity Bank credit card, there are other options available.

For the AMEX Everyday® Credit Card, you will need a minimum of fair credit. This means at least 580, but likely over 600 to be safe. The same is true for the TD Ameritrade Client Rewards Credit Card and the Chase Freedom® Credit Card in our comparison.

While you cannot qualify for any of the cards in our Fidelity credit card vs. TD Ameritrade credit card vs. AMEX Everyday® Credit Card vs. Chase Freedom cash back comparison with poor credit, there are still good options.

Read More: Best Starter Credit Cards | How to Find the Best Credit Cards for Young Adults

Cash Back Rewards

Cash back rewards are used by issuers to convince you to use their card. Americans who use credit cards have, on average, 3.7 cards. That means issuers need to give you a reason to use their credit card.

This motivation comes through cash back and rewards offerings, like Fidelity credit card rewards. Fidelity credit card rewards, and those offered by other credit card issuers, reward you for purchases that you would make regardless.

For example, if an issuer offers 5% cash back on gasoline or grocery store purchases, you are more likely to use their credit card than a card that has lower cash back rewards in those situations.

A Fidelity® Rewards Visa Signature® Card will net you 2% cash back on all eligible purchases. Earning cash back points on everyday purchases is easy, and there are no rotating categories to keep track of. This Fidelity Bank credit card also comes with no earning limits, and these points will never expire.

The TD Ameritrade Client Rewards Credit Card has a rewards program that is easy to keep straight as well. You will earn 1.5 points for every dollar spent, with no exceptions or limits. If you like rewards programs without rotating categories that are easy to follow, the TD Ameritrade credit card is a good option, too.

The AMEX Everyday® Credit Card scores well when it comes to rewards. You will get 1 point for every dollar that you spend, with 2 points per dollar at grocery stores. As an added benefit, if you use your card at least 20 times in a billing period, you will get 20% more points for that period.

The Chase Freedom® Credit Card has interesting rewards earning potential. You will earn 5% cash back on categories that rotate every quarter, and 1% cash back on every other purchase. It can be tricky to follow the rotating categories with the Chase Freedom cash back card, but as you can see on our list, 5% cash back is hard to beat.

Cash back and rewards programs are something to keep in mind. It is important to know how you would like to receive rewards, too. Do you like cash back, points, or even airline miles? Consider your preference when reviewing these credit cards.

Sign-Up Bonus

While continual cash back incentivizes customers to use their credit cards, issuers often offer sign-up bonuses to incentivize customers to even apply for their credit card to begin with. These offers can be in the form of cash back, statement credits, points, or even airline miles.

The AMEX Everyday® Credit Card has a good sign-up bonus offer. If you spend $1,000 in the first three months, you will get 10,000 bonus points. That’s only $334 a month to get 10,000 points.

If you are looking for a cash back sign-up bonus, the Chase Freedom® Credit Card does not disappoint. By spending $500 in the first three months, you will get $150 cash back. This is an easy sign-up bonus to achieve, which makes this Chase Freedom cash back card hard to pass up.

Similar to the Chase Freedom® Credit Card sign-up offer, the TD Ameritrade Client Rewards Credit Card offers $100 cash back if you spend $500 in the first three months. If you’re going on signup bonus alone, the Chase card may be the better option.

Unfortunately, the Fidelity® Rewards Visa Signature® Card does not come with a sign-up bonus. However, this does not mean that it should be excluded from your consideration. While not having a sign-up bonus offer is a drawback, other features make this Fidelity credit card stand out.

A sign-up bonus is a great thing to have, but it shouldn’t make or break whether you consider a credit card. A card with a massive sign-up bonus may have other features that cost you more down the road. While you should definitely consider a card’s sign-up bonus, remember that it is a one-time benefit, and that other features will carry on for the life of your card.

Free Wealth & Finance Software - Get Yours Now ►

Conclusion: Fidelity Cash Back Credit Card vs. TD Ameritrade Credit Card vs. AMEX Everyday® Credit Card vs. Chase Freedom Cash Back Card

When choosing between American Express, Chase, a Fidelity cash back card, and the TD Ameritrade credit card, it is important to consider all the features above. Do not just pick the first credit card that you see.

Instead, consider what you truly need in a credit card, and choose the credit card that meets your needs best.

Whether you choose the TD Ameritrade credit card, the Fidelity rewards card, the AMEX card, or Chase Freedom, just make sure that you choose the best one for you.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.