Definition: What is a Financial Plan?

A financial plan is defined as an in-depth evaluation of an individual or family’s financial circumstances, based on where they currently stand and the financial objectives they want to meet in the future.

Typically completed with the assistance of a licensed financial professional, such as a financial advisor or a certified financial planner, a financial plan can be a comprehensive method that is used to understand the implications of certain financial decisions or indecisions.

Basics of a Financial Plan

A financial plan may also help a client assess how well he or she is invested based on their individual risk tolerance and time frame, or how much more they may need to save toward their retirement goals or education funding for children.

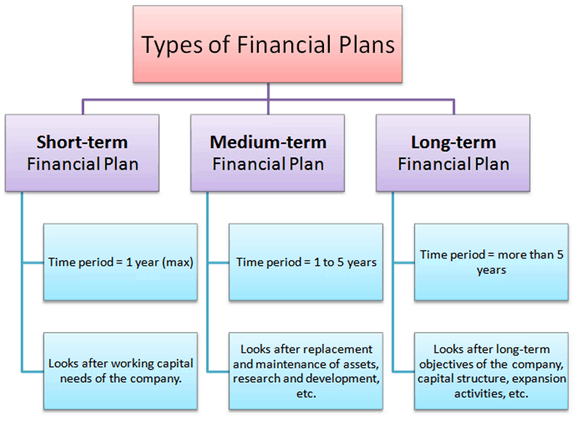

Types of Financial Plans

Roadmap

The financial plan is not simply a document that states a current financial picture, but ultimately helps individuals assess progress toward stated goals and lays out strategic steps to achieve those goals.

A financial plan should act as a roadmap toward financial success that is both suitable and the most efficient for the individual or family receiving the plan.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.