Overview: How to Find Top 20-Year Fixed Mortgage Rates Today and Every Day

Heading into the beginning of 2017, we are still seeing historic lows in mortgage rates. This has led to an increase in home purchases, especially for first-time homebuyers.

In 2015, 32% of homebuyers were first-time buyers with a median age of 31 years and a median household income of $69,400. With a lower income, shaving percentage points off a 30- or 20-year fixed mortgage is extremely important.

Among homebuyers financing their home, most financed about 90% of the home price. Those looking for mortgages to cover large portions of financing often wonder what the best option for a mortgage is.

They’ve heard about 15-year mortgages, 20-year fixed rate mortgage loans, and others. As you begin your search for mortgage rates for 20-year fixed loans, there is a lot to take into consideration. Homebuyers have mortgage questions, including:

- Is a 20-year fixed mortgage rate better than a 30-year?

- Where can you find 20-year fixed rate mortgage loans?

- What are the benefits of a 20-year mortgage?

- Are there drawbacks to getting 20-year fixed mortgage rates today?

- What can you do to secure the best mortgage rates for 20-year fixed loans?

If you have been wondering similar things, or are looking to get the best 20-yr fixed mortgage rates, then look no further. Throughout this article, we will explain different types of loans and then walk you through the process of how to find the best 20-year fixed mortgage rates today. It can be a confusing and challenging process, but with our guide and tools, you will be able to secure a great 20-year fixed mortgage rate.

See Also: How to Find the Highest Savings Account Rates | This Year’s Guide | Highest Savings Rates

What Do You Know About Mortgage Rates and Loans?

Image source: Pixabay

When looking at mortgage loans, you need to consider more than just a 20-year fixed mortgage. There are different loan types and terms that you need to understand when going through the process.

You can choose a 15-year mortgage, 20-year mortgage, 30-year mortgage, or even some options in between. There are adjustable rate mortgages (ARMs) and fixed rate mortgages. Looking at all the options, it’s easy to get confused. That’s why we’re here to break it down simply for you. Here are a few things to pay close attention to:

- Prequalified and preapproved

- Loan term

- Fixed versus adjustable mortgage rates

First, you need to know how much house you can afford. One way to do this is getting prequalified for a loan. This involves providing financial information to a bank or mortgage broker so that they can determine how much they are able to lend you. By using the Discover Affordability Calculator, you can calculate a rough estimate of how much you will be able to afford using 20-year fixed mortgage rates, or other mortgage terms and interest rate options.

Next, we will look at mortgage loan terms, which is the length of a mortgage. A 15-year mortgage will have higher monthly payments, but you will pay less over the length of the loan because your interest rate will be lower. A 30-year mortgage will have lower monthly payments but higher rates and more total interest paid. 20-year mortgage rates fall right in the middle in terms of rates and monthly payments.

Finally, a fixed-rate mortgage is when the interest rate on your loan does not change. This also means that your mortgage payment will always be the same month to month. The drawback to this is that banks often set higher interest rates to begin with than they would on an adjustable rate mortgage. 20-year fixed mortgage rates will stay the same, while 20-year mortgage rates that are adjustable will fluctuate based on market interest rates.

There are many different options for loans, and each has their own benefits and drawbacks. While a 15- or 30-year mortgage is more standard, 20-year fixed rate mortgage loans are a great middle ground between the two.

Don’t Miss: Mortgage Interest Rates Trend | Key Mortgage Rate Predictions, Trends, and Graphs

Why You Should Choose a 20-Year Mortgage

With so many different mortgage types, you may be wondering why 20-year mortgage rates should be your focus. Here are a few reasons why 20-year fixed mortgage rates are a great option for a mortgage:

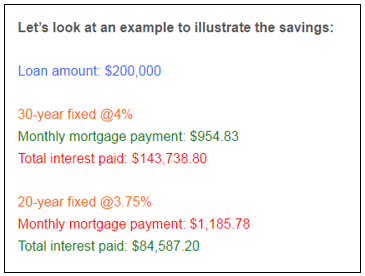

- Interest rates: You will find much better 20-year fixed mortgage rates than 30-year mortgage rates. As shown in the chart below, even a small difference can make a big impact on the total cost of a loan. In the example below, by paying $230.95 more a month, you will save almost $60,000 on interest over the life of your 20-year fixed mortgage.

Source: The Truth About Mortgage

- Monthly Payments: A 15-year mortgage is a good option for those with more cash flow, but a 20-year fixed mortgage has payments that are more affordable.

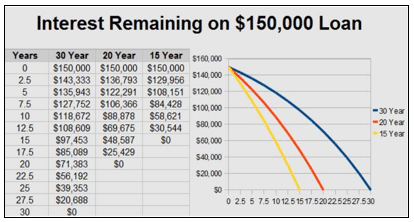

- Amortization: As the chart below shows, the amortization on a 20-year mortgage follows a 15-year mortgage more closely than a 30-year mortgage.

Source: Credit Sesame

- Financial Freedom: With a 20-year mortgage, you will be free from mortgage payments earlier. If you are planning to stay in a house for the long term, with 20-year mortgage rates, you will be living mortgage free 10 years sooner than if you took a 30-year term!

Now that you’ve learned the benefits of having a 20-year fixed mortgage, the nest task is how to find the best 20-year mortgage rates. This is not always easy when there are so many options out there, but the next section is designed to walk you through the process of finding great 20-year fixed mortgage rates.

Related: Top Best Corporate Credit Cards | Ranking | Compare the Best Company, Corporate, and Business Cards

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

How to Find the Best Mortgage Rates for 20-Year Loans

When you begin your search for the best mortgage rates for 20-year loans, you need to do your due diligence. Purchasing a house is a massive financial commitment, and there are several aspects to consider. Finding the best 20-year mortgage rate is important, because even a slim different in mortgage rates can make a large impact on the total cost of a loan. While going through the process of finding the best 20-year fixed mortgage rates, follow these steps:

Examine & Improve Your Credit Score

When you are looking for the best 20-year fixed rate mortgage loans, the higher your credit score, the better your mortgage rates for 20-year fixed loans will be. Banks always look at credit scores when determining 20-year fixed mortgage rates today. If your credit score is subpar, it might be time to look at how you can improve it.

How to Improve Your Credit Score to Find the Best 20-Year Mortgage Rates

How can you improve your credit score? Here are a few tips from Forbes to improve your credit score quickly to get better 20-year fixed mortgage rates:

- Get a credit card

- Become an authorized user

- Under-use credit cards

- Raise your credit limit

- Don’t close cards

- Pay your bills on time

- Negotiate

The first step to having good credit is having a credit card. According to Forbes, having at least one, if not two, credit cards can improve your overall credit score. If you cannot secure a credit card on your own, consider asking a family member to add you on as an authorized user. By getting some credit history, you can improve your score a bit and, in turn, your 20-year fixed mortgage rates.

Another way to improve credit scores to find better 20-year mortgage rates, is to under-use your credit cards. At any one time, you should be utilizing no more than 30% of your available credit. A utilization rate closer to 10% is actually the best way to maximize your credit score. If you cannot cut down on your spending at the time, consider asking for a raise on your credit limit.

It is also important that you don’t close credit cards. This causes your available credit limit to decrease and increases your credit utilization rate.

This lowers your credit score and can increase the 20-year mortgage rates that you are offered by lenders. Payment history also accounts for 35% of your FICO credit score, so make sure that you pay your bills on time. Automatic payments are a great way to make sure that you never miss a payment due date.

One way to lower credit that people don’t often consider is negotiating. If you face significant financial hardship, you can ask creditors to remove the debt from record.

By offering to pay remaining balances if the creditor will report it “paid as agreed” or remove the debt completely, you may be able to erase the negative impact on your credit score. While this may not always prove successful, if it does, you can increase your credit score and get better 20-year mortgage rates.

If time is of the essence, it may be too late to try to increase your credit score in order to obtain better 20-year fixed mortgage rates. It can often take 30 to 60 days to see any improvement in your credit score. Even if you can’t raise your credit score in time, there are other ways to find the best 20-year fixed mortgage rates.

Consider How Long You Will Be in Your House

When you are looking at securing a mortgage to purchase a house, you need to consider how long you will be staying in the house. This will change whether you choose a 20-year fixed mortgage or an adjustable rate 20-year mortgage.

If you are only planning to be in a house for a few years, it makes sense to take advantage of the low initial interest rate of adjustable 20-year mortgage rates. However, you must make sure that you will only be in a house for a few years, or you might be stuck in a house that you cannot afford paying for. In 2008, many homeowners were reaping the rewards of low initial rate adjustable rate mortgages, but when the value of their homes fell as interest rates hiked up, they were unable to sell.

If you are planning to be in a house for the long run, or do not like to take risks, 20-year fixed mortgage rates are the best option. This will allow you to secure a lower interest rate for the long run. With steady 20-year fixed mortgage rates, your payments will be the same month to month. This allows you to plan long term for the future, with no mortgage rate surprises.

Compare Rates

It is important to compare 20-year mortgage rates throughout your search. While one 20-year fixed mortgage rate might seem like a great option, you cannot stop at the first offer. Other banks and lending institutions may offer better 20-yr fixed mortgage rates that will lower the total interest paid over the course of your 20-year mortgage. The more lenders that you look into when shopping for 20-year mortgage rates, the more likely you are to nab a lower rate.

Throughout your search, the internet will be your best friend. Many sources offer mortgage rate quotes from a variety of trusted banks and lenders if you enter some basic information. Bankrate offers a tool that shows not only 20-year mortgage rates, but also 30-year and adjustable mortgage rates. Utilizing tools like this and comparing the results will allow you to narrow down your search and find the best 20-year fixed mortgage rates possible.

Increase Your Down Payment

The higher a down payment is, the lower the mortgage rates for 20-year loans will be. This is as true for 20-yr fixed mortgage rates as it is for 15- and 30-year mortgage rates. Though it can be difficult to part with a larger lump sum of money up front, this can help you secure lower 20-year mortgage rates and lower monthly payments.

Another benefit of a 20% down payment is that you will be able to avoid private mortgage insurance (PMI). These PMI fees vary depending on your credit score and the down payment size, but they are generally between 0.3% and 1.5% of the original loan amount per year. By increasing your down payment, you can lower the amount that you will be paying on your 20-year mortgage, as well as your monthly mortgage payments.

Popular Article: Best 5-Year CD Rates | How to Find the Best Interest Rates on 5-Yr CDs

Conclusion

When you are looking for the best 20-year mortgage rates, it is important to understand the process. By securing the best 20-year fixed mortgage rates while interest rates are still low, you can shave hundred, thousands, or tens of thousands of dollars off the total cost of your 20-year mortgage.

Remember that there are many options available when you are looking at 20-year fixed mortgage rates today. In order to secure the best 20-year fixed mortgage rates today, it is important to:

- Understand what you can borrow

- Know how long you will stay in the homea

- Analyze and improve your credit score if necessary

- Compare the 20-year mortgage rates of many lenders

- Increase your down payment

By utilizing the steps above and the tools throughout this guide, you will be able to secure some of the best 20-year mortgage rates on the market.

Read More: Best CD Interest Rates | Ways to Find the Best CD Bank Rates

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.