Finding the Best CD Accounts – What to Consider

When it comes to saving for your future, there are definitely a lot of options out there. Saving and investing can be quite confusing, especially for those who are just getting started.

If you are in the market for a CD account, you have come to the right place. Here, at AdvisoryHQ, we know the importance of smart saving. Let us help you find the best CD accounts.

To help you get started, we have come up with a list of questions that you should ask yourself. Being prepared with the answers to these questions will not only help you to find the best CD accounts for your own personal needs but also help you to see if CD accounts are the right option for you.

- How long can you be without your money while it is earning interest in your CD account?

- What are your ultimate goals when it comes to saving?

- Are you ready to make a committed investment?

See Also: Banks with Free Checking Accounts | Top Ways to Find Free Checking Account Banks

CD Bank Account vs. Savings Account – Which One Is Right for You?

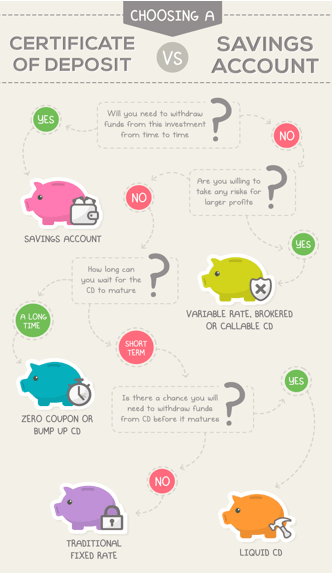

As you delve deeper into your options for saving for the future, you may wonder if a CD or a savings account is the best way to go. The good news is that they are both great options when it comes to saving.

Typically, a CD savings account is going to yield a higher interest rate, but there are some drawbacks. Here is a chart that will help you decide which one is right for you.

Source: cd savings account

If you decide that a CD account would work best for your savings plan, you will then need to make sure that you find the best CD accounts with the highest rates.

Don’t Miss: Finding the Best High-Interest Checking Accounts & High-Interest Online Savings Accounts

How to Find the Best CD Account Rates

Before you choose the best CD account from the many options in the financial market, it is important to make sure that you understand the rates.

Finding the best rates is going to be critical when it comes to your overall savings goals and, ultimately, your future. Rates are going to vary, depending on the prime market rates, but sometimes you can find great deals. You just have to know what you are looking for.

According to the FDIC, these are the current national averages for interest rates on CD accounts with deposits less than $100,000:

Deposit Products | National Rate 1 | Rate Cap 2 |

| Savings | 0.06 | 0.81 |

| Interest Checking | 0.04 | 0.79 |

| Money Market | 0.08 | 0.83 |

| 1 month CD | 0.06 | 0.81 |

| 3 month CD | 0.08 | 0.83 |

| 6 month CD | 0.13 | 0.88 |

| 12 month CD | 0.22 | 0.97 |

| 24 month CD | 0.36 | 1.11 |

| 36 month CD | 0.49 | 1.24 |

| 48 month CD | 0.61 | 1.36 |

| 60 month CD | 0.78 | 1.53 |

Here are its current averages for deposits over $100,000:

Deposit Products | National Rate 1 | Rate Cap 2 |

| Savings | 0.06 | 0.81 |

| Interest Checking | 0.04 | 0.79 |

| Money Market | 0.12 | 0.87 |

| 1 month CD | 0.07 | 0.82 |

| 3 month CD | 0.09 | 0.84 |

| 6 month CD | 0.14 | 0.89 |

| 12 month CD | 0.23 | 0.98 |

| 24 month CD | 0.39 | 1.14 |

| 36 month CD | 0.52 | 1.27 |

| 48 month CD | 0.64 | 1.39 |

| 60 month CD | 0.80 | 1.55 |

These rates will fluctuate, so it is important to continue to check back for changes. Click here for updated rates so that you can determine the best time to open your certificate of deposit.

There are a few things that you can do to ensure that you get the best rates for your CD savings account. Here are a few tips to get you started.

Compare and Contrast the Best CD Accounts

As you begin to look into the various CD bank account options available to you, chances are you will have several questions to ask each of the financial companies. We have made a cheat sheet that will help you make sure that you get the best CD investment options for your savings strategies. Here are a few questions that you will want to ask about a potential CD account:

- How long is the investment period?

- What is the minimum deposit amount for the CD savings account?

- What are the current interest rates for the CD bank account?

Make sure to record the answers; this way, you can keep these notes handy as you continue your search for the best CD account. While these might not be the only questions that you will want to ask, and you may have more questions that come to mind later, these will get you started on the right track.

Consider Investing in a Long-Term CD Account

Image source: Pixabay

As a general rule of thumb, the longer you leave your money in a CD account, the higher the interest rate will be. Long-term CD accounts will not only give you more bang for your buck in the long run, but they also keep your money safer for longer. The main drawback to a CD account with a longer term, however, is that you are unable to access your money for even longer.

If you can afford the long-term CD accounts and won’t be put in a financial bind having the money tied up, it is definitely worth your while in the long run.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Don’t Limit Yourself to a Traditional CD Savings Account

Traditional CD accounts may seem ideal for many consumers, but there is something to be said about nontraditional accounts. If you limit yourself to the traditional CDs, you may be doing yourself an injustice in the long run. With interest rates currently at an all-time low on even the best CD accounts, it is thought that they will be on the rise in the near future. With that being said, look for the best CD accounts that have variable rates.

While these CD accounts may be a bit riskier for you, they have the potential to give you the highest return on your investment. You may start out with a lower rate, but as market rates change and increase, your rate will reap the benefits.

Related: No-Fee Checking Accounts | Top Tips to Finding Checking Accounts with No Fees

The 5 Most Common Types of CD Accounts

Now that we have covered some of the basics when it comes to choosing the best CD accounts, it is time to take a look at the different types of CD accounts that you have to choose from. There are, in fact, many available, but we are going to cover the 5 most common types of CD bank accounts.

1. Online CD Account

In this day and age, more and more people are choosing to do their banking online. That being said, it is no surprise that an online CD bank account is becoming increasingly popular. Online banks don’t have as much overhead expenses and are, therefore, able to pass their savings on to consumers in the form of higher rates of interest.

In fact, according to Rob Berger with Forbes, “The benefit of CDs from an online bank is that they are easy to open, are available nationwide, and offer higher rates than traditional brick and mortar financial institutions.”

2. Brokered CD Account

Another one of the more common best CD accounts is the brokered CD. These accounts are not your traditional CD account opened at a bank. To get a brokered CD, you must open a CD account with a financial advisor, brokerage firm or other financial professional. Typically, this type of CD bank account will have a higher rate of interest than traditional, bank-originated CD accounts.

A brokered CD account may come with added fees; however, oftentimes, the higher interest yield will more than make up for the fees associated with this account. This is something that you will want to take into consideration when looking for the best CD accounts.

3. Liquid CD Account

When you put your life savings into a CD account, you might consider a liquid CD. This type of CD is great for people that want to have a little bit of flexibility without really taking away from their rates. As we have mentioned before, the longer the money stays in the CD account, the more it will pay off in the end. With a liquid CD bank account, you will be able to access portions of your money before the maturity date. This gives you freedom and flexibility without taking away your financial gain.

4. Callable CD Account

Possibly the closest to traditional CD accounts is the callable CD. This CD is likely to offer one of the highest interest rates among CDs, but there is a catch to it: all CDs come with a time frame associated with them. The maturity date for your callable CD savings account may be 5 years from the date that you opened it. The drawback with this type of CD is the bank’s ability to terminate it early.

That means the interest rate will likely be higher, but you have the potential to not be able to keep the CD for as long as they initially said you could. That means that you won’t collect the full amount of interest over the five year period. Instead, you would only collect interest from the date you opened your account until the date that they terminate.

5. No-Penalty CD Account

Upon opening your CD savings account, you will likely find that one of the biggest drawbacks is that you have to pay a fee to access your money before the maturity date. With a no-penalty CD account, that isn’t the case. These CD accounts actually allow you to withdraw your money form the CD without having to worry about a penalty fee.

While this type of account is definitely more flexible than most, it usually comes with lower end rates. If you think about it, the higher the risk you take, the more it will pay off in the end. If you want flexibility, expect it to take away from your potential savings in interest over the life of the CD account.

As you can see, there are several types for you to choose from, and this list doesn’t even include every single CD account type available. The best CD account for you may not be the best CD account for another, so you really have to take into account the benefits of each.

Popular Article: The Best Checking Accounts | Tips to Finding the Best Bank for a Checking Account

What You Need to Open a CD Account

So, are you ready to get started and open a CD account? If so, you will want to make sure that you have proper documentation to take with you.

You will likely need the following available:

- Driver’s license or other state-issued ID

- Funds for opening your CD bank account

- Any questions that you may have about the CD account you have chosen

Make sure that you clarify or are provided information regarding your account opening, including the rates, principle amount, and maturity date. This information should also be included in the paperwork that the bank gives you when you open a CD account.

Conclusion – Where Can You Find the Best CD Accounts?

If you are getting ready to open a CD account, you should now have the information that you need in order to make an informed decision on the best CD account for you.

Choosing the best CD accounts may take some time to research, due to all of the different options available. At times, it can be downright frustrating. The good news is that you can use our easy steps to help you find the best CD accounts to meet your needs.

Whether you choose to go with an online CD account or a traditional CD bank account with a bank or financial institution, check out the rates and fees associated with each account and consider each option’s benefits and downsides. The rates will vary based on the type of account and other factors.

Hopefully, this article has provided the necessary information regarding the best CD accounts for you and will help guide you in the right direction when it comes to your financial future.

Read More: How to Find the Best Banks with Free Checking and No Minimum Balance

AdvisoryHQ (AHQ) Disclaimer: Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info. Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.