Intro: First Time Home Buyer? What You Need to Know about Home Loans and Grants

Any first-time home buyer is excited at the prospect of owning their first real estate property, a home they can truly call their own.

Many of them approach the home buying process with trepidation as well. After all, navigating the world of mortgages, down payments, and interest rates can be confusing at best and financially devastating at worst.

Fortunately, if you understand the programs that are available to assist a 1st time home buyer, you’re in luck.

Image source: Bigstock

AdvisoryHQ wants to help you understand the first-time home buyer loans and first-time home buyer grants available. You should know what programs exist so that you can take advantage of those opportunities.

We will investigate some of the more popular options for a first-time home buyer loan: FHA loans, VA loans, and USDA loans. All of these are excellent options for a first-time home buyer loan.

Iif you’ve been interested in learning more of what is available to help a first-time home buyer, let’s take a closer look.

See Also: Imortgage Reviews – What You Should Know (Complaints & Review)

First Time Home Buyer Loans – Down Payment

Type of First-Time Home Buyer Loan | % – Required Down Payment |

FHA loan | 3.5 – 10% |

VA loan | 0% |

USDA loan | 0% |

FHA Loans

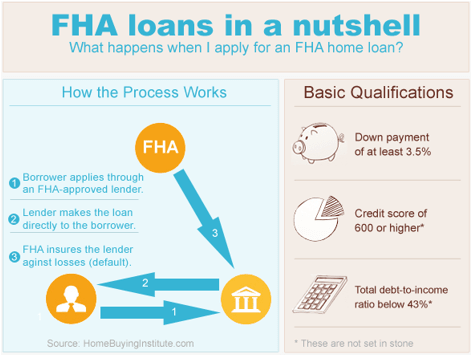

The Federal Housing Administration (FHA) loan is often one of the first programs that mortgage lenders will mention to a first home buyer. An FHA loan is available to most individuals, but it seems to attract a lot of first home buyers. It is very commonly used as a first-time home buyer’s loan because of the flexibility it allows lenders to have.

Eligibility

If you are interested in securing an FHA first-time home buyer loan, you should know whether or not you meet the criteria. Many people like the FHA loan program for a first home buyer because it does not require as high a credit score as some other programs.

In fact, to take full advantage of the benefits of the first-time home buyer loan (most notably the significantly reduced down payment), you should have a 580 credit score or higher. If your credit score is slightly lower (think in the 500 to 579 range), you may still qualify with a larger down payment.

FHA loans are typically secured in part by the Federal Housing Administration, which takes some of the risk off of the financial institutions that would typically secure your mortgage. Banks and mortgage lenders are more apt to consider FHA applicants who would not ordinarily meet their rigorous standards, especially when it comes to credit scores.

Your debt-to-income ratio should total 43 percent or less of your gross income so that they can make sure that you will be able to repay your first-time home buyer loan. You will qualify just two years after declaring bankruptcy and three years after a foreclosure if you’ve spent some time working on your credit.

The other requirement for an FHA loan is private mortgage insurance (PMI). This additional cost will be calculated in both an upfront fee and a recurring monthly expense.

Image Source: homebuyinginstitute.com

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Benefits

A great first-time home buyer loan, an FHA loan gives you a lot of flexibility, particularly when it comes to your down payment. While a conventional 30-year mortgage may require 20 percent or more for a down payment, an FHA loan requires as little as 3.5 percent. On a house that costs only $100,000, this would require an additional $16,500 without an FHA loan.

This can be a huge boon to a 1st time home buyer who may be struggling to accumulate the thousands of dollars extra that a conventional product would require.

You may also include upgrades to make your home more energy efficient into your FHA loan. A first-time home buyer who wants to purchase an older home may want to look into this as their first option for a first-time home buyer loan.

Unfortunately, the FHA loan is not one of the first-time home buyer grants. It won’t offer you money or any sort of financial assistance toward gathering the money you need for your closing costs or down payments.

Don’t Miss: How to Get a Home Equity Loan with Bad Credit (What You Need to Know)

VA Loans

Serving in the military offers certain advantages. If you’re a 1st time home buyer searching for first-time buyer home loans, you may have already come across VA loans. These loans are from the Department of Veterans Affairs, but they come through private lenders specified by the Department of Veterans Affairs.

Eligibility

First-time buyer home loans are typically prefaced with a lot of questions. Perhaps the most pressing one is, “Am I eligible for this first-time home buyer’s loan?” If you’re curious whether or not you would qualify for the VA loan as a first-time home buyer, this section is for you.

The most important criteria for this first-time home buyer loan is service in some branch of the armed forces. It also includes retired service members, reservists, and members of the National Guard. It is possible that spouses may qualify for the VA loan as a first-time home buyer’s loan as well, under certain circumstances. There are additional eligibility criteria based on your service that can be viewed through the Department of Veterans Affairs.

The VA does not require a minimum credit score on their first-time home buyer loan, but it does defer to the standard for the lending institutions it partners with. In most situations, a lender will request a credit score of 620 or higher.

As with all mortgages (not just first-time buyer home loans), you must be able to show proof of income. You should be able to afford your new primary residence with relative comfort, which you won’t be able to do with little to no income or tremendous amounts of debt.

Benefits

Why would you choose a VA loan as your preferred first-time home buyer loan? Similar to the FHA loans, there is a lot more flexibility present in a first-time home buyer’s loan through the VA loan program. You can receive a VA loan just a couple years after filing for bankruptcy.

One of the biggest perks, especially for a 1st time home buyer, is the ability to finance 100 percent of the cost of the property. As we mentioned earlier, the average down payment for a conventional mortgage is approximately 20 percent, so you can save a great deal of money here. It could allow you to become a homeowner much sooner than you would have anticipated otherwise.

Along that same vein, you also avoid having to pay private mortgage insurance (PMI). This additional fee each month is generally waived if you contribute 20 percent or more toward your down payment. With the VA loan as your first-time home buyer’s loan, you can save yourself the added monthly expense.

A 1st time home buyer could use this loan to cover not only the cost of the home but also additional upgrades. Similar to the FHA loan, you can opt to increase the energy efficiency of the property. Unlike the FHA loan, you can also do additional remodeling work if necessary.

Related: Churchill Mortgage Reviews – What You Want to Know (Complaints & Review)

USDA Loans

More recent than some of the other programs that offer first-time buyer home loans or first-time home buyer grants, the USDA loan is often unheard of. The United States Department of Agriculture loans started less than twenty years ago and they encourage a first home buyer to consider more rural or possibly even suburban areas instead of major cities.

If you were a first-time home buyer (or even a second- or third-time home buyer), would you qualify for the USDA loan?

Eligibility

While FHA loans and VA loans simply want to ensure that you have enough income to cover your monthly mortgage payment, the USDA loan wants to make sure that you don’t make too much money. A first-time home buyer will have to fall within certain income guidelines that differ depending on state, county, and your household size. It aims to facilitate a first-time home buyer loan for families in a low to moderate income bracket.

In order to receive this first-time home buyer loan, it must be your primary residence. You should be a United States citizen, a non-citizen national, or a qualified alien.

However, the biggest stipulation for this type of loan is selecting a property within the bounds of what the USDA considers “eligible areas.” While these eligible areas always refer to rural sections (populations of less than 35,000) of the country, you may also be able to find a few suburban areas that qualify.

Certain parts of the USDA first-time home buyer loan may also require you to meet additional standards:

- Be unable to obtain a loan through other, more traditional routes and programs

- The home must be 2,000 square feet or less

- The property must not have a swimming pool or be designed to produce an income

- The market value cannot exceed the amount for the area loan limit

Image Source: teammovemortgage.com

Benefits

The USDA loan can be used for far more than simple renovations or upgrades. It can really go a long way toward helping a first-time home buyer to make a home in a rural area more functional.

You may use it to repair or upgrade your home, to make it handicap accessible, to install utilities, to help cover real estate taxes, or to help prepare the site around the home (sodding, planting trees, paving a driveway, etc.).

Similar to the VA first-time home buyer loan, you may also finance up to 100 percent of the necessary amount. This figure can include the purchase price of the home, closing costs, pro-rated amounts for taxes and insurance, and any of the above necessary renovations or upgrades.

The USDA may also offer first-time home buyer grants under certain conditions, including to repair health and safety hazards. You can receive up to $7,500 in first-time home buyer grants from this avenue, but you must commit to living in the home for at least three years.

Popular Article: Want To Buy a House With Cash? – Get All the Facts! (Save Money, Cash Process & Review)

First-Time Home Buyer Grants

First-time home buyer grants are not typically given out by the federal government, though you have almost certainly heard of someone who received assistance because they were a first home buyer. Plenty of first-time home buyer grants exist, but you have to know where to look for them. These first-time home buyer grants are issued by the state in which the property is located. Not all states will offer a selection of first-time home buyer grants, but some states will offer a wide array of choices.

For example, Texas offers assistance through their Texas Department of Housing and Community Affairs, their USDA rural housing, and their Texas State Affordable Housing Corporation.

By contrast, states like South Carolina offer assistance through the USDA rural development first-time home buyer grants and the HUD Community Development Block Grant. There are different agencies within each state that are responsible for issuing first-time home buyer grants.

First-time home buyer grants are excellent tools to assist you as a first home buyer with your down payment or possibly even major upgrades and repairs. A first-time home buyer who may not be able to otherwise afford a down payment on a home can be greatly advanced toward closing on a new home with first-time home buyer grants.

To find out which first-time home buyer grants may be available to you, check with the United States Department of Housing and Urban Development for state-sponsored programs.

Type of First-Time Home Buyer Loan | Required Down Payment |

FHA loan | 3.5 – 10% |

VA loan | 0% |

USDA loan | 0% |

Free Wealth & Finance Software - Get Yours Now ►

Conclusion: What First-Time Home Buyer Loan Is Right for You?

If you’re in the market to be a first-time home buyer, there are a lot of choices available to you. Your mortgage lender may suggest a few options, but it never hurts to have the knowledge on-hand for yourself. Consider a few of these items when deciding which of the first-time home buyer loan options would work for you and your family:

- What sort of down payment are you able to provide?

- What does your credit score look like?

- Where would you ideally like to live (in the country or in a major city)?

- Do you meet any of the other criteria listed in the loans (active duty service member, rural housing, etc.)?

- Are any first-time home buyer grants available in your state to assist you?

With the answers to those questions in mind, you will be better equipped to navigate your way into the world of homeownership and first-time buyer home loans. Knowing what types of first-time home buyer loan programs and first-time home buyer grants are available in your area can go a long way. Be sure to arm yourself with the information you need to make an educated decision about the longest loan you’re likely to have – your mortgage.

Read More: Guild Mortgage Reviews – What You Need to Know (Company Reviews & Complaints)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.