Best Rates & Terms for Washington First Time Home Buyers

Purchasing a home is anything but a short-term commitment. With payment terms ranging from 15-30 years, it’s likely that a first time home buyer in Washington will be working a mortgage into their budget for decades to come.

For this reason, it’s crucial to find the right mortgage rates and terms that will set Washington first time home buyers up for long-term financial success.

Many first time home buyers in Washington state find that the best way to make a mortgage affordable over the long run is through first time home buyer programs in Washington state.

In the sections below, we’ll outline the top mortgage rates for Washington first time home buyers, top first time home buyer programs in Washington state, and provide a few additional requirements for Washington first time home buyers.

First Time Home Buyers in Indiana | Best Loans for Indiana First Time Home Buyers

First Time Home Buyers in Colorado | Best Loans & Grants for Colorado First Time Home Buyers

Key Requirements for First Time Home Buyers in Washington State

Before you apply for a WA first time home buyers’ loan, you’ll want to complete the below list of requirements.

- Get your down payment ready (~20% of the loan amount)

- Maintain good to excellent credit

- Save some extra funds for your closing cost

- Maintain a low debt balance

- Demonstrate sufficient income

- Gather your financial documents

- Get a home appraisal on the home

You’ll also need to examine your options before choosing between the best mortgage for you as a first time home buyer in Washington.

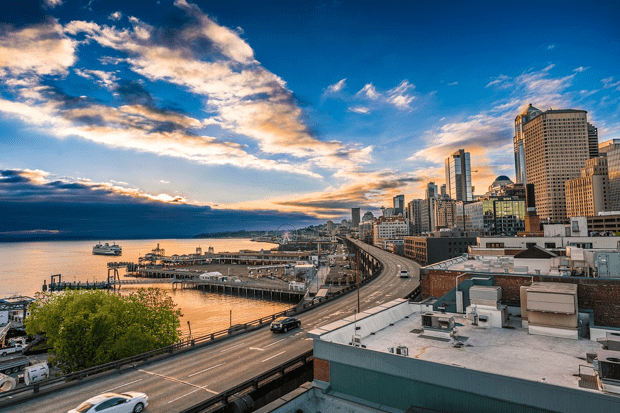

Seattle, WA

Seattle, WA

Mortgage Rates for First Time Home Buyers in California | First Time California Home Loans

First Time Home Buyers in Arizona | Best Loans for AZ First Time Home Buyers

First Time Home Buyer Programs in Washington State

Aside from the mountains of paperwork and lists of financial jargon, many first time home buyers in Washington state find that money is the biggest challenge when obtaining a mortgage.

There are plenty of first time home buyer programs in Washington state for new homeowners to take advantage of, including:

- Home Advantage DPA—Offers up to 4 percent of the mortgage loan amount

- HomeChoice—Provides up to $15,000 in assistance for Washington first home buyers with a disability or a live-in family member with a disability

- Seattle—Allows a first time home buyer in Washington to receive up to $55,000 for buying a home within the city limits

- Bellingham—Offers Washington first time home buyers up to $40,000 for buying within Bellingham city limits

- Tacoma DPA—Offers up to $20,000 to a first time home buyer in Washington within the Tacoma city limits

Aside from the programs listed above, there are other national programs that a first time home buyer in Washington may be able to benefit from, including:

- FHA Loan—Issued by the Federal Housing Authority with smaller down payments and lower credit requirements

- FHA 203(k)—Allows first time home buyers in Washington state to include renovation funds for fixer-upper homes

- USDA Loan—Offered by the U.S. Department of Agriculture for homes in certain rural areas

- VA Loan—For active-duty military members, veterans, and surviving spouses

- Energy Efficient Mortgage—Designed to help first time home buyers in Washington state create an energy-efficient home

- Native American Direct Loan—A type of VA loan that helps Native American veterans purchase homes on federal trust lands

- Good Neighbor Next Door Program—Sponsored by HUD, this program provides aid for law enforcement officers, firefighters, emergency medical technicians, and teachers from pre-k through 12th grade

Conclusion – Additional Considerations for First Time Home Buyers in Washington State

When searching for the best mortgages for first time home buyers in Washington state, keep in mind that there are a few additional pieces of information that may not be disclosed in the early stages of research for Washington State mortgages.

If you have a good, great, or excellent credit history and you are seeking a Washington first time home buyer loan totaling over $424,100, some lenders may be able to provide more favorable terms and rates.

For this reason, it’s important to confirm the specifics of any loan before committing to a mortgage for Washington first time home buyers.

Additionally, it’s also important to keep in mind that APR and payment info often does not include state-specific taxes or required insurance premiums for Washington first time home buyers.

As such, any Washington first time home buyer should expect that monthly mortgage payments will be greater after taxes and insurance products are added.

First Time Home Buyers in Alabama | Best Rates, Terms, & Programs for Alabama First Time Home Buyers

Current Maryland Mortgage Rates | MD Mortgage Rates & Refinance Rates for Good-Best Credit

Mortgage Rate Table Disclaimer

Click here to read AdvisoryHQ’s disclaimer on the mortgage loan table(s) displayed on this page.

Image source:

https://pixabay.com/en/seattle-sunset-marina-harbor-sky-2426307/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.