Intro: Firstmark Credit Union Reviews & Ranking

AdvisoryHQ recently published its list and review of the top credit unions in San Antonio, a list that included Firstmark Credit Union.

Below, we have highlighted some of the many reasons Firstmark Credit Union was selected as one of the best credit unions in San Antonio.

Click here for a detailed review of AdvisoryHQ’s selection methodology: AdvisoryHQ’s Methodology for Selecting Top Banks and Credit Unions.

Firstmark Credit Union Review

Firstmark Credit Union was originally known as San Antonio Teachers Credit Union and was chartered in 1932. This makes it the oldest state-chartered credit union in San Antonio. The first branch office opened in 1986, and since then, it has grown to serve the needs of anyone who lives, works, worships, attends school, or has a business in Bexar County.

It also serves the needs of employees of the education system in Bexar County, as well as their family members and people in the 12 surrounding counties.

Image source: Firstmark Credit Union

Key Factors Leading Us to Rank This Firm as One of This Year’s Top Credit Union Firms

Upon completing our detailed review, Firstmark Credit Union was included in AdvisoryHQ’s ranking of this year’s best credit unions based on the following factors.

Firstmark Credit Union Review: MyMark Online Money Manager

MyMark is a convenient and innovative online platform that provides members of Firstmark with the tools and resources they need to track their finances successfully.

MyMark includes features to create a budget and easily categorize expenses. There are also tools to see where more money can be saved, and there are tracking options for upcoming bills, payments, and income. In addition to having it linked with their Firstmark account, members can connect it to other external accounts and financial institutions, creating a centralized money management hub.

Firstmark Credit Union Review: Quicken Conversion

Firstmark, one of the most technologically advanced credit unions in San Antonio, also offers a Quicken conversion feature. The process to set this up takes about 20 to 25 minutes, and users can then download all of their Firstmark financial account information into their Quicken account.

This can be done using Web Connect, Express Web Connect, or the Quicken Connect option for Macs. With Web Connect, transactions are downloaded directly from the Firstmark Credit Union website and then imported into Quicken.

With Express Web Connect and Quicken Connect on Mac, there is direct communication between Quicken and your accounts with Firstmark. You don’t have to sign into the Firstmark website or manually download transactions. It’s all done by Quicken.

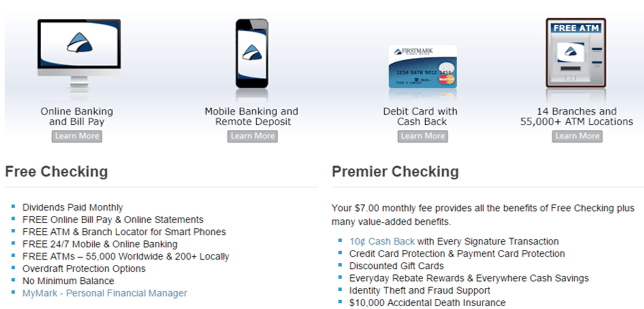

Firstmark Credit Union Review: Free Checking

There are two main checking account options available to members of Firstmark. One of these is Premier Checking, which includes a low monthly fee and benefits including Everyday Rebate Rewards and identity theft and fraud support.

The other account option is Free Checking, which is an account that has no monthly fee and no minimum balance requirement. Dividends are paid monthly, and there are overdraft protection options.

Free checking from this top credit union in San Antonio also includes free online bill pay and statements, and access to the MyMark Personal Financial Manager.

Image source: Firstmark Credit Union

Firstmark Credit Union Review: Summer Loans

This contender for the best credit union in San Antonio also offers Summer Loans, which are personal loans designed to help borrowers pay for a dream vacation. The Summer Loan can also be used to make home renovations or additions, such as installing a pool.

Loan amounts range from $1,000 to $5,000, and the interest rates are low. Members also have the option to take advantage of a fixed 24-month term, which lowers payments, and there are no payments for 45 days.

Request PDF of this Review Get A Free Award Emblem

In addition to reviewing the above Firstmark Credit Union review, you can click on any of the links below to browse exclusive reviews of AdvisoryHQ’s top-rated banking firms & credit unions:

Top Rated Banks

Top Banking firms

Review of Top Mortgage Firms

Bank Reviews

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.