Overview: Firstrade

Firstrade is an online trading broker that allows customers to trade stock, options, mutual funds, exchange traded funds (ETFs), bonds, treasuries, certificates of deposit (CDs), and other investment products using a computer or mobile device.

This type of service is not unique, and consumers have various options to choose from when looking for an online trading broker. So, what differentiates Firstrade.com from the competition?

This article will provide a review of Firstrade so that readers can get a better understanding of the broker before committing money to this platform.

Background Information

Firstrade was founded in 1985 and offers its brokerage products and services by Firstrade Securities, Inc. This Delaware-registered corporation is headquartered in Flushing, NY, and is a member of both Financial Industry Regulatory Authority (FINRA) and Securities Investor Protection Corporation (SIPC).

Firstrade has received recognition as one of the best online brokers through various publications and several awards, including:

- “Best Deal” in 2005 by Smart Money magazine

- “Clear Winner in the Mutual Funds Category” in 2006 by Kiplinger’s magazine

- “Top Clean-Hands Firm” in 2006 by Kiplinger’s magazine

- Rated one of the best online brokers by Barron’s, Forbes and Smart Money

These awards support Firstrade’s business model as a low-cost service provider among competing online trading brokers.

Social Media Presence

Firstrade has a social media presence on some of the most popular platforms:

The Firstrade social media channels provide information about the company, news articles about the financial market, analyst downgrades, long and short position lists, and other information.

Firstrade could look to improve or update their presence on YouTube and LinkedIn. The company has posted a total three videos on YouTube, and nothing in the past two years. As for LinkedIn, it appears the link offered on their site might be broken as it leads to a dead-end.

Pricing

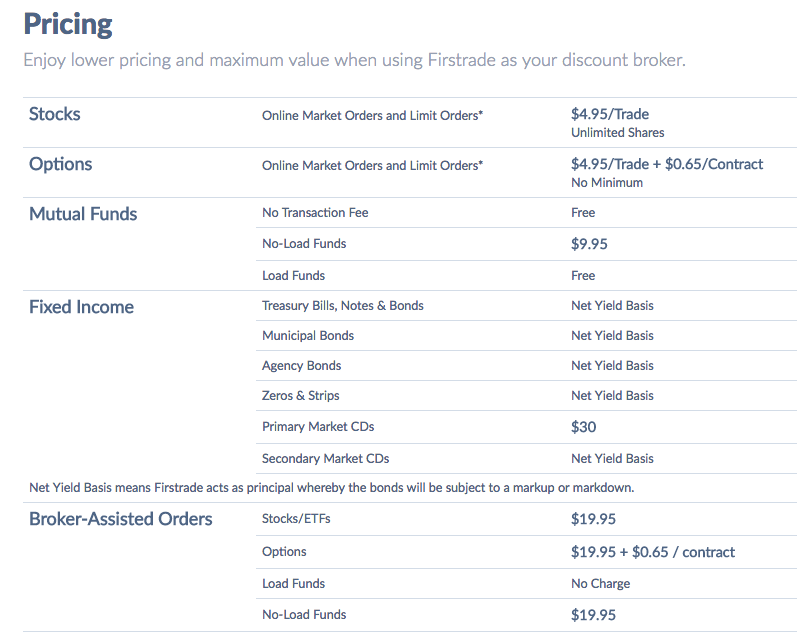

Firstrade fees appear to have been set based on the company’s fundamental value: “Low Costs, Higher Standards.” In general, users can expect to pay the following fees:

- $6.95 per trade on stocks

- $6.95 plus $0.75 per contract on options

- $19.95 per trade on broker-assisted stock orders

- $9.95 per trade on no-load mutual funds

Firstrade’s commission information is readily accessible and easy to follow. Users can see a screenshot of the pricing chart below:

Image Source: Firstrade Pricing

Image Source: Firstrade Pricing

It is important for users to pay attention to the fine print seen below the pricing chart. This is where various additional charges can be found, and consumers may experience some dissatisfaction with the platform if caught off guard by extra fees on trades. Here are some particular charges that consumers might want to consider before opening a Firstrade account:

- ½ cent per share for stocks priced under $1.00

- Short-Term Redemption Fee of $19.95 on redemptions of mutual funds under 90 days

- $19.95 on broker-assisted redemptions or redemptions less than $500

Firstrade fees information is nice to have, but is much more useful once consumers can compare the information to the competition.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Pricing Comparison

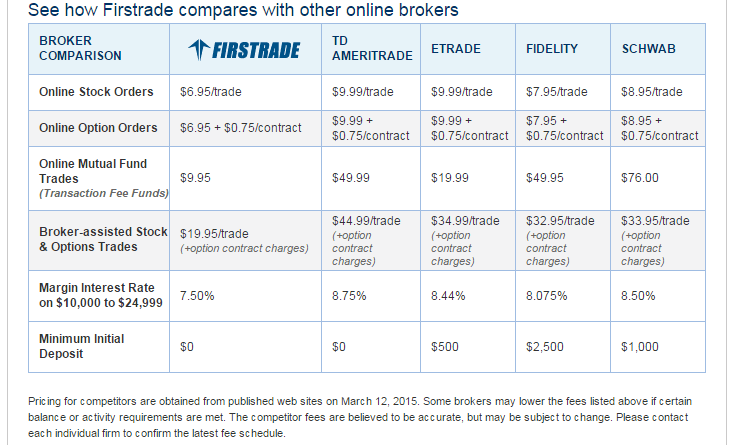

The above pricing information is much more useful when put in to context. As the low-cost leader among reputable online trading brokers, Firstrade is willing to display a price comparison chart on its website (pictured below).

Image Source: Firstrade

Firstrade fees come in as the lowest among the four competitors pictured on the price comparison chart for every type of trade. This results in less money going out in transaction fees and more money in the user accounts. With fees lower than the competition, one would assume that Firstrade dominates the online trading broker industry. However, price is not the only contributing factor when choosing an online trading broker.

Competition

A quick internet search for Firstrade reviews provides more than enough information to potential consumers on the strengths and weaknesses of this broker compared to other online trading brokers.

Stockbrokers.com serves as a valuable tool for consumers to review and compare potential online trading brokers before committing to one and opening an account. This site provides broker comparisons and reviews. For the purpose of this article, I chose to compare Firstrade to the following brokers:

- Fidelity Investments

- TD Ameritrade

- E-Trade

- Charles Schwab

The brokers being compared to Firstrade are well-known brokerage platforms with strong reputations. On a five-star scale, the four competitors all received 4.5-star ratings compared to the 3.5-star rating Firstrade received.

Image Source: BigStock

Image Source: BigStock

Firstrade fared well against these competitors by receiving ratings higher than or similar to the competition in the following areas:

- Commission & fees

- Ease of use

- Customer service

- Research

However, one review of Firstrade showed where the broker is lacking compared to these well-known competitors. While Firstrade may have received a decent rating on the five-star scale in some areas, the rating was relatively weak in others:

- Platform & tools

- Banking

- Offering of investments

- Education

- Order execution

Competition Analysis: While Firstrade seems to be a good option based on fees and other intangibles, it appears the competition far exceeds Firstrade in relation to the substantive material and related areas an investor might need from a broker. Whether the consumer is a beginner or an expert, reliable information is a big part of the decision-making process when investing money.

Features

Firstrade offers many features that are on par or unique compared to the competition. After opening an account with Firstrade, users can expect these features:

- Monitored daily balance changes

- Content customization

- Account history and protection

- Downloads of account details

- Web-based platform

- Mobile site

- iPhone and Android application

- Linking of checking accounts

- No minimum deposit

Account Opening Process

Firstrade, like many other websites, makes it easy for new users to open an account. The platform is user-friendly and guides new users through the process with ease. Firstrade also has a special offer currently running that allows new users to transfer to their platform for “free.” The new account will receive a credit (up to $100) for the account transfer fee charged by other brokers upon a successful transfer to Firstrade.

Users who do not have an existing account to transfer, or simply wish to open a separate brokerage account with Firstrade, will be asked to provide the following information during the application process:

- Full legal name

- Social Security number

- Email address

- Mailing address

- Date of birth

- Country of citizenship

- Income and net worth information

- Employer information

- Investment experience and profiling information

- Similar spousal information for joint accounts

This is all standard information requested from someone opening a brokerage account in the United States.

While setting up an account, a new user will need to decide how they would like to go about funding the account. Firstrade offers several methods by which new and existing users can fund their brokerage account. The options to fund the account are as follows:

Electronic Funds Transfer

The system allows users to electronically transfer money from a checking account to a Firstrade account on a periodic basis or on-demand.

Check

Users are able to write a check payable to Firstrade Securities and mail it to an address located in Flushing, NY.

Wire Funds to Firstrade

This option is available for both domestic and international clients; however, third-party wires will be rejected and returned.

Account Transfer

If you already have a brokerage account with another and wish to move your other funds, Firstrade will credit your account (up to $100) with fees charged by the company you are leaving. This special offer may not last forever, but users should be able to transfer their account for the foreseeable future.

Promotions

Firstrade currently offers some promotions for potential new customers. At the time of this Firstrade review, there are two big promotions going on. Readers of this review should check out the Firstrade promotions page to see if these promotions are still available.

Trade Free for 30 Days

While Firstrade already operates as a low-cost option among online trading brokers, new account owners can completely forego the per-trade fees for a thirty-day period if they fund a new account with a minimum deposit of $3,000 in assets or cash. New account owners have a thirty-day window to fund the minimum balance. The promotion does have limitations–100 maximum trades where the commission fee would normally cost $6.95.

Cash Back Bonus

Firstrade advertises that there is no minimum balance required to open a new brokerage account. However, there is a cash back bonus program for new Firstrade account owners, motivating larger deposits within thirty days of opening a account. The following cash back bonuses are available to new account owners:

- $100 cash back for a minimum deposit of $10,000

- $200 cash back for a minimum deposit of $25,000

- $300 cash back for a minimum deposit of $100,000

- $600 cash back for a minimum deposit of $250,000

- $1,200 cash back for a minimum deposit of $500,000

- $2,500 cash back for a minimum deposit of $1,000,000

Free Wealth & Finance Software - Get Yours Now ►

Trading Platform

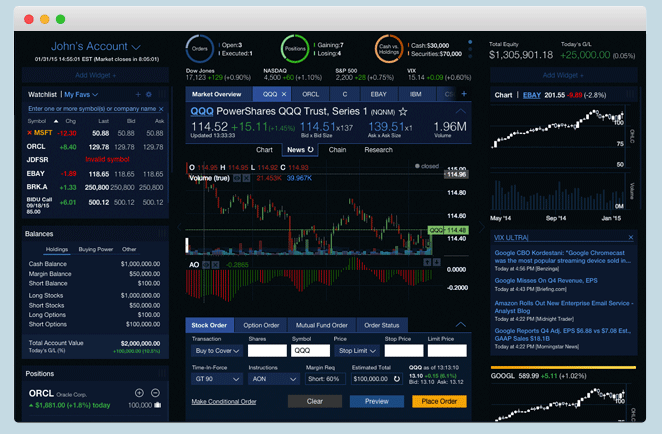

Firstrade has an exciting feature on the horizon that will provide users with an innovative experience to manage their investments: the Firstrade Navigator.

The Firstrade Navigator will allow users to manage account information and trades all on one screen. This new feature is visually appealing (pictured below) and shows real-time streaming data.

Image Source: Firstrade Navigator

The Navigator seeks to provide information in a customized manner. While it is nice to have access to all this data in one place, a novice investor might be overwhelmed at first. Fortunately, the Navigator advertises several features to work with investors of varying backgrounds:

- Adjustable layout

- Customizable widgets

- Advanced technical charting

- Convenient graphs

The Navigator sounds like a great tool to attract and keep customers; however, this tool is advertised as “coming soon.” Readers will have to take Firstrade’s word that the tool will operate as advertised.

Free Budgeting Software for AdvisoryHQ Readers - Get It Now!

Summary

Firstrade is a good option for investors looking to make trades at a low cost. While the brokerage platform may be lagging behind the top-tier competition in some facets, it’s on par with others at a competitive rate. When considering which broker to use, each user will need to consider how their investment goals and objectives fit into the pricing schedule.

If you plan to make a large number of trades on tight margins, Firstrade might be a good fit as it would save anywhere from $1 to $3 per trade. If you plan to make very infrequent trades and hold positions for longer periods of time, you may prefer an online trading broker that can provide greater educational information.

Ultimately, the decision to use Firstrade versus competing brokerage platforms rest with the needs and goals of each particular user. Firstrade is a user-friendly, low-cost online trading broker. Firstrade may not offer all the high-end bells and whistles of the top-tier broker platforms, but it can provide quality service and help investors achieve their goals.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.