Intro – GE Capital Bank Reviews

Most of us know about Bank of America, Citi, JPMorgan Chase, Wells Fargo, HSBC, Barclays, PNC Bank, etc.

But what do we really know about GE Capital Bank? Is GE Bank safe to bank with?

Since we posted the very first review of GE Capital Bank, our editorial staff has received numerous emails from site visitors asking: “Is GE Capital Bank safe?”, “How safe is GE Capital Bank?” etc.

Overview – GE Capital Bank vs. GE Capital Retail Bank

Before we go forward with our review of GE Capital Bank, we’ll like to clear the confusion that a lot of consumers have about the two GE banks.

On the one hand, there is GE Capital Bank, which is directly owned by General Electric.

On the other hand, there is GE Capital Retail Bank, which was owned by General Electric but was later divested and sold as part of a company called Synchrony.

Image Source: GE Capital Retail Bank

GE Capital Retail Bank is now Synchrony Bank.

Click here for a review of Synchrony Bank: Synchrony Bank Review

What Type of Bank is GE Capital Bank?

GE Capital Bank (Previously GE Money Bank) is a Utah state-chartered industrial bank owned by General Electric Corp.

An industrial bank is a type of bank that is authorized to accept most types of deposits, except checking accounts (demand deposits).

Based on their charter, industrial banks are limited in the scope of services that they provide.

However, this type of charter or structure comes with advantages and disadvantages which we’ll discuss below.

Image Source: BigStock

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

A lot of GE Capital Bank consumers choose the bank because they believe that the advantages (i.e., higher interest paying accounts) overwhelm disadvantages (i.e., the bank not able to offer checking accounts)

GE Bank acts as a multi-product commercial finance bank and uses deposits to fund their commercial loans and leases.

Being an industrial bank allows the firm to cost-effectively provide financing and higher yield accounts to its customers.

GE Capital Bank Reviews – Is GE Bank Safe?

So is GE Capital Bank really a safe bank to bank with?

The answer to that question is “yes it is.”

For the most recent quarter, the bank recently reported over $20,000,000,000 in total assets, and interest income of over $540,000,000 and noninterest income in excess of $300,000,000

Most importantly, the firm is an FDIC member, which means your deposits are FDIC-insured up to the maximum allowed by law.

This is the same FDIC coverage that allows firms like Bank of America, Citi, Chase, HSBC, and Wells Fargo to be considered safe banks – in addition to their size of course.

Basically, if any of these FDIC insured banks were to go under, then the FDIC would step in and take over the bank.

At the height of the recent financial crisis, the FDIC took over ownership of hundreds of banks, rather than letting the banks go under.

“History is pretty clear,” says Gary Evans, president and CEO of Palm Desert National Bank in Palm Desert, Calif. “Insured accounts are either paid out soon after a bank closes or the account is assumed by a purchasing bank. As stated on the FDIC website no insured account has ever lost money.”

GE Capital Bank Products

If you are looking to open an account with the bank, below are the products and services that are available to you

- High yield interest savings account

- High yield CDs – 12 Months

- High yield CDs – 5 Years

GE Capital Bank Review – High Yield Savings Rate

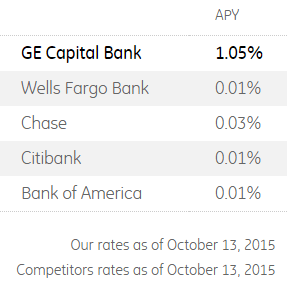

- GE Capital Bank’s online high yield savings account offers a 1.05% APY on balances: $1 to $1,000,000.

Image Source: GE Capital Bank

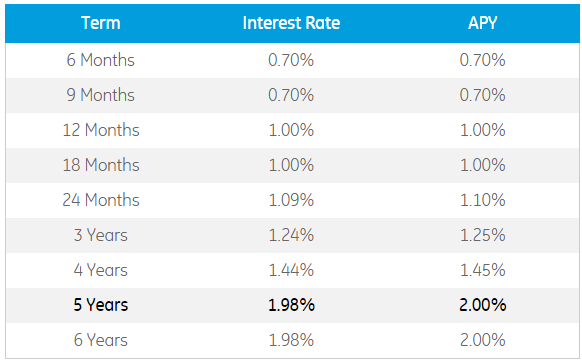

GE Capital Bank CD Rates

- GE Capital Bank’s CD rates range from an APY of 0.70% (6 months CD term) to a CD rate of 2.30% (6 years CD)

Image Source: GE Capital Bank

* Note: All rates / yields shown on this article can be changed at any time without notice. Please review the bank’s website for the most updated information.

Pros – GE Capital Bank Reviews

- No minimum deposit to open an online savings account

- Highly competitive savings, CDs and money market rates

- Wide range of CD terms. From 6 months to 6 years

- You have the option to withdraw (penalty-free) any interest credited to your account at any time during the term of the CD

- Minimum balance required to open a CD is only $500

- No transaction fees for an online savings account

- Savings account interest yield compounds daily and paid monthly

- Maximum deposit amount $1,000,000

- FDIC insurance up to the maximum allowed by law

- CD: Terms from 6 months to 6 years

- CD: Low $500 minimum deposit

- CD: 10-day CD Rate Guarantee

- CD: Choose your monthly interest disbursement

Free Wealth & Finance Software - Get Yours Now ►

Cons – GE Capital Bank Reviews

- The bank only offers two products (Savings and CDs). No credit cards, no checking accounts, etc.

- GE Capital Bank is predominately an online banking firm, not much physical branches

- To deposit checks, you’ll need to mail the check to: GE Capital Bank, PO Box 4571, Carol Stream, IL 60197-4571

- To send a wire transfer, you’ll need to call the bank at 1-855-730-7283 Monday through Friday, 7am to 11pm CT

- In most circumstances, the bank will only allow a transfer of funds from your account at GE Capital Bank to an account you own at another financial institution

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.