Making Good Use of Virtual Wallets

Chances are you’ve held up the line at the cash register because of your cluttered wallet once or twice in your life.

New technology promises to make life more convenient by emptying out your wallet of the extra clutter and placing it somewhere else.

These new virtual wallets practically eliminate the need for your plastic to ever surface from your bag or wallet again.

Competitors are lining up to produce the best programs and apps for this purpose. The three top competitors – Android Pay, Apple Pay, and Google Wallet – have consumers wondering exactly which one is the best.

How do you know which features you should be looking for in these new applications?

Image source: Pexels

But before you seek to download any new program onto your smartphone, you’ll want to take a closer look at the reviews. We’ll give you a thorough rundown on what you can expect from each program, including detailed Android Pay reviews, Apple Pay reviews, and Google Wallet reviews.

Let AdvisoryHQ help you declutter your bag, simplify your finances, and bring you into the future with these new virtual wallet applications.

See Also: Top Credit Cards with No Balance Transfer Fee (15–21 Months with Zero Balance Fees)

High Level Comparison Table

Best Virtual Wallets | Ideal for | Highlights |

| Android Pay | Making purchases |

|

| Apple Pay | Making purchases |

|

| Google Wallet | Sending money to family and friends |

|

Table: Google Wallet vs. Apple Pay vs. Android Pay | The above list is sorted alphabetically

What Is a Virtual Wallet?

Before you can decide whether you should get the Android Pay app or the Google Wallet app, it would help to have a working knowledge of what a virtual wallet can do. The features inherent to the app itself will vary, but they are all designed to have similar functions to increase the convenience factor in your life.

Whether you’re considering Android Pay, Apple Pay, or GoogleWallet, you’ll need a definition to get you started. A virtual wallet takes the information from the physical cards you keep in your wallet and stores it on your smartphone.

These apps, particularly the Android Pay app and the Apple Pay app, allow you to use the information stored on your smartphone or mobile device to conduct transactions at the register.

The device you have will determine exactly how you can go about using Android Pay or using Apple Pay. Selected retailers and participating merchants will allow you to hold your device up to the card scanners and walk through the process of paying without reaching for your wallet. Certain applications even have the added benefit of storing information other than your credit cards, including:

- Gift card information

- Select loyalty or rewards cards

- Debit cards

- Store-specific credit cards

Other times, you may be able to use a virtual wallet to send and receive money from friends or clients. This is a convenient feature that enables you to pay the occasional bill or receive money for your services faster than ever.

Convenience should certainly be considered after security, though. By keeping all of your personal and sensitive financial information on one app from your smartphone, is it really safe to use GoogleWallet, Android Pay, or Apple Pay?

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Developers have worked hard to incorporate enhanced security features to put your mind at ease and allow you to make transactions safely.

Each program has a slightly different way of securing your information. Some virtual wallets will allow you to remotely remove or lock data even when you lose your phone. Others send only unique transaction identification numbers at the register, rather than your actual credit card number.

Overall, the invention of virtual wallets has created a new level of convenience for making financial transactions securely. It saves time at the register and has the potential to make shorter lines in the places you shop most often.

In the sections below, we’re going to dive deeper into the specific features you should be aware of when it comes to Android Pay reviews, Apple Pay reviews, and Google Wallet reviews. After looking at each program individually, we will compare them to one another and see which app ranks the highest.

Don’t Miss: Top Hotel Rewards Programs & Hotel Credit Cards | Ranking and Reviews

Android Pay

Android Pay is the counterpart to Apple Pay, designed specifically for Samsung and Android product users. Depending on what type of devices your household uses or what smartphone model you purchased, you’ll likely have an easy decision made between the Apple Pay reviews and Android Pay reviews. This program will not be available on any Apple devices, including iPhones, Macs, or Apple Watches.

For those who have the capability of using the Android Pay app, the download itself is free through the Google Play store.

Using Android Pay

Android Pay reviews must mention just how simple using Android Pay can be. While some of the virtual wallet apps will require you to open the program and fish for information buried deep within your phone, using Android Pay takes only seconds at the cash register.

Participating retailers will allow you to hold your Android phone straight up to the terminal. The only thing you need to do is unlock your phone. A key feature to note in Android Pay reviews is that you don’t even need to open up the virtual wallet application in order to make a convenient and secure transaction.

If you’re wondering where you can begin using Android Pay, you only have to search for one of the below symbols at the cash register. There are plenty of participating retailers, including Best Buy, Dunkin Donuts, GameStop, Panera, Walgreens, and more.

Image Source: Android

Keep in mind that you can also use Android Pay to make purchases through other apps on your smartphone and on the Google Chrome browser. This allows you to carry the convenience of shopping at retail locations over to your online shopping as well.

Security

It would be impossible to have thorough Android Pay reviews without mentioning the level of security involved for your information. This should really be a top priority for consumers who are seeking the best virtual wallet application for any type of device or situation.

Android Pay reviews your credit card transactions each and every time so they can send a unique transaction code instead of your actual card information. Credit and debit card information remains secured on your device. Merchants will receive a virtual account number generated through the Android Pay app to symbolize your transaction instead.

The Android Device Manager will allow you to access all of your information remotely if necessary. Did you misplace your smartphone, or did it go missing from your purse?

Android Pay reviews note that you can take several steps to keep your information secure in one of these unfortunate circumstances:

- Lock information, no matter where you are in relation to the device

- Secure information with a brand-new password

- Wipe the device clean of all your personal information

Convenience

Chances are that if you’ve signed up for rewards credit cards or loyalty cards, you want to continue to redeem those rewards points. Fortunately, Android Pay reviews your cards and memberships so that you can continue to receive rewards just as you would through a normal transaction.

In addition to receiving the perks associated with your usual credit card, you can also add store rewards and loyalty cards into the Android Pay app. Currently, only two of these types of cards can be used with the program: Walgreens Balance Rewards and Coke MyRewards.

Apple Pay

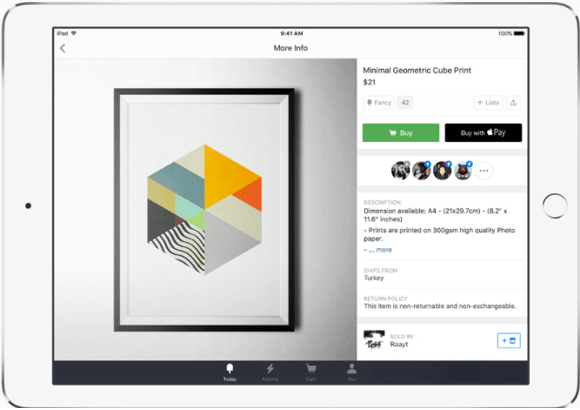

Apple Pay reviews are fairly plentiful because this program is one of the most well-known virtual wallets available on today’s market. It can only be used by consumers who buy into the full Apple line of products, though, ranging from the iPhone to the MacBook to the Apple smartwatch. This limitation does pose restrictions that are one of the first key features to note in Apple Pay reviews.

Image Source: Apple

The program itself is free to download to any of these devices.

Using Apple Pay

Using Apple Pay at the store is an incredibly easy process with the iPhone or Apple Watch. At the end of your transaction, you hold your device near the reader with your finger on the touch ID or you can double-click the side button on the watch.

Apple Pay reviews note that the whole process should happen within the span of just a few seconds.

However, you can certainly make good use of this program outside of purchases at brick and mortar stores. You can begin using Apple Pay through many different apps to make online transactions or donations easier than ever.

Apple Pay reviews also mention that the app can be used through the Safari browser for online shopping from your Mac computer as well.

Security

Apple Pay reviews would be remiss not to mention the detailed attention they give to the security of your sensitive data. Purchases are made using device-specific numbers and unique transaction codes instead of your actual credit card number.

These codes and numbers allow you to make purchases without having to store your credit card information on either your smartphone or on the Apple servers.

It is less likely for your information to fall into the wrong hands using these advanced security measures. Furthermore, Apple Pay reviews note that the card numbers are not shared with merchants at any point.

Your transactions cannot be tied back to you while using Apple Pay. All purchases you make are completely private and Apple does not retain a record of your personal transactions. However, you can view past receipts and purchase history conveniently in your wallet app if you choose to.

Convenience

When you start to look at the Apple Pay reviews, it is important to realize just how convenient this app is for individuals who have too many items in their wallet. The Apple Pay app can store tons of information beyond just your run-of-the-mill credit or debit card:

- Store credit cards from participating merchants (currently including Kohl’s, BJ’s, Ulta, and Meijer)

- Rewards and loyalty cards (currently including Walgreens Balance Rewards, Kohl’s Yes2You Rewards, and soon to include MyPanera)

- Rewards credit cards

The best part of the convenience included in the Apple Pay app is that you don’t lose the potential rewards and perks of your cards. From loyalty cards to rewards credit cards, Apple Pay reviews your transactions, and the companies are still able to issue the rewards they owe you. You truly sacrifice nothing to begin using Apple Pay effectively.

Popular Article: Top Credit Cards for Very Bad Credit | Ranking | Cards for Damaged, Horrible, and Really Bad Credit Histories

Google Wallet

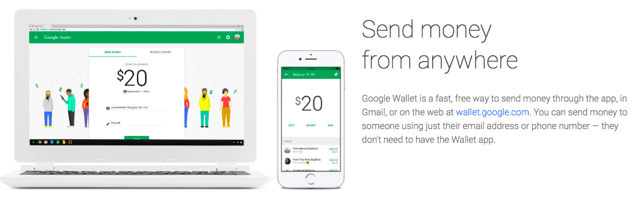

Google Wallet is a popular option among the top virtual wallet programs, but it works slightly differently than the Android Pay and Apple Pay programs that are better known. The first thing that should be noted in a Google Wallet review is that the app is not designed to be used to make transactions at stores, whether through brick-and-mortar locations or through online shopping.

Image Source: Google

The Google Wallet app is designed to simplify the process of sending and receiving money. Friends and family are able to send requests or payment for various bills, holidays, or just because they’re feeling especially generous that day. This is perhaps the most important feature to note in a Google Wallet review because it is this aspect that sets it apart from the other two apps.

Using Google Wallet

Google Wallet is incredibly simple to use, even if you don’t want to download the Google Wallet app onto your mobile device. The program allows you to send money to anyone you know using only a phone number or email address. Your recipient does not have to download the Google Wallet app either.

Transactions can easily be processed through the app (available through iTunes and the Google Play Store for free), but there are other options as well.

A major advantage to this program that should be included in a Google Wallet review is that you can process transactions through a Gmail account or through the internet.

Not only can you send money using the Google Wallet app, but you can also request money. Did you split the dinner bill with your brother last night, or does your roommate owe you for their share of the rent? Keeping track of what people owe is easy using GoogleWallet, one of the best features to note in a Google Wallet review.

Security

You can gain the peace of mind of having your sensitive data backed up by the protection that Google has to offer. In a Google Wallet review, you can easily find that your information is encrypted and stored on the Google protected servers.

Another advantage to the security features available on the Google Wallet app is their fraud protection monitoring, available 24/7. Any unauthorized transactions will be covered 100%, which is a huge draw in most of the available Google Wallet review sections.

If you feel like your account could be in jeopardy, you can log on from any device to remove all access to the program.

Convenience

There is certainly a high level of convenience that needs to be accounted for in a thorough Google Wallet review. A top feature is the ability to receive the money directly into your bank account versus having to manually transfer it through a third-party website.

This eliminates some of the hassle that has traditionally been involved with the use of programs and websites such as PayPal.

You can also use Google Wallet to your advantage when it comes to collecting money for services rendered. With the potential to turn on commercial payment options, you can receive payment for your products and services faster than ever.

Read More: Top TD Credit Cards | Ranking & Reviews | TD Bank Travel, Rewards, Business, Cash Back Cards

Free Wealth & Finance Software - Get Yours Now ►

Which Is the Best Virtual Wallet?

When it comes down to weighing the advantages and disadvantages of each program, you will ultimately have to decide which virtual wallet app will fit your lifestyle the best.

The Apple Pay and Android Pay are specific to their respective devices and platforms, while the Google Wallet app has its own unique function.

If you’re looking to make transactions simpler at the checkout or for online shopping, Android Pay reviews and Apple Pay reviews both boast a secure way to do so.

There are additional advantages when it comes to the convenience of adding rewards cards and store credit cards, with the upper hand going to Apple Pay reviews in this situation. However, both are widely accepted at major retailers and promise to help lighten the load of your wallet.

The Google Wallet review can be classified in a completely different category. The Google Wallet app is designed to promote simplified transactions between friends and family members, though it can also work for commercial transactions.

The Android Pay reviews, Apple Pay reviews, and Google Wallet reviews make clear distinctions between the different services. While some decisions are easy to make depending on what type of smartphone you may have, others are determined by which program suits your needs the best.

It should be noted in a Google Wallet review that you can download this for usage in tandem with Android Pay or Apple Pay. By combining two of these programs, you can have all of your bases covered when you need to make a purchase or send money to friends and family.

There is no clear winner when it comes to the best virtual wallet app. You will simply have to determine which service you would use most often or if it would benefit you to have access to two different apps.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.