Intro – Grow Financial Federal Credit Union Reviews & Ranking

Grow Financial Federal Credit Union was recently ranked and reviewed by AdvisoryHQ as a top rated credit union. Firms on our top rated lists were selected after they successfully passed AdvisoryHQ’s ground-breaking, four-step banks and credit unions selection methodology.

Click here for a step-by-step breakdown of the methodology and selection process used during our Grow Financial Federal Credit Union review: AdvisoryHQ’s Methodology for Selecting Top Banks and Credit Unions.

The Grow Financial Federal Credit Union review below provides a detailed assessment, including some of the factors used by AdvisoryHQ News in its ranking and selection of Grow Financial Federal Credit Union.

Grow Financial Federal Credit Union Review

Grow Financial Federal Credit Union began in 1955 as a credit union for base personnel serving at the MacDill AirForce Base in Tampa, FL.

To represent its client base, originally it was called the MacDill Air Force Base Federal Credit Union. The institution continued to grow over the past 60 years.

Today, the Grow Financial Federal Credit Union prides itself on helping its members grow personally, professionally, and financially.

With locations throughout West Central Florida and South Carolina, not to mention 70,000 surcharge-free ATM machines and mobile and online banking options, your money is always accessible.

Photo courtesy of: Grow Financial Federal Credit Union

Key Factors Leading Us to Rank This Firm as One of This Year’s Top Credit Union Firms

Upon completing our Grow Financial Federal Credit Union review, Grow Financial Federal Credit Union was included in AdvisoryHQ’s ranking of this year’s best credit unions based on the following factors.

Grow Financial Federal Credit Union Review: Checking and Savings Accounts

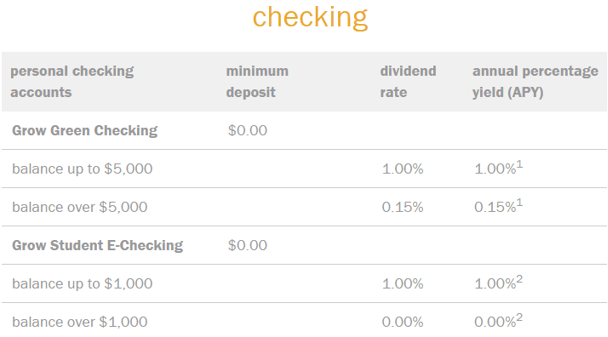

While the Grow Financial Credit Union’s checking account offerings are limited to its Grow Green Checking and its Grow Student E-Checking account, both offer rates up to 1.00%.

This is significantly higher than many mainstream banks, and on par with other credit unions. No minimum deposit is required for either checking account.

Photo courtesy of: Grow Financial Federal Credit Union

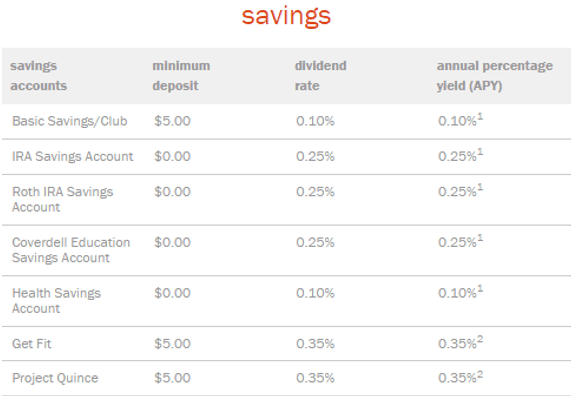

Your options increase when it comes to savings accounts and CDs. Once again, Grow Financial’s rates are competitive.

Photo courtesy of: Grow Financial Federal Credit Union

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Grow Financial Federal Credit Union Review: Financial Calculators

Let’s face it: We don’t all have the time or wherewithal to manage our finances to their greatest potential. Luckily, Grow Financial’s many financial calculators do the number crunching for you.

Grow Financial Federal Credit Union Review: Mobile App

In today’s era of smartphones, Grow Financial’s mobile app is there to help you conduct your banking transactions while you’re on the go.

Members can use the mobile app to view account balances and activity, send secure transfers and bill payments, deposit checks, and find a nearby branch or ATM.

A growing number of credit unions and banks are recognizing the value in providing their customers with mobile banking options, but not all are there yet.

Grow Financial is among the former cohort, one of the reasons it is ranked among the best credit unions in Tampa.

Grow Financial Federal Credit Union Review: Member Perks

Members of Grow Financial Credit Union automatically qualify for Love My Credit Union Rewards.

There are discounts to be had on numerous products and services, including Sprint phone plans, online shopping deals, a 25% discount on Budget and Avis rental cars, and DirectTV packages, to name just a few.

In addition to reviewing the above Grow Financial Federal Credit Union review, you can click on any of the links below to browse exclusive reviews of AdvisoryHQ’s top credit unions:

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.