Guide: How to find Best Bad Credit Credit Cards

When you have bad credit, one of the most important things you can do for your future financial freedom is to begin working toward improving your credit score.

Many experts will recommend using a small amount of credit responsibly in order to achieve that, but are there really credit cards for bad credit out there? How about credit cards for students with no credit history?

Image Source: Pixabay.com

If these “bad credit credit cards” do exist, then how do you go about getting one of them?

You are not alone in your search of the best credit cards for bad credit. In fact, credit cards for no credit and credit cards for bad credit definitely do exist if you know where to look. We’re going to take a thorough look at what you need to know about getting a credit card with bad credit so you can be prepared.

So if you have questions about credit cards for bad credit, let’s find a great starting point.

See Also: Best Credit Cards to Rebuild Credit | Ranking & Reviews | Best Cards for Rebuilding Credit

Bad Credit Credit Cards or Short-Term Loan?

Before you dive too deep into the issue of credit cards for bad credit, it’s imperative to understand why you’re seeking one of these programs.

Even the best credit cards for bad credit could do more harm to your already low score if you’re not using them properly. Experts recommend evaluating whether what you really need is a bad credit credit card or if you could benefit from a short-term loan instead.

Bad credit credit cards and credit cards for no credit should be used as a tool to help you improve your credit score. Doing so allows you to qualify for more products in the future and to receive more favorable terms on those products.

For example, with a better score from using a bad credit credit card, you may qualify for a better mortgage program or receive lower interest rates on your auto loan if your credit score soars into the “good” category instead of the “bad” or “non-existent” category.

No credit history credit cards, bad credit credit cards, and any other form of revolving credit shouldn’t be used as a way to make ends meet on a regular basis. By continuously using your credit card with bad credit to pay the bills without paying off the balance at the end of the month, you are accumulating more debt to your name. The longer you carry that debt, the more interest you will owe on it, and the further away you’ll be from financial freedom and comfort.

A short-term loan could allow you to make ends meet in just one situation, taking away the temptation to swipe your plastic at the store on a regular basis. If you think you could benefit from a short-term use of funds instead of credit cards for bad credit, be sure to investigate this option thoroughly before committing to one of the best credit cards for bad credit or the best credit cards for no credit.

Understand Your Score

Do you know what your FICO credit score is currently? Most lenders will take a look at this number before making decisions regarding their ability to trust you to repay a loan. Similarly, your FICO credit score is usually what qualifies you for credit cards that offer perks.

You should educate yourself on what your credit score currently says and what the stipulations are for various credit cards for bad credit so you know in advance what you qualify for.

You are entitled to one free credit report each year, easily accessible from AnnualCreditReport.com. Viewing this document can tell you if everything on your credit history is accurate and current. It’s a quick way to spot identity theft and potentially improve your credit score quickly.

After this point, you can utilize services like Credit Karma. They will give you a VantageScore credit score, slightly different from the FICO numbers that most lenders will use. However, it does give you a great reference point for where to begin with your search for a credit card with bad credit or a credit card with no credit. Once your score is in, they can also offer suggestions and recommendations for how to improve it.

Some credit cards will offer your FICO score free at the bottom of your monthly statement. If you already have several credit cards, you should take a quick glance at your statement to see if your credit score is listed. Alternatively, you may want to consider looking for bad credit credit cards that will have your FICO score available on a regular basis so you can watch as your score hopefully improves.

If you’re using your credit to help this score increase, be sure to find credit cards for bad credit and credit cards for no credit that will make reports to all three credit reporting agencies. Without being able to see how responsibly you are using your card, the credit bureaus won’t be able to take it into account to improve your score for the future.

Don’t Miss: The Best Business Credit Cards | Citi vs Wells Fargo vs U.S. Bank vs Chase Business Credit Card

Secured Credit Cards

When you have a bad credit score (generally accepted as anything below 620) or if you have no credit history at all, it can be discouraging to apply for credit card with no credit history. Many times, individuals don’t receive the exact type of credit card they imagined they would. Most credit cards for no credit will be secured credit cards versus unsecured credit cards.

A secured card (the vast majority of which will be credit cards for no credit or credit cards for bad credit) requires you to make a deposit up front with your lender. This initial deposit provides security and peace of mind for the bank or lender in case you default on your payments. They take a greater risk on individuals who have a history of defaulting on payments or have an ambiguous or non-existent history. Credit cards for no credit history are risky, but offering secure credit cards gives banks some leverage.

Some of the best credit cards for bad credit will allow you to make your deposit over time. Depending on the severity of your low credit score, you may not even need to put down a deposit equal to the full line of credit available. Some of these are ideal as credit cards for students with no credit as well because of the low initial fees.

According to some financial experts, unsecured credit cards for no credit or bad credit do exist, but they don’t feature very friendly terms. The annual fee can be fairly steep with high interest rates, meaning you might be in big trouble if you can’t pay the balance at the end of the month.

Don’t forget that with some secured credit cards for no credit, your deposit is refundable after a certain period of time, and it then becomes an unsecured credit card as your credit history improves.

Improving Credit with No Credit History Credit Cards

If you’re looking to apply for credit card with no credit history, there are a few things you should keep in mind as you work toward developing or improving your score. After all, having even the best credit cards for no credit won’t be of any help to you if you don’t know how to use them effectively. Here are a few tips for improving your credit score via no credit history credit cards:

- Pay it off monthly. We’ve already discussed this earlier, but you don’t want to allow your balance to accumulate from month to month. You’ll end up in debt and paying potentially hefty interest rates as well. Credit cards for bad credit or no credit should help lenders to see that you’re spending responsibly and can pay back what you borrow in a timely manner.

- Don’t apply over and over again. Credit cards for students with no credit (or for anyone else) are sometimes denied, even if they were designed to be credit cards for bad credit. Even if they’re approved, you need to accept the card you were given and move on. Applying for many credit cards for no credit over a short period of time can actually damage your credit score.

- Don’t spend beyond the limit. The goal is not to max out your credit cards for no credit history. Spending as much as possible or even beyond your limit certainly won’t help your credit score. Experts recommend limiting the amount placed on the card to approximately 60 percent of your available credit line.

- Apply with a cosigner. Let’s face it. The terms and offers made with even the best credit cards for bad credit or the best credit cards for no credit aren’t as good as the ones offered for good credit. Filling out your application with a cosigner can improve your credit score on the application and qualify you for better rewards and programs. This does put your cosigner at risk for responsibility if you default on your payments though. Make sure that person understands the risks of signing with you before you head to the bank.

Finding a credit card with no credit isn’t an impossible task. Over the long run, it can help to dramatically boost your credit score into the good or even excellent ranges. However, you do have to be aware of the potential downfalls of even the best credit cards for bad credit. Using them irresponsibly will leave you at an even worse disadvantage.

Related: Best Credit Cards for College Students| Ranking | Best College Student Credit Cards

Best Credit Cards for Bad Credit

Searching for the best credit cards for bad credit can be tedious and daunting. That’s why we’ve already rounded up a few of the top choices for the best credit cards for no credit.

These are great choices if you’re ready to apply for a credit card with no credit history, ideal credit cards for students with no credit history, and are some of the all-around best credit cards for bad credit. Take a look at what they may have to offer you.

Capital One® Secured MasterCard®

The Capital One® Secured MasterCard® is one of the best credit cards for bad credit and for individuals who can’t afford to make their deposit up front. It can be made in smaller increments as long as it is fully funded within eighty days of opening the account. The deposit amount on most bad credit credit cards will be equal to the line of credit extended, but Capital One® offers $49, $99, and $200 deposits for a $200 line of credit, depending on your creditworthiness.

The annual fee is extremely low among credit cards for no credit or bad credit credit cards, coming in at absolutely nothing. Unfortunately, the major disadvantage to the Capital One® Secured MasterCard® is the incredibly high interest rate, clocking in at 24.99 percent variable APR. After just five on-time monthly payments, they will raise your credit limit with no extra money down.

Image Source: CapitalOne®

U.S. Bank Secured Visa® Card

The U.S. Bank Secured Visa® Card offers a potentially higher credit limit than most of the best credit cards for bad credit. As one of the top credit cards for no credit history, they will allow a credit limit up to $5,000 if you can scrape up an equal amount for a deposit. One year of using the U.S. Bank Secured Visa® Card responsibly will put you up for consideration for credit cards for students with no credit history that are unsecured as well.

The annual fee for this is low compared to some bad credit credit cards but still more than that of the Capital One® option. Their annual fee is just $29 each year but with a lower interest rate at just 19.24 percent variable APR.

Unfortunately, this card does not provide access to your FICO credit score for you to monitor over time. The best credit cards for bad credit typically do, but this one offers the TransUnion credit score instead. It can still be used to track improvements, but most lenders still refer to the FICO score.

Popular Article: Best Starter Credit Cards | How to Find the Best Credit Cards for Young Adults

Image Source: US Bank

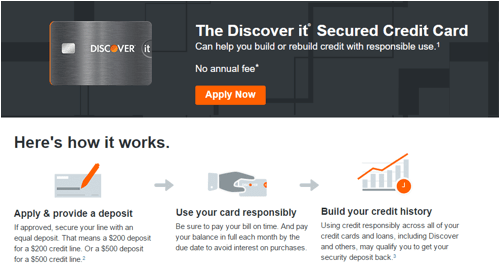

Discover it® Secured Credit Card

The Discover it® Secured Credit Card is one of the best credit cards for bad credit because it is one of the few options that features cash back rewards. No credit history credit cards or credit cards for bad credit are typically lacking in this perk. You’ll earn 1 percent cash back on every purchase and 2 percent cash back at restaurants and gas stations, which will be matched by Discover at the end of your first year.

Open an account with a credit line and an equal deposit amount, ranging from $200 to $500. Unfortunately, there is no payment installment plan set up with these particular credit cards for no credit history.

Your annual fee is non-existent, but you are looking at a higher-than-average interest rate of 23.24 percent variable APR. You’ll get your FICO® Credit Score for free right at the tips of your fingers, making it a great option for credit cards for students with no credit. It will appear on your account login or on your monthly statement.

Image Source: Discover

Conclusion

Finding the best credit cards for bad credit can be difficult, as not many banks and lenders are open to issuing credit to someone who has no clear history of using it responsibly.

You can apply for a credit card with no credit successfully if you know where to look. Be sure to really evaluate whether you’re able to make the payments on your credit cards for bad credit or if a short-term loan would be the better choice for you.

Bear in mind that credit cards for bad credit and credit cards for no credit can be wonderful assets in improving your credit score over time.

Unfortunately, they can also do just the opposite if you don’t use them responsibly. Evaluate what your needs are when it comes to credit cards for no credit or bad credit to determine which choice might be the best fit for you.

Read More: Best Frequent Flyer Credit Card Offers | Ranking | Best Credit Cards for Travel Rewards

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.