UK Robo-Advisors Comparison: Hargreaves Lansdown vs. TD Direct Investing vs. Nutmeg

How do you know which company charges the lowest fees, offers the best performance, and provides the best resources for your investments?

Really, the only way to figure out which firm is right for you is to compare them side by side for the features that matter to you.

To help you decide which company might best suit your investment needs, AdvisoryHQ has lined up three of the top names for online investment companies in the UK: Hargreaves Lansdown, TD Direct Investing, and Nutmeg Investment.

These three companies often come up in conversations regarding the top choices for upcoming investments, so it’s time to take a closer look at how they compare to one another.

If you’ve been considering Hargreaves Lansdown, TD Direct Investing, or Nutmeg Investment to help you save for retirement or just to allocate a few dollars into an ISA, join us as we analyse just what you can expect from each firm.

See Also: Are Robo Advisors Worth It? Want Help Managing Risk? (Investment News & Strategies)

Hargreaves Lansdown

Hargreaves Lansdown is sometimes referred to as the “investment supermarket” of private investors with more than 35 years’ experience in the wealth management industry.

Sometimes better known as Hargreaves Lansdown PLC or HL Investments, they offer a number of investment opportunities for beginners and seasoned professionals alike.

You also receive access to use their Hargreaves Lansdown app, education centre, and calculator tools to help you become a more experienced and educated investor.

Hargreaves Lansdown Services

At Hargreaves Lansdown, you can opt to have as much control as you would like over your investments. Through their firm, you can opt for ISAs or pensions, as well as buying or selling funds and shares.

Many people like to use their ISA service for the flexibility it gives them for an exceptionally tax-efficient investment opportunity. Money placed into an ISA at HL Investments features tax-free gains and is exempt from the UK tax on income and interest.

Image Source: BigStock

New investors or those with less experience in selecting their own stocks may want to consider one of the premade ISA portfolios geared toward a low, moderate, and aggressive growth or income portfolio. These six choices are rebalanced on a regular basis and closely monitored by their team of professionals.

Those who want to try their hand at self-selecting funds and shares can buy and sell according to their own desires with Hargreaves Lansdown PLC as well.

There are more than 2,500 funds to choose from in the Hargreaves Lansdown PLC collection. If funds aren’t what you’re interested in, Hargreaves Lansdown can also assist you with purchasing ETFs, trusts, and government and corporate bonds.

Alternatively, HL Investments also gives you the option of registering for a self-invested personal pension or SIPP.

You have the same wide selection of funds available through Hargreaves Lansdown PLC that you have through the self-directed ISA funds from Hargreaves Lansdown. They’ve been named the best SIPP provider for the past nine years running from What Investment.

Don’t Miss: Robo Advisors (UK)—Everything You Should Know! (Investment Help & Advice)

Hargreaves Lansdown Fees

For funds under management, you pay a percentage based on a tiered scale. The scale is the same for both the ISAs and the SIPP accounts from Hargreaves Lansdown, which can all be managed online and through the Hargreaves Lansdown app.

This means that Hargreaves Lansdown bases their fees off of the amount of money in your individual account. For the details regarding the annual management fees from Hargreaves Lansdown, see the chart below:

Hargreaves Lansdown Fees Breakdown

Account Balance | Hargreaves Fees (in Percentages) |

Less than £250,000 | 0.45 |

£250,000 to £1m | 0.25 |

£1m to £2m | 0.10 |

More than £2m | No fee |

Table: Hargreaves Lansdown Fees

When you buy and sell shares directly through Hargreaves Lansdown, the fees are relatively minimal. If you are not a regular or frequent trader, you may find yourself paying up to £11.95 per trade.

However, for a slightly more frequent trade through Hargreaves Lansdown, you could pay £8.95 (10–19 trades) or £5.95 per trade (more than 20 trades). The price is the same for those handled online as well as those through the Hargreaves Lansdown app.

TD Direct Investing Review

TD Direct Investing offers a similar selection of services to Hargreaves Lansdown: ISAs, trading accounts, and SIPPs.

TD Direct Investing International began in the UK in 1997, since coming to manage more than £13 billion in stock and cash assets for more than 300,000 clients.

They’ve accrued a collection of awards including Best Online SIPP Provider 2015, Best Online Share Dealing Provider 2014, and Best Online Stocks and Shares ISA Provider 2014 from YourMoney magazine.

TD Direct Investing Review: Services

If you were looking to open an Independent Savings Account (ISA) with TD Direct Investing, you could choose from more than 2,000 funds (both UK funds and international options), ETFs, and trusts among other investment options.

Unlike Hargreaves Lansdown, there are no choices for a premade portfolio. The only choice for an ISA is a self-selected assortment of stocks and shares so you will need to direct your own investment decisions.

Ultimately, this option from TD Direct Investing is a great choice for seasoned investors who want to have complete control over the outcome of their finances.

While it cannot accurately predict whether you would increase or decrease your initial investment, TD Direct Investing International does give you a larger degree of control and flexibility.

The TD Direct Investing SIPP offers a flexible selection of options at retirement. You have several drawdown options at varying fees. The ADVFN International Financial Awards named TD Direct Investing the Best SIPP Provider of 2016.

Planning for retirement features an education centre and pension calculator, as well as investment ideas for your SIPP.

Related: Robo Advisors vs. Financial Advisors—Is It the Future of Automated Stock Trading & Investing?

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Fees

What can you expect from TD Direct Investing fees? TD Direct Investing has several fees associated with their service, but they are overall very competitive in price with the other leading online investment companies in the UK.

For SIPPs, you can expect to pay 0.25 percent of the value biannually, with a minimum of £80 and VAT each year and a maximum of £200 and VAT each year in TD Direct Investing fees.

The TD Direct Investing fees on their TD Direct Investing International ISAs are also incredibly reasonable and lower than many of their competitors.

When you have a monthly draw set up or a total ISA balance of more than £5,100, there are no fees associated with the account. Without these requirements, there is a minimum fee of £30 plus VAT each year (or partial year depending on whether or not your account remains open for the full year).

When opening a regular trading account with TD Direct Investing, you can open an account for free with a minimum of £100 and monthly investments of £25 each month.

You can also waive the account fee with an ISA or a SIPP through TD Direct Investing International, place one trade or more every six months, or have an individual portfolio value exceeding £15,000 or funds valuation exceeding £10,000.

Don’t Miss: Top Rated Best UK Robo-Advisers | Ranking | Top Automated Investment Firms in the UK

Nutmeg Investment Review

Nutmeg Investment was one of the original robo investing platforms available in the UK, referring to themselves as a “lone voice” in the discretionary wealth management service online.

Nutmeg Finance has been around since 2011, created as the outflow of discontent with the wealth management industry and aiming to create a more transparent resource for clients to invest their money with.

Nutmeg UK was the very first online discretionary management company, one in a long line of new robo advising platforms.

Nutmeg Investment Review: Services

The primary service that Nutmeg Investment is known for is their robo advisor.

By filling out a brief survey regarding your personality, savings goals, and the length of time you intend to leave your investments with Nutmeg UK, they can create an overall picture of your financial situation. From here, they develop a customized investment strategy specifically for you and managed by their team of Nutmeg Investment professionals.

You can opt to create an ISA or a pension fund through Nutmeg Investment with varying fees and account minimums, but the overall inner workings of the company are very similar.

They diversify your assets according the risk tolerance that your profile indicates would work best to help you achieve your financial goals.

Nutmeg UK points out that you could model your own portfolio after the ones created by the robo advisors.

However, without the constant rebalancing and monitoring inherent to their system, you could face higher trade fees and more headaches by trying to do the majority of work yourself. Most investments are done through ETFs to represent equities, bonds, commodities, and cash.

You can find some educational resources and calculators on their site as well. Most of the useful information from Nutmeg Investment is scattered throughout their blog that offers more information on making wise investments, as well as an occasional calculator.

For example, they offer this calculator that allows you to track what your investments could be worth in years to come, as well as how much you lose by waiting just one year to make your initial investments through Nutmeg Finance.

Popular Article: Best Forex Brokers—UK | Ranking | Top UK Forex Broker Trading Platforms

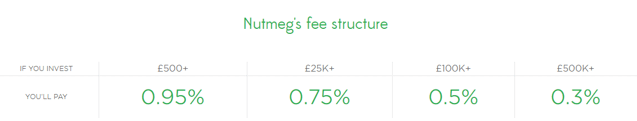

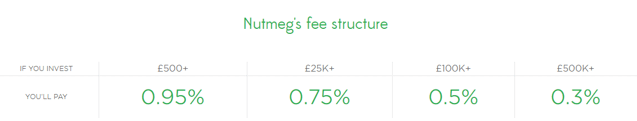

Nutmeg Investment Review: Fees

The fees for opening an account with Nutmeg Investment are right in between those required by Hargreaves Lansdown and TD Direct Investing.

A beginning balance must be at least £500 with monthly contributions of an additional £100 until your account balance reaches at least £5,000. Their pension requires the highest minimum balance with a one-time contribution of £5,000.

The average fund cost for your portfolio is roughly 0.19 percent with no trading or set-up fees necessary. The rest of their fees are based on a tiered system, taking into account the total value of your investments with Nutmeg Finance (both in an ISA account and a pension fund).

Their overall rates range from 0.35 percent to 0.95 percent. For details on how the breakdown works out, see the chart below:

Source: Fee – Nutmeg.com

Comparing the Three

It is obvious that while there are a number of similarities between the three online investment companies within the UK, there are also a number of differences that make them ideal for different types of investors.

Having received an overview of the companies, let’s take a more detailed look at which company takes the lead for these popular categories:

- Self-Directed Investments: There is no clear winner in this category, as it is mostly dependent upon what type of services you feel you need for your investments. Hargreaves Lansdown offers the best of both worlds, with an option for both premade portfolios and a more do-it-yourself approach in the ISA category. TD Direct Investing offers only a self-directed form of investment, and Nutmeg Investing offers only robo advisors who select and plan your investments for you.

- Fees: Overall, this will depend on the balance of your account with each individual investment company. The fees from Nutmeg Finance are significantly higher than those from Hargreaves Lansdown. The fees from Hargreaves Lansdown are reasonable and very competitive in the online investment companies in the UK, but TD Direct Investing has the appeal of no fees under certain circumstances, including for account balances substantially lower than those from Hargreaves Lansdown.

- Minimum Deposit: Hargreaves Lansdown and TD Direct Investing are tied in this category, with a low one-time lump sum investment of just £100. This makes robo investing easily accessible to all individuals, even younger or newer investors who aren’t ready to take large risks yet. Nutmeg Investment isn’t a terribly expensive option either with only a slightly higher minimum balance of £500 for the ISA option.

All three companies are excellent options for making an online investment. However, most of the decision will be based upon your personal preference for investment style and strategy. A seasoned investor who wants to take more control over their assets may very well prefer TD Direct Investing. A newer or younger investor is likely to prefer the security of having a professionally picked portfolio that Hargreaves Lansdown or Nutmeg Investment can offer.

All three offer resources for you to learn more about potential investment strategies, including tax efficiency, savings contributions, and the various types of accounts available for your use.

It might not be a bad idea to consider browsing through the education centre on all three companies in order to find the information you are seeking to make wiser investment decisions.

Read More: HiFX Reviews (UK) | Is HiFX Safe? (Fees, App & Foreign Exchange Review)

Conclusion: Hargreaves Lansdown vs. TD Direct Investing vs. Nutmeg

When it comes to choosing an online investment company, Hargreaves Lansdown, TD Direct Investing, and Nutmeg Investment are all prime choices among today’s robo advisers in the UK.

You will need to closely evaluate your own investment needs, preferences, and styles to determine if one of these companies may be better suited for you than another. Consider asking yourself these questions:

- How much money am I looking to invest with a company initially?

- How much experience do I have in selecting my own funds, shares, and bonds? If none, am I willing to research and learn, or would I prefer for a professional to handle it for me?

- What sort of fees can I expect to pay based on my account balance?

There cannot be a one-size-fits-all answer for which company is the best robo advisor or online investment company in the UK. Instead, it will vary significantly from person to person, depending on your personality, your preferences, and your desire for what an investment company should bring to the table. Spend some time exploring all of the options that appeal to you before making a long-term commitment to Hargreaves Lansdown, Nutmeg Investment, or TD Direct Investing.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.