Intro – Hawthorn Bank Reviews & Ranking

Hawthorn Bank was recently ranked and reviewed by AdvisoryHQ as a top rated banking firm. Firms on our top rated lists were selected after they successfully passed AdvisoryHQ’s groundbreaking, four-step banks and credit unions selection methodology.

Click here for a step-by-step breakdown of the methodology and selection process used during our Hawthorn Bank review: AdvisoryHQ’s Methodology for Selecting Top Banks and Credit Unions.

TheHawthorn Bank review below provides a detailed assessment, including some of the factors used by AdvisoryHQ News in its ranking and selection of Hawthorn Bank.

Hawthorn Bank Review

A community bank operating in central and western Missouri, Hawthorn Bank has served the area for 150 years. Currently, Hawthorn maintains 24 locations and is known as one of the best banking firms in Independence, Springfield, Columbia, Jefferson City, and Branson. Areas of focus at Hawthorn include commercial banking for small and mid-sized businesses, personal banking, and trust services.

Specific personal banking services include checking and savings accounts, personal loans, home loans, and trust estate planning.

Image Source: Hawthorn Bank Review

Key Factors Leading Us to Rank This Firm as One of This Year’s Top Banking Firms

Upon completing our detailed reviews, Hawthorn Bank was included in AdvisoryHQ’s ranking of this year’s best banking firms based on the following factors.

Hawthorn Bank Review: IDProtect

When you open certain accounts at Hawthorn, you receive IDProtect, which is a comprehensive suite of services that provide the utmost in security and protection for clients and their finances.

The IDProtect program includes the following:

- Identity Theft Expense Reimbursement Coverage: Account holders can receive up to $10,000 to assist in the payment of expenses, repairing damaged credit and more if they become a victim of identity theft.

- Comprehensive Identity Theft Resolution Services: If a Hawthorn qualifying account holder becomes an identity theft victim, a resolution service will work with that individual until everything is resolved and credit is restored.

- 3-in-1 Credit File Monitoring: Account holders’ Equifax, Experian, and TransUnion credit files are monitored daily, and they will receive alerts if anything changes.

- Total Identity Monitoring: This service includes monitoring of over 1,000 databases.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Hawthorn Bank Review: Value Checking

Value Checking is a signature account offering from Hawthorn that includes many perks and benefits.

These include:

- Free electronic banking package

- Free MasterCard debit card

- Only a $25 minimum deposit to open an account

- Overdraft forgiveness (one-time coupon)

- ATM fee reimbursement

- Disappearing fee (the account monthly service fee is reduced $0.25 for every debit card purchase made. If 20 or more purchases are posted and cleared during a statement cycle, the fee is waived altogether)

- Accidental death and dismemberment insurance

- Cell phone protection for lost or damaged devices

Hawthorn Bank Review: Business Checking

For clients who want to streamline all of their banking at one location, Hawthorn offers a full lineup of business products including checking accounts.

Business checking accounts from Hawthorn include Small Business Checking, which is for those smaller organizations that have 200 or fewer transactions a month. There is no minimum balance to maintain this account.

The standard Business Checking account is designed for businesses with 200–400 transactions a month.

Business Analysis Checking is for higher transaction volumes, and it’s ideal for larger businesses.

There is also a Business Now Account for nonprofits, government entities, and sole proprietorships.

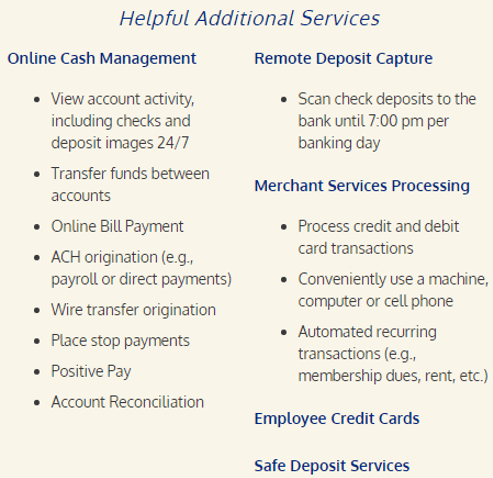

Image Source: Hawthorn Bank

Hawthorn Bank Review: Personal Loans

Hawthorn is a lender with personal loan options that are designed to help consolidate debt or make a large purchase.

With debt consolidation loans, clients can pay off high-interest credit cards and other loans while taking advantage of the benefits of a lower interest rate. Hawthorn offers loan calculators to show clients how much they can save.

There are also home improvement loans and auto loans available from this leading banking firm.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.