Intro—Heritage Bank Reviews & Ranking

AdvisoryHQ recently published its list and review of the top mutual banks and building societies in Australia, a list that included Heritage Bank.

Below we have highlighted some of the many reasons Heritage Bank was selected as one of the best mutual banks and building societies in Australia.

Click here for a detailed review of AdvisoryHQ’s various selection methodology: Ranking Methodologies.

Heritage Bank Review

Heritage Bank has the distinction of being not only a top mutual bank in Australia but also the largest customer-owned bank, with a history dating back to 1875. Heritage’s long history started with them being a top building society in Australia, and they’ve since merged with other financial institutions to create the mutual bank they’re recognised as today.

Heritage outlines its goals as being to provide industry-leading service, to produce strong financial results, to be a great place to work, and the support the community. For members, this results in competitive pricing, fees and charges, flexible products, a great staff, security, and simplicity.

Image Source: Heritage Bank

Key Factors That Enabled This to Rank as a Top Australia Building Society or Mutual Bank

Among top Australia mutual banks and top Australia building societies, Heritage is well-ranked in the industry and by consumers. The following list highlights some of the specific reasons.

Heritage Bank Review: Savings Account Interest Rates

A primary reason so many consumers become frustrated and stop working with conventional banks and financial institutions is because they feel like they don’t have the opportunity to earn on their savings and deposits. Conventional banks often have very low interest rates paid to the consumer, but this isn’t the case with Heritage.

They offer a variety of savings account options, all of which have competitive interest rates.

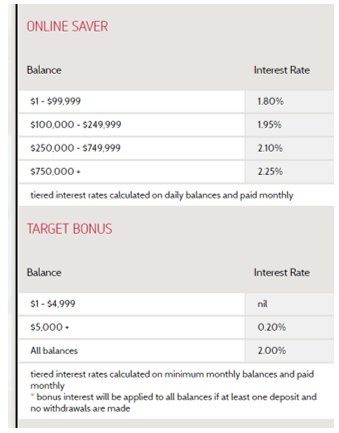

The Online Saver Accounts and Target Bonus accounts have some of the highest interest rates, and rather than rates going down with the amount of money a member has deposited at Heritage, they instead are tiered upward, rewarding members for loyalty and maintaining a higher balance.

Image Source: Heritage Bank

Heritage Bank Review: Secure Super Account

Heritage, which has a history as a top Australia building society and now as one of the best Australia mutual banks, has an account called the Secure Super. The Secure Super Account is a retirement savings account that offers guaranteed security and the tax advantages of a superannuation fund. It’s somewhat like a combination of a superannuation and a term deposit account, which makes it ideal for someone who’s more risk-averse.

It’s a safe way to protect retirement savings while also getting a healthy return. The return is permanently set at 0.5% above the RBA cash rate, and there are no management or account keeping fees.

Deposits up to $250,000 are protected by the Australian Government’s deposit guarantee, and savings can’t go down in value.

Heritage Bank Review: Simply Access

Before delving into the specifics of the Simply Access transaction account, it’s worth noting that Heritage Bank doesn’t charge any account keeping fees on any of their personal accounts, which is a critical reason they were included in this ranking of the top Australia mutual banks and the best Australia building societies.

They also offer a wide variety of personal account options including Simply Access, which is a simple, straightforward, everyday account that offers many of the features members need, without what they don’t need.

Along with having no monthly account keeping fees, Simply Access offers free Internet and phone banking transactions and free mobile banking transactions. Heritage ATM transactions are free, and account holders have access to more than 3,000 network ATMs nationwide.

A Visa debit card or chequebook is available, as are eStatements.

Heritage Bank Review: Target Bonus

Heritage, a leader among the top Australia mutual banks and top Australia building societies, features Target Bonus accounts. These are designed to help members reach their personalised savings goals with bonus interest rewards when they make regular deposits without withdrawals.

Account holders are eligible for a bonus interest rate above the standard rate for every month they make at least one deposit and no withdrawals. Interest is calculated on the minimum monthly balance, and this account includes free online and phone banking.

In addition to reviewing the above Heritage Bank review, you can click on any of the links below to browse exclusive reviews of AdvisoryHQ’s top-rated banking firms & credit unions:

Top Rated Banks

Top Banking Firms

Review of Top Mortgage Firms

Bank Reviews

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.