Home Remodel Loans | This Year’s Guide to Remodeling Construction Loans

Remodeling construction loans and home remodel loans are a great option when it’s time to take on a home improvement project. When a homeowner has to make a decision to move to a different house or remodel the one they own, there are a few things they must consider.

Giving up a low mortgage payment and moving to a new neighborhood may seem like a lot of work. In addition, moving can be expensive. Closing costs on a new mortgage, the realtor fees when selling a home, and even hiring a company to move possessions creates huge expenses.

In many cases, home remodel loans are a much less costly and less stressful choice. Loans for home improvement take many forms. Using the home as collateral, it’s possible to obtain a HELOC or home equity line of credit.

Borrowing from a 401(k) account isn’t recommended by most professionals, but for many people, it helps bridge the gap between the amount of money they can borrow and the amount they need to finish the project.

Personal loans and custom credit lines from a bank or credit union make great home remodel loans. They have the advantage of fast approval without high closing costs. They also keep a chunk of debt separate from the mortgage itself.

If a homeowner is also looking for a lower mortgage interest rate and also need to remodel their home, they may consider remodeling construction loans or home remodel loans as an option.

See Also: Imortgage Reviews – What You Should Know (Complaints & Review)

What Are The Options For Remodeling Loans?

When shopping for remodeling loans, consumers have many options. Sources of financing include:

- Credit cards

- Store cards from home improvement stores

- Home equity line of credit (HELOC)

- Personal loan without collateral

- Low-interest loan from the government

- Grant from a non-profit or government entity

- Insurance proceeds

Using Credit Cards and Store Cards for Home Remodel Financing

Image Source: Home Remodel Loans

Typically, credit cards and store cards come with high interest rates, even if the borrower has good credit and a high credit limit. It’s important to understand the terms of the card or cards before using them as a home remodel financing option.

Rates as high as 29.99% are common. Credit cards with lower APRs may have a penalty APR as high as 29.99% if the card holder makes even one payment after the due date. Some store cards offer a 0% APR for a short time. Savvy homeowners who need home addition loans or home remodel loans use this to their advantage.

For example, if the price of a remodeling project is $25,000 and the combined credit limit on a credit card and a store card is $30,000 but the cards have a 29.99% APR, the home owner would do well to explore other options. That same home owner with good credit and a low debt-to-income ratio may qualify for traditional financing at a low rate, but choose to use a credit card with an introductory 0% APR for 12 months.

People with high income or homeowners who are expecting a windfall of income from inheritance or a company bonus in the next few months can get started on their project right away without paying interest on their purchases.

Smaller DIY home improvement projects that a home owner is comfortable with completing themselves are an ideal match for a home improvement big box retail store offering 0% APR on a new store card account. People who are loyal to one home improvement store location or brand and realize that they will be making multiple trips and spending thousands of dollars throughout the life of their project can take advantage of this short term “free money” as long as they are able to pay the balance off completely before the introductory period ends.

In many cases, after the 0% APR period is over, the interest rate reverts to between 15% and 20% annually. Home owners considering their options for loans for home improvement should keep this danger in mind.

Don’t Miss: Best Banks for Mortgages – A Complete Guide (Best Mortgage Rates & Reviews)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Getting Remodeling Loans From a Bank or Private Lending Institution

People who have a solid credit history, verifiable income, and some equity in their home should sail through the application process for a remodeling loan without any problems. In some cases, it makes sense to roll remodeling loans into a new mortgage and use the home as collateral.

This offers the borrower the advantage of historically low interest rates and the simplicity of making one payment as opposed to paying off loans for remodeling separately from the mortgage each month.

How Do FHA 203(k) Mortgage Loans for Home Improvement Work?

Image Source: Remodeling Construction Loans

FHA 203(k) mortgage loans for home improvement allow a homeowner to refinance their mortgage completely and add home remodel loans to the principal. This type of loan moves a mortage away from the former lender completely. The loan amount is based on the value of the home after the improvements are finished so the equity and the total amount available to borrow will be larger.

The normal term for home remodel loans inside this format is 30 years. The amount available to borrow is dependent on the county where the home is located and varies widely according to local demographics.

The advantage to these home remodel loans is that the closing costs are simplified and combined into just one loan. The entire process is streamlined to allow the homeowner to create their dream home at a low interest rate. This type of loan is backed by the federal government, as well.

Many people who want to purchase a foreclosed home in need of repairs or buy a fixer-upper house find these types of loans for home improvement the ideal solution to their problems.

Related: Stearns Lending Reviews – What You Want To Know (Home Loans, Complaints & Mortgage Reviews)

Is a Home Equity Line of Credit a Good Option For a Femodeling Loans?

Many homeowners who need to make improvements or updates to their house use a simple HELOC from the same bank or lending company that holds their mortgage. This type of loan typically requires no more paperwork that an unsecured personal loan and usually has a lower interest rate, depending on creditworthiness, than a personal loan or credit card.

People who have good credit and a source of steady work simply need to verify their income, provide some personal information, and give the bank a few days to look through their credit file to get this type of remodeling loan. Getting a HELOC is a great option for kitchen remodel financing or making improvements and repairs to a home.

These types of remodeling loans work a lot like a credit card. There is a limit to the amount of money a homeowner can spend, but they’ll only pay interest on the amount they borrow from the bank for the improvements. It’s important for homeowners seeking a remodeling loan to pay attention to the terms. Many HELOCs come with a low introductory rate that rises at a certain point.

How to Borrow from a 401(k) Account Instead of Getting a Home Improvement Loan

A retirement account may offer the ideal way to obtain a much-needed home improvement loan. People who have a 401(k) account can typically borrow up to the lesser of $50,000 or 50% of their balance. While terms vary, it’s important to understand that if the borrower loses their job or quits, the loan amount may be due within 60 days of ceasing employment with the company. If the borrower can’t pay back their remodeling loans under these conditions, the amount borrowed is subject to a 10% early withdrawal fee and income tax.

A similar option for a homeowner seeking remodeling loans is a 72(t) withdrawal from an IRA. There isn’t a 10% early withdrawl tax on this money. The borrower must take distributions in a series of equal payments that last for at least five years or until they turn 59 ½, whichever comes later.

Federal Government Grants for Home Improvements

Ideal for seniors on a fixed income, college students living in their first home, single parents with limited income, or anyone struggling with a difficult economic situation, getting a grant from the federal government instead of remodeling loans is a viable option.

Home repair assistance programs vary from state-to-state and from county-to-county. Sometimes, combining one of these grants with a 403(k) loan through Housing and Urban Development (HUD) is the perfect solution to a home remodel financing problem.

Non-profits often provide a portal to grants for home improvements that can be easily combined with loans for home improvements. Learning about these location-specific programs is worth the time it takes and can be a great help to people who are renovating a historic home or need to make their home handicapped accessible. Many programs also provide volunteers to help complete the necessary upgrades and repairs.

Habitat for Humanity builds new homes for people in need. They also spend time recruiting skilled volunteers to help low-income households perform critical maintenance and repairs.

The NeighborWorks program is a non-profit with roots in Congress designed to help homeowners in middle-class and low-income tax brackets update and repair their homes without taking out remodeling loans.

The Rebuilding Together program offers help to people living at or below poverty, and they are focused on making cruial repairs to homes. Most of these organizations are easy to find in an Internet search by typing in a zip code and the search term, “Habitat for Humanity,” “Rebuilding Together,” or “NeighborWorks.”

Some grant programs also offer very low-interest home remodel loans for critical home repairs required to bring a home up to local codes for living standards. These home remodel loans are subsidized by the federal government and help to bring homes in need of repair up to code and increase their comfort and overall liveability.

Trends in Home Remodel Financing and Spending

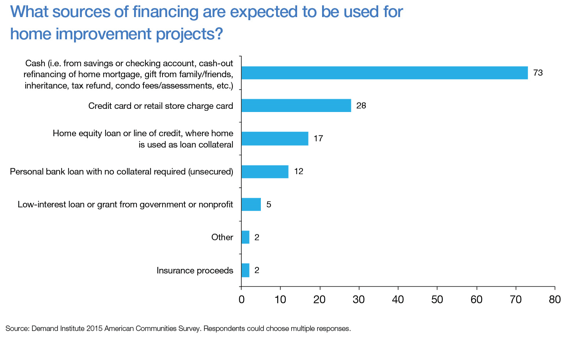

According to the 2015 American Communities Survey by the Demand Institute, 73% of Americans expected to use cash for their home remodel financing.

Only 28% expected to use a credit card or store line of credit, 17% thought they would obtain a home equity line of credit with their home as collateral, and 12% planned to get a personal bank loan without collateral. Only 5% of survey respondents thought they’d use a low-interest government loan or grant for their remodeling financing.

Image from Freddie Mac.com

Private Lenders Help Consumers With Money Problems Get Home Remodel Loans

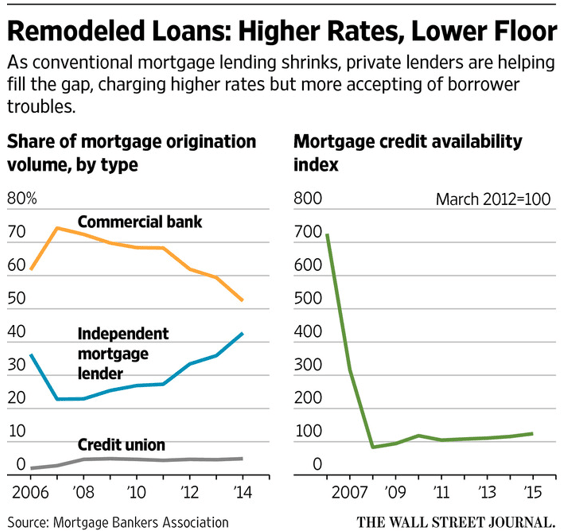

People who can’t get home remodel loans because of past difficulties with money management, a low FICO score, problems documenting income, or a high debt-to-income ratio often turn to the private money industry for remodeling construction loans from people who specialize in high-risk loans.

Since the banks are subject to tighter lending regulations, the traditional mortgage business is getting smaller. This type of non-traditional home remodel loan or purchase loan legally offers higher interest rate loans to consumers who have problems qualifying for any type of home remodel financing.

It also invites investors to participate with the promise that they can earn between 8% and 15% on their money if they are willing to take the risk. Bank loan standards are not flexible, so people who don’t fit into the typical and desireable borrower mold often have huge problems getting traditional financing.

Since 2007, the private mortage lending world has seen a steep increase in the number of loans they finance for people with bad credit or money problems. Independent mortgage lenders now service over 40% of the total volume of home loans.

The mortgage credit availability index fell sharply between 2007 and 2009 and has since remained nearly flat, forcing people who need to get mortgages and home remodel loans to find other ways to come up with the money to fix or improve their homes.

Image from The Wall Street Journal

Popular Article: What Is a Jumbo Loan? A Complete Guide (Loan Limit, Mortgage & Rates)

Free Wealth & Finance Software - Get Yours Now ►

Conclusion: Which Remodeling Construction Loan is Right Choice?

Even with the myriad of information available today, it can still be difficult to decide which remodeling construction loan is the best choice. While home remodel loans are fairly easy to get for people with great credit, verifiable and ongoing employement, and some equity in their home, there are still many viable options for homeowners who find themselves in less than ideal situations.

Private lenders, home improvement grants, and government-backed lending programs offer viable choices for low-income households, seniors on fixed incomes, and even people in very difficult financial situations.

Finding traditional home remodel loans in the form of a home equity line of credit (HELOC), unsecured bank loan or personal loan, or credit cards is a good place to start. After careful evaluation of the home owner’s financial situation, it may be necessary to move past these better-know options and on to 401(k) loans, FHA loans, privately backed remodeling construction loans, or local grant programs.

Read More: Prospect Mortgage Reviews – What You Should Know (Complaints & Review)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.