It’s not surprising at all that when you are in your early to mid 20s, the questions on your mind are about college, career choices, and choosing the right employer. At that age, you’ll never stop to ask, “Well, how much money is needed for retirement?” That’s because retirement is so far down the line, that it seems more constructive to worry about how you’ll repay your student loans or finance your own apartment than to worry about the money needed to retire.

As one ages, however, the truth about savings and retirement hits closer to home; by the time you are in your mid-30’s, it will surprise you how often you may be asking yourself: “How much money do I need to retire at 50? Or 60? Or even 65?” Age has a way of changing one’s perspective on life, and as you get older, and retirement looms closer, retirement planning becomes your number one priority.

WHY PLAN?

Assume you are planning your vacation for the coming summer. In January of this year, you have six whole months to plan your July getaway. You can make plans, run them by friends and experts, change them several times over, and then eventually settle for the “perfect vacation.”

Perfection, however, wouldn’t be possible if you started planning a week prior to your vacation date! What if things went wrong? Suppose flights are booked or hotel accommodation isn’t available? Maybe last-minute changes to your work schedule mean you can’t even make a getaway as originally planned!

So, too, it is with retirement. At 40, it’s more effective to ask, “How much money do you need to retire at 60?” and try to figure it all out than to reach 60 and then try to figure it out. The longer your planning horizon is, the more flexible (and realistic!) your retirement plans will be.

WHEN TO PLAN?

So, what is the ideal age to sit back and ask yourself, “How much money do I need in retirement?” The correct answer is: It all depends! Ideally, the sooner you start planning–even as early as in your late 20s or 30s–the better.

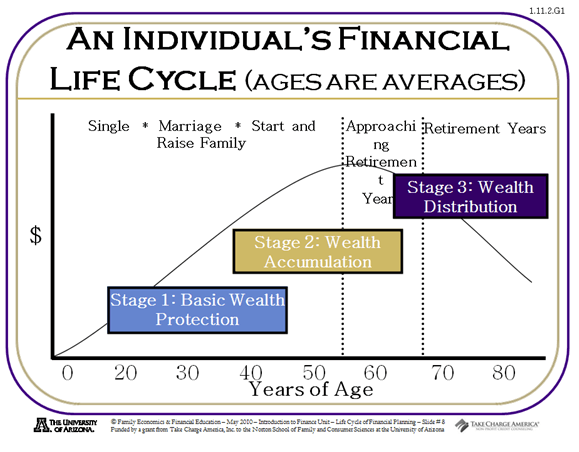

Typically, financial planning experts divide retirement planning into three phases over an individual’s life span. While these “stages” are not discrete or absolute in any sense, they do offer an insight into whether you should be answering the question, “How much money do I need to retire at 60?” or “Can I retire at 65?” or “How about 40?”

- Stage I – Basic Wealth Protection is when individuals concentrate on building a basic foundation for future financial security.

- Stage II – Wealth Accumulation is the period when you are clear about the amount of money needed to retire and you accelerate your savings to meet those goals.

- Stage III – Wealth Distribution is when you retire and start drawing-down on your retirement nest egg.

Image Source: Family Economics & Financial Education

It is advisable therefore to question how much money you need to retire during each of those phases. Often, it would behove you to revisit that question at least once every year, especially once you enter Stage II.

HOW MUCH TO PLAN FOR?

So, how much money is really needed to retire? Just how much money do you need to invest? Like the “When to…?” question above, “How much…?” also depends on various factors. In order to determine how much you’ll need to retire at a certain age, you’ll need to figure out the answer to questions like:

- When do I plan to retire?

- What will my expenses be in retirement?

- What type of a lifestyle will I lead when retired?

- How long do I expect my retirement nest egg to last?

It is only after you have a pretty good sense of the answers to these questions that you can ask, “How much money do I need to retire at 50? Or how much money do I need to retire at 60, or 65?” Without knowing how much you will spend during retirement, it is hard to establish how much money you need to retire at any particular age.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

THE BASIC BUILDING BLOCKS

There are four main building blocks to addressing how much money you will need to retire. These include asking questions about:

- Yourself and your current personal situation

- Your current investment portfolio

- The income you expect to receive during retirement

- The expenditure you are expecting to incur on your retirement lifestyle

By carefully using the details from all these four building blocks, you can look at how much money you need to retire or how much you need to save in order to retire by a certain age.

Let’s illustrate with the help of an example:

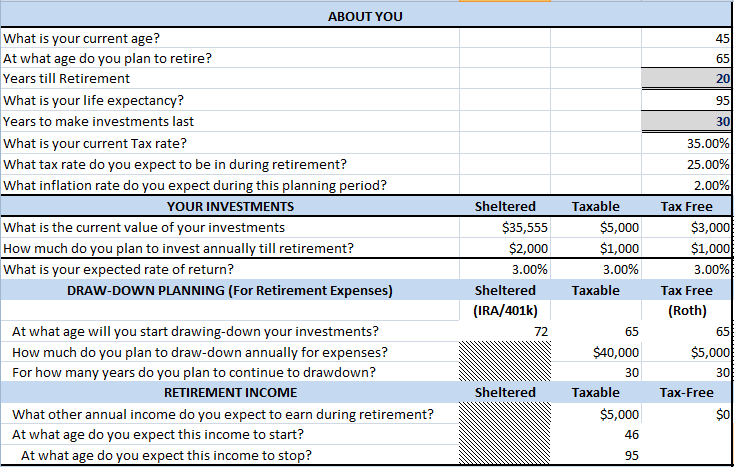

Table 1: Information for your 4 building blocks

Let’s assume you are currently 45 years old, and you ask yourself, “How much money do I need to retire at 65?” Using a spreadsheet, as displayed in Table 1, you can provide information that will allow you to answer that question–to a fair degree of accuracy.

- ABOUT YOU: This building block needs your current age, the age at which you plan to retire, how long you expect to be in retirement (life expectancy), current income tax rate as well as expected rate during retirement, and the expected rate of inflation over the planning horizon.

- YOUR INVESTMENTS: You need to provide details of what your current investments look like under the three “buckets” of investments: Sheltered (IRA, 401(k), Taxable (Savings accounts, Term Deposits, Mutual Funds etc.) and Tax Free (Roth savings). Also, to help work out the money needed to retire, you must factor in how much you plan to save in each of these “buckets” annually, for how long, what rates of return to expect, and when to start mandatory draw-downs from sheltered accounts.

- RETIREMENT INCOME: If you plan to work (casual work, part-time, etc.), even if it is during some part of your retired life, you need to factor that into the mix as well. Your retirement income could also come in the form of government benefits, private insurance plans, or employer pension schemes. All of these need to be accounted for.

- RETIREMENT EXPENDITURE: Finally, you need to decide how much it would cost annually for you to live the retirement life that you want. For the purpose of this example, we will simply assume that minimum drawdown from Sheltered savings is based on a certain percent each year. If you wish to be more accurate in your calculations, you may use various IRS tools provided for the purpose.

With this information now available to you, you can figure out how much money you need to retire at 65.

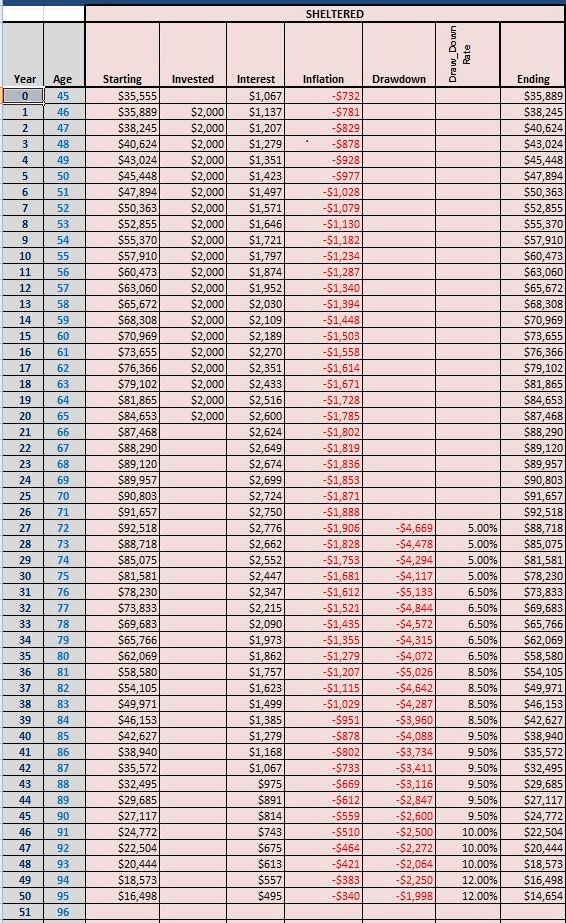

Table 2A.1: Retirement Plan from age 45 to 95 (Sheltered Assets)

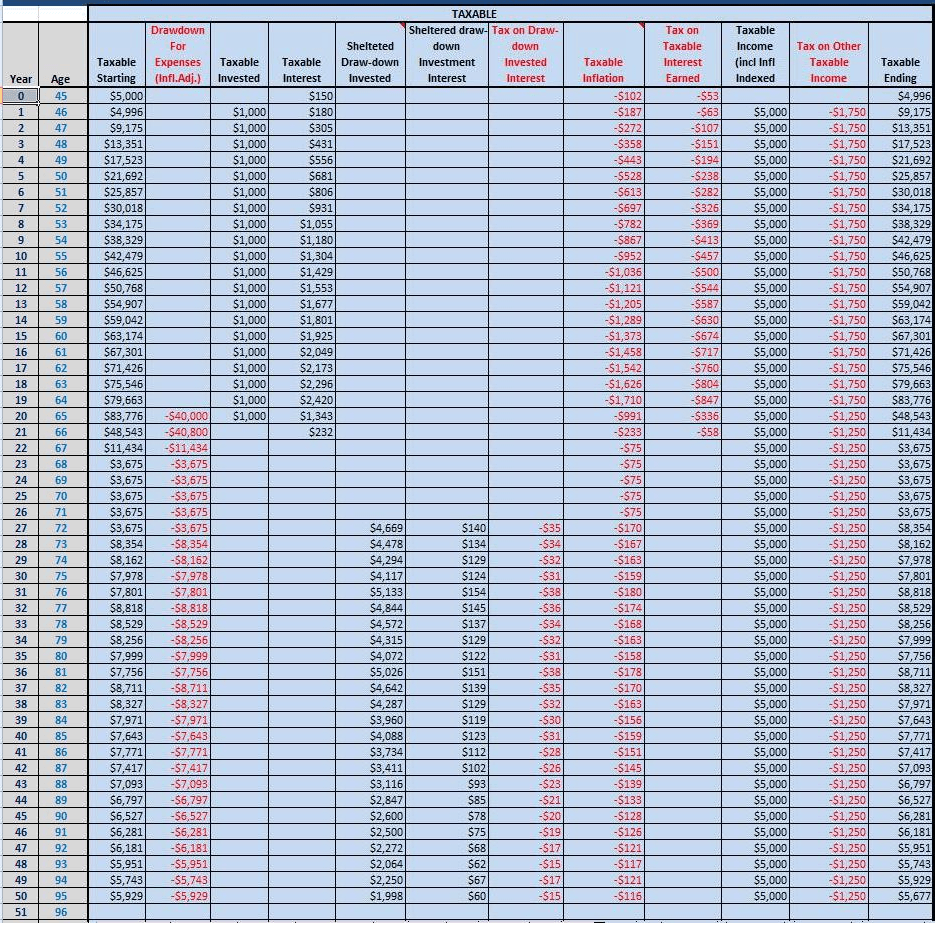

Table 2A.2: Retirement Plan from age 45 to 95 (Taxable Assets)

Table 2A (1 and 2) provides a partial look (covering Sheltered and Taxable assets only) at how much money might be needed to retire at various stages during your pre- and post-retirement period–starting at age 45. A closer look at Table 2A (and Table 2B shown below) will answer questions like:

- If I saved $35,555 and $5,000 in Sheltered and Taxable assets (the next table–2A.3–shows similar information for $3,000 of your Tax Free assets) respectively at age 45, will I have enough money in those buckets to last me throughout my retirement life (age 95), if I retire at age 65?

- If you spent a total of $45,000, indexed to inflation, from your Taxable ($40,000) and Tax Free savings ($5,000) annually, starting at age 65, how much money do you need to retire by that age?

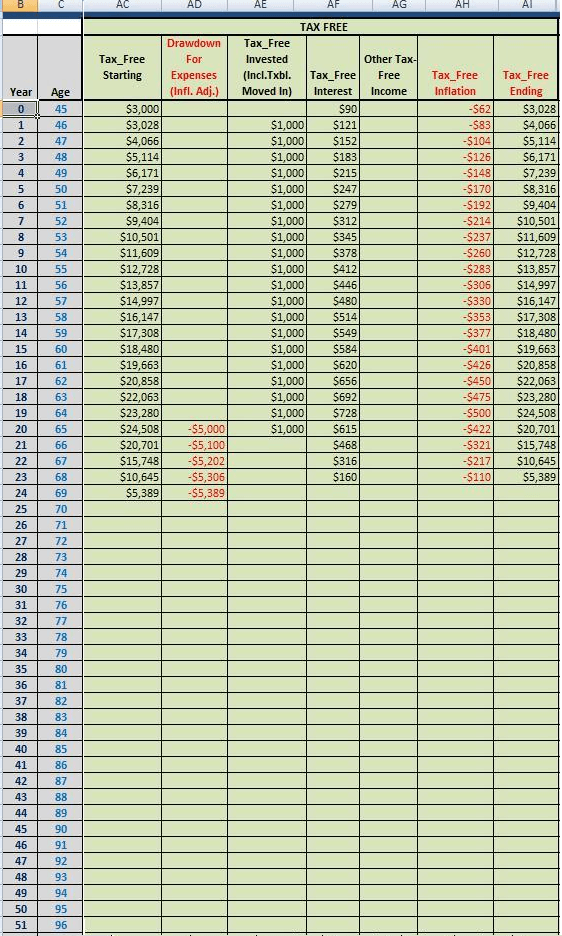

Table 2A.3: Retirement Plan from age 45 to 95 (Tax Free Assets)

While the information in Tables 2A.1 to 2A.3 provide some great insights into the amount of money you’ll have at various stages of your life–starting at 45 until 95; the last three columns of Table 2B really address the question “How much money do you need to retire at 65?”

Based on the building block information provided in Table 1, we can now see that you will not have sufficient money needed to retire at 65. Here’s why:

- By age 64, your retirement nest egg (Sheltered + Taxable + Tax Free) will have grown to $192,938.

- As you start withdrawing $45,000 ($40,000 and $5,000 in today’s dollars from Taxable and Tax Free sources respectively), your nest egg starts depleting.

- By the time you hit 67 (or thereabouts), you will have a net shortfall of $30,182 for your annual expenditure. That’s because, based on Table 1, you plan on withdrawing $46,818 (inflation adjusted) that year from your Sheltered and Taxable accounts, BUT you only have enough money to cover $16,636 of those expenses.

BRIDGING THE GAP

The above scenario uses a mix of Sheltered, Taxable, and Tax Free savings to begin with. When you start calculating how much money you need to retire at 60, or 40 or 55, the “gap” between the amount needed for retirement expenditure and that covered by your nest egg will vary depending on how much there is in each pot at retirement.

For instance, if you could save $20,000 annually (it’s difficult–but let’s just see what the impact is on the “gap”!) in each of your three pots until retirement, it could make a huge difference on how much money was needed to retire at a certain age.

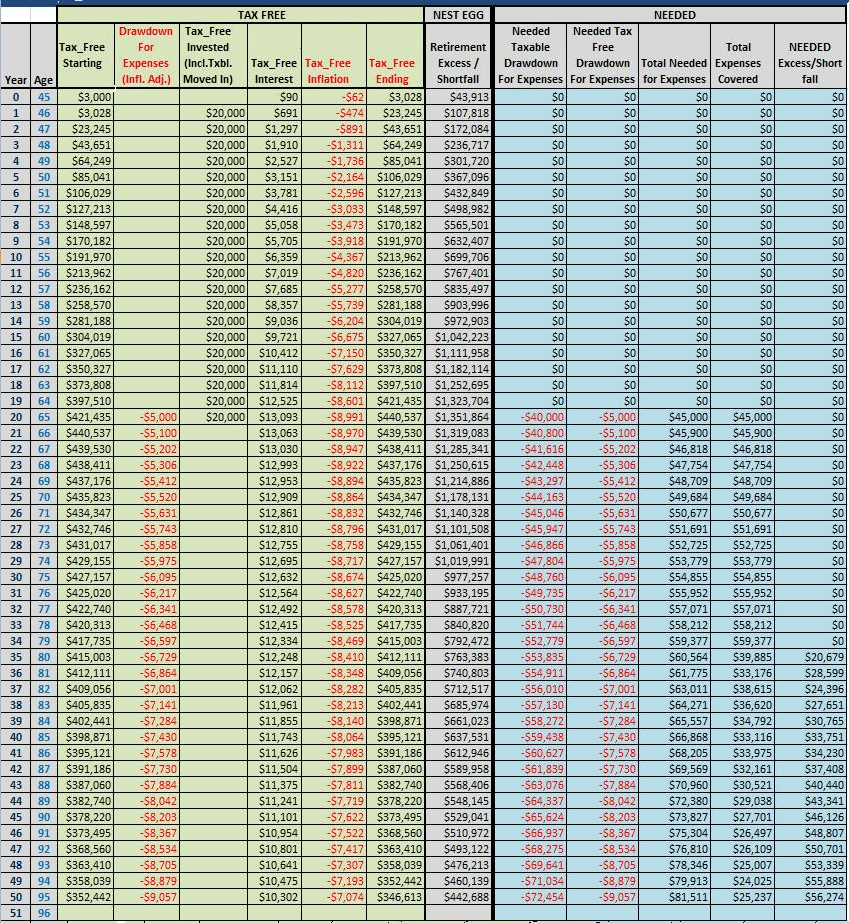

Table 3: Managing The Excess-Shortfall from age 45 to 95

Clearly, your accelerated saving plan has paid off, because now you can live comfortably until you hit 80 before you have a shortfall to fund retirement expenditure. The money needed to retire at 50, 60, or 65, therefore depends on two very important factors:

- How much you have saved prior to retirement

- How much that pot will grow and deplete during retirement

Summing it all up then, to find out how much money do you need for retirement, follow these steps:

- Decide WHEN you want to retire

- Determine WHAT you will spend in retirement

- Confirm HOW MUCH you have right now

- Work out HOW MUCH your current pot will be worth (at various age points) prior to retirement

- Do some math to find out HOW MUCH more you need (at various age points) to bridge any gaps between (b) and (d)

TOUGH CHOICES

When you finally figure out or 60 or whenever it is that you plan on retiring, you may not like the answer! You may find out that you will have saved too little by then, or you may realize that you need much more money to fund your retirement lifestyle.

Whatever the case may be, if you find yourself in that unenviable position, there are some tough choices you may need to make:

- Retirement Expenses: Revise your retirement lifestyle expectations

- Delayed Retirement: Work longer to save more, so that you can meet your retirement expectations

- Increase your risk: Take more risk by investing into higher-risk, higher-reward types of investments, hoping your nest egg will grow much bigger by the time you retire

The best advice anyone can give you is to first make an inventory of your current savings; then, work out how much you plan on spending during retirement. Then, armed with all that information, consult a qualified financial planner and ask, “How much money will I need to retire?”

DISCLAIMER

This article uses several examples in order to provide hypothetical answers to the question “How much money do you need to retire at 65 or 50 or 40?” The examples used may not fit perfectly to any particular individuals’ financial situation. For instance, while some individuals may maintain sizable Sheltered savings, they may not have anything in Tax Free accounts (contrary to what the example shows).

Each individual’s minimum drawdown rate may also be different as they start dipping into Sheltered accounts for retirement expenditure. The examples used above use a simple rate, starting from 5% and gradually increasing every few years. In real life, that rate will be determined by the size of your Sheltered account and the age at which you make a withdrawal.

Despite these differences, however, the process illustrated in this article to determine the amount of money needed to retire at various ages is sound and may be applied generically for most retirement planning situations.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.