Overview: How Much Should I Save for Retirement?

Whether you are 20 or 50, it’s never too late to start thinking about retirement planning.

If you are savvy enough to build a plan on your own – good for you! But there’s no harm seeking experts to give you retirement planning advice on how much to save for retirement.

Image Source: Pixabay

Image Source: Pixabay

In fact, even if you do feel at home with number crunching, it might be a good idea to review your plan with a financial planner, when answering the question: “how much should I save for retirement?”.

What are the Building Blocks of an Effective Retirement Plan?

Sound retirement planning advice for figuring out how much to save for retirement will always start with four building pillars.

Then, based on the information provided for each of these pillars, a comprehensive retirement plan can be built.

In this article, we’ll offer some hypothetical retirement planning advice on how much to save for retirement using a Microsoft Excel spreadsheet.

Remember, this article is not about developing an Excel tool. It merely uses Excel to illustrate sound retirement planning advice you should expect to receive.

So let’s start putting together our building blocks to the plan.

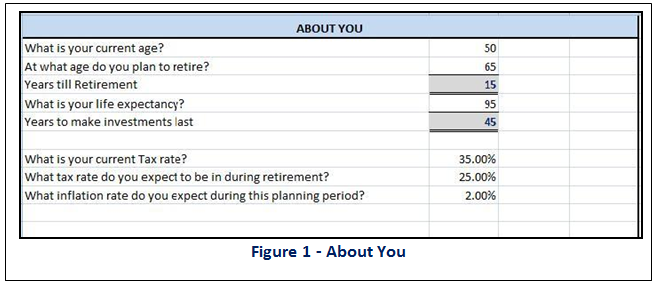

Pillar#1: About Yourself

“Knowing thy self” is pillar 1, when it comes to receiving sound retirement planning advice on how much to save for retirement.

As you start putting your plan together, make sure you search deep and hard within yourself to come up with answers to questions such as:

- What are my plans are for retirement?

- At what age do I want to retire?

- How much do I need to save for retirement?

- What sorts of returns on my investment do I expect to earn?

Figure 1 is a snap shot of the questions you need to answer in order to erect that first pillar.

Image Source: AdvisoryHQ

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

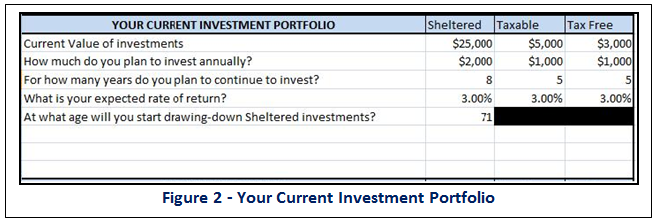

Pillar#2: About Your Investments

For anyone to provide you with a realistic retirement planning advice on how much to save for retirement, they (or you…if you are building a plan yourself) will need to know what your current retirement nest egg comprises of.

This is the starting point of any plan, and as you move from pre-retirement into retirement and beyond, your existing investments will provide a platform to get you there.

Take careful stock of all your investments, and:

Group them into three “buckets” – Tax-sheltered, Taxable and Tax-free

Retirement planning advice to determine how much to save for retirement will need you to put some thought into what your plans are to continue savings/investments

You’ll also need to come up with realistic expectations about how much you’ll earn from those returns

Figure 2 is a snap shot of the questions you need to answer in order to erect that second pillar.

Image Source: AdvisoryHQ

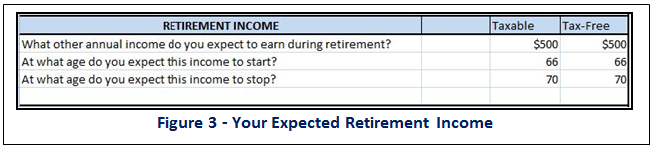

Pillar#3: Earnings in Retirement

Many individuals, especially if they aren’t lucky enough to have a large enough nest-egg to start with, may need to continue seeking income when in retirement.

When seeking retirement planning advice on how much to save for retirement, do give serious thoughts into:

Where such income opportunities might come from?

When, and how long you expect those streams to last

Figure 3 is a snap shot of the questions you need to answer in order to erect that third pillar.

Image Source: AdvisoryHQ

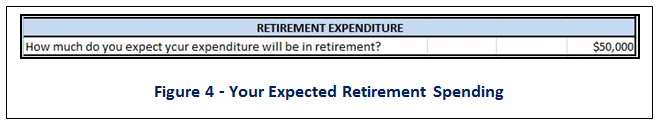

Pillar#4: Spending in Retirement

The final pillar, upon which sound retirement planning advice on how much to save for retirement will rest, comes from estimating what your retirement spending will look like.

Give realistic thought about what you plan to spend in retirement, and how much it will amount to.

Figure 4 is a snap shot of the questions you need to answer in order to erect that last pillar.

Image Source: AdvisoryHQ

And with that, you are ready to get some credible retirement planning advice on how much to save for retirement!

Understanding the Math – How Much to Save for Retirement

Based on the information you provide to your planner, the math behind the retirement planning advice on how much to save for retirement really simple. Start off with how much you have saved today, and for every year (until your expected life expectancy):

- STEP 1: work out how much you’ll earn from your savings (interest/dividends etc)

- STEP 2: work how much inflation will eat up from that pot

- STEP 3: work out what you’ll give away in taxes (for Taxable investments) each year

- STEP 4: determine how much you’ll withdraw (draw down) from your savings each year. The example uses a straight 15% here, but individual circumstances differ. Consult the IRA to determine this amount (Required Minimum Distribution)

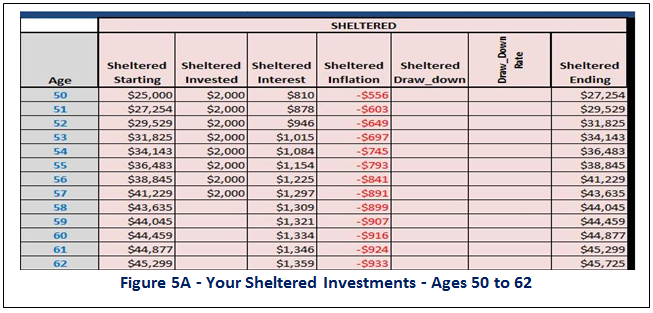

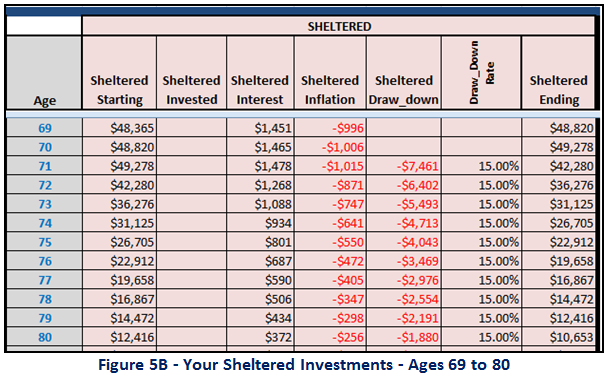

Figures 5A and 5B are assumed calculations of what your sheltered investments will look like over the years, leading into and post retirement.

Image Source: AdvisoryHQ

Based on the information you provided earlier:

- From ages 50 to 57, you continue to invest $2,000 into your sheltered account

- You receive (tax sheltered) interest on that savings ($810, $878 etc.) at 3% annually

- Inflation bites off 2% of your sheltered savings each year

- Overall, your sheltered account continues to grow

Image Source: AdvisoryHQ

As you continue doing the math, you’ll notice that:

- Commencing age 71, you start drawing down your sheltered savings (this example uses a straight 15% just for illustration. Actual draw down must take into consideration the Required Minimum Distribution tables stipulated by CRA)

- Now, your sheltered savings start declining over time

- By the time you hit your expected life expectancy age (91), your sheltered account will contain a balance of just $1,071

Overall retirement planning advice on how much to save for retirement will be based on crunching the numbers, following the four steps highlighted here, for each of three “buckets” of your savings – Tax-sheltered, Taxable and Tax-free. By the time you’re done, you’ll know if you have saved enough or are falling short.

The bottom line

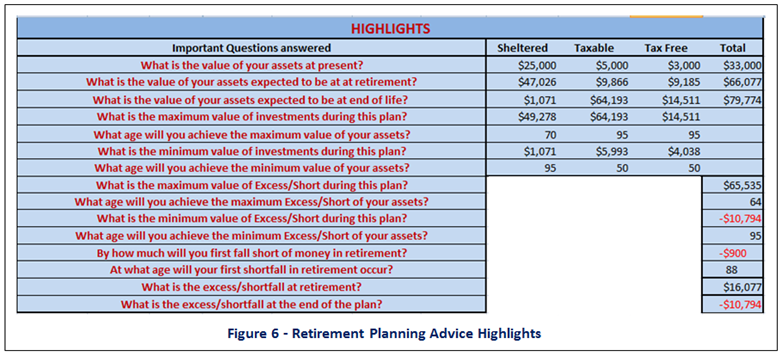

Based on the information you provided earlier on, your retirement planning advice on how much to save for retirement can include a number of key highlights on the status of your various investment “buckets”, and on the excess/shortfalls in income you can expect to encounter along the way.

Image Source: AdvisoryHQ

Figure 6 is a snapshot of the type of information you could expect from someone offering you advice on how much you should stash away for retirement:

Based on the parameters you provided at the outset of this planning process, you will start falling short of retirement funding at around age 88. Starting then, your shortfall will be $900 over and above your retirement expenses of $50,000 ($78,845 when indexed for inflation!).

By the time you reach your expected end of life (age 95), your retirement shortfall will hit $10,794. Clearly something must be done if you are to outlive your savings.

And a good planner delivering you retirement planning advice on how much to save for retirement will offer the following advice:

- Start saving much earlier

- Save more than you are doing now

- Wherever possible, tap government retirement benefits to their maximum

- Invest wisely, reducing investment expenses, fees and commissions where possible

- Spend less in retirement

More than meets the eye!

The information provided above is based on simplistic/straightforward retirement planning advice on how much to save for retirement.

There will likely be unique “twists” to this advice based on what types of investments you currently have, how social security benefits apply, and when and how you plan to draw down your savings.

However, this should be a great start for the vast majority of individuals.

Retirement planning advice will also differ based on how your investments are held (single, joint) with a spouse/partner, and what tax minimization strategies you employ to maximize your retirement savings.

Before finalizing a retirement plan, consult a qualified financial/tax/legal advisor and ask specific questions that impact your personal situation.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.