Stock Market Definition

The typical dictionary definition of the stock market is something like, “the marketplace through which stocks are bought and sold.”

Don’t confuse this marketplace with the physical stock exchanges where the actual buying and selling, or trading, takes place.

The stock market enables companies to raise capital and investors to create wealth. Sometimes the stock market is referred to as the financial market. If you look up the definition of financial market or equity market, it will look pretty much like the definition of the stock market. Let’s refer to it simply as the stock market to avoid confusion.

Image Source: How the Stock Market Works

Understanding the Stock Market

Here’s how the stock market works. For any market to exist, there must be both buyers and sellers. In the stock market, it’s stocks that are being bought and sold. Stocks represent an ownership interest in a company. Owning stock in a company gives you equity in the company, or a “piece of the action.”

Understanding how the stock market works requires an understanding of what both buyers and sellers stand to gain from it.

Stock Market Explained

When a company wants to raise money — to expand its operations or modernize its facilities, for example — it sells shares of its common stock to buyers. These may be individual investors or large institutional buyers like pension plans.

At any point in time, large companies have millions of shares of common stock owned by investors and potentially available for purchase in the stock market. Typically, any one investor will own only a tiny fraction of a percentage of the company.

When a privately owned company decides to begin offering ownership interest to investors by issuing shares of stock, it is often referred to as “going public.” The company’s first stock offering is called an initial public offering, or IPO.

A company that is going public must go through a rigorous approval process to get its stock listed on an exchange. This process requires the company to prove that it has enough capital and financial stability to meet its obligations to investors. Most of the time, however, investors are not buying newly listed stocks. They are usually buying shares owned by another investor who has decided the time is right to sell them.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

People buy a company’s stock because they believe they will profit in two ways:

- First, they will receive regular income in the form of dividend payments, usually paid quarterly. A dividend is simply a percentage of the company’s profits during the preceding dividend period.

- Second, buyers hope that the stock’s price will rise over time. If they eventually their shares at a higher price than they purchased them for, they make a profit—a capital gain. That’s the reason for the common slogan, “Buy low and sell high.” Stocks that are expected to gain in value are often called growth stocks.

Some investors are primarily interested in receiving current income from dividend payments. Others are mainly interested in long-term growth and may be willing to accept lower dividends and a bit more risk in exchange for a potentially bigger profit when they sell their stock.

Buyers’ investment objectives and tolerance for risk have a lot to do with how much they are willing to pay for a particular company’s stock. So another important aspect of understanding the stock market is understanding how stocks are priced and traded.

That’s where the stock exchanges come into the picture.

Don’t Miss: What Is Debt Consolidation? – Is It Good or Bad? (Ways to Consolidate & Explanation)

Stock Exchange Definition

There can be some confusion about the terms “stock market” and “stock exchange.” They’re often taken to mean the same thing, although they don’t. The stock market is the marketplace for stocks. Stock exchanges provide the mechanisms through which the stock market operates.

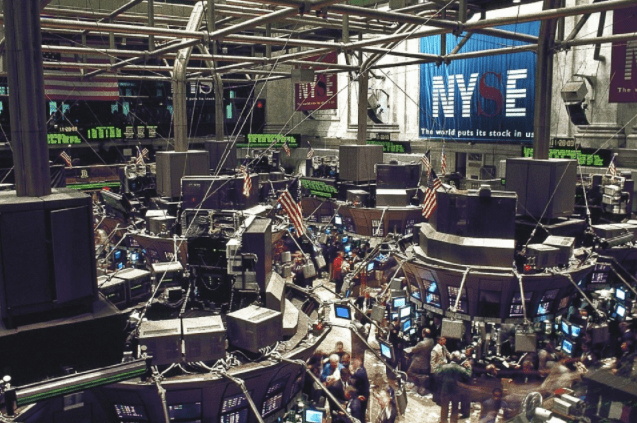

When people ask, “What is the stock market?” they’re often thinking about the frantic trading activity they’ve seen on television and in movies. All of that activity takes place on the trading floor of a stock exchange.

The answer to the question, “What is a stock exchange?” has two dimensions:

- It is a place where stocks and other securities are traded through an organized system.

- It is also the organized group of people that provides an auction market for buying and selling stocks and other securities.

Stocks are bought and sold on stock exchanges all around the world. Currently, there are 60 major stock exchanges, with the largest ones concentrated in North America, Europe, and Asia. The New York Stock Exchange (NYSE), representing $18.5 trillion in market capitalization, is by far the largest stock exchange in the world.

A particular stock may be listed on more than one exchange. (There are also stocks called over-the-counter, or OTC, stocks that are sold through a network of dealers rather than being listed on an exchange like the NYSE.)

The actual trading process inside a stock exchange is overseen by people called specialists, who match up buyers and sellers. Specialists are responsible for making sure that the process is fair and orderly. One of their main jobs is to try to prevent large fluctuations in the price of a stock from one trade to the next.

Why Stock Prices Go Up and Down

Image Source: Stock Market Definition

There’s an old saying on Wall Street that a stock is worth as much as someone is willing to pay for it. It’s all about supply and demand. The price of a stock is not controlled by the company that issued the stock or by the stock exchange it’s traded on. A stock’s price is determined by investors deciding how much it is worth to them.

Investors’ perceptions of what a stock is worth are shaped by a number of factors, such as the company’s financial health and the health of the industry the company is part of. Other key factors are:

- The general state of the economy

- Economic trends such as interest rate changes

- World and national events

All of these can affect the public’s confidence about the economic future.

Investors’ perceptions change continually as new information becomes available. Those changing perceptions drive stock prices up and down on a minute-to-minute basis.

The more desirable investors perceive a stock to be, the more they are willing to pay for it and the greater the demand for it. Yet there is a limited supply of shares available, so the increasing demand pushes the stock’s price higher.

If the price continues to rise, investors will eventually decide that it is too high, fewer people will be willing to buy, and there will be less demand for the stock. With shrinking demand, people who own the stock will not be able to get as high a price when they sell. The stock’s price will fall until investors once again believe that it is worth what sellers are asking for it.

So, understanding the stock market and how the stock market works is largely a matter of understanding supply and demand. Understanding the stock market well enough to begin investing in it also requires an understanding of the risks involved.

Related: What Is Brexit? – Get The Definition & Review (Britain Leaving EU?)

Risk and Reward

The stock market rewards those who are willing to take on more risk by giving them the possibility of a potentially greater reward. The risk lies in the fact that the reward may turn out t0 be far less than anticipated or may never materialize at all.

Any number of factors can contribute to risk in the stock market, from interest rate changes to economic downturns here or abroad, to wars and natural disasters. Risk can never be completely eliminated, but there are some ways to mitigate it, beginning with an honest assessment of your own risk tolerance.

The amount of risk you can or should take on as an investor depends on:

- How much money you have available for investing

- Your reasons for investing, such as supplementing your current income, funding a major purchase like a house or college education, preparing for retirement, and so on

- How old you are and your time horizon for achieving your objective

- Whether you are by nature a risk-taker or risk-avoider

Your risk tolerance must be a key consideration in making investment decisions.

Asset Allocation

Asset allocation is a strategy for decreasing an investor’s exposure to risk. You’ve certainly heard the adage, “Don’t put all of your eggs in one basket.” The same concept applies in investing.

If you put all of your investment money into the stock of a single company, or companies in the same industry, your entire investment could be at risk if something unexpected happens. But if you spread your investment money across several different stocks in several different industries, or better yet, across different types of securities, the resulting diversification gives you a measure of protection against loss.

Other securities, like bonds or mutual funds, entail different risks than stocks and respond differently under the same market conditions. When your investment is spread across different types of securities, you end up with multiple baskets, which lessens the overall impact of dropping any one of them. Any investment professional you work with will help you make investment decisions within the framework of an asset allocation strategy that is right for you and your particular situation.

Popular Article: What Is a Decent Credit Score? Get All the Facts! (What Is Bad Credit?)

Free Wealth & Finance Software - Get Yours Now ►

Industry Regulation

The decision to begin investing in stocks is not necessarily an easy one, even once you have a basic understanding of how the stock market works. News reports of the market falling hundreds of points in a single day can give even seasoned investors the jitters. Potential investors may also worry about becoming the victims of fraud.

First and foremost, understand that the stock market is highly regulated for the protection of everyone involved:

- Congress passes laws that govern the securities industry and has established the bodies that oversee it. Individual states pass their own laws as well.

- The Securities and Exchange Commission (SEC) is the primary regulatory agency overseeing the stock exchanges and all organizations involved in the sale of securities.

- The Financial Industry Regulatory Authority (FINRA) polices the industry, licenses individuals involved in the sale of securities, and takes disciplinary action against them if they violate ethical standards.

- Sophisticated monitoring systems are in place to detect fraudulent and illegal trading activity.

- Securities firms police their own operations and the actions of their employees for compliance with applicable laws and ethical standards.

This regulatory structure provides a high degree of protection for investors, but it does not guarantee that you will make money in the stock market. There are no guarantees when it comes to investing.

Getting Started

You can increase the likelihood of getting what you want out of investing in the stock by continuing to learn about how the stock market works. It’s also a good idea to find an investment professional to advise you and help you make sound investment decisions. Even seasoned investors with a good understanding of the stock market typically rely on experts to help manage their investments.

Read More: What Is Swing Trading? (Basics, How-to, & Strategies)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.