How to Become a Mortgage Broker

If you’ve spent any time nosing around, especially in the housing industry, you have most likely heard about mortgage brokers. All kinds of legislation have been passed in recent years to protect homebuyers. This legislation has diminished the market share for mortgage brokers, but that doesn’t mean all the opportunities in the field have disappeared too.

What do mortgage brokers do? How do you become a mortgage broker? How much does a mortgage broker even make? Unless you’re a real estate veteran, you probably have some of these questions.

Maybe you recently bought or sold a house and you were inspired to look into this field by a positive experience with the broker you used. Maybe a friend of yours has a friend in the mortgage brokering field and loves it. Or maybe you are wondering, how does a mortgage broker make money? Regardless of your motivations for being here, this article will tell you all you need to know about how to become a mortgage broker.

Image source: Bigstock

What Do Mortgage Brokers Do?

Mortgage brokers act as the “middlemen” between the mortgage lenders and the buyers of a home. A broker’s job is to help the homebuyer qualify for the best mortgage rates by working with various banks and having access to various mortgage loan options.

That is a pretty simplified explanation of all the nuanced elements hide within the mortgage broker requirements. Let’s talk about becoming a mortgage broker.

See Also: Top Project Management Keywords You Must Have on Your Resume

Mortgage Broker Requirements: How Do You Become a Mortgage Broker?

The logical first concern here is education. The good news: to become a broker, you only need to have completed high school. There are certain skill requirements, but you only need a high school diploma to get started on your path to a mortgage broker license.

According to Study.com, there are essentially five steps to becoming a mortgage broker:

- Complete related courses

- Complete pre-license education

- Take the licensure exam

- After licensure, begin working as a broker

- Continue your education

Step 1: Complete Related Courses

As stated earlier, the only official education requirement you need to meet is obtaining your high school diploma. There are certain skills specific to mortgage brokering that will be helpful for you to have. Keep in mind that you’ll be dealing with financial documents. It’s also important for you to be able to conduct research.

With those elements in mind, Study.com notes that certain classes will be more advantageous than others. Classes that develop your computer and keyboarding skills or sharpen your research and math skills will be more beneficial in your pursuit of becoming a mortgage broker.

Step 2: Complete Pre-License Education

The SAFE Act, or the Secure and Fair Enforcement for Mortgage Licensing Act, was passed in 2008. This act requires that all mortgage brokers be licensed in the state(s) in which they conduct brokering business. This act also requires that anyone interested in becoming a mortgage broker completes pre-licensure education.

The pre-license education includes 20 hours of education approved by the NMLS. The NMLS stands for Nationwide Multistate Licensing System. The NMLS Resource Center is an invaluable tool for those looking into how to become a mortgage broker. It has valuable, accurate information. It also has all the forms and guidance you could need on how to be a mortgage broker. The 20 hours of education are broken down as such by the NMLS:

- Federal law and regulations (3 hours of education)

- Ethics, focusing on fraud, fair lending, and consumer protection (3 hours)

- Lending standards in the non-traditional mortgage market (2 hours)

- Instruction on mortgage origination (12 hours)

For specific details on education, you should look to your state’s agency for the requirements. The NMLS has a helpful resource for determining your state’s education requirements.

Don’t Miss: 6 Tips on Passing the Certified Financial Planner (CFP) Exam

Step 3: Take the Licensure Exam

The next step towards your mortgage broker license is to actually take the licensing test. This exam is another element of the SAFE Act. Every aspiring broker needs to take the national portion of this exam. Some states will require that you take a second, state-specific portion of the exam.

The NMLS offers a great testing handbook resource to help mortgage broker aspirants prepare for the exams. When you’re ready to create an account and register for a test, go to the testing portion of the NMLS site. Both portions of the test are available to take on demand. Once you sign up for a test, you’ll have 180 days to sign the agreement and prepare for and take the exam. If you don’t take the test or sign the agreement in 180 days, your testing window will close.

Step 4: Begin Working as a Broker

After you obtain your mortgage broker license, you can begin working as a broker. It’ll be important to build relationships with different lenders. A powerful tool, once becoming a mortgage broker, is having a wide compendium of lenders. The more lenders you can talk to, the more varied mortgage offers you’ll be able to make to clients.

Step 5: Continue Education

Another stipulation of the SAFE Act mandates that, in order to maintain your mortgage broker license, you will need to participate in continued education. The NMLS Resource Center not only has information on how to become a mortgage broker but also on how to keep up with your continued education and maintain your mortgage broker license. The NMLS testing page outlines some of the continued education requirements you’ll need. Here is a breakdown for the state-licensed mortgage broker continued education program:

- Federal law and regulations (3 hours)

- Ethics, focusing on fraud, fair lending, and consumer protection (2 hours)

- Lending standards in the non-traditional mortgage market (2 hours)

- Instruction on mortgage origination (1 hour)

You’ll notice that the list of topics mirrors the pre-licensure list. The hours are substantially reduced, from 20 hours down to 8 hours. Similarly to pre-licensure education, it is the state agencies that can provide the specific details surrounding the education requirements.

Here is an NMLS resource with state-specific education requirements. As mentioned above, license renewal will depend upon a mortgage broker’s annual completion of 8 hours of education. The SAFE Act also has a Successive Year Rule, which states that the same course(s) cannot be completed in the same two years and be counted towards continued education. The more you know!

Image source: Bigstock

Related: How to Become a Financial Advisor

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

How Much Does a Mortgage Broker Make?

Now that you understand some of the requirements regarding how to become a mortgage broker, it’s time to take a look at how much a mortgage broker makes and how he or she earns that income.

It is possible to work through a larger mortgage broking business entity. In that case, you’d earn a salary on top of whatever potential commissions you earn on the deals you make.

Let’s take a look at what you can expect to make as an individual entity first.

How Do Mortgage Brokers Make Money (as an Individual)?

Due to the nature of the mortgage broker position, a broker typically receives a percentage of the mortgage for which the deal was brokered.

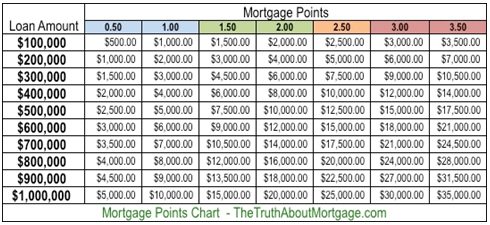

According to Realtor.com, this amount is typically 1% or 2%. This fee is paid either by the lender or the borrower. The Truth About Mortgage contests that mortgage brokers can make up to an average of 2.25 mortgage points on a loan.

What’s a mortgage point? It’s essentially a percentage point. So, at 2.25 points (or 2.25%) a mortgage broker would make $6,750 on a $300,000 mortgage. The money you make as a mortgage broker depends on the amount of deals you can close in a given month.

Image source: The Truth About Mortgage

There are some ways you cannot get paid (as of 2014) as a mortgage broker. This is the list Realtor.com put together.

As a broker, you cannot:

- Charge hidden fees

- Tie your pay to the interest rates of loans

- Receive additional pay for directing a buyer towards an affiliated business

- Receive payment from the borrower and the lender (typically)

These are part of the laws and regulations that you’ll cover in your pre-licensure education and your continued education.

Popular Article: Must Read: Why Is It Important to Set Realistic Goals?

How Do Mortgage Brokers Make Money (as Part of a Business)?

For a salaried position, your compensation will vary depending on a few factors.

First, your actual salary itself. Second, the amount of bonus compensation, or commission, you are entitled to by your company.

A Payscale.com search for New York, New York puts the median salary range at $55,000 for mortgage brokers. A quick “anonymous profile” comparison on Payscale.com shows these varied figures:

Mortgage Broker (anonymous profiles):

Years in Field: 1

Salary: $85,000

Bonus: $15,000

Mortgage Broker:

Years in Field: 1

Salary: $32,000

Bonus: $2,000

There’s no mention of location for these two brokers, but it does show you the wage disparity.

It’s a good idea to hop on Payscale.com yourself and see what kinds of numbers are generated for you. Payscale.com makes its estimates based on the numerous variables surrounding your total pay. It doesn’t take long, and it will give you a more personal answer to the question, how much does a mortgage broker make?

How to Become a Mortgage Broker: Surety Bonds

Now that you’re enticed again by the fiscal prospects, it’s time to introduce another piece to this brokerage game. There is a final, important element in the puzzle of how to become a mortgage broker. It is the surety bond. What is the function of this bond, aside from being a key piece in becoming a mortgage broker?

Basically, the state you are operating in needs a guarantee from you that you will follow all the laws and rules involved in mortgage brokering. Enter surety bonds: rather than acting as any kind of insurance for your brokering business, they act as insurance for the state that you are trustworthy.

How do you get a surety bond? There are a number of surety bond providers. A quick Internet search should turn up plenty for you. Make sure you shop around for the best rates and conditions. Allbusiness.com mentions a few factors that could influence the premium you pay for your surety bond. The list looks like this:

- Credit score

- Experience in the field

- Personal financial situation

Every bond provider will require that you, the principle, pay a percentage of the bond in order to get “bonded.” If your credit score is in good standing, you could pay as little as 1-4% of the total bond. If your credit score is in poor standing, say 600 or less, you could be looking at 5-15% of the total bond amount. Similarly, with less experience in the field, you are likely to pay a slightly higher price.

Read More: Quick Guide on How to Find and Choose a Financial Advisor

What’s Next?

Now that you know how to become a mortgage broker, there’s nothing stopping you from beginning your pre-licensure education. You are only months away from obtaining your mortgage broker license and becoming a mortgage broker.

You know the big mortgage broker requirements: education, licensure, and surety bonds. You now have answers to the questions, how do mortgage brokers make money and how much does a mortgage broker make? And you have a good beginner’s arsenal of tools to get you to where you want to be in your mortgage brokering career. All that’s left is to go for it.

Click here to view AdvisoryHQ’s advertiser and editorial disclosures, which includes a list of our affiliates.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.