Summary: How to Buy a House with No Money Down | Guide to Buying a Home with No Down Payment

After financial crises shook our country decades ago, credit requirements for home buyers became stricter. There was a time when you could buy a house with no money down fairly easily. Today’s mortgage-hunting process does not typically support those buying a home with no down payment.

Options do exist, though, for those who lack the funds to put down money for a mortgage. This article will explain how to buy a house with no down payment using one of several government-funded, low-income, or first-time home buyer solutions. Learning how to buy a house with no money down is the first step in securing one of the most important purchases you will make in your life.

Why Is a Home Down Payment Important?

Before learning how to buy a house with no down payment, you should know why most lenders require a down payment. Yes, down payments are important; no, they are not always a necessity.

Image: freddiemac.com

If you are looking to buy a house with no money down, it is probably because financially, you cannot afford a down payment. Down payments are typically about 10 to 20% of a home’s purchase price. For a $100,000 mortgage, you could be spending between $10,000 and $20,000 for the down payment. This amount of money is not readily available for most people, and it is why they want to know how to buy a house with no money down.

But buying a home with no down payment has its cons. Lenders like to see down payments so they know you are serious about the home you are buying and that you are financially stable enough to buy it. From the perspective of a lender, someone who has saved the money for a down payment could be more likely to consistently pay mortgage payments in full and on time.

Still, there is no harm in learning how to purchase a home with no down payment. In fact, there are several legitimate ways to buy a house with no money down if you cannot afford a down payment. When you use a legitimate funding option, lenders will not fault you for researching how to buy a house with no down payment and using what you learned.

See Also: iMortgage Reviews—What You Should Know (Complaints & Review)

Before You Buy a House with No Money Down

Before we go into how to buy a house with no down payment, there are a few things you should know. First, take a look at your finances—both cash on hand and savings. Are you in a position to put at least a small amount of money down? Even $1,000 looks better to lenders than zero because it shows that you are a responsible saver.

When looking into how to buy a home with no down payment, you should also consider the amount of money your monthly mortgage payment will increase by. Think about what is more important to you long-term: Having more money to start with or more money each month? If you want a lower monthly payment, you should not consider learning how to buy a house with no down payment and instead work on building your down payment savings.

Deciding how to buy a house with no money down should never be a rash decision. It takes significant research and careful planning of finances to understand your needs to meet both short-term and long-term goals. However, many people want to buy a home, but they cannot afford anything out-of-pocket for a down payment.

Low-income families or those who recently faced economic hardship should also have the opportunity to buy a home. Luckily, there are several options available for buying a home with no down payment.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

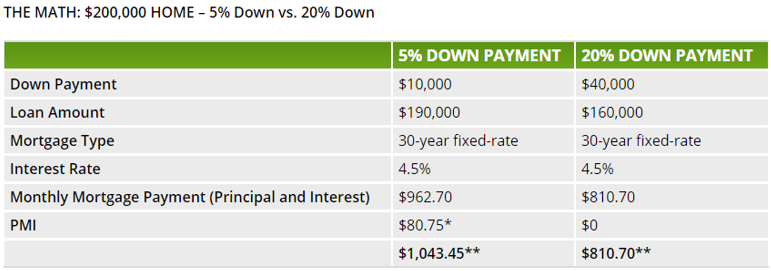

U.S. Department of Veterans’ Affairs (VA) Loans

If you are a veteran of the United States military, you have the option of learning how to buy a home with no down payment using a VA loan. This is an excellent way to buy a house with no money down if you qualify. To qualify for a VA loan, you should have both sufficient credit and income and a Certificate of Eligibility (COE) proving you have been discharged honorably from the military or are currently serving.

Image: benefits.va.gov

A VA loan is one of the most popular options when learning how to buy a house with no money down. If you qualify, you are eligible to build or buy a house with no money down. VA loans are typically some of the fastest to close and usually result in lower mortgage payments each month.

Federal Housing Authority (FHA) Loans

When researching how to buy a house with no down payment, you will more than likely come across the Federal Housing Authority (FHA). The FHA provides insurance on loans so lenders can create a better loan package for you. The FHA does not currently offer an option for those wanting to learn how to purchase a home with no down payment, but it does offer an extremely low down payment option of 3.5%.

This low percentage of your purchase price is much lower than most lenders require—the typical 10 to 20% as previously discussed. So, choosing an FHA loan can still be a good option to start with. Once you qualify for the loan, you can then research your state’s options for how to buy a house with no down payment using down payment assistance programs.

Don’t Miss: Best Banks for Mortgages—A Complete Guide (Best Mortgage Rates & Reviews)

Down Payment Assistance

Many states offer certain types of down payment support for those who want to know how to buy a house with no money down. Several states, for example, offer the Down Payment Assistance (DPA) Grant, which can help you with the 3.5% down payment for your FHA loan. The DPA Grant never has to be repaid and can actually pay up to 5% of your loan amount.

Down Payment Resource is a helpful website in learning how to purchase a home with no down payment using down payment assistance programs. This website works with lenders, realtors, and home buyers to search for options the home buyer might be eligible for. When you enter your basic personal, household, and income information, you will learn what options are available to you for buying a home with no down payment.

United States Department of Agriculture (USDA) Loans

If you live in a rural area and want to know how to buy a house with no money down, the United States Department of Agriculture (USDA) could help you. The property you are looking to purchase must be eligible by USDA standards and you must fall into specific income guidelines to qualify for its program.

Before learning how to buy a home with no down payment using a USDA loan, take some time to look through its different loan options to determine the best solution for you. There are two main programs the USDA offers: Single Family Housing Guaranteed Loan and Single Family Housing Direct Home Loan.

Both programs require you to be within specific income guidelines, although the Direct Home Loan requires lower income limits. They both offer the option of buying a home with no down payment. The USDA requires 2% of the home’s purchase price as a fee, but it allows this fee to be rolled into the loan, making this a valid option for those looking into how to buy a house with no down payment.

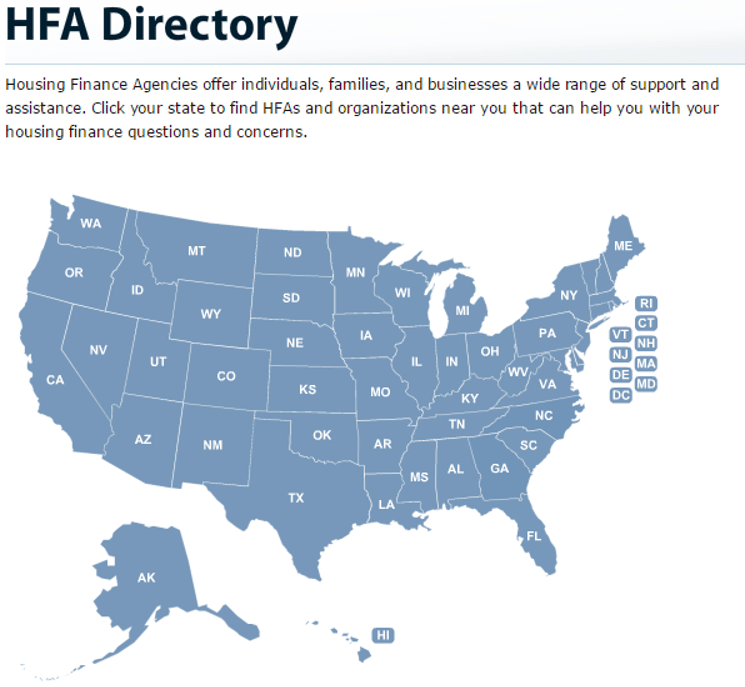

First-Time Home Buyer Programs

If you research how to buy a house with no down payment, you will probably read a lot about first-time home buyer programs. Often, those learning how to buy a house with no down payment are first-time home buyers who lack the assets needed for a down payment. Therefore, first-time home buyer programs often provide excellent resources for those purchasing a home for the first time.

Image: ncsha.org

First-time home buyer programs vary from state to state. You can check the National Council of State Housing Agencies website to search for your state’s Housing Finance Agency. Once you find your state’s Housing Finance Agency, check out its options for how to buy a house with no down payment.

Many first-time home buyer programs offer several types of programs for those looking into how to buy a house with no money down. Programs can range from down payment assistance to tax credits to special housing units offered at below-average costs. Some even offer low-interest loans or loans with down payment and closing costs included for first-time home buyers.

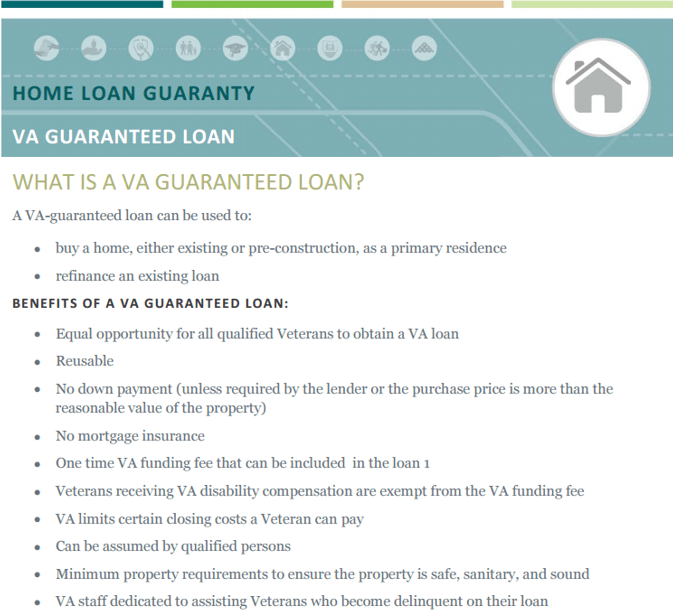

How to Buy a House with No Money Down Using Private Mortgage Insurance

Private mortgage insurance is something you should become educated with if you are interested in how to buy a house with no down payment. Most lenders require you to obtain private mortgage insurance (PMI) if you want to buy a house with no money down, or any down payment less than 20% of the purchase price.

Private mortgage insurance is a way to protect the financial interest of the lender should you become unable to afford your mortgage. Since most lenders would prefer a down payment as an added measure of security and financial responsibility, PMI is another way for them to achieve this security with those buying a home with no down payment.

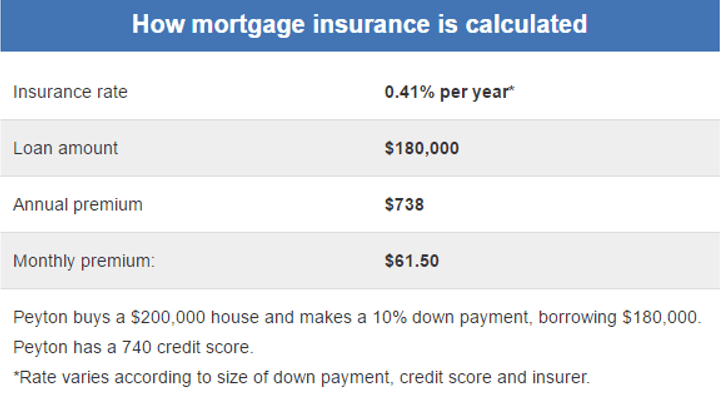

Image: bankrate.com

If you want to know how to buy a house with no money down using PMI, check out Bankrate’s example calculation. Basically, your private mortgage insurance rate will annually fall between 0.3% and 1.5% of your loan amount, depending on your credit-worthiness and down payment amount, if any.

So, a $100,000 loan with no down payment and a PMI rate of 1% will cost $1,000 per year. You can pay most PMI premiums monthly, so this premium would be about $83.34 per month. If you are looking into how to buy a house with no money down, you might decide that this PMI premium is more affordable for you each month than a lump-sum down payment.

Popular Article: Churchill Mortgage Reviews—What You Want to Know (Complaints & Review)

Free Wealth & Finance Software - Get Yours Now ►

Is Buying a Home with No Down Payment a Good Idea?

Now that we have covered how to buy a house with no money down, you might still be wondering if buying a home with no down payment is a good idea. The answer to this depends on each home buyer’s specific situation.

Is it imperative that you buy a home right away? If you are at risk for losing your current rental or being displaced from your current housing situation, you might want to purchase a home right away, but you may not have enough savings for a down payment. In emergency cases, learning how to buy a house with no down payment is a viable option.

However, if you can afford a down payment but are still considering how to buy a house with no money down, you may be causing a disservice to yourself. Consider your long-term financial situation. Even if you can only afford a 10% down payment, which is the lowest most lenders allow, this amount will help you lower your mortgage cost each month. You will also have some equity in your home to start with, bringing you one step closer to paying off your loan.

For those who cannot afford money down and want to know how to buy a home with no down payment, researching the legitimate options mentioned in this article will help you determine what will work for you. There is no shame in knowing what you can and cannot afford. Purchasing a home is a wise long-term financial goal and learning how to buy a house with no down payment can help you reach that goal faster.

Read More: Want to Buy a House with Cash?—Get All the Facts! (Save Money, Cash Process & Review)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.