Overview: How To Get Rid Of PMI Mortgage Insurance | 6 Ways to Getting Rid of PMI

As a potential or current homeowner, you ultimately want to reduce additional expenses on your mortgage loan. Unfortunately, every time you get a break such as no closing costs, low-interest rates, or low down payment assistance, there is a loophole.

One major loophole you may have run into is the requirement to have private mortgage insurance (PMI).

If you are researching methods on how to get rid of PMI, this article helps you do that, and it addresses how to get rid of mortgage insurance at little or no cost to you.

Investopedia identifies six reasons one would want to avoid private mortgage insurance. You may be facing one or more of these reasons now as you’re researching how to get rid of mortgage insurance. The six reasons are:

- It’s an additional expense

- It may not be deductible

- This is not death insurance to pay off your loan

- You’re practically giving money away

- It’s a hard process to cancel

- The payments can be indefinite

Image source: Bigstock

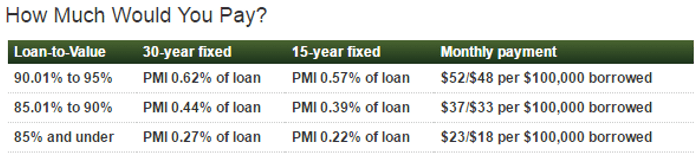

The main negative reason that you may identify with for getting rid of mortgage insurance is the additional out-of-pocket expense. Look at the chart from Interest.com, located below.

You could pay a PMI anywhere from as low as $23 to as high as $52 per month, per $100,000 borrowed for a 30-year fixed-rate loan. In June 2016, the average U.S. home sales price was at $247,700. That is at least an additional $50 or so you can put back into your savings account.

Image from Interest.com

If you are a current homeowner, another major method that could help your current situation is to refinance to get rid of PMI.

It does not matter if you have a Federal Housing Administration (FHA) loan or another type of government-funded loan; we’ll discuss how to get rid of PMI. PMI is not always tax deductible, which is another reason you are looking at how to get rid of PMI. PMI is money you could invest instead of throwing away.

There are some benefits to keeping mortgage insurance, like job loss protection and receiving a partial claim advance in the event of foreclosure.

However, just being informed for future purposes regarding how to get rid of mortgage insurance and what the different types of mortgage insurance are is a good step. PMI is not private mortgage insurance to pay your home off in the event of your death. It is simply to protect the lender.

See Also: Prospect Mortgage Reviews—What You Should Know (Complaints & Review)

How to Get Rid of Mortgage Insurance: Defining PMI

First, we need to understand what Premium Mortgage Insurance (PMI) is in comparison to Mortgage Insurance Premium (MIP). Then we will answer how to get rid of PMI and how to get rid of PMI on an FHA loan. Essentially, PMI is insurance for the mortgage lender.

If you have a conventional loan and put down less than 20 percent down payment, you will need PMI. If a borrower were to default on the loan, the lender could sell the home for less than the balance of the home loan. However, getting rid of PMI is a possibility.

As a borrower, you benefit from having PMI because you don’t need to pay the entire 20 percent down payment for your home. Having PMI makes it possible for many potential homeowners to make their dreams of home ownership come true.

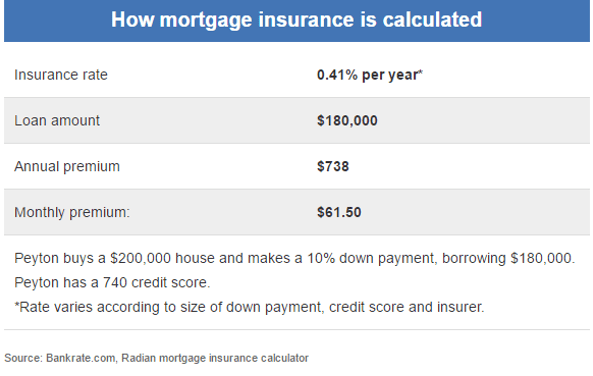

It’s helpful to know how to calculate mortgage insurance. When the time comes, you’ll know how to get rid of PMI insurance without the banks getting one over on you.

Image from Bankrate.com

Don’t Miss: Types of Mortgage Loans—What You Need to Know Before (Mortgage Types & Review)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

How to Get Rid of Mortgage Insurance: Defining MIP

Mortgage Insurance Premium (MIP) is an insurance policy for FHA loans. MIP is not associated with a conventional loan, but acts almost the same as PMI. When looking into how to get rid of PMI on an FHA loan, the terms are used interchangeably.

You will receive an FHA MIP either upfront at closing or broken up into monthly instalments added to your mortgage payment. According to SFGate Home Guides, the FHA Upfront Funding Fee is 2.25% of your new mortgage amount.

Now that you understand what the different mortgage insurances are, it’s time to cover how to get rid of mortgage insurance and the six things to know if you’re interested in getting rid of PMI.

1.How to Get Rid of PMI Automatically

During our research on how to get rid of PMI, we remembered the Homeowners Protection Act of 1998. This act sets the regulations regarding how to cancel private mortgage insurance. There are three methods of termination under the Homeowners Protection Act policy.

The first type of termination is automatic termination. Lenders can eliminate PMI automatically as long as you have at least 20 percent equity in your home and are current on your payments. Your lender is required to eliminate the private mortgage insurance once your loan balance is less than 78 percent of your home’s value at the time of purchase. If you’re near this threshold already, getting rid of PMI is in your near future.

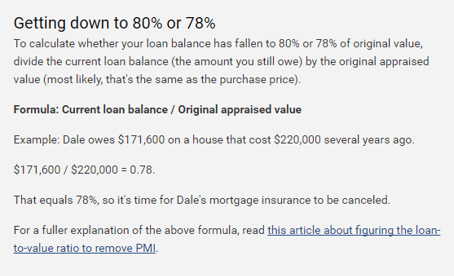

In your efforts to find out how to get rid of PMI, you should know that a borrower could request to cancel their PMI as well. Once your balance is at 80 percent of the home’s appraised value, you can do so. This is the second type of termination.

This example from Bankrate shows how to calculate the percentage of your loan balance.

Image from Bankrate.com

The last method of getting rid of PMI is the final termination. Final termination is when your loan has hit the midpoint of its amortization.

Related: Top Bad Credit Mortgage Lenders for Bad Credit Borrowers (Mortgage Lenders and Programs)

2.The 20% Rule Does Not Always Apply in How to Get Rid of PMI

You may think that once you have your home equity above the 20 percent threshold, getting rid of PMI is automatic. However, there are several factors involved in getting rid of mortgage insurance.

We reviewed factors that Quicken Loans discussed in their article regarding getting rid of PMI. If you’re looking into how to get rid of PMI, be sure to understand the following six factors, as these may affect getting rid of PMI:

- Type of mortgage insurance

- Lender of your loan

- Loan-to-value ratio

- Property type

- Age of the loan

- If your property value has increased

3.Getting Rid of PMI by Getting a New Home Appraisal

Another method of getting rid of PMI is obtaining a new home appraisal. The 20 percent equity threshold is typically based on the original sales price of your home. According to Nationwide, a typical appraisal can cost anywhere from $300 to $700.

Your home’s value can automatically increase, unbeknownst to you, and aid in your quest of how to get rid of PMI. According to US News, location is an important factor that influences your home’s resale value. Inman covers six other factors that affect the value of your home:

- Living near parks and golf courses

- Living within half a mile of a 24-hour Walmart

- Having a great walkability scale

- Having a separate living space

- Living in a city with a professional sports arena

- Having mature trees on your property

When looking at your options on how to get rid of mortgage insurance, think about any of the above changes have taken place in your area since you’ve purchased your home. These factors take place at no cost to you and help you in getting rid of mortgage insurance.

4.How to Get Rid of PMI by Increasing Your Home’s Value

In your attempts toward getting rid of PMI, why not increase the value of your home? If your home’s value is higher, then there is more equity in your home. Additional equity makes it less risky for the banks if you should default.

To increase your home’s value, you can remodel a room or make a significant home improvement. Before making any home improvements, speak to your lender to inquire if the change will be effective in getting rid of PMI in your specific situation.

According to the Hanley Wood Media, Inc., insulation is one of the highest returns on investment (ROI) for a homeowner, especially those looking into getting rid of PMI. Insulation is energy efficient and helps reduce heating and cooling costs.

A major concern about getting rid of PMI by increasing your home’s value is the expenses in doing so. However, there are many ways to spend just a few hundred dollars. HGTV gives 30 great tips to do just this, ranging from projects that cost less than $100 up to projects for around $750. A few options include:

- Eliminate or redo the kitchen island

- Add curb appeal with plants

- Change fixtures in the bathroom

- Change lighting fixtures in the foyer

Before just choosing options, you should plan how to get rid of mortgage insurance through a home improvement plan that works for you financially.

5.How to Get Rid of PMI by Requesting a PMI Cancellation

As mentioned, it’s not always easy to put in a request for getting rid of PMI. There are processes in place that will help under the Homeowners Protection Act. Nevertheless, it also has to be fair to mortgage lenders too.

If you’re looking for ways on how to get rid of mortgage insurance on your own, below are the requirements to be met as according to Consumer Finance:

- You must put your request in writing.

- You must not only be current on your mortgage payments, but you must also have good payment history.

- You may be required to provide proof you don’t have additional liens such as a second mortgage.

- You may be required to provide proof that your property value hasn’t decreased.

If you’re looking into how to get rid of PMI, be sure you meet the above requirements before speaking to the lender. Each lender is different; inquire with your specific lender before attempting to get rid of PMI.

According to Investopedia’s suggestions on how to get rid of mortgage insurance, a good payment history means your payments can’t be more than 30 days past due within the last 12 months before the cancellation date request. Your payments can’t be more than 60 days past due within your first 12 months mortgage payments in the last 24 months before your cancel request.

6.Refinance to Get Rid of PMI

Another question we’d like to address is for those wondering if getting rid of PMI on an FHA loan is possible? As MIP is different, here is how to get rid of FHA PMI. Getting rid of PMI on an FHA loan depends on when you applied or closed on your loan. Wells Fargo covers the criteria regarding how to cancel your MIP for FHA loans. Below is a brief summary of important factors:

- If you closed on your FHA loan between July 1991 and December 2000, you can’t eliminate your MIP. As long as you have this loan, getting rid of PMI is impossible.

- If you’ve applied for your FHA loan between January 2001 and June 2013 and you’ve owned your home for at least five years, the MIP will automatically be removed when your loan-to-value (LTV) is 78 percent.

- If you’ve applied after June 2013, and your loan amount was less than 90 percent LTV, the MIP will be removed after 11 years. If it were more than 90 percent LTV, again, your MIP will remain for the duration of the loan.

A common theme in how to get rid of FHA PMI is simply getingt rid of the FHA loan altogether. This is why you should consider the option to refinance to get rid of PMI.

Popular Article: Credit Score for Mortgage Loans for this year (Good Credit Score Needed to Buy a House)

Free Wealth & Finance Software - Get Yours Now ►

How to Get Rid of PMI Insurance—Final Thoughts

In any case, for conventional loans or FHA loans, getting rid of PMI is going to help you out, putting more money back in your pocket. Some methods, such as getting your home appraised or making home improvements can generate an out-of-pocket expense, but will ultimately assist in getting those monies back within a short amount of time.

Electing to refinance to get rid of PMI seems to be a great option when dealing with an FHA loan. The mortgage rates today are extremely low. You’ll not only be getting rid of PMI on an FHA loan but also lowering your monthly principal and interest payments.

The information given in this article about how to get rid of PMI insurance will help you make an informed decision, whether to pay down your loan or refinance to get rid of PMI.

Read More: Carrington Mortgage Reviews – All You Need to Know (Mortgage Services Reviews)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.