Overview: Interactive Brokers Review | What You Should Know: Fees, Margin Rates, Deposits & Requirements

Interactive Brokers Group, Inc. is an award-winning company with a long history of success. It’s not surprising, then, that there are many potential investors searching for Interactive Brokers reviews online.

In our Interactive Brokers review, we wanted to focus on several key areas: the company’s background, Interactive Brokers fees, Interactive Brokers margin rates, Interactive Brokers minimum deposit requirements for various types of investors, and the company’s requirements for investors.

(Please note that, unless otherwise noted, the fees, margin rates, deposits, and requirements discussed throughout this article are for U.S. investors only and given in U.S. dollars. Interactive Brokers fees, Interactive Brokers minimum deposit requirements, and other requirements for international investors can be found on the Interactive Brokers site.)

About Interactive Brokers Group, Inc.

Image Source: Interactive Brokers Group

In 1977, Thomas Peterffy, now the chairman and CEO of Interactive Brokers Group, Inc., bought a seat on the American Stock Exchange and became a member, trading as an individual market maker in equity options. From those early roots, the company grew and evolved over the past 39 years to become one of the world’s premier securities firms, with more than $5 billion in equity capital.

Throughout its evolution, the company’s mission has remained the same: “Create technology to provide liquidity on better terms. Compete on price, speed, size, diversity of global products, and advanced trading tools.”

It has executed on that promise so well that it earned an overall rating of 4.5 stars from Barron’s in 2016 (losing to Fidelity by a scant tenth of a point while still garnering the same 4.5 star rating). In the article, Barron’s spoke highly of the company’s access to international markets, praised Interactive Brokers fees for remaining consistently low, and applauded its transparency in pricing.

Indeed, Barron’s Interactive Broker review resulted in the firm being rated as the following:

- “Top Online Broker”

- “Best for International Traders”

- “Best for Frequent Traders”

- “Lowest Cost Broker Rating

- “Low Cost” for the 15th year in a row

Also, in 2016, an Interactive Broker review by the WSL Institutional Trading Awards named the company the winner for “Best Options Trading Platform—Broker” and “Best Broker-Dealer Futures.”

It’s not surprising, then, that so many potential investors are seeking Interactive Brokers reviews that cover the areas they most want to see addressed: Interactive Brokers fees, Interactive Brokers margin rates, Interactive Brokers minimum deposit requirements, and Interactive Brokers account management tools.

See Also: Top Futures Trading Brokers Trading Platform Reviews

Interactive Brokers Review: What Are the Interactive Brokers Fees?

So how do Interactive Brokers fees stack up to the competition? In the same exploration of its 2016 “Best Online Broker” ranking, Barron’s estimated a customer’s cost at each of its top 16 online brokers. In its Interactive Brokers review, it found that Interactive Brokers fees were the best deal for both occasional traders ($20 estimated monthly costs compared to an average of $63.45) and frequent traders ($847 estimated monthly costs compared to an average of $1,905).

In our Interactive Brokers review, we wanted to delve a little deeper into Interactive Brokers fees. Interactive Brokers fees vary depending on the product: stocks, ETFs and warrants, options, futures and FOPs, forex, metals, bonds, CFDs, mutual funds, and trade desk.

When it comes to stocks, ETFs, and warrants, we learned that Interactive Brokers offers both fixed-rate and tiered-rate plans, so traders can select the option that best fits their needs and level of trading.

- Charges a fixed-rate low commission per share (0.005 per share) or as a percent of trade value (maximum of 0.5% of trade value)

- Includes all exchange and regulatory fees

- Applies to U.S. stocks (transaction fees are passed through on all stock sales), ETFs, and warrants

- Offers lower broker commissions that decrease depending on volume (with a minimum of 0.35 per order and a maximum of 0.5% of trade volume)

- Up to 300,000 shares: 0.0035

- 300,001 to 3,000,000 shares: 0.002

- 3,000,001 to 20,000,000 shares: 0.0015

- 20,000,001 to 100,000,000 shares: 0.001

- More than 100,000,000 shares: 0.0005

- Plus exchange, regulatory, and clearing fees

- In cases where an exchange provides a rebate, Interactive Brokers passes some or all of the savings directly back to the client

Other fees that may apply to stocks, ETFs, and warrants include a 0.00020 clearing fee (per share), transaction fees (0.0000218 value of aggregate sales), NYSE pass-through fees (0.000175), FINRA pass-through fees (0.00056), FINRA trading activity fees (0.000119 of quantity sold), and a minimum fee for U.S. stock trades allocated by brokers and advisors to their clients of trade value * 0.0005, or 0.35.

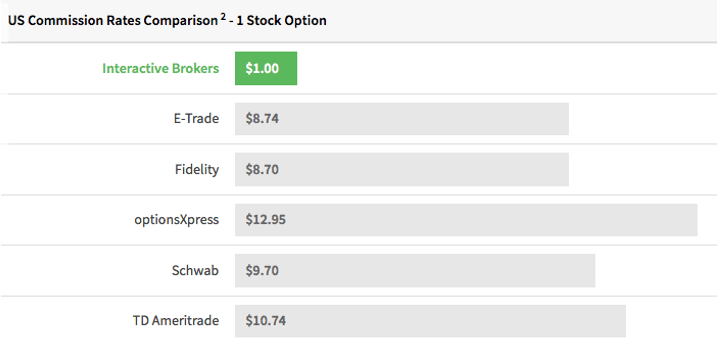

Interactive Brokers fees for options are similar to what it offers for stocks, with both fixed-price and tiered volume options. Most impressive, Interactive Brokers fees for options have been cited by Barron’s as being 91% lower than its competitors.

Image from Interactive Brokers

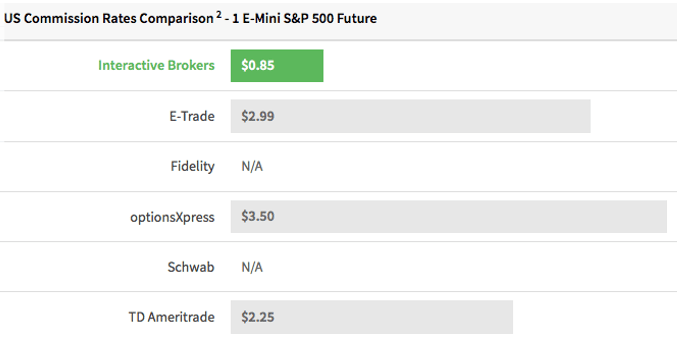

For futures and FOPs, Interactive Brokers fees, again, were praised for their dual fixed and tiered plans, ranking 69% lower in fees than its competitors, according to Barron’s.

Don’t Miss: Top Forex Brokers—Comparison of the Best Forex Trading Platforms

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Image from Interactive Brokers

Interactive Brokers fees for forex are wonderfully transparent. Instead of marking up quotes and waiving commissions, as do many forex firms, Interactive Brokers passes through the prices that it receives and charges a separate low commission. See the chart below for details:

Image from Interactive Brokers

Interactive Brokers fees for metals are simple. All trade amounts are subject to a 0.15 basis point *trade value commission ($2.00 minimum) and a storage cost of 0.10% per annum. Borrow fees for less than $1,000,000 are benchmark plus 1%, between $1,000,00 and $10,000,000 are benchmark plus 0.5%, and above $10,000,00 are benchmark plus 0.3%.

Interactive Brokers fees for share CFDs are based on a volume-tiered pricing structure, while index CFDs US 500 and US 30 have a flat 0.005 per trade fee and USTECH 100 has a flat 0.010% per trade fee.

Interactive Brokers fees for U.S. bonds are based on a tiered commission structure. Commissions are calculated based on volume, and any external fees are added on. U.S. corporate and municipal bonds of 10,000 or less are charged 0.1% of face value while those over $10,000 are charged 0.025% of face value. United States Treasuries (bonds, bills, and notes) of $1,000,000 or less are charged 0.02% of face value while those over $1,000,000 are charged 0.002% of face value. Bonds executed via BONDLARGE are charged $5 per $1,000,000 face value. FINRA trading activity fees of 0.00075 x quantity sold apply.

Interactive Brokers fees for U.S. mutual funds are a fixed $14.95 per transaction, including all regulatory and exchange fees. Commissions apply to all mutual funds except no transaction fee mutual funds. The minimum size on an initial fund order is $3,000 while subsequent minimum orders are $100.

Through its trade desk, Interactive Brokers offers broker-assisted trading for U.S. stocks, options, futures, and futures options with a minimum order size of 10,000 shares, or 100 contracts. Interactive Brokers fees for this service are commissions (0.01 per share for stocks and ETFs, 0.95 per contract on options, and $3.00 per contract on futures and futures options) plus third-party fees that are passed through regardless of the standard commission model the account has selected.

Related: Best Online Stock Trading Sites for Investors—Top Rankings

What You Need to Know about Interactive Brokers Margin Rates

Interactive Brokers uses a blended rate based on its established tiers to calculate the interest charged to clients on margin loan balances. Interactive Brokers uses the set benchmark rate (BM) or a benchmark rate of 0 for all benchmark rates less than 0. Its tiers for U.S. dollars are as follows:

- $0– $100,000: 1.8% (BM + 1.5%)

- $100,000.01–$1,000,000: 1.3% (BM + 1%)

- $1,000,000.01–$3,000,000: 0.8% (BM + 0.5%)

- $3,000,000.01–$200,000,000: Greater of 0.5% or BM + 0.25%

- $200,000,000.01 and up: Greater of 0.5% or BM + 0.25%. May be subject to a 1% surcharge applied to the spread if financing is not pre-arranged

Interactive Brokers margin rates are thus calculated by blending the appropriate tiers. For example, for a balance of $1,000,000, the first $100,000 is charged at the Tier I rate, with the next $900,000 at the Tier II rate.

To make is it simple for customers to calculate their rate, one of the Interactive Brokers account management tools is a calculator that can be found on the website. As would be expected for an online broker that specializes in international trading, there are varying tiers for different currencies, the complete breakdown of which can be found on its website. Interactive Brokers fees are adjusted periodically to reflect changes in currency rates.

According to its site, International Brokers accrues interest on a daily basis and posts actual interest monthly on the third business day of the following month.

Interactive Brokers Review: What about Deposits?

Interactive Brokers minimum deposit requirements will vary based on the type of account you establish with it. In general, the following minimum deposits are required to open an account:

- Individual accounts: $10,000

- Trading group masters: $10,000

- Broker masters: $10,000

- Indian residents trading with an IB India account: INR deposits only, equivalent to $2,000

- Indian residents trading with an IBLLC-US account: $5,000

- IRAs: $5,000

- Individuals ages 25 or younger: $3,000

- Advisor and broker clients: $5,000

To trade a margin account, clients must maintain an Interactive Brokers minimum deposit balance of at least $2,000.

Of course, pattern day traders (defined as someone who affects 4 or more day trades within a 5-business day time period) are subject to higher account minimums by NYSE regulations. In order to day trade, the account must have at least $25,000 in net liquidation value, where net liquidation value includes cash, stocks, options, and futures P+L.

What many traders like in Interactive Brokers reviews is that Interactive Brokers account management has created algorithms to prevent small accounts from being flagged as day trading accounts, thus avoiding triggering a mandatory 90-day freeze.

Interactive Brokers implements this system by prohibiting the 4th opening transaction within 5 days if the account has less than $25,000 in equity.

Interactive Brokers Review: What Are Additional Requirements?

One of the comments frequently mentioned in Interactive Brokers reviews is that the company caters to active professional traders and investors. Due to this, Interactive Brokers account management guidelines require that each account generate a minimum of commissions each month.

Accounts that generate less than the minimums mentioned below will be assessed the difference as a monthly activity fee. So your Interactive Brokers fee for monthly activity would be the difference between the required monthly commission and your actual monthly commission in any given month. Minimum monthly commissions for each type of account are listed below:

- Single accounts (individuals and small businesses): $10

- Average equity balance is less than $2,000, or if a balance is maintained in a closed account: $20

- Clients ages 25 or younger: $3

- UGMA/UTMA accounts: $10

- Advisor, friends and family, family office, and hedge fund investment accounts: no activity fee for Advisor Master accounts; $10 minimum per each client account

- Linked accounts: $10 per account

- Separate trading limit: $10 per account

In many cases, waivers are granted for your first three months of trading, or if your account’s net liquidation value is greater than $100,000. You can view the complete list of Interactive Brokers fees and exceptions on the website.

Brokers have a different set of monthly Interactive Brokers fees. There is no monthly activity fee on the Broker Master account if consolidated monthly commissions are equal to at least $2,000. Brokers are required to make an initial Interactive Brokers minimum deposit of $10,000, which is applied against the total of their first eight months of minimum commissions. At the end of the eighth month, their total commissions are subtracted from the $10,000 deposit to reach the required commission minimum.

Thanks to these consistently low Interactive Brokers fees, international trading capabilities, and the robust platform of Interactive Brokers account management tools, it’s no surprise that the Internet is buzzing with positive Interactive Broker reviews.

Popular Article: Top Futures Brokers for Futures Trading (Ranking, Reviews, and Ratings)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.