Intro: Is Credit Karma Safe to Use? What You Need to Know

Knowing and managing your credit score is a great step towards understanding your finances and giving you a solid foundation to build upon. Not sure what your credit score is? There are plenty of websites that offer you the ability to gather a free credit report, but one of the better-known sites is Credit Karma.

However, with all of the scams that so freely exist on the Internet, many consumers may be wondering, “Is Credit Karma safe to use?”

In this review, we will examine whether Credit Karma is safe and legit based on the objective facts surrounding the data it gains and the services it provides. When we’re through, you’ll be able to confidently decide whether Credit Karma is free and safe.

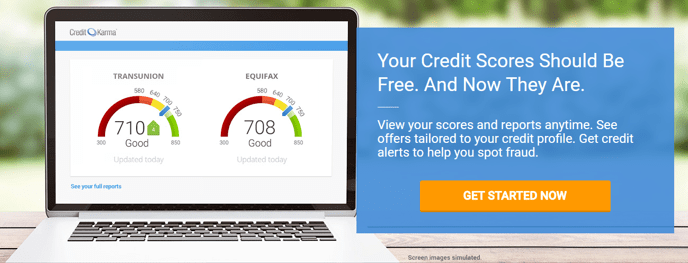

Image source: Credit Karma

How Does Credit Karma Work?

Banks can and do pull your credit report whenever you’re applying for new credit cards, a mortgage or an auto loan among other things. Do you know what your credit report says? Credit Karma wants to “put the power back in your hands” to understand the same information that the bank already sees. Many people have heard of Credit Karma, but is it safe?

Credit Karma’s primary draw is its claim to provide free, accurate credit scores on a regular basis with weekly reports. It aims to make your personal financial information easily accessible to you as well as to provide tools and tips to help you make better use of the data you receive. If Credit Karma is really free and safe, how does the company survive? Its business model is fairly simple:

- You register for its scores and reports: What makes Credit Karma safe to use? In terms of your finances, it’ll never be able to charge you for the reports you receive. Signing up takes only a few minutes, during which time you are never required to enter payment information.

- It makes recommendations based on your results: Credit Karma will analyze your credit score and history to make suggestions for the sort of products that might help you to improve your current status or help you to save money. These advertisements are highly personalized based on the information provided by your account and your credit report.

- Credit Karma gets paid: Is Credit Karma free and safe? It’s free for you! The company makes its income based off recommendations that you agree to. When you purchase or take advantage of an offer suggested to you after you receive your credit report, Credit Karma receives payment through that bank or lender. Those lenders are willing to pay for this sort of highly-specialized advertising because Credit Karma has already been able to identify you as a qualified lead.

Credit Karma also offers an app to allow you to check your credit score wherever you go and to receive instant notifications if important changes occur in your credit report. It can alert you to new credit applications, delinquent payments, new public records, and improved payment history among other things.

Is the Credit Karma app safe? Now that we’re clear on what services Credit Karma offers and have covered a little bit of the business model, we will evaluate its security measures in the following sections.

Don’t Miss: How to Build Credit Fast – Best Ways to Improve Your Credit Score Fast

Credit Karma: Is It Safe?

Is Credit Karma safe to use? Is Credit Karma a safe site? Is Credit Karma safe and secure? These are all legitimate questions to be concerned with before entering your sensitive personal information onto an unknown website. Consumers are hyper aware of the possibility of a scam, and its developers appear to be on top of making sure that Credit Karma is safe and legit.

One of its more impressive security features is the 128-bit encryption, which is on par with bank encryption standards. For those who aren’t as well-versed in what the technical jargon means, this means that Credit Karma is safe and secure. Information transmitted through its website cannot be cracked according to current computer power.

Even Credit Karma employees only have the ability to read your information. They have no capability to do anything with your money, including transfers, bill pay or siphoning it directly from your bank account. Without the ability to make changes or alterations to the information you enter, your credit information is safe from both employees and any hackers that might make their way into the Credit Karma system.

What makes Credit Karma safe to use? Even when you’re first registering for your account, the site asks you very personal questions regarding specific details of your history. It might seem like an over-the-top security measure or overly intrusive, but it helps to prevent unwanted strangers from gaining access to your credit reports.

Is Credit Karma safe to use? For right now, the answer seems to be “yes,” though it hasn’t always been that way.

Credit Karma’s Security History

Most people will want to know if Credit Karma is a safe site in the here and now, but they might pay little attention to the problems of the past. Just two years ago, Credit Karma was in the midst of trying to reach a settlement with the Federal Trade Commission for misrepresenting the security standards of its mobile app. Consumers were starting to ask the questions like, “Is Credit Karma really free and safe?” and “Is Credit Karma safe and legit?”

The Federal Trade Commission argued that the company had not been taking the necessary precautions to protect the information that users were inputting, including highly personal details like Social Security numbers. According to the Federal Trade Commission press release, the information was susceptible to being intercepted by third parties, particularly when on public wi-fi connections.

What was the end result? Credit Karma was able to reach a settlement, and it now has legally mandated security reviews every other year until 2034. The Federal Trade Commission will be reviewing its independent security assessments to ensure that the company is following proper protocol for monitoring and protecting sensitive consumer information.

Is the Credit Karma app safe? With the additional measures that the FTC helped to put in place (SSL certificate validation), the Credit Karma app is safe for use and should remain that way for the next several years while it conducts its independent security assessments.

Related: What Is a FICO Score? What You Should Know! (What Is a Good Score & Definition)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Is Credit Karma Really Free and Safe?

Now that we know Credit Karma is safe, we can evaluate if Credit Karma is really safe and free. In many cases, credit report sites will offer a free trial that ultimately requests for you to pay its monthly subscription fee if you would like to continue its services. Annualcreditreport.com is required to give you a free credit report annually upon your request, but how many other sites really offer free financial monitoring?

While Credit Karma’s free mobile app can alert you of any major changes in your credit report, you could also opt for its email notifications that would serve the same purpose. Even for this service, Credit Karma is free and safe.

US News advises that Credit Karma never asks for your credit card information at any time. If a site does ask for this information, you should be aware that it is likely to auto-enroll you into a monthly subscription or to charge you for the single report.

Is Credit Karma Safe and Accurate?

It is important to know whether Credit Karma is safe and accurate simultaneously. You don’t want to sacrifice accuracy for the sake of security. The scores that Credit Karma gives are legitimate, pulled from two of the three major credit bureaus: TransUnion and Equifax. Credit Karma takes that information and provides an independent VantageScore 3.0 because this report is “a collaboration among all three major credit bureaus and is a transparent scoring model.”

Just two years ago, in 2014, more than 2,000 lenders used almost a billion VantageScore reports to judge creditworthiness, determining if applicants were eligible for loans, mortgages or credit scores. Six of the ten largest banks examined VantageScore reports.

So is Credit Karma safe and legit? VantageScore 3.0 isn’t the only option for tracking and monitoring your credit score, but it can be a great place to start. Many banks still refer to your FICO score with more than 11 billion of these reports being looked at by lenders in the same 2014 year. However, tracking and managing your credit score on either system will do wonders for your credit over the long run.

It is more important to accurately manage the information you have access to than it is to worry about collecting every type of score available. Rest assured that the information provided by Credit Karma is safe and accurate.

Is Credit Karma safe?

It is understandable and should be encouraged for consumers to ask questions, like “Is Credit Karma safe to use?” and “Is Credit Karma safe and free?” Entering your personal information, including your Social Security number, onto the Internet for detailed information relating to your sensitive financial information is risky. You want to be sure that the information you receive from Credit Karma is safe and accurate.

Image source: Big Stock

Is Credit Karma safe and legit? I think consumers can agree that the answer is “yes.” The company is currently taking all the precautions to protect your personal information with high-end Internet security and individual identifications. Its run-in with the Federal Trade Commission even gives you an added layer of security as its independent security evaluations are monitored over the next two decades. It provides everything, including an app, to help you rest assured that Credit Karma is safe.

So, go ahead and register for an account to make the most of the financial knowledge that Credit Karma is prepared to arm you with.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.