AML Know Your Customer Rule

The Know Your Customer (KYC) provision is a financial regulatory rule that is mandated by the Bank Secrecy Act and the USA PATRIOT Act of 2003.

It requires banking and non-banking financial institutions to conduct a thorough review of a new customer before accepting that customer as a new client.

The objective of the KYC rule is to reduce the possibility of the financial system being used for money laundering and terrorist financing activities.

KYC vs. CIP vs. CDD

There are some slight variations in how compliance officers use the term KYC vs. CIP vs. CDD across the financial industry.

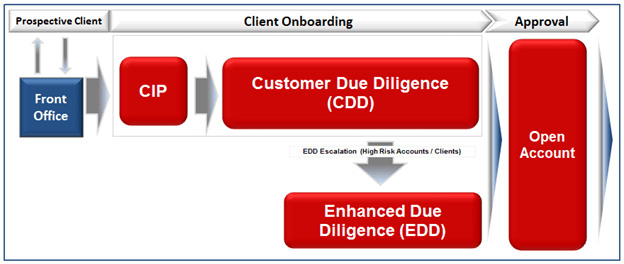

When some compliance officers refer to KYC, they are referring to three key phases in the overall AML onboarding lifecycle: CIP, CDD, and EDD as presented in the diagram below.

Image Source: AdvisoryHQ

For most compliance officers, however, the term KYC refers to the CIP phase of AML onboarding.

CIP involves gathering information. Click here for more details: Developing a Well-Defined Customer Identification Program (CIP).

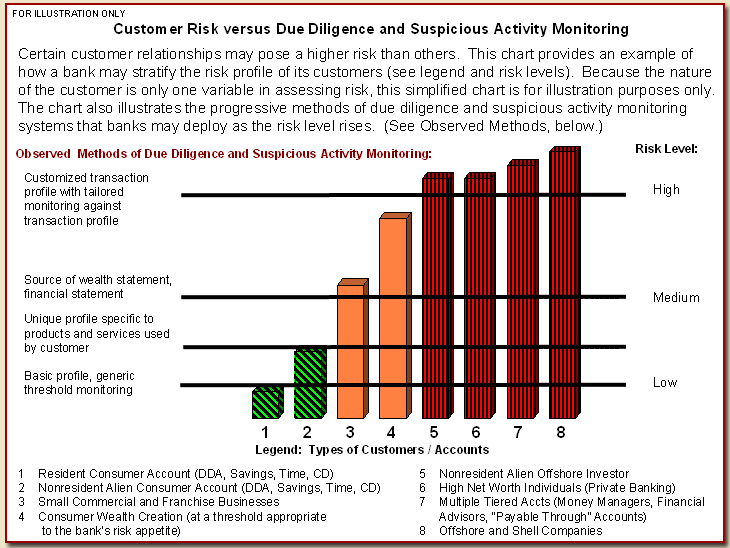

CDD (customer due diligence) on the other hand is the second phase of the overall AML process. It begins after CIP, and it involves conducting detailed analysis and assessment of the new client from an AML risk perspective (i.e., low, medium or high risk).

Image Source: Bank Secrecy ACT/Anti- Money Laundering Examination Manual

See Also: Developing or Managing a Well Defined Customer Identification Program

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.