Why Do We Need Lenders Mortgage Insurance?

Before we look at what lender paid mortgage insurance is, let’s try to understand why we need to pay mortgage lenders insurance in the first place. What exactly does this term mean?

Imagine you’re buying a home and that you need to borrow money from a bank. For this, you need an initial down payment, which is calculated based on the value of your home. If you are only able to pay less than 20% of the value, the lender (the bank) is left to pay more than 80% of it.

In these situations, the lender will require you to pay an additional lenders mortgage insurance so that they are protected in case you are not able to pay off your mortgage. This adds a monthly insurance premium to your mortgage installments.

According to Investopedia, the cost of Private Mortgage Insurance would range from 0.25% to 2% of your balance loan per year. It also depends on your credit score and the down payment you make at the beginning.

Image source: Pixabay

See Also: Want To Buy a House With Cash? – Get All the Facts! (Save Money, Cash Process & Review)

How Does Borrower-Paid Mortgage Insurance Work?

If you are paying lenders mortgage insurance premium as an addition to your mortgage, it’s called borrower-paid mortgage insurance.

You need to keep a check on your payments toward the principal amount in this case. Once you have paid off 20% of the principal, you can cancel this insurance.

The lender will agree to this, provided the following conditions are satisfied:

- You pay your mortgage installments on time

- The value of your home hasn’t dropped

- You don’t have another mortgage payment

This could be a good thing for many. You don’t need to pay any extra amounts other than your mortgage once you pay off this 20%. But the thing here is to check how long it would take you to pay off 20% of the mortgage principal.

What Is Lender-Paid Mortgage Insurance? / What Is LPMI?

What is the first thing that comes to mind when you see the term “lender-paid mortgage insurance”? It means exactly what you might expect: the lender pays for your mortgage insurance.

This relieves you of paying the extra premium every month. However, you need to pay a higher interest rate for your loan here, so you are, in fact, paying for the insurance. It’s just that you don’t pay it in the form of a premium.

For this reason, lender paid mortgage insurance isn’t very popular.

Don’t Miss: Should I Payoff My Mortgage Early? Prepayment Penalty Definition!

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Some Factors to Consider

Image source: Pixabay

Your Eligibility Criteria

Both lender-paid mortgage insurance and the regular borrower-paid mortgage insurance will increase or decrease depending on the loan to value ratio as well as your credit scores.

If the loan to value ratio is higher or your credit score is lower, the amount you have to pay as mortgage lenders insurance will increase.

Your Income

According to About Money, if you are a high income earner, you could get greater tax returns if you opt for lender-paid mortgage insurance.

The Term of Your Loan

It is said that lender paid mortgage insurance is more beneficial for short-term borrowings rather than long-term ones. See more details here.

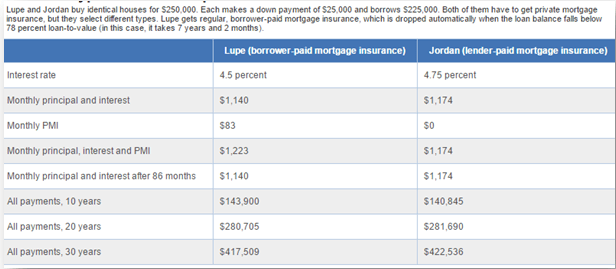

Let’s look at an example of a short term loan with lender-paid mortgage insurance.

Lender Paid Mortgage Insurance

If you look at the table, you can see that a short-term loan with lender-paid mortgage insurance saves you more than borrower-paid mortgage insurance. If your loan is for a shorter period, then LPMI is quite beneficial.

The Loan to Value Ratio

If your Loan to Value ratio is close to 80%, you could opt for borrower-paid mortgage insurance; once you reach the 20% of principal payment level, you could quickly cancel the insurance.

Refinancing

Refinancing means to replace one debt with another one that has different terms and conditions. People refinance their homes for mostly the following reasons:

- To get a better interest rate

- To reduce their monthly mortgage payments

- To switch from a variable interest rate to a fixed interest rate or vice versa

- To consolidate many debts into one single debt

Find out more information about refinancing here.

Refinancing provides an option for you to cancel a lender paid mortgage insurance policy. This is something that you need to consider after carefully analyzing your current financial situation.

It is said that you might also incur closing costs to close the present loan. You may need to pay for insurance again in this case if you still need to borrow 80% or more of your home’s value.

Related: What Is a Jumbo Loan? A Complete Guide (Loan Limit, Mortgage & Rates)

Home Affordable Refinance Program (HARP)

There are simple options if you plan on using HARP to refinance tje home for which you’re paying lender-paid mortgage insurance along with your monthly payments.

HARP was launched in 2009 to help home owners in the U.S. get lower mortgage rates and payments. Previously, it would have been quite difficult to refinance your home if you were paying any sort of lenders mortgage insurance, as there were many obstacles in underwriting.

Now there has been an update to the program:

- You can find refinance options with any lender who is under HARP

- You are allowed to remove the name of any co-borrowers who don’t live in the home any more

- Unlimited Loan to Value Ratio

So if you decide to refinance your home after a few years, you do have that option even if you have a mortgage lender’s insurance.

Tax Deductibility

In 2007, private mortgage insurance became very popular because tax deductions were allowed for families that earned less than $100,000. Those with incomes greater than $100,000 did not enjoy this privilege.

Lender-paid mortgage insurance is also a private mortgage insurance option. It grew more popular because:

- It was (and still is) fully tax deductible for all no matter what level of income you fall in

- For short-term borrowing, LPMI is much cheaper

Popular Article: Refinance Your Mortgage with Bad Credit (How to Complete a Bad Credit Refinance)

How to Calculate Lenders Mortgage Insurance

You will be able to find mortgage lenders insurance calculators on any lender’s website. Here is one to find your rate.

You will be able to get an estimate of the premium amounts as per current rates.

To calculate lenders mortgage insurance, you’ll need to know the following:

- The purchase price of your home. If you are buying a house later, you should at least have an estimate.

- Your down payment. This will help estimate the Loan to Value Ratio.

- The term of the loan. It is usually 30 years, though you can change it.

- An idea about your credit score.

These are the common fields you’ll need to fill when you are using a lender mortgage insurance calculator on any lender’s website.

You may need to provide the following also when you use a mortgage lender’s insurance calculator.

- The type of property you wish to purchase

- How you would use the property

- The state in which you wish to buy your property

- How you would rate your credit score

These factors will decide how much you will have to pay as insurance. After this is done, you will be able to choose the kind of insurance that is suitable to you.

You can calculate the premium amount yourself, too. Here is how you can do it. The basic idea for these calculations was derived from here.

- First determine the initial deposit amount you can pay. You should have an estimate of the property’s value, too.

As an example, let’s assume that the value of your property is $200,000 and the deposit you can pay is $20,000.

- Find the mortgage lender’s insurance rate. It should be available on the lender’s website. Let’s assume that it’s 0.50% for now.

Lender-Paid Mortgage Insurance vs Borrower-Paid Mortgage Insurance

Let’s look at a few calculations and see which of the two insurance methods is profitable from a borrower’s point of view.

This calculation was derived from the examples provided on the website The Truth About Mortgage.

Let’s assume the following:

- Loan amount – $100,000

- Loan to Value Ratio – 90%

- Mortgage insurance monthly premium – $52

If the lenders mortgage insurance is paid as a separate premium (borrower-paid mortgage insurance), the monthly installments would be calculated this way:

- Mortgage – $463.12 + $52 = $515.12 (assuming 3.75% APR)

Now, under lender paid mortgage insurance:

- Mortgage – $477.42 + 0 = $477.12 (assuming 4% APR)

Even with a slightly higher APR, lender-paid mortgage insurance makes for a lower payment.

Let’s look at the following table from Bankrate, which shows the differences in payment amounts for both types of insurances.

Image source: Bankrate

We can see that the monthly payment is much cheaper if you choose lender-paid mortgage insurance. At the same time, like we saw previously, a borrower-paid private mortgage insurance can be cancelled once you pay off 20% of the principal.

Once the insurance is cancelled, the first option becomes more profitable. However, till you pay the 20% in principal, you will need to pay the higher monthly installment. You must definitely consider these factors before you choose the kind of installment system you prefer.

Is Lender-Paid Mortgage Insurance Good or Bad?

It is often seen as a bad thing. People generally dislike paying the mortgage, let alone the mortgage lenders insurance on the loan. But let’s look at the pros and cons of Lender Paid Mortgage Insurance.

These are the pros of lender-paid mortgage insurance as per The Truth About Mortgage:

- Again, what is LPMI? Insurance on your mortgage that the lender pays on your behalf. The first advantage we can think of is that you don’t have an extra insurance premium.

- You may be able to borrow a larger sum, which lets you buy a more expensive house (if you qualify).

- LPMI allows a bigger tax deduction.

- You can quickly buy your home without having to save the whole 20% down payment.

Free Wealth & Finance Software - Get Yours Now ►

Now let’s look at the cons:

- The first thing is that Lender-paid mortgage insurance cannot be cancelled, unlike private mortgage insurance.

- Since it cannot be cancelled, you may eventually end up paying extra interest.

- As we saw previously, lender-paid mortgage insurance is not available to everyone. You need to have a good credit score for it.

The main benefit of choosing a lender-paid mortgage insurance is that you can buy a new home without having to make the full 20% down payment. It would be a good option if you want lower monthly payments and don’t mind the higher interest rate. It creates a tax deduction, too.

Those are the details and factors of lender-paid mortgage insurance you must consider before choosing your insurance type. It can be quite difficult to choose between the two as both have their advantages and disadvantages. To have better and more precise estimates, consult your mortgage consultant.

Read More: Prospect Mortgage Reviews – What You Should Know (Complaints & Review)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.