Overview: Average Life Insurance Cost in 2017

Life insurance is one of those unpleasant topics that many people prefer not to think about, but it’s important to be prepared in the event that you pass away sooner than you might expect.

Many of the details surrounding life insurance seem to confuse most individuals, particularly because of the variation in types of insurance as well as the life insurance cost.

It’s important to know what the average cost of whole life insurance is or term life insurance is in order to make sure that you are getting the best possible deal.

AdvisoryHQ understands that you want to leave behind enough money to cover your own expenses and perhaps even leave some left over for your children and family members. We want to take some of the confusion out of life insurance cost by answering some of these questions:

- What is the difference between term life insurance and whole life insurance?

- What does term life insurance cost?

- How much does whole life insurance cost?

- Which one is the better deal?

So without further ado, we’ll dive into the details of what you can expect to pay on a life insurance policy cost.

Difference Between Types

Life insurance cost varies significantly under the two primary types of life insurance policies: term and whole life policies. In order to understand the difference between the cost for term life insurance and the whole life insurance cost, we wanted to first give you a brief overview of what these types of life insurance really cover.

Image source: Big Stock

Term Life Insurance

Term life insurance covers you for a specific period of time, particularly during years where you feel your family may be most vulnerable if you died prematurely.

Term life insurance cost covers you for a set amount of money to be issued upon your death. These funds can help your family to manage without your income, to cover the mortgage payments, and to pay for your services.

Apart from your death, there is no other way to gain access to the money you paid into the cost for term life insurance.

Terms can range from as little as one year all the way to thirty years, with experts stating that the average coverage term lasts for approximately twenty years. Throughout the entirety of your specified term, the term life insurance cost would remain the same each month.

Most individuals discontinue their term life insurance after this point in life because their family would no longer be as vulnerable to a lack of income.

They may have generated a larger emergency fund or have significant savings in place to help in the event of a premature death. If your family is not as stable as you imagined you would be at the end of your term, you can always reenroll for a separate term and evaluate the new term life insurance cost.

Whole Life Insurance

Whole life will cover you in the event of your death throughout your entire life. The money that you pay each month to the cost of whole life insurance is invested and grows in a tax-deferred account. Whole life insurance is permanent, meaning that the monthly cost of whole life insurance will remain the same until your death, as will the benefits that your surviving family members will receive.

You do get more security through whole life insurance, but you also have the ability to cash out against your policy. You may borrow money from the life insurance policy cost that has been growing in your investment accounts or cash it out entirely.

In general, the cost of life insurance policy for whole life insurance is going to be significantly higher than that of term life insurance. The reason for this cost difference is because term life insurance is unlikely to be cashed out, whereas it is a guarantee that whole life insurance will have to pay out at some point.

Price Differences in Life Insurance Cost

Understanding the cost of life insurance policy can be as simple as understanding which factors influence the rates and cost of term life insurance and whole life insurance.

While some of the factors may seem predictable, others may be more surprising. Take a look at this list of factors than can raise or lower your life insurance premiums:

- Age: The life insurance policy cost can increase substantially with age. Term life insurance cost for individuals in their twenties or thirties won’t be nearly as much as it would be for someone in their sixties or seventies. The older you get, the more likely it is that you would cash in on that policy and it raises the life insurance policy cost for both term life insurance and whole life insurance.

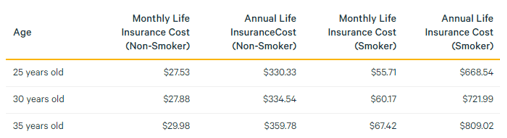

- Smoking: Because of the negative health side effects of smoking, chronic smokers can expect to pay more than non-smokers on average. For an example of how the life insurance cost differs, take a look at the term life insurance cost chart below with a separate column just for smokers.

Image Source: ValuePenguin.com

- Health: Apart from smoking, chronic conditions that show up on your medical history can also raise the cost of life insurance policy. Conditions such as depression, diabetes, a family history of heart disease, and other chronic conditions can alter your life insurance cost.

- Gender: Because women statistically live longer than men, they will also typically have a lower life insurance cost.

- Occupation: The risk factor involved in your job title can also mean big changes for the cost of term life insurance or whole life insurance. Riskier positions that have a greater chance for death or injury are more likely to see a higher term life insurance cost than sedentary and safer office jobs.

Of course, one of the other biggest influencing factors in the average cost of whole life insurance and term life insurance is how much coverage you desire to have. A policy that pays out $500,000 upon your death will certainly cost more than one that pays out only $250,000 upon your death.

Keep in mind the needs your family may have in the event of your untimely death to decide what level of coverage is right for your family. There are a number of ways to calculate the amount of money that you may need in your life insurance policy, but a good rule of thumb is to consider coverage of eight to ten times your annual income.

Average Life Insurance Cost (Non-Smoker)

Age | Monthly Life Insurance Cost | Annual Life Insurance Cost |

25 Years Old | $27.53 | $330.33 |

30 Years Old | $27.88 | $334.54 |

35 Years Old | $29.98 | $359.78 |

Non-smoker

Average Cost of Life Insurance Cost (Smoker)

Age | Monthly Life Insurance Cost | Annual Life Insurance Cost |

25 Years Old | $55.71 | $668.54 |

30 Years Old | $60.17 | $721.99 |

35 Years Old | $67.42 | $809.02 |

Smoker

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Average Cost of Term Life Insurance

As we discussed in the previous section, there can be a lot of variation among price quotes for term life insurance cost. However, we are going to dive into this section of our discovery to look at the cost of term life insurance assuming a few different things about you as an individual:

- You are relatively healthy, meaning you have no chronic conditions and are of a healthy weight.

- You are a non-smoker.

- You don’t have a particularly risky job.

Term life insurance cost for a twenty-year term with $500,000 worth of coverage can expect to pay roughly $25 to $110 depending on your age and gender. Within this range, the cost of term life insurance for younger individuals (in their twenties and thirties) typically runs from $25 to just under $40.

Individuals searching for the cost for term life insurance in their fifties might expect to pay roughly $100, and those who are 65 or older should expect somewhere between $400 and $600 each month.

For a lower coverage amount, around $250,000, the average cost of term life insurance decreases yet again. You could expect rates of roughly $15 to $100 each month for healthy, non-smoking individuals aged between twenty and sixty.

Term life insurance cost for people between twenty and thirty years of age should range anywhere from $15 to $20 each month, whereas term life insurance cost for individuals sixty and above could range from $100 to $350 each month.

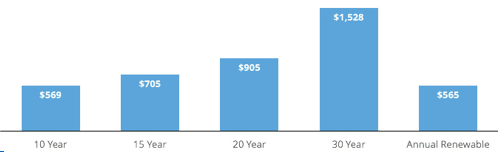

One study shows how life insurance cost can add up as the term length increases as well. For example, the average annual cost for a ten year term is in the mid-$500 range, while a twenty year average annual term life insurance cost comes in around $900. You can view the term life insurance cost chart below for comparison between the different lengths of terms.

Image Source: ValuePenguin.com

Term Life Insurance Cost for Smokers

As we’ve already seen, the cost for term life insurance can vary significantly depending on the amount of years you desire to have coverage, the amount of policy coverage you desire, and your age. The next biggest factor in determining your life insurance cost is whether or not you are a smoker.

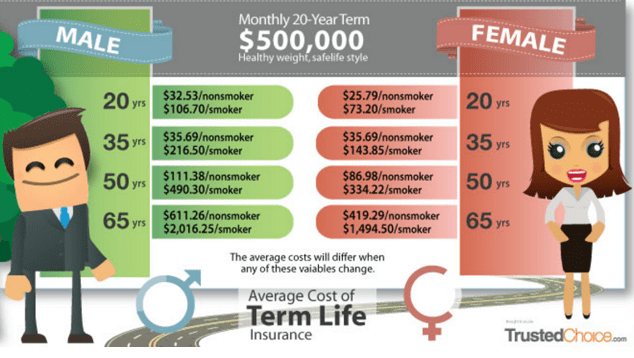

Smokers can expect to pay significantly higher rates for their term life insurance cost than their non-smoking counterparts. In many cases and situations, the average cost of term life insurance is nearly double that of nonsmokers. Where a nonsmoker may pay $25 to $35 each month for $500,000 of term life insurance over the course of 20 years, a smoker can expect to pay $75 to $100.

The term life insurance cost chart below demonstrates the difference between male and female term life insurance cost at various ages, alongside the life insurance policy cost for smokers and nonsmokers. You’ll notice how the cost of life insurance policy for smokers increases substantially as the age bracket increases.

Image Source: TrustedChoice.com

As age increases, along with tobacco usage, the cost for term life insurance creeps even higher. According to one collection of data, at 65 years old, you could expect to pay $350 each month for a $250,000 policy over the course of twenty years if you were a nonsmoker. And those who smoked? Their life insurance cost skyrocketed to a whopping $988 each month for the same amount of coverage.

How Much Does Whole Life Insurance Cost?

Once you’ve investigated the term life insurance cost, it’s time to answer the next most pressing question: how much does whole life insurance cost? The average cost of whole life insurance will be higher than the term life insurance cost.

Assuming that you are a nonsmoker, you can quickly see that the average cost of whole life insurance will be higher than term life insurance.

For $250,000 worth of coverage, the whole life insurance cost will range from $60 to $250 as you increase in age. While term life insurance cost for someone between the ages of twenty and thirty might range from $15 to $20 each month, whole life insurance cost might be closer to $60 to $100 each month.

As you surpass 45 years of age, the cost of whole life insurance rises to $100 to $150 each month. At 55 years of age, you can expect to pay between $200 and $250 each month for your whole life insurance cost.

If you opted for a lower amount of coverage, such as $100,000, your whole life insurance cost for the same age ranges (20-55) could range from $30 to $110 each month. After the age of 60, it increases again to a rate closer to $150 each month.

Which Option is the Better Deal?

The difference between whether the life insurance cost for term life insurance or whole life insurance is the better deal for you really depends on your personal needs. Term life insurance cost may fit more conveniently into your monthly budget.

It is considered ideal if you only believe you will need coverage for a set period of time (such as until your kids finish college or until your mortgage is paid off).

Depending on your provider, there is also a possibility that you can convert your term life insurance cost into a whole life insurance cost.

On the other hand, whole life insurance cost is worth considering, especially under certain circumstances. If you have a lifelong dependent such as a special needs child or if you will need to cover the cost of your estate taxes, a whole life insurance policy might be a good fit for you. Whole life insurance policies also guarantee that you will leave behind some money which can create an inheritance for your children and cover your funeral expenses.

You’ll have to take a closer look at your family’s unique financial situation and needs to determine whether the average cost of whole life insurance or term life insurance better fits your needs.

Conclusion

Deciding on a life insurance policy can be tricky, as there are so many differing factors involved in the life insurance policy cost. Term life insurance cost can be lower initially than whole life insurance cost is, but you won’t be able to cash out against the money you invest. Furthermore, you do not maintain coverage with a term life insurance policy throughout the duration of your life.

Different families will find themselves with different needs regarding their coverage and what they can afford for the cost of life insurance policy. How much can you afford to spend on the cost of life insurance policy each month? What sort of cash would you need to leave behind in the event of your death?

Consult a few companies to determine what the rates would be for your age, gender, health status, location, and more to determine the average cost of whole life insurance or term life insurance for you.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.