2017 Guide on How to Get the Best Life Insurance Rates (Best Life, Term, and Whole Life Rates)

In the hustle and bustle of everyday life, the last thing many people think about is life insurance. After all, what is the use of searching for life insurance rates if you are barely making ends meet from month to month?

However, life insurance is one of the most important things you can have to protect your loved ones in the future.

Image Source: Pixabay.com

But finding the best term life insurance rates can be stressful.

Not only does it force you to think of the future in terms of your health and loved ones, but life insurance rates vary significantly between providers, and their terms are sometimes fuzzy. It takes time to compare policies to find the best life insurance rates.

Fortunately, the Internet has made searching for whole life insurance rates and term life insurance rates easy and painless. You can easily search for term life insurance rates by age, health, and other important factors using free tools like a term life insurance rates chart.

This guide will provide tips for finding the best term life insurance rates and whole life insurance rates and introduce you to using tools, like a whole life insurance rates chart, to find the best policy for you.

First, let’s explain the two types of life insurance we will discuss in this article: term and whole life insurance.

Differences between Term and Whole Life Insurance

Before you search for life insurance policy rates, you should understand some common terms you will hear as you search. Term life insurance and whole life insurance are the two main types of life insurance.

The best term life insurance rates often surpass the rates of whole life insurance. However, whole life insurance offers additional benefits term life insurance does not.

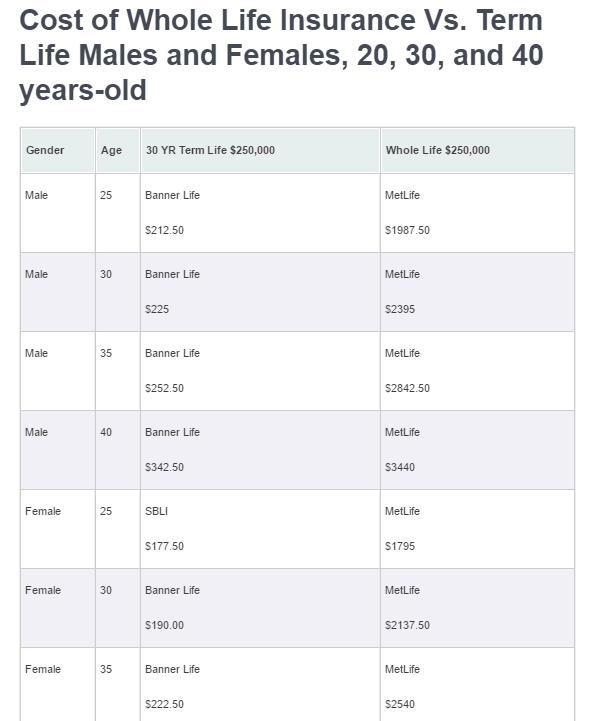

Image Source: Life Insurance by Jeff

The above chart combines term life insurance rates by age with average whole life insurance rates per age. You may notice the significant difference between the term insurance rates by age and the whole life insurance rates. But why?

A whole life insurance policy covers an individual through his or her whole life, hence the name. Whole life insurance builds a cash value that you can borrow against or release the policy in exchange for the cash value. This creates a much higher premium for average whole life insurance rates by age compared to term life rates.

The term life insurance rates chart, on the other hand, shows much smaller premiums. Term life insurance covers an individual for a certain amount of time, usually 10, 20, or 30 years. This insurance will cover the individual for the set time period but holds no other value after. For example, 20-year term life insurance rates will provide you a lower premium, but your policy will have no cash value. You can think of it like renting a policy.

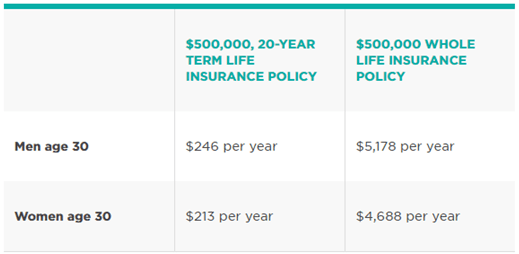

Image Source: Nerd Wallet

The above chart gives an example of 20-year term life insurance rates compared to average whole life insurance rates by age 30 for both men and women. Notice the huge gap in annual premium costs. However, men and women with whole life insurance policies are paying into a policy that they can later borrow money from or receive the cash value, if needed.

Don’t Miss: What Is Debt Consolidation?—Is It Good or Bad? (Ways to Consolidate & Explanation)

Tip #1: Shop the Internet for the Best Life Insurance Rates

Gone are the days of calling insurance companies to give you their best term life insurance rates or whole term rates. You no longer have to have your pen and paper ready to jot down information from each company. The Internet has streamlined the process of searching for life insurance rates with little to no hassle, and it can actually save you a lot of money.

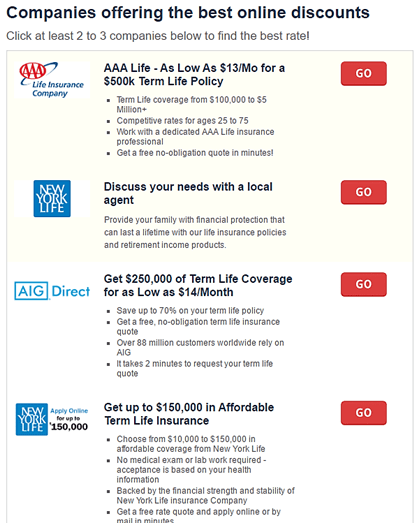

Image Source: The Simple Dollar

Just like this article, the Internet provides numerous places to find a whole life insurance rates chart or term insurance rates by age. You can compare and contrast rates for several insurance policies at once.

For insurance policies you would like to take a closer look at, you can usually contact the companies by email or live chat to get a few more details to help you decide.

To find the best life insurance rates, you can also search the Internet for a term life insurance rates chart or whole life insurance rates chart, like the ones discussed in this guide.

If you are still undecided about what type of insurance policy is for you, these side-by-side comparisons can help you see, at a glance, term life insurance rates by age compared to whole life insurance policy rates.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Tip #2: Get Life Insurance Policy Rates Quotes

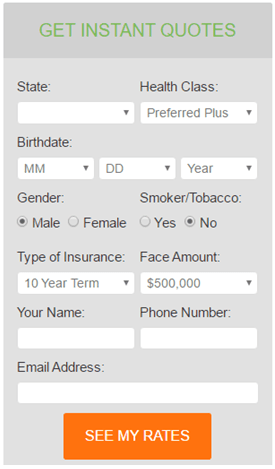

Just as you can search the Internet for life insurance rates, you can also use the Internet to get quotes from prospective insurance companies.

Quotes will go more in-depth than the information a website or whole life insurance rates chart will give you. An Internet quote will take your personal information into consideration to provide you more personalized term life insurance rates.

There are several reputable websites that allow you to input your information to provide you with quotes from several insurance companies and policies.

Although this method could cause a lot of companies to contact you within a few days’ time, it can help you learn more about each company and lead you toward the best term life insurance rates.

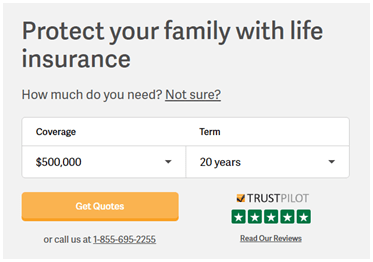

Image Source: Policy Genius

Life insurance policy quote websites allow you to narrow down your specific requirements for a policy, such as amount of coverage and term. You can then compare the tentative quotes for term insurance rates by age or 20-year term life insurance rates, for example.

Related: What Is a Decent Credit Score? Get All the Facts! (What Is Bad Credit?)

Tip #3: Check Out Term Life Insurance Rates

You might be considering whole life insurance over term life insurance because of its ability to build cash value and cover you for life. However, it is no secret that term insurance rates by age are much lower than whole life insurance rates for the same amount of coverage.

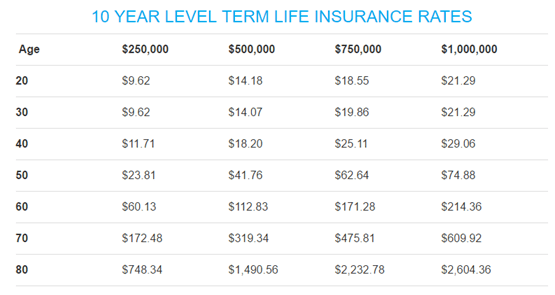

Image Source: Best Life Rates

One of the biggest concerns of those searching for the best life insurance rates is, “How will I afford this?” If you struggle from paycheck to paycheck but still want to make sure your family is covered in the case of your untimely death, you should consider looking for the best term life insurance rates rather than whole life rates.

When your term is up, you can consider opening a new policy or checking out the average whole life insurance rates by age at the end of the term. By then, you may be more financially stable and able to afford a whole life plan.

Tip #4: Use an Independent Insurance Agency

Now you have narrowed down the insurance policies or companies you are interested in and what type of life insurance is right for you. Instead of making the choice on your own using your research of life insurance rates, consider contacting an independent insurance agency or broker to help guide you to the right policy.

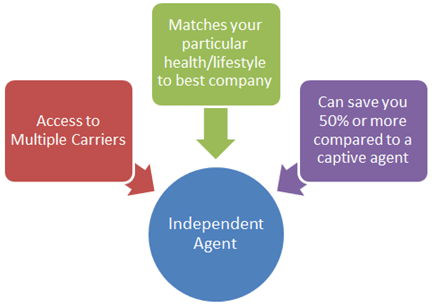

Image Source: JRC Insurance Group

A one-company insurance agency, of course, looks out for the interests of the company it represents. In contrast, an independent insurance agency represents several insurance companies. An independent agent will represent your best interests and can help you find the best term life insurance rates.

An independent insurance agent is especially helpful if you are torn between three or four insurance policies or the type of insurance you need. The agent will guide you in determining the life insurance rates you can handle financially and compare terms with you in a way you can understand. Your agent represents you, and therefore should continue to have your best interests in mind.

Tip #5: Try to Bundle Your Coverages

Do you have an insurance agent or company that already covers your home, auto, or other insurance policies? Talk to the company about possible savings from adding another policy to your account. Bundling your existing coverages with a new policy could give you better life insurance rates than a policy with a different company.

Insurance companies want their customers to stick around rather than shop around. Therefore, a company will offer some of its best term life insurance rates to you, its existing client, before offering those rates to a new customer. Customers who bundle coverage can save hundreds to thousands on their annual premiums for their combined coverages.

If you choose to go through an independent insurance agent for your insurance coverages, they may be able to provide further discounts to you by continuing to use their service. An agent’s discounts combined with discounted life insurance rates from a company can lead to significant savings.

Tip #6: Consider Layering Insurance Policies

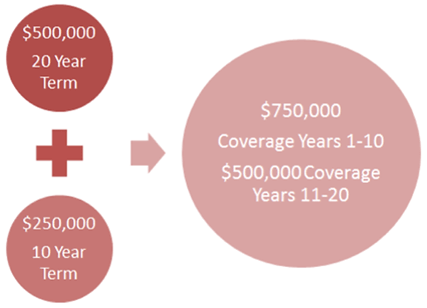

Some people looking for the best term life insurance rates notice that layering policies can save money. Most insurance companies will not suggest this method because it provides no benefit to them. However, layering policies can provide you with the exact coverage you need for your current and future situations and saves you from paying more on life insurance rates for coverage you do not need.

For example, suppose you are 30 years old with a baby and a toddler. You want to cover them should something happen to you before they are of age, out of college, and beginning their own lives. You want a life insurance policy for a 30-year term for $100,000. You shop for the best term life insurance rates and find a policy that suits your needs.

Image Source: JRC Insurance Group

Then, five years later, you purchase your first home. You decide to call your insurance agent, who encourages you to add more coverage to your existing policy, making it a 30-year term for $500,000 to cover the price of your home. However, your mortgage is only a 20-year loan. So, raising your coverage does not provide you with the best term life insurance rates long-term because you will now have 5 years with an additional $100,000 of coverage you do not need.

Although insurance companies do not recommend this method, it is still an option you have to save money with your life insurance policies and find the best life insurance rates.

Popular Article: Algorithm Trading—What Is Algorithmic Trading? (Strategies and Software Reviews)

Tip #7: Keep Your Health in Check

With your focus on finding life insurance rates that fit within your budget, you could be neglecting the most important thing to remember: your health. The best term life insurance rates are often dependent upon your current health situation.

Image Source: Best Life Rates

At the very least, insurance companies want to know if you are a smoker. In fact, this is usually one of the first questions asked even when you search for life insurance rate quotes. If you want to find the best term life insurance rates, the easy answer is to stop smoking and take control of your health.

Most insurance companies will require you to get a physical examination before they provide you with their final life insurance rates. It is a good idea to begin eating healthier and exercise if you are not already. The better physical health you are in, the best term life insurance rates you will qualify for.

Honesty wins in this case. Should you have any physical ailments, be honest with the insurance company. If the company later finds that you lied, you can be subject to losing your coverage and paying hefty fines for insurance fraud.

Free Wealth & Finance Software - Get Yours Now ►

Conclusion

To find the best term life insurance rates, do your preliminary research online. The Internet opens up a world of information for you to compare and contrast in the comfort of your home without receiving biased information from insurance companies.

Consider using an independent insurance agent to help you find the life insurance rates that work for you.

Finally, consider your own health and how it affects your proposed life insurance rates. Make it a point to make important lifestyle changes now to benefit your family’s future.

We hope this article provided useful tips to help you achieve your financial goals and find the best term life insurance rates for you and your family.

Read More: What Is Private Equity—What Do Private Equity Firms Do? (Definition & Types)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.