2017 RANKING & REVIEWS

TOP RANKING BEST LOAN PAYOFF CALCULATORS

Finding the Best Loan Payoff Calculator

Loans are generally a part of life for many people. Loans allow individuals to borrow money for an expense and pay the borrowed money back over a particular amount of time. However, many loans involve more than just paying back what was borrowed.

Interest rates and other factors need to be considered as a loan is paid back. Loan payoff calculators can help borrowers better understand the money that they owe and can help them plan optimal repayment strategies.

Award Emblem: Top 6 Best Loan Payoff Calculators

Many people use loan payoff calculators to help them answer important questions, like:

- How long will it take to repay this loan?

- How much interest will I pay?

- Should I consolidate my debt?

- How much would I need to pay to resolve my debt faster?

Different loan calculators are designed to answer different questions. Because there are so many available to borrowers, it can be time consuming to find the best ones.

However, these rankings and reviews can help users quickly find the best loan payoff calculator to answer their questions and help them strategize their own payoff solutions.

See Also: Which Mortgage Calculator Is the Best? Yahoo? Bankrate? Dave Ramsey Mortgage Calculator?

AdvisoryHQ’s List of the Top 6 Best Loan Payoff Calculators

List is sorted alphabetically (click any of the credit card names below to go directly to the detailed review section for that credit card):

- Bankrate Debt Payoff Calculator

- Calculator.net Loan Calculator

- Calc XML Pay Off Loan Calculator

- Credit Karma Debt Repayment Calculator

- The Simple Dollar Debt Payoff Calculator

- Yahoo! Personal Finance Loan Calculator

Top 6 Best Loan Payoff Calculators | Brief Comparison & Ranking

| Calculator Names | Focus | Advanced Option Available | Graph/ |

| Bankrate Debt Payoff Calculator | Early Payoff and Comparison | Option to Add Additional Debt | Graph and Table |

| Calculator.net Loan Calculator | Loan Payoff- Interest and Principal | No | Graph, Table, Report |

| Calc XML Pay Off Loan Calculator | Loan Payoff- Interest and Principal | No | Graph and Report |

| Credit Karma Debt Repayment Calculator | Early Payoff-credit card debt and Loan Payoff- Interest and Principal | No | Graph, Table, Report |

| The Simple Dollar Debt Payoff Calculator | Early Debt Payoff | Option to Add Additional Debt | Table and Report |

| Yahoo! Personal Finance Loan Calculator | Loan Payoff- Interest and Principal | No | Graph, Table, and Report |

Table: Top 6 Best Loan Payoff Calculators | Above list is sorted alphabetically

APR vs. Interest Rate

An interest rate is the percentage of money charged to a borrower for the use of borrowed money. Interest is generally added into a borrower’s monthly payments along with the principal. An APR, or Annual Percentage Rate, is the total money paid by a borrower, including interest and other fees, aside from principal, broken into a yearly percentage.

Image source: Pixabay

Loan Balance

A loan balance is the amount of outstanding money still owed to the lender. At the beginning of the loan term, the balance will be equal to the original borrowed amount. The balance will decrease with each payment until the loan is repaid. Interest payments do not lower the loan balance.

Monthly Payments

Monthly payments are required for many different kinds of loans. These payments go toward the loan interest and paying down the loan balance. Often, these payments can be increase to allow borrowers to pay down their loans faster.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best Loan Payoff Calculators

Detailed reviews providing specific information regarding the benefits of each of the top ranking loan payoff calculators are included below. This list is designed to bring together all of the pertinent information so that each consumer can make the best choice to fit their own finances.

Don’t Miss: Air Force vs. Guard vs. Navy Retirement Calculators | Comparison Reviews

Bankrate Debt Payoff Calculator Review

The Bankrate Debt Payoff Calculator focuses on the advantages of debt consolidation. This option works as both a loan comparison calculator and an early payoff calculator.

As a loan comparison calculator, it helps user find the potential savings offered by a consolidated debt payoff plan compared to their current payments. As an early payoff calculator, it shows users how the savings offered by a consolidated debt payoff plan could be applied to the monthly payments to pay off debt fast.

Specialization

This calculator is broken into two sections. The first section is the loan comparison calculator, which asks customers for information about multiple kinds of debt, including credit card debt and auto loans.

Depending on what debt a particular user has, this can be used as a credit payoff calculator, student debt calculator, or any needed combination. This calculator asks for loan information like:

- Interest rates

- Total loan value

- Monthly payments

This section takes into account all of the inputted information and creates an example of a consolidation loan. This shows customers the consolidation loan balance, monthly payment, interest rate, and term so that they can compare a consolidated loan with their current payments. The loan comparison calculator presents this information in an adjustable table.

The second section is the early payoff calculator. This section shows users their monthly payment savings offered by the consolidation loan. Users are then able to increase or decrease this amount to see how additional payments can shorten their loan term and save money.

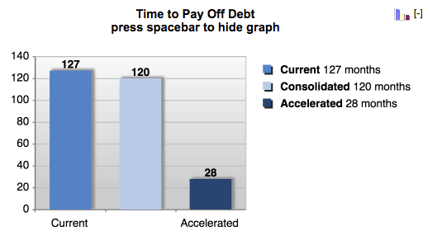

The early payoff calculator shows users this information in two bar graphs. The first graph shows how many months it will take to pay off the debt using the current, consolidated, and accelerated debt payoff plans. The second graph compares the monthly payments required for each debt payoff plan.

Image from Bankrate

Benefits

This early payoff calculator shows users how they can pay off debt fast and save money doing so. This is a good choice for users with many different kinds of debt, particularly those who are interest in debt consolidation.

This can help users gain an overall picture of how much their debt is actually costing them in the long run and how much interest can be saved through early settlement.

Calculator.net Loan Calculator Review

The Calculator.net Loan Calculator is divided into three separate loan payoff calculators. These can all help users calculate how long it takes to pay off a loan and much of their total payment will be interest. These loan payoff calculators address three different kinds of loans:

- Those paid back in a fixed amount over a period of time

- Those paid back all at once at the end of the loan term

- Those paid back in a fixed amount at the end of the loan term

Each payoff calculator asks for nearly the same information:

- Loan amount

- Loan term in months and years

- Loan interest rate

- How the interest is compounded

Specialization

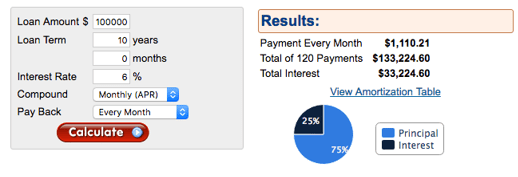

The first loan payoff calculator is designed for debt like mortgages, student loans, and credit cards. It shows users their monthly payments, the total amount paid including principal and interest, and the total interest paid. This payoff calculator offers users an amortization table and a pie chart showing the percentage of principal and interest paid in total.

Image from Calculator.net

The second loan payoff calculator is designed for loans that are paid all at once at the end of the loan term, like certain personal loans or payday loans. This calculator shows users the amount paid at the loan maturation and the total interest paid. Like the first payoff calculator, it also includes a schedule table and a pie chart depicting the percentage of principal and interest paid.

The third and final loan payoff calculator is designed for loans that are paid back in a fixed amount at the time of the loan maturation like bonds. This calculator shows users how much they will receive at the start of the loan and the total interest that will be paid. This payoff calculator also features a schedule table and a pie chart like the previous calculators.

Benefits

This payoff calculator is an excellent option for users with specialized debt. It also offers users a chance to compare different kinds of debt to see how the relationship between principal and interest can change. These payoff calculators also include basic loan information to help users understand how different kinds of loans function in different ways.

Related: Best Credit Card Payoff Calculators | Guide | How to Find Top Credit Card Repayment Calculators

Calc XML Pay Off Loan Calculator Review

The Calc XML Pay Off Loan Calculator is much more simple than some of the other calculators being reviewed. This option can be used to calculate loan payoff dates. This calculator takes into account:

- Current loan balance

- APR

- Current monthly payment

Specialization

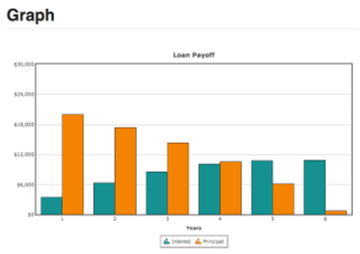

The pay off loan calculator displays results using sleek, easy-to-read graphs and tables. The first table shows users the number of payments left on their loan, how many years until the loan is paid off, and the total amount of interest that will be paid.

The second graph shows how payments will change over the lifetime of the loan. It illustrates how much interest and principal will be paid each year and how the relationship between the two will change. This pay off loan calculator also offers users a detailed data table that shows the beginning balance, interest, annual payment, and ending balance for each year.

Image from Calc XML

While this option allows users to calculate loan payoff information quickly and easily, it does not offer additional loan information directly on the calculator page. However, the website does offer users links to more detailed information that might be helpful as they learn about and plan for their debt. These links include information like:

- Affordable financial planning software

- How much debt is practical

- General information about credit

- Debt management assistance

Benefits

This is a great option for users who want to calculate loan payoff and break down payment information in basic ways. Though this calculator does not offer information about how to pay off debt fast, it does offer clear, concise graphics and simple calculations. This could be very helpful for users seeking basic information and those who want to calculate how long to pay off a loan.

Credit Karma Dept Repayment Calculator Review

The Credit Karma Debt Repayment Calculator offers users unique flexibility. This option can be used to show how long it takes to pay off a loan, or it can be used as an early payoff calculator to show how high payments need to be to pay off the debt in a certain amount of time. This is a debt calculator designed specifically to function as a credit payoff calculator. This calculator takes into account:

- Balance owed

- Interest rates

- Expected monthly payment or desired payoff timeframe

Specialization

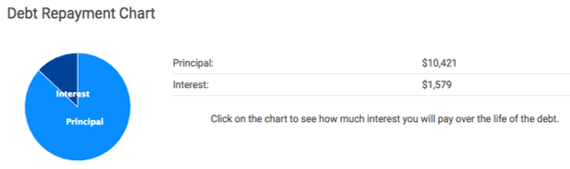

This credit payoff calculator displays results in clear tables and charts. The first table shows users their original balance, interest rate, expected monthly payment, and expected payoff time. A pie chart is used to illustrate the total principal and interest paid over the lifetime of the loan. The final table offers users variations of their results to show how the calculated information might change with different balances, monthly payments, rates, or payoff timeframes.

Image from Credit Karma

As an early payoff calculator, the information presented in the tables and charts can show users how different strategies and lower payoff times can affect the total amount paid on a loan. For example, it can show that users who pay off debt fast can accumulate less interest. However, it also shows that this strategy will increase monthly payments.

Benefits

This early payoff calculator hinges on adjusting the particulars of a debt. As adjustments are made, monthly payments, total interest paid, and the lifetime of the loan will all change. This early payoff calculator can show users the importance of finding a balance in debt repayment strategies. This is a great option for users looking to compare and contrast different payment strategies to find the best one to suit their needs.

Popular Article: Best Loan Payoff Calculators | Guide | How to Find the Best Loan Payoff Calculators

The Simple Dollar Debt Payoff Calculator Review

The Simple Dollar Debt Payoff Calculator is an early payoff calculator designed to help users understand how extra payments can affect long-term debt and the potential savings offered by an accelerated payoff plan. This early loan payoff calculator bases information on:

- The kind of debt being paid

- The principal owed

- The interest rate

- The monthly payment

Specialization

After users calculate loan payoff information based on their current monthly payment, it becomes a loan payoff calculator with extra payment options. Users can adjust extra monthly payment amounts to see how much interest can be saved with an earlier payoff date. This early loan payoff calculator can add the extra payment to the current monthly payment to help users find a middle ground that works best for them.

This loan payoff calculator with extra payments provides a results table that compares their current payment strategy with an accelerated plan. This table shows the total monthly payment, total principal, total interest, and payment date for both options.

Benefits

This loan payoff calculator with extra payments can help users find the best balance between high monthly payments and early loan payoff that best fits their needs. It can help users form a realistic plan to alleviate their debt as quickly as possible.

Users are also able to add different kinds of debt to the calculator to help them gain a holistic view of their entire financial life. This early loan payoff calculator is a good option for customers who have multiple kinds of debt or those who are seeking alternative strategies for accelerated debt relief.

Free Wealth & Finance Software - Get Yours Now ►

Yahoo! Personal Finance Loan Calculator Review

The Yahoo! Personal Finance Loan Calculator is designed to calculate how long it takes to pay off a loan. This payoff calculator is relatively simple. It takes into account:

- Current loan balance

- APR

- Current monthly payment

Specialization

This payoff calculator shows users how long it will take to pay off a loan, how much a user will pay in total interest, and how many payments will need to be made. Results are presented with a chart and a table. The chart displays how the breakdown of interest and principal taken per payment will change each year that the debt is active.

The table breaks down the beginning balance, total interest, annual payment, and ending balance per year that the loan is active. This offers users the chance to see how their debt will change and decrease over the course of its lifetime. Customers are able to adjust their inputted information to see how a shorter loan term can affect the amount of interest paid.

Benefits

This payoff calculator is a good choice for users looking for a basic breakdown of how their interest and principal payments relate to each other over time. This is not a good option for users seeking detailed explanations or comparisons. However, this calculator does link directly to additional loan and debt informational resources, which can be very helpful.

Conclusion- Top 6 Best Loan Payoff Calculators

Each loan payoff calculator presented above answers different questions. Some will be more helpful than others, depending on each user’s individual needs. Each has the potential to be a solid choice, and none of them would steer a user wrong.

To find the best for your needs, keep in mind the highlights from our comparison:

- Bankrate Debt Payoff Calculator: Focuses on debt consolidation

- Calculator.net Loan Calculator: Offers a Roth IRA conversion calculator to help users choose the best IRA

- Calc XML Pay Off Loan Calculator: Calculates loan payoff dates

- Credit Karma Debt Repayment Calculator: Has an adjustable extra payment option

- The Simple Dollar Debt Payoff Calculator: Shows how extra payments can affect overall cost

- Yahoo! Personal Finance Loan Calculator: Offers a breakdown of how interest and principal payments change over time

To choose the most effective calculator for your finances, it is important to focus on the aspects that are most relevant to your situation. With the information provided in our comparison, you can weigh the best aspects of each option against their potential drawbacks to find the best fit for you.

Read More: Top Best Credit Card Balance Transfer Offers & Deals | Ranking | Interest-Free Credit Card Transfers

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.