2017 Guide: Ways to Get Personal & Payday Loans with No Credit Check

Although the average FICO credit score was at a record high of 695 in 2015, many people still feel the burden of having a credit score much too low to qualify them for traditional loans.

More and more consumers are turning to payday loans with no credit check when they need extra cash.

Image Source: The Street

Most financial experts cringe at the idea of payday loans without credit checks because they can send consumers into a spiral of debt difficult to climb out of. Instead, experts will tell you to wait, build your credit, and qualify for traditional loans.

However, the process for those with bad credit is not that simple. They need money now, either for an unexpected emergency or a necessary purchase. Sometimes, easy payday loans with no credit check are the quickest options.

How can you find the best unsecured personal loans with no credit check? This article provides tips to help you obtain loans with no credit check, avoid getting scammed, and use what you already have available to get some extra cash.

See Also: Myinstantoffer.com Review— Get All the Facts! (Is Myinstantoffer.com Legit? & Review)

What Is a Payday Loan?

A payday loan is one of the most popular ways to secure loans with no credit check. Although they are highly frowned upon by financial experts, payday loans with no credit check help consumers have access to cash quickly and conveniently.

No credit check payday loans are extremely easy to qualify for. The few requirements for a payday loan typically include identifying information, proof of regular pay and bank account information, usually in the form of a check for the amount of the loan.

When a payday loan lender gives you money, it is usually for a small amount, about $500 or less. Payment for easy payday loans with no credit check typically is due by your next paycheck. You are also responsible for paying back the interest of the loan at this time.

Payday loans without credit checks should be limited to emergencies. Since they are so easy to obtain, it can be easy for someone to fall into a trap of borrowing money and not having the funds to cover the loan plus interest by his or her next paycheck.

If another financial emergency arises, you could get caught in a never-ending cycle of borrowing money. Save payday loans with no credit check for when you need them the most.

What Is a Personal Loan?

How do no credit check personal loans differ from payday loans? Personal loans with no credit check are typically more difficult to find than no credit check payday loans because a personal loan is for a longer term.

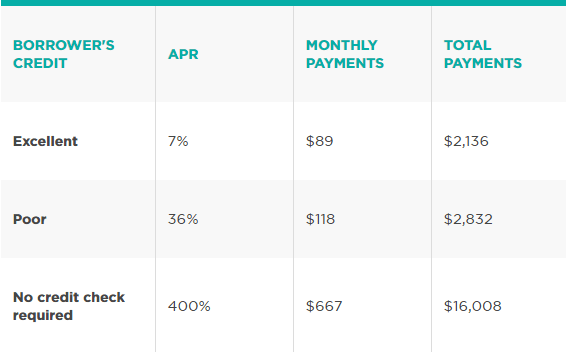

Personal loans are usually paid in installments and offer you a longer-term financial solution with monthly payments. However, personal loans with no credit check often come with through-the-roof interest rates that can cost you hundreds to thousands more than your original loan amount.

Image Source: NerdWallet

Because those who apply for no credit check personal loans do not have a good credit history, they also do not have access to more reputable forms of credit. Unfortunately, this causes some no credit check loan lenders to take advantage of borrowers in desperate financial situations by providing extremely high interest rates.

Don’t Miss: Blue Trust Loans Review—What You Should Know! (Loan Reviews)

Why Are Credit Checks Usually Required?

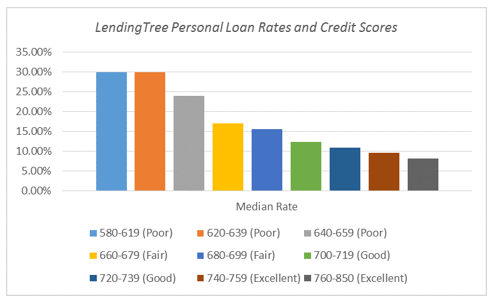

Potential loan lenders check your credit score to gain an understanding of your credit history. Although a score itself does not provide detailed credit information, it gives lenders a quick glimpse of your creditworthiness. Searching for personal or payday loans online with no credit check can, therefore, prove to be a difficult process.

Ways to Get Personal & Payday Loans with No Credit Check

Credit scores affect interest rates for personal loans. The higher your score, the lower your interest rate, in most cases. Low credit scores usually equate to the highest interest rates. Since unsecured personal loans with no credit check do not require your credit score for borrowing, your interest rate could be very high.

How can you still find the best options for easy payday loans with no credit check? Read the following tips to guide you through the process and avoid lending scams that use your financial emergency to their advantage.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Tip #1: Consider No Credit Check Payday Loans for Short-Term Cash

Although payday loans with no credit check are not the most coveted option for quick cash, they are a viable option for very small loan amounts. If you need only a few hundred dollars for car repairs, and you are positive you can pay off the loan by your next paycheck, payday loans might be a good choice for loans with no credit check.

Check with cash advance lenders in your area to see what loan terms they offer. Check with friends or family who might have used payday loans with no credit check to see what lenders they suggest. Or, find trustworthy payday loans online with no credit check by doing your research and reading online customer reviews.

Tip #2: Attempt to Find a Reliable Cosigner

If you are looking for a larger amount of money, before settling on payday loans without credit checks, consider applying for a traditional loan with a cosigner. Ask your close friends or family if they would be willing to cosign on a loan if they have good or excellent credit.

Even if you have no credit or bad credit, lenders will sometimes forgive this if you have a cosigner with excellent credit history. It can be a viable option for you in lieu of using no credit check loan lenders.

Image Source: The Balance

Your cosigner acts as a backup should you default on the loan. The loan then becomes both your and your cosigner’s responsibility. In the long run, this method can keep you from owing much more money than you borrowed from loans with no credit check.

Related: How to Get a Small Business Loan for a New or Growing Business

Tip #3: Keep an Eye Out for Scammers

Unfortunately, many unsecured personal loans with no credit check turn out to be scams. Some lenders of payday loans with no credit check prey on those in desperate financial situations by asking for money up front before loaning money or lending with ridiculously high interest rates.

Be cautious of lenders of payday loans online with no credit check. Some lenders will ask for unnecessary personal information to secure a loan. For example, your social security number should not be needed to obtain no credit check personal loans because the lender does not need your credit report.

Also, watch out for lenders who ask for an up-front payment, known as an advance fee, before they give your borrowed money. Legitimate lenders of personal loans with no credit check will not ask for money for processing, paperwork, or any other reason before you receive your loan.

If you are unsure whether you are dealing with no credit check payday loans scams, check with the National Association of Attorneys General (NAAG). Lenders are required to register with the NAAG for their specific states. If your prospective lenders of loans with no credit check are not registered, then they are not trustworthy lenders.

Tip #4: Consider Microlending for No Credit Check Loan Lenders

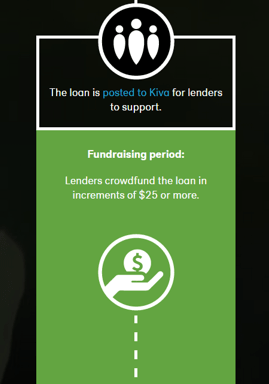

Microlending is a way to provide small amounts of money to people in financial need. Websites like Kiva and LendingTree connect borrowers with lenders to provide funding to cover borrowers’ financial needs. Since microlending is typically for small loans, it can be a way to receive payday loans online with no credit check.

Image Source: Kiva

Although microlending tends to cater toward small-business owners or entrepreneurs, regular people looking for small loans can still try to gain support for their financial goals by requesting money for personal loans with no credit check. Be honest with potential lenders about your financial situation and purpose for the money. With a clear vision for your funds, you are more likely to receive offers for loans with no credit check necessary.

Popular Article: Karrot Loans Review—Does Karrot Provide the Best Personal Loans?

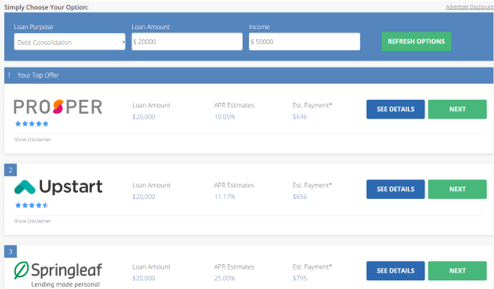

Tip #5: Research Payday Loans Online with No Credit Check

Searching for payday loans online with no credit check can provide you with a lot more information than you can receive from calling lenders in your immediate area. The Internet provides you with a huge database of lenders willing to provide payday loans with no credit check.

The best way to search for payday loans online with no credit check is to use a reputable loan matching system. Most loan matching systems do not need a lot of personal information from you to view offers from reputable lenders. Usually, you have to provide your basic information, an email address or phone number, and your loan needs.

Bankrate

Once you enter your information for personal loans with no credit check, you will be directed to a page where you can compare offers from different lenders. From there, you can see the details for the offers you are most interested in and contact the lender to see what payday loans with no credit check it has available.

Tip #6: Try a Pawn Shop for Personal Loans with No Credit Check

A pawn shop loan is not what most people consider when they think of getting loans with no credit check. However, this can be a quick and convenient way to get cash quickly, no credit check required.

To get a pawn shop loan, you bring an item or a few items of value to a pawn shop. Electronics, antiques, and jewelry are some of the items that usually have the most value to a pawn shop. To get personal loans with no credit check from the pawn shop, the shop will appraise your item and give you its value in cash.

The pawn shop will outline the terms, such as how long you have to come back and pay off your personal loans with no credit check before the shop sells your items. Pawn shops follow state and federal regulations for their business, making them a reliable alternative to most payday loans online with no credit check.

Tip #7: Secure No Credit Check Personal Loans with Your Car

Another less-popular way to obtain loans with no credit check is through title loans on your vehicle. When you ask for a title loan on your vehicle, your vehicle’s loan lender will place a lien on your vehicle and give you the cash. Essentially, you are relinquishing ownership of your vehicle in exchange for personal loans with no credit check.

SOS Title Loans

This is a good option for those in need of cash quickly with no credit checks. However, it should be an alternative to loans with no credit check that you consider very carefully. Most title loans must be repaid quickly, meaning your installments will be higher than most other loan options. You also put yourself at risk for defaulting on payments and losing your vehicle.

Read More: OnDeck vs. Kabbage Comparison & Ranking (Kabbage Competitors)

Conclusion

Searching for payday loans online with no credit check is a must for some people looking to get cash quickly. But it can be risky, and it is sometimes difficult to weed out the scammers. Consider other options for quick loans with no credit check, like title loans, pawn shop loans, or applying for a traditional loan with a cosigner.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.