Overview: How to Get LOW Interest Loans for Bad Credit

Whether you are having a difficult time raising your credit score due to financial problems or are hoping to build credit for the first time, low interest loans for bad credit are often difficult to secure.

In general, low interest loans for bad credit are seen as higher risks for a lender since there is a greater chance the customer will default, leaving the lender in a financial bind.

Luckily, there are still ways to secure low interest bad credit loans. We have compiled the following review to discuss several ways you can not only gain low interest personal loans for bad credit but ultimately remain solvent during financially difficult times. The two most common questions we will answer throughout this review are:

- How do I get low interest personal loans with bad credit?

- How do I get low interest auto loans for bad credit?

While our goal is not to sugarcoat the process of getting low interest loans for bad credit, we are here to prove that it is possible to keep your head afloat and continue to live the way you want. You have come to the right source for answers.

See Also: How to Get VA Small Business Loans for Veterans | This Year’s Guide

Know Your Credit Score

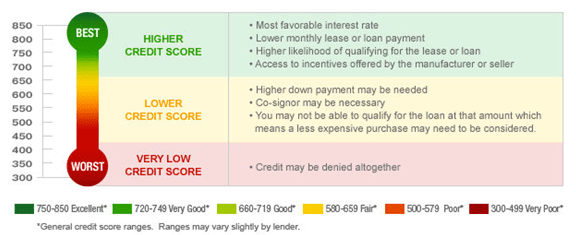

Although the definition of a bad credit score varies slightly in number, anything below a 630 generally begins to garner much higher interest rates.

Therefore, to get personal loans for bad credit with low interest rates requires a little bit of expertise. The chart below offers a good way to think about what range your credit score may currently be in.

Source: Score Power – BlackbookCreditScore.com

According to a NerdWallet Lender Survey, credit scores below 630 encounter interest rates that are often 9% higher than for those who have an average score of 630 and above.

One reason for this is that a score in the low 600s raises a red flag to financial institutions; the other reason is that consumers do not search hard enough for low-interest personal loans for bad credit.

The following table shows the average loan rates, broken down by tier, as researched by NerdWallet:

Credit Tier | Range | Loan Rates |

Excellent | 720-850 | 10.94% |

Good | 690-719 | 14.56% |

Average | 630-689 | 19.84% |

Bad | 580-629 | 28.64% |

Personal Loans: Credit Unions

One of the most common financial concerns is how to get low interest personal loans for bad credit.

A personal loan is just as it sounds: a loan from a bank or financial institution that is intended for personal use, rather than for business or commercial pursuits. With this in mind, low interest personal loans for bad credit are often tricky because they are generally unsecured, backed only by your promise to repay.

When beginning your search for low interest personal loans for bad credit, start with your local credit union.

One way to find a credit union that is best for you is by visiting Asmarterchoice.org. Credit unions offer flexible loan terms as well as lower interest rates than many of the online lenders that claim to be geared solely toward giving low interest personal loans with bad credit.

As seen in the table above, someone with a score below 630 does not tend to get low interest bad credit loans. At a federal credit union, however, the maximum annual percentage rate is 18%, more than 10% below the average for a borrower in the bad credit tier.

Don’t Miss: Top Ways to Get the Best Unsecured Personal Loans with Bad Credit

Personal Loans: Online Lenders

Low interest loans for people with bad credit can also be attained via online lenders. One thing to keep in mind is that you should only look at lenders who clearly state that they offer low interest loans for bad credit.

This may seem like an obvious recommendation, but many online lenders do not consider your credit score at all and will tend to offer no-check-credit installment loans. Lenders like these try to reel in clients who are unaware and desperate; they will often carry APRs over 1,000%, trapping borrowers in a debt cycle.

Clearly, you can do better than that. Many of the online lenders that offer low interest personal loans for bad credit cap the interest rate at 36% APR.

This may sound like a lot, but you should keep in mind that this is the maximum. Depending on your precise score, you may be able to attain low interest bad credit loans for an even smaller percentage.

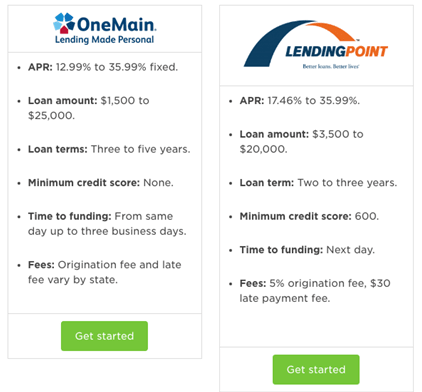

Examples of Online Vendors with Low Interest Personal Loans for Bad Credit

As previously mentioned, one of the most effective ways to get low interest personal loans with bad credit is to search through online vendors that actually consider your credit score. These lenders will not charge exorbitant interest rates and will vary in the types of customers they consider.

For instance, OneMain requires no minimum credit score to secure a loan. Anyone looking for low interest personal loans for bad credit in the range below 600 may have to consider a lender like this if the credit union is not receptive.

OneMain has over 1,100 branches across the country and will process your loan in a branch closest to you once you have completed the online application.

Another strength in going through OneMain is that most low interest personal loans for bad credit are approved in a single day.

Once your application has been accepted, you will receive your money within three days. While your interest rate for severely bad credit may be as high as 35.99%, a slightly higher score could get you a low interest bad credit loan closer to 13%.

Source: Personal Loans for Bad Credit – Nerdwallet.com

On the other hand, there are many online lenders that do require a minimum credit score, such as LendingPoint. LendingPoint’s minimum credit score is 600, still in the bad credit tier, but just high enough to weed out credit scores that cannot be trusted with an unsecured personal loan.

One of the benefits of LendingPoint is the flexibility in your payment schedule, which you can decide. At the same time, securing low interest loans for bad credit through them is limited to resident of just 14 states.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Acquiring a Co-Signer for Low Interest Bad Credit Loans

While the list of online lenders goes on, they are not the only way of getting low interest personal loans for bad credit. Although it is sometimes risky to have someone you know co-sign a loan, several lenders will offer you better interest rates if your co-signer has a high credit score.

There are several advantages of having a co-signer on your loan, but it is important to weigh the risks with the rewards.

Many lenders will offer you lower interest rates knowing that the co-signer will be held legally responsible for the loan if you cannot afford to pay it. In a way, this is a safety net for the lender.

These low interest personal loans for people with bad credit come with a lot of personal responsibility, but they will ultimately pay off if you are careful to pay on time. Remember, this loan’s payment history will be reflected in your co-signer’s credit reports as well.

By not paying off your loan in time, your co-signer’s credit score could become permanently damaged. Hopefully, this will not be a problem given the lower rates that the co-signer will help you attain.

Related: Karrot Loans Review – Does Karrot Provide the Best Personal Loans?

Automotive Purchases: Bad Credit Low Interest Car Loans

If you are simply looking to purchase a car, you might find it necessary to move your focus away from personal loans for bad credit with low interest rates to companies that specialize in auto loans.

Image source: Pixabay

In an ideal world, people with bad credit would try to avoid making large purchases and would focus instead on building credit before purchasing a car. Realistically, however, most of us will need a car for work and for travel. This is where bad credit low interest car loans come into play.

Several lenders will offer low interest auto loans for bad credit, but it is important that you choose wisely by weighing the pros and cons of each. Similar to acquiring low interest personal loans for people with bad credit, these lenders all vary slightly in the customers they look for, as well as the minimum requirements of your credit score. There are countless online resources for attaining the best lender possible.

Automotive Loans: Special Financing

One of the first sites to consider for low interest auto loans for bad credit is Auto Credit Express.

The reason this special financing site succeeds in offering low interest auto loans for bad credit is that the company works not only with traditional dealers but with special-finance dealers who consider buyers with even the lowest of credit scores.

Keep in mind that when you decide on which lender to choose for your bad credit low interest car loans, you will often need to meet a minimum monthly income to pay it back.

At Auto Credit Express, you will need to make at least $1,500 to $1,800 to get a loan. As long as you fall within that range or higher, you’re in luck. Auto Credit Express will even help you get a low interest auto loan for bad credit if you have previously filed for bankruptcy.

Automotive Loans: Big Banks

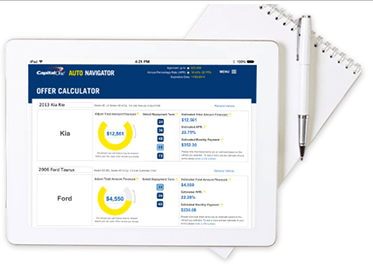

Capital One is another option to consider when looking for low interest loans for bad credit.

The strength of Capital One is that it is one of the biggest bank lenders for bad credit low interest car loans. Thanks to its reputation, over 12,000 dealers will accept a low interest loan for bad credit through Capital One.

Additionally, the Auto Navigator Tool on the website allows you to get pre-approved to buy a car while also letting you compare payments on different vehicles without having to go to a dealer.

For the sake of convenience alone, getting approved for a low interest loan for bad credit through this Capital One resource will be one of the best options.

Source: Car Buying Smarts – Carleyk.com

Automotive Loans: Lead Generators

The final site that we will consider for automotive-related low interest loans for bad credit is MyAutoLoan.com. These three websites are not the only places you should search, but for our purposes, these are often among the best in attaining your low interest bad credit loans.

While MyAutoLoan.com is not a lender, it will get you in touch with four different loan providers regardless of your credit score.

The interest-rate estimator on the site will give you an idea of the APR you should expect, depending on both your score and location. This will give you a sense of the precise low interest loans for bad credit you might expect to receive.

Similar to Auto Credit Express, you will have to make at least $1,800 a month. But again, if this is possible given your salary, there is no harm in letting a website do most of the looking for you.

Popular Article: CashNetUSA Review – What You Should Know Before Using CashNetUSA

Payment Breakdown: Bad Credit Low Interest Car Loans

When making a final decision on which provider can offer the best low interest loans for bad credit, it will be important for you to keep in mind the APR financing that most people receive with your credit rating.

The table below is based on a 60-month, $20,000 auto loan:

Credit Score | APR | Monthly Payment | Total Interest Paid |

720-850 | 3.31% | $362 | $1,730 |

690-719 | 4.64% | $374 | $2,448 |

660-689 | 6.76% | $394 | $3,624 |

620-659 | 9.48% | $420 | $5,191 |

590-619 | 13.86% | $464 | $7,834 |

500-589 | 14.95% | $475 | $8,516 |

These numbers are simply averages. Therefore, if your credit score is 640, understand that your interest rate will be around 9.48%. Be sure to pass on any lenders that offer you a loan with much higher interest rates, and remember that there are dozens of good lenders to consider.Clearly, the lower your credit score, the higher your monthly payment will be. However, these numbers should give you something to shoot for when looking at low interest auto loans for bad credit.

Conclusion: There Are Ways to Get Low Interest Loans for Bad Credit

Thanks in part to the technological age we live in, there are several ways to get both low interest personal loans for bad credit and bad credit low interest car loans, regardless of your precise score. Once you understand what your credit score is and how it affects you, your search for the best rates can begin.

Personal loans for bad credit with low interest rates are possible not only through online lenders but through your local credit union.

Additionally, acquiring low interest personal loans for bad credit is possible with the help of a co-signer. As mentioned earlier, you should weigh the pros and cons of all your decisions when choosing the best rate. Understand the impact your loan will have on the co-signer’s finances.

Throughout your search, remind yourself of the two credit score tables provided in this review. There is no magic way of getting low interest loans for bad credit that are as good as those who have high credit scores.

There is, however, a great range of interest rates that your credit score might allow you. By weighing all of these options, you will be able to get the lowest rate possible. It’s just a matter of digging.

Read More: How to Get a Small Business Loan for a New or Growing Business

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.