Intro – About AdvisoryHQ

AdvisoryHQ News is one of the fastest-growing review and ranking media for the banking, credit union, financial advisory, wealth management, and accounting industries. Read more here: Overview of AdvisoryHQ News.

Our focus is on the everyday consumer. All of our research is conducted from the end user and consumer’s perspective. And, best of all, we publish our top ranking reviews for anyone to view for free.

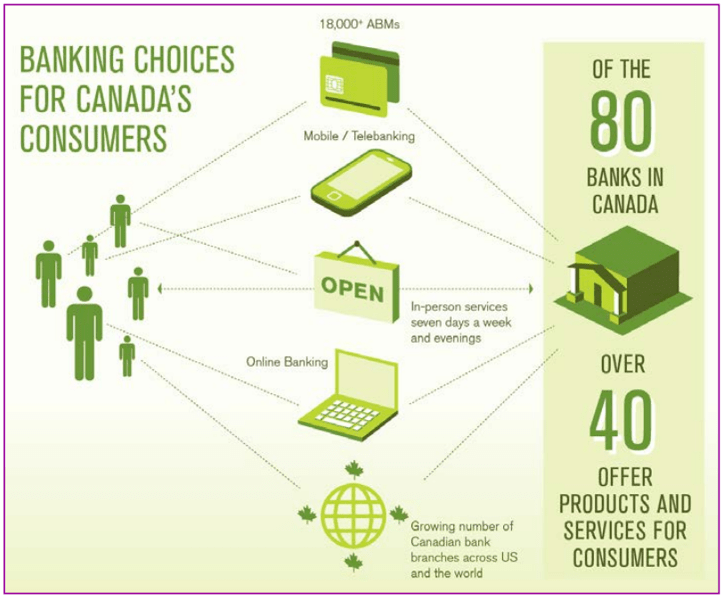

Consumers & Canadian Banking Institutions

Canada’s banking system offers good value and a wide array of choices for its consumers and businesses. Approximately 99% of adult Canadians have a bank account; of those, 30% claim to pay no service fees at all, while 45% pay $15 or less per month. Only 0.28% of mortgages are in default.

Some of the reasons Canadians feel secure and are interested in opening a banking or credit union account are:

- Affordable banking services

- Mortgages that are easy to understand

- Convenient & flexible credit card options

- Convenient & secure technology options

- Convenience of banking (apps, telebanking, ATMs, etc.)

- Consumer education & financial literacy

- Stable & Secure banking system

- Trust & value in their banks

The Financial Consumer Agency of Canada offers an Account Selector Tool, which allows you to compare the different types of accounts offered by banking institutions. You can view information about the different types of accounts, including an overview, withdrawals, transfers, payments, recordkeeping, ways to bank, services and various accounts.

Due to the wide range of banks/credit unions in Canada, how are you supposed to find time to conduct the detailed comparison research needed to identify the best financial institution for your needs?

That’s where AdvisoryHQ comes in.

AdvisoryHQ’s Objectivity

Our review and ranking articles are always 100% independently researched and written.

Firms do not pay to be included in our ranking. In fact, most firms do not even realize that they are being reviewed by AdvisoryHQ until after our reviews have been completed and published to the public.

Read more: AdvisoryHQ’s Objective Approach.

AdvisoryHQ’s Methodology for Selecting and Rating Banks and Credit Union in Canada

Conventional methodologies used by firms like Forbes and Bankrate.com to rank financial institutions are typically focused on return on average equity, profitability/efficiency ratios, nonperforming loans, interest margins, return on assets, and other key financial ratios and metrics.

To generate a more reflective ranking, AdvisoryHQ went beyond fees, ratios, and metrics. We developed the below breakthrough “Bank and Credit Union Selection Methodology” that is based on the quality of services and overall value provided by the financial firm and not on financial ratios.

Key Questions to Ask

When seeking top rated banks or credit unions to bank with, the first thing you need to figure out is what you want from a bank or a credit union.

- Do you just want a checking account? Or a savings account, too?

- Do you want to use one financial institution for all of your needs, including a personal loan, mortgage, home equity line, car loan, and other products?

- Are you seeking a financial firm that provides fee-free ATM withdrawals, higher yields, or a friendly neighborhood branch?

- If you are more comfortable performing most of your transactions online and are interested in earning a higher annual percentage yield (APY) on a free checking or savings account, then have you considered using an online-only bank with high-yielding accounts?

These are just some of the key questions that you’ll need to ask yourself as you review the top rated banks and credit union lists published by AdvisoryHQ News.

Building Our Bank & Credit Union Ranking Methodology

When building our “top-down selecting methodology” for identifying and ranking banks and credit unions in Canada, AdvisoryHQ’s review and selection team considered the factors presented below.

A big focus was given to banks and credit unions that provided a vast array of services and products, including checking, savings, online banking, loans, mortgage, and other credit products.

Although Canadians are careful borrowers and over half pay their full credit card balance each month, not everyone knows how to keep good track of their spending or savings/checking accounts. Therefore, firms that are education-friendly were highly favored when developing our selection logic.

Other considerations included:

- Legitimacy/trustworthiness (reputation of the bank)

- ATMs (Are they part of a network of machines that won’t cost you, or will you pay ATM fees every time you use your ATM card?)

- ATM coverage (few locations or all across the state?)

- Asset sizes

- Hours and convenient locations

- If you travel, will the bank/credit union travel with you?

- Online banking capabilities and services

- Product/service range & quality

- Competitive pricing & monthly fees

- Ease of communication

- Bill pay services & mobile app availability

- Overdraft protection (and its cost)

- Innovation

- And many more

AdvisoryHQ’s Four-Step Selection Methodology Structure

Below is a step-by-step breakdown of our methodology process.

Step 1: Develop a Comprehensive List

Using publicly available sources, AdvisoryHQ identifies a wide range of banks and credit unions that are providing banking services and products in a designated area, whether city, state, country, or geographic location.

Step 2: Apply Initial Threshold Filters

After developing a comprehensive list of banks and credit unions, AdvisoryHQ then applies the initial methodology filters below to narrow down the list.

Initial Filters (List):

- Full-service (scale of service)

- Size of assets and deposits

- Checking account options

- Savings account options

- Overdraft protection

- Credit cards & rewards

- Loans offered

- Mobile banking option

- Transparency

- Quality of the bank/credit union’s website

Initial Filters (Overview):

Full-Service (Scale of Service)

With full-service banking, you can do more than simply open a checking and/or savings account. Typically, these services include:

- Consumer credit

- Mortgage financing

- Commercial lending

- Trust services

- Pensions

- IRAs

- Insurance

- And more

Our methodology has been designed to favor full-service banks and credit unions to ensure that consumers are able to select a firm that can meet their wide-ranging financial needs.

Firms with a broad listing of services, products, and experienced staff are best positioned to provide comprehensive banking support to individuals, families, and institutions throughout the life of each relationship.

Credit Unions

Credit unions in Canada are quite popular, having the highest per-capita in memberships in North America; more than a third of the population is a member of at least one credit union. Membership in Canada is highest in Quebec, where credit unions are referred to as caisses populaires (people’s banks). There are currently over 300 credit unions or caisses populaires in operation in Canada today serving 5.5 million members, according to the Canadian Credit Union Association (CCUA).

Although there are not as many credit union branches and ATMs as banks, Canadians are interested in giving them a second look. Some of the reason credit unions are drawing interest are:

- Competitive rates

- Fewer fees

- They are on your side

- Profits are kept within the community by way of charitable donations and scholarships

- Support of business start-ups (small & large)

- Convenient locations

- Services geared toward its members

- Top ranked services

- Flexibility

Credit unions are non-profit, member-owned financial cooperatives that are provincially regulated. Each credit union is closely regulated within each province by one or more organizations in order to protect its members’ deposits.

The credit unions are democratically controlled by their members, and their primary function is to pool deposits together and make these deposits available to their members in the form of low interest credit and loans, as well as providing other financial services to their members at competitive rates.

Credit Unions in Canada have led the way in innovation, inventiveness, and governance. These credit unions were the first to:

- Offer daily interest savings

- Offer debit card services

- Have full-service ATMs

- Have fully functional online banking centers

- Open branchless banks (Citizens banks)

- Offer loans based on borrower character

- Lend to women in their own names (1960s)

- Offer payroll deduction services for deposits/loan payments

- Offer cheque imaging services

- Open mortgages

- Offer home equity lines of credit

- Offer registered education plans

When reviewing credit unions for ranking, AdvisoryHQ considers each credit union’s overall asset size. Credit unions with higher asset sizes are favored in AdvisoryHQ’s selection methodology.

Credit unions with larger asset sizes can achieve greater levels of economies of scale.

Banks

When developing our methodology for selecting banks, we also considered total assets as part of our selection logic. However, total assets were not given as much weight in our methodology formulas as they were given for credit unions.

- # of Branches (Banks)

The number of branches a bank has weighs higher in our selection methodology for ranking top banks in a specific geographic location, due to banks having more branches than credit unions. This is important because a bank that has only one or a few branches may not be as convenient to do business with if a consumer is located far away or prefers a branch over online banking.

- Checking Accounts

Finding a financial institution that fits all of your needs can be a tricky task.

When developing our selection methodology, we integrated search elements for firms that offer various checking account options to allow you to choose the option that best suits your needs.

While some banking and credit union firms offer basic checking accounts with no monthly maintenance fee, others offer accounts with additional “value-add” features and charge monthly fees for the use of such accounts.

- Savings Accounts

Finding a savings solution that meets your unique needs is of utmost importance to most consumers. Our methodology favors banks and credit unions with versatile features that can help you with your savings goals.

Do you simply want a basic savings account to put away money for that summer vacation, or are you looking for a savings account with higher interest rates to maximize your savings for your child’s college tuition or to pay off your debt?

Either way, our reviews will provide you with the pertinent information to choose the right savings account for your needs.

- Overdraft Protection

Let’s be honest, it happens. We make a purchase and don’t actually have the sufficient funds to cover the payment. Having overdraft protection on your account will allow you to avoid overdraft fees. Should you find yourself in a situation such as this, the bank or credit union would cover the purchase using either money from your savings account or debit card.

- Credit Cards and Rewards

You can find the card that’s right for you, right at your bank or credit union, without having to apply to a credit card-focused financial firm (for example, Capital One)!

Depending on the type you are looking for, you may be able to qualify for a credit card that offers rewards for the amount you spend or where you use it. Rewards can range from airline miles and hotel accommodations to earning points when you pay for gas or groceries. Typically, these points can be redeemed as cash, merchandise, gift cards, travel, or you can even choose to donate to an affiliated charity.

- Loans

At some point in everyone’s life, a loan of some sort is needed. Whether it be a home improvement loan to remodel your house, a home equity loan to buy a new one or a student loan to go back and finish that degree, the more information you have, the better off you’ll be.

Knowing which firm offers the type of loan you need and what its payment options are is invaluable information that we aim to present on our top ranked review publications.

- Mobile Banking Option

Have you ever left the house and realized you forgot to pay your electric bill or transfer some money from your checking to your savings account?

With mobile banking, this is a non-issue. You can pay these bills or perform the transfer from your phone or tablet using the banking app.

Financial firms that provide this feature make it easier for their members to pay their bills or conduct online transactions.

- Transparency

You always want to know upfront the types of fees you are going to be required to pay for certain accounts, overdraft fees, etc. Knowing such fees or rates will also assist you when deciding what type of bank to choose. Banks that make these types of fees clear are the types of banks you want to work with. As such, our methodology has been designed to favor such banking firms.

Quality of Bank/Credit Union’s Website

We want to provide you, the consumer, with firms that are easy to navigate online. Yes, we are reviewing mostly brick-and-mortar banks and credit unions that you can physically visit, but there will be times when getting online to do your banking is your only option.

Also, when learning more about a banking institution, consumers often visit the bank or credit union’s website for additional information.

Therefore, we designed our selection logic to favor banks and credit unions with user-friendly and easy-to-navigate websites.

Step 3: Deep Dive Assessment

After trimming down our initial list using our initial methodology filters, we then conduct a deep dive assessment of the remaining banks/credit unions to select our final list of the top financial institutions.

Step 4: Generating the Final List of Top Banks & Credit Unions

Based on the results of our overall assessment, we then select the entities that make it onto our list of the top rated banks and top ranked credit unions.

The firms we review and rank often do not realize they are being reviewed until after we’ve published our ranking and comparison reviews to the general public. This is to ensure an absolute level of objectivity in our reviews.

Scale of AdvisoryHQ’s Methodology Selection Factors and What’s Not Included

Please note that our methodology does not factor in the below analytical elements when ranking/selecting top rated banks and credit unions:

- Return on average equity

- Return on assets

- Return on investments

- Profitability/efficiency ratios

- Nonperforming loans (NPLs) as a percentage of loans

- Return on average tangible common equity

- Net charge-offs as a percent of total loans

- Net interest margin

- Nonperforming assets as a percent of assets

- Reserves as a percent of NPLs

- Two capital ratios (Tier 1 and risk-based)

- Revenue growth over the last 12 months

There are hundreds, if not thousands, of possible factors, filters, and selection criteria that can be applied to any ranking and rating selection across any industry. It is nearly impossible for any ranking or review company to accommodate all possible selection filters when developing a selection methodology.

Also, the research performed by AdvisoryHQ and the top ranking publications and findings we published are meant for everyday consumers.

As such, we focused our groundbreaking methodology on those banking elements that provide real and overall value to our key constituents: the average Canadian consumer.

If you have questions, comments, or tips about this “Selection Methodology for Ranking Banks & Credit Unions article, send us an email. Also, follow us on social media to be the first to hear about major economic news stories.

- Follow AdvisoryHQ on Twitter

- Like/Follow AdvisoryHQ on Facebook

- Follow Us on LinkedIn

- Follow Us on Google+

Cheers,

AdvisoryHQ Team

Note: The above page may include affiliate or other related advertisements. Click here to view AdvisoryHQ’s advertiser and editorial disclosures, which includes a list of our affiliates.