2017 RANKING & REVIEWS

TOP RANKING BEST MONEY MANAGEMENT SOFTWARE AND APPS FOR ALL DEVICES

We’re immersed in a digital age in which almost anything can be done from our smartphones, tablets, or computers. That includes budgeting.

There are so many outstanding software and app options for people who want to get a better handle on their finances and manage their money more effectively.

Some of the advantages of using money management software and apps include:

- With the use of many of these platforms and resources, you have constant access to multiple accounts from one integrated location. This gives you an idea of how much money you have and helps you avoid costly mistakes such as overdrawing an account. You can also watch spending as it happens, so you’re not surprised by anything.

- Speaking of surprises, using online money management software and apps can help you spot any potential fraud situations as they arise.

- You can create not only a daily budget but also plan more effectively for the future and meet your financial goals when you rely on money manager software.

Award Emblem: Top 4 Money Management Software and Apps for All Devices

Choosing the Best Money Management Software

With all the available choices, how do you decide which money manager software or mobile app is right for you?

The decision depends on a few things, including your personal needs, your goals, and the device you’ll be most often accessing it from.

To guide the decision-making process and help you choose the best money management app or software for your needs, we ranked our top four picks.

We’ll cover the essential features of each, as well as the benefits and why you might find them advantageous to better manage your finances.

It’s our goal that this comprehensive compilation of money management software reviews will guide your decision-making process and put you on a path toward a stronger financial future.

AdvisoryHQ’s List of the Top 4 Money Management Software and Apps

Sorted alphabetically:

Personal Capital Review

What It Is

Personal Capital is a platform offering a suite of financial tools and is used by nearly one million investors to track their money and investment portfolios.

Many users prefer Personal Capital because of its abundant options. Registered users can access these free tools, along with an intuitive and user-friendly dashboard, all of which simplify the process of managing money from multiple accounts.

>> Click here to open your free Personal Capital account <<

Image Source: Personal Capital

Features of Personal Capital Include:

- The Personal Capital Dashboard is designed to integrate with all your existing financial accounts, including checking and savings. You can also use it along with your investment and IRA accounts, mortgage, home equity loans, and you can link it to your credit card accounts.

- The Personal Capital Fee Analyzer shows you how much you’re paying in hidden broker fees on your retirement accounts and investments.

- The Investment Checkup Tool analyzes portfolios to uncover improvements that can be made to help you reach your long-term goals.

- The Personal Capital Dashboard also gives you real data to assess how individual events are impacting your finances, both planned and unexpected, from medical costs to college payments.

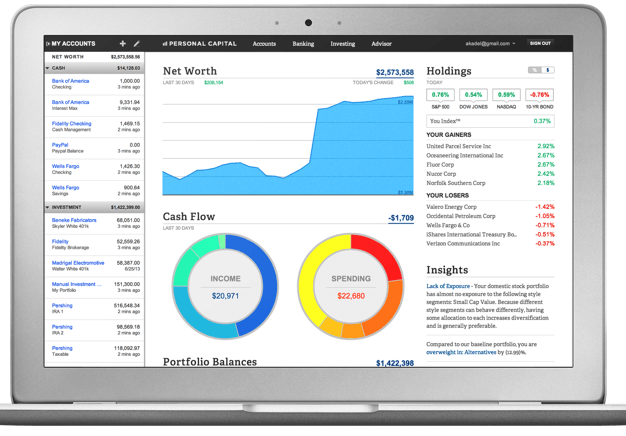

Image Source: Personal Capital

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

The Personal Capital Dashboard shows users the following, in a way that’s simple to monitor and analyze; plus, you can login securely from your desktop, tablet or mobile device at any time:

- Net worth

- Cash flow

- Portfolio balances

- Portfolio allocations

- Key holdings

- Top gainers and losers

- Account balances and transactions

- Spending by account or category

- Income reports

- Spending reports and upcoming bills

- Investment returns

- Project investment fees

Personal Capital’s Net Worth Features

Using the Personal Capital Dashboard, users are able not just to see but also to truly understand their net worth, which makes this a great product for anyone interested beyond just short-term budgeting toward long-term retirement and financial planning goals.

Since Personal Capital lets you link everything (including things like your mortgage, credit cards, and home equity), you’ll get a comprehensive picture of net worth, which includes assets as well as liabilities.

Benefits of the available net worth feature include:

- You have a consolidated view of your accounts in one place.

- Personal Capital will compile trends which show you whether you’re moving in a positive or negative direction regarding net worth so you can make necessary adjustments.

- You can track your portfolio performance to see how your net worth changes over time.

>> Click here to open your free Personal Capital account <<

Fee Analyzer

One of the unique and valuable features of this money management software free product is the fee analyzer.

Many consumers and investors don’t realize the startling amount of money they’re losing as a result of paying hidden fees in their mutual funds, investments, and retirement accounts.

Most financial institutions charge annual fees on assets, and over time, this can add up and significantly impact your savings and net worth.

With the Fee Calculator and Analyzer available with this money management software, you’ll find the following advantages:

- Analyze your holdings and then get a view of how they impact your savings.

- Access projections as to how these fees may affect you in years to come.

- Uncover high mutual fund expense ratios.

> Sign up for a Free Personal Capital Account <

Retirement Planner

The highly advanced retirement planner, which is entirely free of charge when you join Personal Capital, is one of the reasons we ranked this as a pick for the best free money management software.

This innovative tool shows your current standing as compared to your retirement goals. It lets you:

- Use actual data from linked accounts to see how ready you are for retirement, as compared to your targeted date.

- Plan for big expenses like college or buying a new home.

- View your automatically calculated monthly income and projected Social Security distributions.

- Build a data-driven retirement plan based on powerful modeling tools.

Our Analysis

What we like about this money management app for Mac, Android, and all other devices, is that it gives more than just a real-time view of your finances: it helps you plan for the future.

QuickBooks for Small Business Review

What It Is

QuickBooks for small business is perhaps one of the world’s most well-known and best personal money management software options.

This particular QuickBooks product is designed to help you keep track of the money that comes in and out of your business in one integrated location. It connects to more than 16,000 financial institutions so you can automate the categorizing and management of your transactions.

QuickBooks can also pull information from other apps you use, including PayPal and Square.

Everything is automatically backed up with bank-quality security, and you can access your information from any device, which means QuickBooks for Small Business is perfect for web-based use, but it also includes a money management app for iPhone and Android devices.

Features

As a well-respected and established name in the world of money manager software, QuickBooks certainly isn’t lacking in features.

Some of the most popular available features include:

- Automatic syncing with your bank and financial accounts, as well as automated downloads, categorization, and reconciliation with not just bank but also credit card transactions.

- You can track expenses to create a record that’s useful when it’s time to pay your small business taxes.

- QuickBooks for Small Business also lets you take photographs to accurately save receipts to your phone.

- Create beautifully designed, custom and branded invoices and then send them to your clients.

- Not only can you email invoices through this software, but you can also accept online and mobile payments, so you get paid more quickly.

- Sync data from popular apps you’re also using, such as Square.

- Record and pay bills from vendors and schedule recurring payments if you choose.

- QuickBooks automatically backs up your data each and every day.

You can choose a plan with access for up to five users.

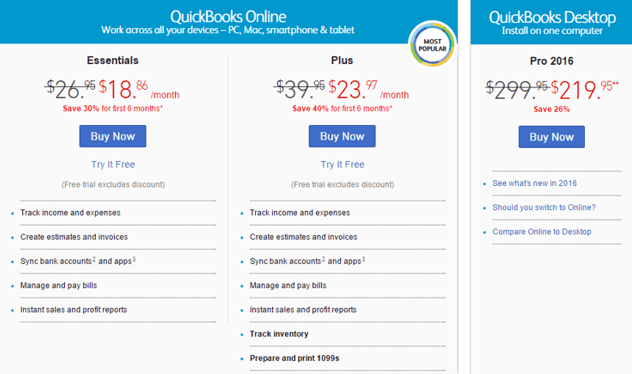

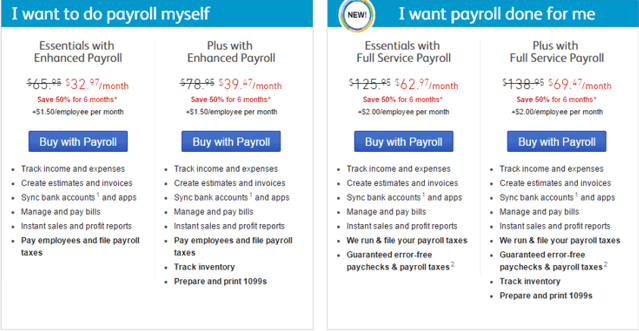

QuickBooks Pricing

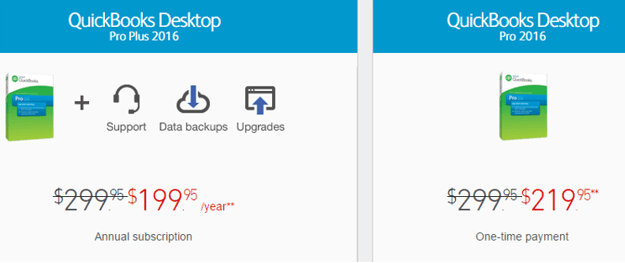

QuickBooks offers a wide range of pricing options to meet most price points. You can choose one of four monthly plans (for the online versions) which allow you to work across all your devices–PC, Mac, smartphone & tablet–or you can choose one of the “one-time cost” pricing options for the downloadable desktop versions.

QuickBooks – Regular Versions (Monthly Costs)

Image Source: QuickBooks for small business

QuickBooks Pro (Monthly Costs)

Image Source: QuickBooks for small business

QuickBooks with Payroll Features (Monthly Costs)

Image Source: QuickBooks for small business

QuickBooks Desktop (One-Time Payment)

Image Source: QuickBooks for small business

QuickBooks Online

As a respected provider of money management solutions, QuickBooks offers quite a few options for customers, including QuickBooks Online, which is the world’s number one accounting software.

With the online version, you have access to the features listed above, as well as others, including:

- The ability to cut paychecks with expert payroll customer service.

- See your Profit and Loss, Balance Sheet, and dozens of other reports with one click.

Securely collaborate with your team or accountant online. Files sync automatically for simultaneous use.

With an online subscription, you receive full use of features of the version you purchase, automatic upgrades to that version, secure data storage, and product support at no additional cost. You can also add additional features at any time.

QuickBooks Online works with the following devices and system standards:

- Windows 7 and 8, Mac OS X 10.8 (Mountain Lion), 10.9 (Mavericks), 10.10 (Yosemite), or Chromebooks

- Internet connection required (high-speed connection recommended)

- Supported browsers: Chrome 41 or later, Firefox 36 or later, Internet Explorer 10 or later, Safari 6.2 or later

- Also accessible via mobile browsers: Android, Chrome (Android and iOS), and Safari

QuickBooks Apps and Desktop

In addition to QuickBooks Online standard offerings, which are available as subscription purchases, charged on a monthly or annual basis, you can also opt for QuickBooks apps, which are an easy way to manage your money from any mobile device.

QuickBooks Desktop includes Pro, Premier, Enterprise, and Mac Desktop versions, although features are generally more limited in desktop versions.

Our Analysis

QuickBooks is a great product for self-employed professionals and small business owners, but it’s not necessarily a home money management software product. It is tailored to business needs, but it’s great for tracking all of your day-to-day business financials.

We also like that it integrates with apps like Square and that it’s very flexible; you can easily customize the products to your specific business and finance needs.

Quicken Review

What It Is

Quicken is the world’s leading personal money management software. This complete financial solution lets you do essentially anything related to your money in one location, including connecting to your banks, creating budgets, and developing solutions to pay off debt.

All information is encrypted and securely transmitted into Quicken with bank-level security. You can also sync data between devices so you can access and manage your money at any time and from anywhere.

Some other general features of all Quicken products include:

- The ability to see, track, and pay your bills in one place. You can link your statements, and Quicken will automatically follow the due date and how much you owe so you’re not late with payments.

- You can also see where you stand with bills and cash flow without logging into other accounts.

- Quicken offers free phone support.

- The new 2016 versions are designed for increased reliability and accuracy so you can eliminate duplicate transactions and proactively fix missing transactions.

- On-the-go tracking features let you make better spending decisions.

- You have the option to export Quicken data directly to TurboTax for tax prep.

- All Quicken financial products are backed by a 60-day money-back guarantee.

Quicken Product Options

Quicken offers a wide variety of product options. Perhaps the most used in terms of home money management software is Quicken Starter Edition 2016.

The starter edition includes the following features:

- Access to bank and credit card accounts in one place

- Automatically categorized spending to simplify budgeting

- Bill linking to track due dates and amounts due

- Income and expense reports automatically and securely downloaded from bank and credit card accounts in one place

- Forecasted balances

- Free credit monitoring alerts, credit score, and report summaries

- Automatic budget goals based on your past spending, which you can customize and track

- Custom alerts for large deposits, fees, or overspending

- Quicken mobile app access so you can sync information and snap store receipts to track big purchases

Image Source: Best Money Management Software

Quicken Deluxe 2016 features everything available with the Quicken Starter Edition, plus extra features, which include:

- Manage not just your checking, savings, and credit card accounts, but also integrate your loan, investment, and retirement accounts.

- Use tools to help you create debt reduction plans.

- Determine how to best reach your retirement goals.

Quicken Premier 2016 goes a few steps further and boasts all of the features of Quicken Deluxe, as well as the following:

- Efficiently manage your investments and tools to strengthen your buying and selling decisions.

- Track cost basis and capital gains to make it easier to file your taxes.

- Identify ways to improve your portfolio, which is organized to show your risk vs. return.

- View reports not just on funds but also securities within your funds.

- Gain access to instant multiple portfolio views which can include asset allocations, sectors, geographic regions, and more.

- Download income and expenses automatically so you don’t have to manually enter information.

- Receive maximum tax benefits with Quicken Premier’s exclusive design.

- See how your investments perform over time compared to market indexes.

Other available Quicken products include Quicken Home and Business 2016, which features the ability to categorize personal spending and business expenses automatically. It saves you money by finding tax-deductible business expenses, and you can see profit and loss snapshots anytime.

Also available are Rental Property Manager and Quicken 2016 for Mac.

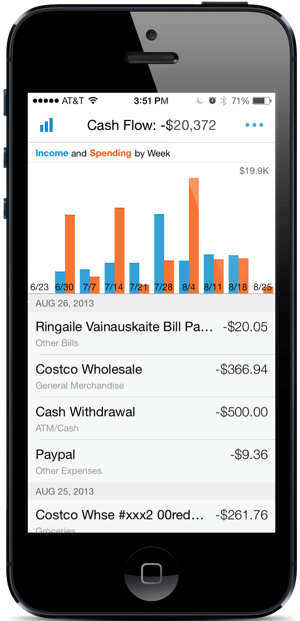

The Money Management App for iPhone and Android

Quicken offers access to a free mobile app, which lets you do the following:

- Sync data from your computer to your phone or tablet

- Check balances from anywhere

- Enter transactions for current balance and budget updates

- Navigate easily with a new, easy-to-use navigation bar

- Use the updates tab to find recent and uncategorized transactions

- Snap and store receipts to eliminate paper clutter and make it easier to return purchases

- Enjoy a little peace of mind knowing that the Quicken app is passcode protected

Our Analysis

Quicken undoubtedly is one of the best money management software products available.

It includes nearly anything you could want or need from money manager software, and you can choose from a range of products to suit your individual needs. It’s easy to use, highly accessible, and customizable, making it an excellent online money management software solution.

Quicken is backed by the utmost in security, as well as decades of experience providing the very best in financial management and budgeting products.

This is our list of the top four money management software and apps for all devices in 2016.

Whether you want a simple platform to help you keep track of your expenditures or a comprehensive product that manages both home and business finances, it’s our hope you found these money management software reviews helpful and informative.

YNAB (You Need a Budget) Review

What It Is

You Need A Budget, also called YNAB, is a money management software product designed to help you take control of where your money is going, which enhances the ability to pay off debt, save more, and break the cycle of living paycheck-to-paycheck.

While YNAB isn’t a free money management software platform, you can try it free for 34 days to see how it can benefit your life and your finances.

One big advantage of using YNAB is the simple-to-use signature apps. This online money management software is available in a web-based format and for iOS and Android.

General benefits of YNAB include:

- It runs in the cloud, so you don’t have to set anything up, and you’re ensured the utmost in security.

- YNAB connects directly to thousands of banks and credit cards.

- It’s always up-to-date and syncs in real time, so you constantly have an accurate picture of your finances.

You Need a Budget has a homegrown foundation. It was created by a married couple who felt as if they weren’t adequately watching and budgeting their money. They decided to take control of their spending based on sound core principles built into this software.

Key Principles

One of the special things about You Need a Budget is that it’s designed around key principles, which are intended to help people become smarter with their money and get themselves out of negative financial situations or habits.

These principles include:

- Give Every Dollar a Job: The idea here is to prioritize your spending needs, and then assign dollars to those priorities, thereby giving every dollar a job. This helps you put your money toward your highest priorities and avoid spending on unnecessary things.

- Embrace Your True Expenses: Your true expenses aren’t just the bills you have that are set in stone. This also includes the unexpected, and YNAB helps users integrate even the unexpected into their monthly budgets.

- Roll with the Punches: This is an important principle and an essential component of this money management software. The idea is this: your budget is a plan, but plans can and do change. Rather than stressing out about a change in your budget, these tools are designed to account for them and help you adapt in a flexible way that’s attainable for the real world and real life.

- Age Your Money: This final principle centers around increasing the amount of time between receiving money and spending it. When you’re able to do this, gradually, you experience a greater sense of financial security and flexibility. According to the creators of YNAB, if you’re able to follow the first three principles of money management, the final one naturally follows, and that’s what lets you break the cycle of living paycheck-to-paycheck.

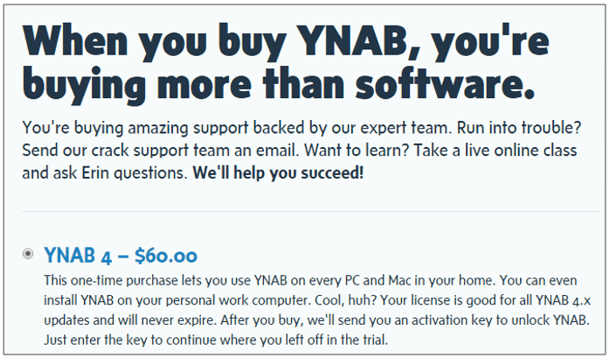

Pricing and Plan Options

As we mentioned, this is not free money management software, but it is relatively affordable for most users, and ultimately ends up saving you quite a bit of money.

Cost: $60 one-time cost, but if you click below to open an account, you get a 10% discount.

YNAB has a free trial–a 34-day, full-featured demo–so you can try it out and see if you like it before making your purchase: Try YNAB–Free. After your purchase, YNAB will send you an activation key to unlock the YNAB app. Just enter the key to continue where you left off in the trial.

Image Source: Try YNAB–Free

A few notes on subscriptions:

- YNAB is offered free for college students with proof of enrollment!

- Choose from several subscription plans if you’re not a college student; you will be charged monthly or annually, according to your choice.

- If you’re a current user, you can keep using the version you have for as long as you’d like. If you’d like to upgrade when new versions become available, you do have to purchase a new subscription.

- If you’re an existing user, take advantage of a 10% lifetime discount that’s automatically applied to your account when you make a new purchase.

Free Wealth & Finance Software - Get Yours Now ►

Classes and Resources

One of the many things we find compelling about this home money management software is the holistic approach to changing how you see and manage your money.

Along with the software and app products, you can also take advantage of a variety of free classes that show you more about budgeting, and the YNAB blog and in-depth guides are also great tools.

YNAB isn’t just about seeing where your money goes; it’s really about changing how you view your finances and your lifestyle.

Our Analysis

There are a lot of things to love about You Need a Budget in addition to the creative yet practical principles upon which it is based.

One of the things that led us to rank it as a top money management app for Mac and all other devices is the simplicity of use. The user interface makes it easy to see what you’re working with and make decisions. It’s well-organized and boasts a logical layout.

One thing that is important to point out, however, is that YNAB doesn’t sync directly with companies. You can upload a variety of file formats with your transactions, and then edit and organize your information.

You can save your information from months before to make organization easier and you can also copy your budget from the previous month, but if you’re interested in investment tracking, this isn’t the money management software for you. Instead, YNAB is perfect if you want something that’s user-friendly, easy to use without requiring a lot of time, and highly mobile-friendly.

It’s great for simple, straightforward budgeting needs and works well if you’re just getting started using online money management software.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.