UK Robo Advisers Reviews: Wealth Horizon vs. Wealth Wizards vs. Wealthify vs. MoneyFarm

Selecting the correct robo adviser in the UK for your financial goals, needs, and expectations is imperative.

Taking a look at UK robo advisor reviews can help you to determine which online investment company can help with your wealth management needs the best.

You’ve likely already heard of several of these new investment management centres, companies like MoneyFarm, Wealth Horizon, Wealth Wizards, and Wealthify. In a side-by-side UK robo adviser comparison, which one would be the best choice for you?

Here at AdvisoryHQ, we want to offer an objective review of MoneyFarm, Wealth Horizon, Wealth Wizards, and Wealthify to help you determine if they could be the right fit for you.

We will review their services and fees to assist you in finding a robo adviser in the UK that can help you to save for the future and manage your investments.

Image Source: BigStock

See Also: Robo Advisors (UK)—Everything You Should Know! (Investment Help & Advice)

Wealth Horizon Review

If you’re looking for a UK robo adviser that offers more personalised advice than many of the more hands-off online investment companies, Wealth Horizon has a lot to offer.

While most companies offer premade portfolios that cannot be altered, Wealth Horizon specializes in offering financial advice and a personalised portfolio that matches up with your risk tolerance and financial goals.

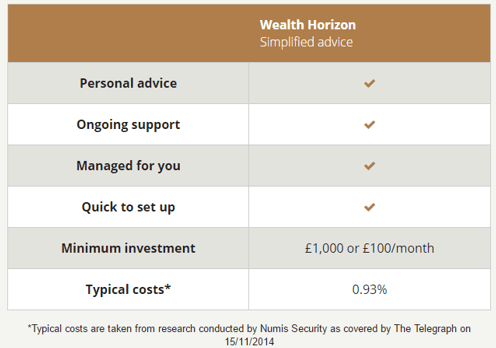

Source: Fees – Wealth Horizon

In an attempt to get away from the traditional model of scheduling meetings to discuss your wealth management, Wealth Horizon offers online financial advice for those who have uncomplicated investment needs and only require simple strategies. In just half an hour, they can offer a comprehensive investment strategy based on your personal preferences.

Unlike many of the robo advisers in the UK, you can call into the Wealth Horizon customer service department and speak to a live person at any time. Prior to agreeing to a particular strategy or even months down the road, you can ask questions regarding your investment portfolio with a live person whenever they arise. If you prefer, Wealth Horizon also offers a live chat software for your concerns.

One of the best features about Wealth Horizon is their transparent honesty. They value the advice that their professionals have, and if they don’t feel like you would be making a wise investment, they will tell you up front. Based on the advice process required by Wealth Horizon, if it doesn’t seem like you can afford the risk of your portfolio, they will notify you.

Don’t Miss: Top Rated Best UK Robo-Advisers | Ranking | Top Automated Investment Firms in the UK

Fees

Opening an account with Wealth Horizon requires an initial deposit of £1,000 in one lump sum, or you can choose to make monthly contributions of £100 or more each month. Compared to some robo advisers in the UK, this is a relatively low sum for a minimum investment.

The fees for investing with Wealth Horizon are relatively low in comparison to those of a traditional financial adviser. Up front, you can expect to pay 0.25 percent of your initial investment should you opt to move forward with the suggested portfolio that Wealth Horizon creates for you.

In exchange for managing your portfolio. Wealth Horizon charges an additional 0.75 percent for a yearly review. Of course, there is also the underlying fund charge for Wealth Horizon, which typically equates to 0.18 percent.

Overall, you can expect to pay 0.25 percent initially and somewhere around 0.93 percent of your portfolio value per year after the fact.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Wealth Wizards Review

Wealth Wizards has the potential to be an excellent wealth management company to help you save for retirement—if you can use them. The one thing that sets Wealth Wizards apart from other investment management services is their niche offering solely to employers. Employees whose companies opt for these services receive personalized information regarding advice for switching and managing pensions to better help save for retirement.

As with most wealth management services, Wealth Wizards are centred on the algorithms that help to determine what works best for your investments after collecting information regarding your personal financial circumstances and goals. They offer a completely diversified portfolio that is reviewed annually or at your request.

Another of the unique features that sets Wealth Wizards apart from their competitors is their propensity to deliver advice online. You can register for their apps, the Pension Wizard and the Retirement Wizard. If your needs are more complex than that, you can still receive advice and support via phone or Skype. These services are available to help you with financial planning such as planning for taxes, pensions, and retirement income as well as an annual review of your current investment strategy.

Fees

The fee structure through Wealth Wizards is a little more complicated than some of the others included in our UK robo advisor reviews. Because the services are covered through employers, the charge depends on the number of employees that will be added to the plan. Employers should expect to pay Wealth Wizards £100 per employee with extra charges for additional services.

For example, pension tidy-ups or top-ups range from £200 to £499. Alternatively, you may even pay an hourly fee if a fixed price isn’t agreed upon with Wealth Wizards. The hourly fee is subject to the appropriate professional from Wealth Wizards who would need to handle your claim.

Basic questions and issues that can resolved with the assistance of a Wealth Wizards administrator will only cost you £50 per hour. A paraplanner or research analyst would charge £100 per hour. At the top tier of pricing, if you need a chartered financial planner or a director, you could be paying £200 to £250 per hour.

If your employer does not cover the cost of the annual review through Wealth Wizards, you will be charged based on the amount of funds invested in your account. For more information on what an annual review with Wealth Wizards costs, see the chart below:

Account Balance | Charge | Maximum |

Up to £30,000 | £65 | N/A |

£30,001 to £50,000 | 0.45% | £225 |

£50,001 to £75,000 | 0.40% | £300 |

£75,001 to £100,000 | 0.30% | £300 |

More than £100,000 | 0.25% | N/A |

Table: Wealth Wizard Costs

Related: Top Robo-Advisors (Reviews) | A Changing Trend in the Robo-Investment Field

Wealthify Review

Appealing largely to a younger generation, Wealthify is one robo adviser in the UK that is encouraging clients to invest with extremely small amounts of money. Wealthify is great for young clients and those who are just beginning to dabble in investments. They call themselves a “new wave of investors,” claiming that can expect more than just “poor savings rates” by allowing Wealthify to invest on your behalf.

Demonstrating that investments on the global market have held an annual return of almost nine percent over the past half-decade, Wealthify encourages clients to make investments based on their personalities. Are you cautious or adventurous? Choose from either option or put yourself somewhere squarely in the middle so Wealthify can begin to build a portfolio with a combination of investments just for you.

Wealthify is great for individuals who prefer to sit back and watch their money grow without much thought or effort on their part. This UK robo adviser rebalances and monitors your account every day to keep it heading toward your financial goals.

They approach portfolio-building through passive investment, meaning that Wealthify uses your funds for ETFs, mutual funds, and similar types of low-cost investments. This type of strategy is shown to be more effective than simply selecting stocks that appear likely to do well.

Fees

While some of the other robo advisers in the UK require £1,000 to begin, Wealthify requires only £250 to open an account with minimum monthly contributions of £20. This makes robo investing significantly more accessible for new investors and gives clients a small-scale opportunity to test the company before making a long-term commitment. However, there are never any withdrawal fees (other than taxes that would be due).

Based on a tiered pricing structure, smaller account balances warrant a higher annual fee. For those that are at £250 to £14,999, you can expect to pay 0.7 percent. At £15,000, you receive a small discount from Wealthify, dropping your annual fee to 0.6 percent. Their highest tier is for account balances higher than £100,000, which is 0.5 percent.

Don’t forget that there is also an underlying fund charge, which averages 0.28 percent each year.

One unique feature about Wealthify is the ability to reduce your fees by adding friends to your circle. You receive a 5 percent discount for inviting two or more friends, a 10 percent discount for inviting five or more friends, and 20 percent discount for inviting more than fifty friends. A £13,000 investment over 10 years with fifty friends would lower their payments by £182.

Popular Article: What Is a Robo Advisor? Everything You Should Know about Robo Advisors (Definition)

MoneyFarm Review

Of those included in our UK robo adviser comparison, MoneyFarm is the only UK robo adviser to offer both a general investment account and a stocks and shares ISA. When you initially set up your MoneyFarm account, expect to be walked through a behavioural questionnaire that should take approximately ten minutes to complete. Based on your assessment, they will assign you to one of their twelve diversified portfolios that they recommend for your investment management.

In order to quickly diversify your portfolio, MoneyFarm uses low-cost ETFs. These are perfect for clients who are planning to maintain their investment management for the medium to long-term future.

The MoneyFarm investment committee consistently rebalances your portfolio to optimise the potential return on your investment. When necessary, MoneyFarm will notify you that they are making changes to your portfolio and then carry out the necessary trades. This service is included in their list of fees.

MoneyFarm makes it easy to determine your potential returns with a calculator on nearly every page, adjustable for your initial investment, continuing contributions on a monthly basis and the length of time you intend to maintain your investment management along with your risk level. You also have access to the MoneyFarm app to analyse your portfolio on the go and keep abreast of pertinent news.

Fees

The most attractive quality that should be mentioned in UK robo advisor reviews is that MoneyFarm is a free service for individuals who have £10,000 to invest or less. They are also free for clients with more than £1,000,000 to invest. While the fees for a robo adviser in the UK are generally minimal (especially compared to traditional investment management and wealth management services), a free service is always a great consideration.

Not only that, but there is no minimum account balance. MoneyFarm allows you to be assigned a portfolio with an investment as low as £1. However, they do recommend an investment of £1,500 in order to better allocate and balance your portfolio.

Once your investments with MoneyFarm surpass £10,000, they begin to charge based on a tiered structure. You can view the details of what each account balance will cost you in annual fees in the table below:

Price Bracket | Fees |

£0–£10,000 | 0% |

£10,001–£100,000 | 0.6% |

£100,001–£1,000,000 | 0.4% |

More than £1,000,000 | 0% |

Table: Money Farm Annual Fees

Keep in mind that all MoneyFarm accounts still have an underlying fund cost. On average, this generally runs around 0.25 percent.

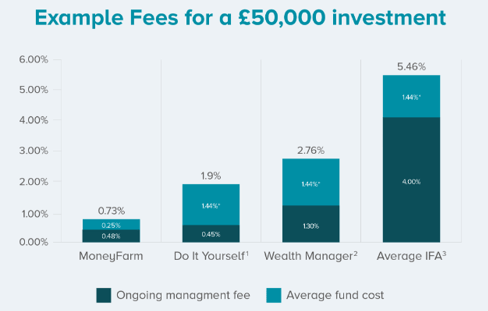

This infographic from MoneyFarm demonstrates that savings that you can expect from their service compared to a do-it-yourself approach, wealth manager, and the average IFA (including management fees and fund costs). You can see the significant savings from MoneyFarm in comparison to wealth management services other than a UK robo adviser.

Source: Pricing – Money Farm

Free Wealth & Finance Software - Get Yours Now ►

Determining the Right UK Robo Adviser

Viewing the various options for robo advisers in the UK in a side-by-side comparison is the most effective way to determine which company can offer the services that you are most in need of. Consider what might be the most important features for you to have in a UK robo adviser to determine which one is right for you.

For example, Wealth Wizards may not be an option if your employer doesn’t already use their services. However, if it is an option for you, they offer an affordable retirement savings plan.

MoneyFarm offers a completely free service with no minimum account balance, making it an excellent option for new investors who may not have much in savings to contribute to their account initially. Wealthify is also a great service for individuals who are just beginning to investigate wealth management.

Wealth Horizon requires a slightly larger deposit of £1,000 but you can expect slightly lower rates than Wealthify for a very similar service. However, if you don’t have the money to deposit initially, Wealthify does not cost significantly more (only .05 percent difference).

Of those services included on this list, only MoneyFarm offers a general investment account, while MoneyFarm and Wealthify both offer ISAs. Wealth Wizards and Wealth Horizon are both more focused on retirement planning and saving with pension funds.

Don’t Miss: Robo-Investing—What You Should Know! (Automated Stock Trading & Overview)

Free Budgeting Software for AdvisoryHQ Readers - Get It Now!

Conclusion: Which Should You Choose?

Learning all the ins and outs of the various robo advisers in the UK can be tricky. There are so many different facets that you need to consider before making a commitment to long-term investment management with any one particular online investment company. You’ll need to take into consideration your own needs and financial goals to determine whether Wealth Horizon, Wealth Wizards, Wealthify, or MoneyFarm is the appropriate company for you.

Think about what your realistic financial goals are and how quickly you hope to achieve them. In addition, consider what your initial investment can comfortably be with any of these UK robo adviser options and what additional monthly contributions you can make. These may help you to narrow down the potential options for a robo adviser in the UK among Wealth Horizon, Wealth Wizards, Wealthify, and MoneyFarm.

All of these online investment companies have great offerings for a specific type of client, depending on the needs and expectations you have for wealth management. Taking a closer look with our UK robo adviser comparison will put you one step closer to your savings plan.

Read More: Investing Basics—Are Robo Advisors Right for You? (Robo Investing Guide)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.