Intro – About Morgan Stanley: A Long History of Wealth Management

When it comes to investing your hard-earned money, it is wise to have someone on your side to help with important, life-changing decisions. Morgan Stanley has been helping people manage their money for over 75 years.

If you are not familiar already, you may be wondering, “What is Morgan Stanley?” Morgan Stanley is a wealth and investment firm with a strong history. In learning about Morgan Stanley, you will see just how they are moving with the times to remain current in this global and changing market.

Morgan Stanley is an investment firm that was formed in 1935 by JP Morgan & Co., which included Henry S. Morgan and Harold Stanley as well as others.

Their existence came about as a result of the Glass-Steagall Act that required commercial and investment banking to split into two entities. Today, Morgan Stanley’s major areas of business are Global Wealth Management, Institutional Securities, and Investment Management. You can read more about Morgan Stanley on their website.

See Also: Union Bank Reviews – What You Will Want to Know! (Mortgage, Credit Card, & Reviews)

Who Runs and Owns Morgan Stanley?

Quite surprisingly, based on keyword search analysis, AdvisoryHQ has noticed a rather large number of searches for “who owns Morgan Stanley” and also how the firm’s revenue is earned and allocated.

Morgan Stanley is run by James P. Gorman, the firm’s Chairman and Chief Executive Officer (CEO) who took the position in 2010 after having been the Chief Operating Officer since 2006, and the Co-Head of Strategic Planning in 2007.

Prior to joining Morgan Stanley, James held several executive positions at Merrill Lynch. Bloomberg Markets magazine lists him as one of the 50 Most Influential individuals. Jonathan Pruzen is the Vice President and Chief Financial Officer.

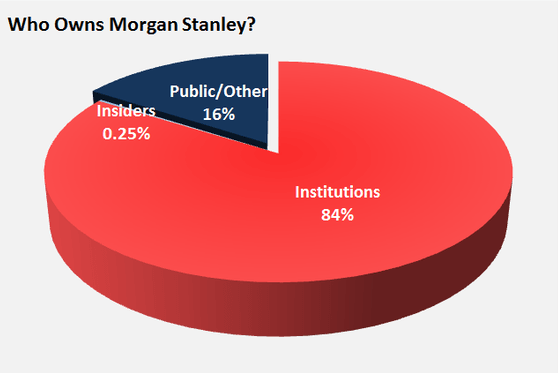

Although there is a large globally-located staff of executives responsible for operating the company, stakeholders play a crucial role in defining who owns Morgan Stanley. According to a recent article by John Maxfield for The Motley Fool:

Who Owns Morgan Stanley? – Morgan Stanley Review

- Institutional investors own 84% of Morgan Stanley (1.97 billion shares)

- Company insiders, including board members and executives, own .25% of Morgan Stanley

- The public at large owns 16% of Morgan Stanley

As you can see, the majority of people who own Morgan Stanley are institutional investors, while only a small portion of Morgan Stanley is owned by the public.

Don’t Miss: Nationwide Bank Review – What You Need to Know! (Auto Lending, Loan, & Mortgage Reviews)

A Wealth of Sustainable Offerings

But what does Morgan Stanley do exactly?

Morgan Stanley is a top research and investment bank that specializes in a range of services including:

- Wealth management

- Investment banking and capital markets

- Sales and trading

- Investment management

- Research

- Sustainable investing

To answer the question “What does Morgan Stanley do?” more clearly, the six categories of services are explained in more detail:

- Wealth management is a term used for how you can, as the phrase implies, manage your money. Morgan Stanley reviews your portfolio to ensure smooth and effective strategies to create long-term financial goals for the future and to make sure that those goals are achieved.

- Investment banking assists individuals and corporations in raising financial capital by acting as the client’s agent in issuing financial assets, or funds. Morgan Stanley assists in mergers and acquisitions, which combines ownership of companies to create stronger financial bonds and leverage. Unlike a regular commercial bank, investment banks do not take deposits; rather, they are broker-dealers of monetary transactions.

- Sales and trading involve collecting and pooling assets from a variety of sources and contributors or investors to place toward a common goal, such as creating a limited partnership or limited liability company. These relationships are commonly referred to as hedge funds. Recent Morgan Stanley reviews stated that the traders at Morgan Stanley offer high-touch trading with better returns.

- Investment management provides a service to better help individuals make decisions for their investments and to manage how and when they may be interested in selling or trading their investments.

- Morgan Stanley’s research teams offer the latest in analysis and current market trends to ensure their clients are always in the know about how their money is doing and where their interests should focus.

- Sustainable investing offers clients forward-thinking strategies for the rapidly changing and growing global economy. Morgan Stanley has established the Morgan Stanley Institute for Sustainable Investing to gain a strong presence in this important aspect of investing.

As you can see, Morgan Stanley is about creating diverse offerings for its clients.

Related: Comerica Bank Reviews – What Is Comerica Bank & What You Should Know (Review)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Making Meaningful Investments for Your Future

Not only is it important to understand what Morgan Stanley is, but it is also important to know about Morgan Stanley’s client advice expertise.

Morgan Stanley Review

Morgan Stanley Review

Morgan Stanley’s website includes many helpful articles that educate anyone from families and small businesses to large companies or those looking to secure their estate planning for the future of their heirs.

The current emphasis is on creating meaningful, sustainable investments. It focuses on statistics of individuals with High Net Worth (HNW), ranging in age from 26 to 79. Recent studies show that more HNW people are becoming increasingly aware of three important investment characteristics:

- Responsible

- Sustainable

- Impactful

Creating not only a lucrative portfolio but a meaningful one requires sensitivity to these three areas:

- Socially responsible investing focuses on avoiding investments based on a specific criterion such as poor environmental practices or unfair labor practices. Socially responsible investors focus on organizations and commodities that are socially conscious and that practice fair labor or are committed to creating or maintaining environmentally safe practices.

- Sustainable investing focuses on making investments with companies that aim for both market-rate financial returns and simultaneously provide positive social and environmental impact.

Impact investing is a strategy that allocates financial support to private enterprises that intend to create positive social and environmental impact.

Morgan Stanley recently conducted extensive research in which one thousand people were surveyed for Morgan Stanley reviews. The respondents were between the ages of 25 and 79, and fifty-five percent of them were particularly interested in sustainable investing, and 32% believed that sustainable investing was a good investment approach for 2016 and beyond.

Millennials, in particular, were very interested in sustainable, responsible, and impactful approaches — with a substantial 82% of them expressing interest in the three categories compared to the 45% interest expressed by the overall survey population.

It appears that the future of who owns Morgan Stanley might sway toward individuals and away from large firms.

Morgan Stanley May Not Be All That – Cons

If you are a high-net-worth investor, you may be wondering if Morgan Stanley is the right firm to help you with your investments.

There are several Morgan Stanley customer reviews online, and many of them are not good. One customer stated, “If they were truly investment counselors, they should have notified my sons so they could liquidate the account before they were broke.” Another one stated, “I felt like there was no interest in protecting me or my money.”

Several Reuters articles include Morgan Stanley reviews that describe recent financial difficulties with the company. In 2014, the firm had to pay out $1.25 billion to resolve mortgage lawsuit issues and $4.5 million to settle an overtime pay case to wealth management staff.

Do Research to Make the Right Choices – Positive Morgan Stanley Reviews

It is obviously important to do your research to find what kinds of investments are best for you and who should manage them.

Although the Morgan Stanley customer reviews may not seem very promising, there are several articles that offer glowing Morgan Stanley reviews.

For example, Forbes outlines the benefits of Morgan Stanley’s wealth management function. Brokerage Review states that Morgan Stanley has a “private banking” feel compared to other large investment firms, and an article in Kiplinger explains that Morgan Stanley is a full-service top-rated brokerage firm.

These Morgan Stanley reviews are much more promising than the Morgan Stanley customer reviews.

People Make All the Difference

It is best to be informed when it comes to your hard-earned money and the future of your family or business. According to an article by Morgan Stanley’s Chief Investment Officer Mark Wilson, there is a lot to be hopeful over the next few years

- 151,000 were jobs created in January.

- The U.S. unemployment rate is below 5%.

- First quarter shows a 2.7% Gross Domestic Product growth.

- The recession is over, and the likelihood of it recurring is low.

And what does Morgan Stanley do to maintain this hope, gain the trust of its investors, and squelch the fear of investing? Three key factors that the firm is focusing on have the greatest impact on the future of who owns Morgan Stanley:

- Investor relations

- Giving back

- Diversity and inclusion

Of these three, “investor relations” seems to be the most pressing area of focus. Their website states, “By putting clients first, leading with exceptional ideas, doing the right thing, and giving back, Morgan Stanley aims to deliver results today, while setting strategic goals for the future.” Although this section of their website is least developed, they are offering a Fixed Income Investor conference call on May 5, 2016.

Meanwhile, the ways in which they are giving back include creating strategic planning for:

- Headstrong, an organization that works with veterans with PTSD

- Mower Moves, Miami, a startup that provides opportunities for minorities

- Morgan Stanley Healthy Cities, providing playgrounds, meals, and medical assistance to children in Newark, Oakland, and Chicago

Lastly, their position on diversity and inclusion spans not only investors but their staff as well. Several articles highlight women returning to the workforce after being out for years raising families, people of color, and the LGBT community.

In learning more about Morgan Stanley, potential investors can make wise decisions. Although some Morgan Stanley reviews may prompt fear in some investors, it is important to keep in mind what they do: create an opportunity for those willing to take the risk, and to trust in what they are offering.

When one asks “What is Morgan Stanley?” it might be wise to consider that they are an investment firm first and foremost — but, hopefully, the people behind the name will be the thing that really sets them apart.

Image Sources:

- static2.bigstockphoto.com/thumbs/1/0/4/small2/4018267.jpg

- https://www.fool.com/investing/general/2013/02/26/who-owns-morgan-stanley.aspx

- https://www.morganstanley.com/

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.