Intro: Which Is the Best Mortgage Calculators? Zillow? Bankrate? SmartAsset?

You want to buy a home, but what is it going to cost you? Surely, you already have an idea of what sort of price range you can afford, but you may have forgotten to factor in a few items.

If you aren’t sure what the taxes, insurance, and private mortgage insurance might run on the home of your dreams, you won’t be able to accurately assess if it can fit into your budget.

Using a mortgage calculator can help you get a lot closer when it comes to paying for the incidentals that are inevitably going to crop up during your closing process.

AdvisoryHQ knows that consumers want to make the most informed decisions they can, especially when it comes to making large purchases like a home.

A long-term investment like a mortgage means you need to factor in all of the cost throughout the years. A mortgage payment calculator can help you to make wise decisions, especially if you are using a mortgage calculator with taxes, insurance, and other items.

What sort of questions do you need to ask before using a mortgage calculator or mortgage affordability calculator? We will cover information like:

- What does a good mortgage payment calculator include?

- Is the Zillow mortgage calculator, Bankrate mortgage calculator, or SmartAsset mortgage calculator the best mortgage calculator?

- How can you benefit from a mortgage affordability calculator?

Without further ado, let’s take a look to discover the best mortgage calculator to help you find the answers.

Best Mortgage Calculator Reviews

Mortgage Calculator | Best Uses |

| Zillow Mortgage Calculator | Mortgage calculator with PMI, taxes, and insurance |

| Bankrate Mortgage Calculator | Basic mortgage calculator with no taxes or insurance, mortgage payoff calculator |

| SmartAsset Mortgage Calculator | Mortgage affordability calculator, mortgage calculator with taxes and insurance |

See Also: Best Mortgage Companies (Overview of the Top Mortgage Lenders)

Choosing a Mortgage Calculator

When you need to determine what the monthly cost on a mortgage would be for the home of your dreams, it’s likely that you will need to rely on someone else’s expertise to estimate that for you.

Most of us lack the math skills and the know-how to create our own mortgage calculator. Enter the mortgage payment calculator.

A mortgage calculator with taxes and insurance can be a substantial asset when determining what size house, what neighborhood, and what price range you ultimately need to be searching in.

Our banks can give us a rough idea of the monthly cost with a good faith estimate, but a home mortgage calculator may help us to get a ballpark figure without involving a third-party. For those who are more determined to complete their mortgage online or without significant involvement from a lender, this might be a good option.

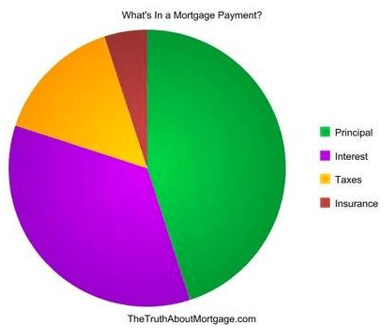

Sometimes, a mortgage loan calculator will include only your principal and interest. You will want to steer clear of a mortgage calculator in this vein.

By neglecting to add in the significant costs of private mortgage insurance (PMI), taxes, and property insurance, you are likely under-budgeting what you will actually be shelling out to the lender each month. This combination is sometimes referred to as PITI (standing for principal, interest, tax, and insurance).

Look for a mortgage calculator that features PITI in all of its calculations for the most accurate assessment of your monthly payments.

Source: The Truth About Mortgage

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Mortgage Affordability Calculator

A mortgage affordability calculator is a significantly different tool that is equally helpful when determining your monthly mortgage payments. The best mortgage calculator often has a separate tool where you can calculate exactly what you and your family can afford on a monthly basis.

Different from a mortgage calculator with taxes, which already assumes that you are capable of affording a house in this price range, a mortgage affordability calculator helps you to determine what fits comfortably in the realm of your current financial situation.

A mortgage calculator along this vein considers different aspects of your financial status: the location of the home you’re looking to purchase, your current income, the down payment you hope to issue, and your current debt level.

By taking all of this very personal information into its formula, a mortgage affordability calculator can help determine a good debt-to-income ratio for you that allows for a mortgage to exist. Some of them may even give you an idea of what a monthly payment should look like to fit into your budget.

From there, you can plug those numbers into your budget and determine whether it would be a wise financial decision.

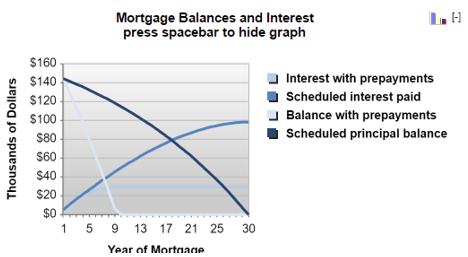

You may also want to find a mortgage payoff calculator that can help you to determine what would be necessary in order to pay off your mortgage early. Doing so can lessen the amount that you will pay to your lender in interest over the course of your mortgage and shave a few years off the term of your loan amount.

Don’t Miss: Capital One Mortgage Reviews – Get What You Need to Know! (Home Loans, Complaints & Review)

Zillow Mortgage Calculator

With all of the different options available for a mortgage calculator with taxes, how do you know which is the best mortgage calculator? With a high degree of visibility and brand recognition, the Zillow mortgage calculator is an obvious first choice for the best mortgage calculator.

As a default setting, the Zillow mortgage calculator already includes the full PITI range of expenses. Their mortgage calculator with taxes and insurance can strike consumers as thorough from the beginning. On an initial glance, the Zillow mortgage calculator includes a brief glance at the principal and interest, taxes, and insurance. However, you can also opt to view the full breakdown for a complete amortization table and to see the 1.2 percent property tax it calculates.

Another key feature that has many claiming the Zillow mortgage calculator as the best mortgage calculator is their acknowledgment of private mortgage insurance. It can vary depending on your lender and the loan type that you sign on with, but this additional cost is generally required for mortgagees who purchase a home with less than a twenty percent down payment.

A mortgage calculator will generally include this private mortgage insurance, or PMI, at a rate of 0.5 percent. The Zillow mortgage calculator does just this, intuitively recognizing whether or not you have paid a full twenty percent in your down payment. If you are planning on putting down twenty percent or more, the Zillow mortgage calculator quietly omits the private mortgage insurance from your estimated payment.

Related: Cost to Build a Home – What You Might Be Missing! (Typical Closing Costs, Estimated & Average)

Source: Mortgage Calculator – Zillow

For the most part, experts claim that the Zillow mortgage calculator is fairly accurate overall. It gives plenty of room for consumers to place their detailed information in and it will come back with numbers that should be close approximations to an actual monthly cost. However, they do warn against checking estimated mortgage payments included on initial listing pages, as those seem to be off when it comes to taxes and insurance.

Bankrate Mortgage Calculator

Are you planning on paying your taxes and insurance on your own as opposed to having them bundled into a package from your lender? If you’re responsible for these fees separately, you may be pleased with the very basic mortgage calculator from Bankrate. The Bankrate mortgage calculator is wonderfully simple and takes only a handful of seconds to input all of your information.

If you were looking for a mortgage calculator with taxes and insurance, you won’t find it with the Bankrate mortgage calculator. Consider using this Bankrate mortgage calculator to get an idea of the overall cost of principal and interest. It can also pull today’s interest rates for you to give you an idea of what you may expect from a lender. You will even be able to pull a full amortization schedule from the calculator, assuming you are opting for a traditional mortgage product.

On the other hand, there is a Bankrate mortgage calculator that has a slightly different specialty. If you are looking for a mortgage payoff calculator, Bankrate may have something that would work for you. For individuals and families who desire to pay off their mortgage early, a mortgage payoff calculator can help you to determine how much you should pay monthly in addition to your usual payment.

Use the Bankrate mortgage calculator as a mortgage payoff calculator to determine how much money you will save on interest over the course of the loan, as well as how much you can shorten the loan length. The Bankrate mortgage calculator is, overall, very basic but the addition of a mortgage payoff calculator makes this still an appealing option for the best mortgage calculator.

Source: Mortgage Loan Payoff Calculator – Bankrate

SmartAsset Mortgage Calculator

Is the SmartAsset mortgage loan calculator the best mortgage calculator on the internet? Many would argue that the other ones available pale in comparison to the home mortgage calculator from SmartAsset. They offer a host of resources for those who are seeking to purchase a home, from a mortgage affordability calculator to a mortgage calculator with PMI, taxes, and insurance.

Their affordability calculator takes everything about your unique financial situation into account to determine what you could comfortably afford, including the total amount of funds in your savings account. Other aspects of the mortgage calculator help you to explore tax benefits related to the location of the potential home you purchase.

Similar to the feature that makes the Bankrate mortgage calculator considered for the best mortgage calculator, SmartAsset also uses real time data in order to offer the most current rates to their consumers and shoppers.

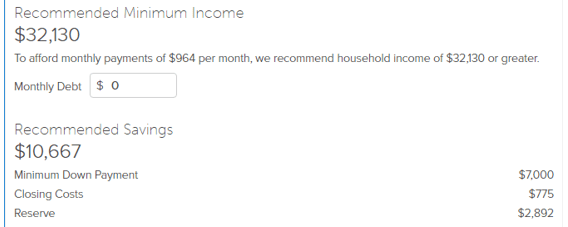

You can view all of these items without even leaving the page with the mortgage calculator with PMI. Consider the most recent listing you viewed. Once you input all of the information, it will give you a mortgage calculator with taxes and insurance. Scroll a little further down, and you’ll continue to see information not included on other calculators: a recommended minimum income and recommended savings.

Popular Article: FHA Loan Requirements – What You Need to Know – FHA Mortgage & Home Loan Requirements

Source: Mortgage Calculator – Smart Asset

These tips and tricks make this the best mortgage calculator for individuals who are still trying to figure out exactly what they can afford or how they will manage the additional costs of purchasing a home. Their home mortgage calculator breaks down the estimated down payment, closing costs, a guess at how much you’ll need to save, and what income makes it affordable on a monthly basis. Only the best mortgage calculator could provide all of this information in one fell swoop.

Choosing the Best Mortgage Calculator

Choosing a mortgage calculator with taxes is an important first step in making determinations of what you can afford or what you can expect to pay on your new home. You can utilize a mortgage loan calculator to consider what price range you should be looking in first, but the SmartAsset mortgage calculator with taxes will give you hands-down the most detailed information available on what is recommended for someone to afford that property.

That being said, there are tons of other options for a mortgage calculator with taxes available on the internet. If you don’t find the Zillow mortgage calculator or Bankrate mortgage calculator easy enough to use, consider doing a search for one of the many other choices. You can find options from large financial institutions that deal in mortgages (think of Bank of America or Wells Fargo), as well as consumer websites that deal in personal finances like Nerd Wallet.

We could never include a completely exhaustive list of every mortgage calculator with taxes or without taxes available today. However, the three mentioned in our article (the Zillow mortgage calculator, Bankrate mortgage calculator, and the SmartAsset mortgage calculator with PMI) are some of the most well-known and prevalent options for a mortgage calculator in the industry.

Each of these options for the best mortgage calculator is ideal for a specific situation and function. For more information in an easily understood format, take a look at the chart below to see which mortgage calculator might work best for your mortgage calculation needs:

Mortgage Calculator | Best Uses |

| Zillow Mortgage Calculator | Mortgage calculator with PMI, taxes, and insurance |

| Bankrate Mortgage Calculator | Basic mortgage calculator with no taxes or insurance, mortgage payoff calculator |

| SmartAsset Mortgage Calculator | Mortgage affordability calculator, mortgage calculator with taxes and insurance |

Conclusion

Now that you know what to expect from a mortgage calculator, it’s time to start doing a little research for yourself. How much home can you really afford? Is your savings account sufficient to cover the amount that you will need for the estimated closing costs, down payment, and reserves?

A mortgage calculator with taxes, insurance, and PMI is a great way to make sure that you can comfortably afford the home before you make a purchase.

A mortgage calculator gives you a wonderful option for investigating the monthly cost of a home from the comfort of your couch. As you move closer to placing an offer, it’s a good idea to ask your lender to produce a good faith estimate of what the monthly payments would be on your home.

Their mortgage calculator will likely be more accurate, accounting for the cost of property insurance and taxes in your area more specifically than an online mortgage calculator with taxes is capable of doing.

Remember to ask them what you can expect to pay in terms of private mortgage insurance or PMI. Some banks will require this fee for individuals and families who purchase a home with less than twenty percent down, while other loan types will not require PMI.

Understanding what options you are pre-approved for may help you to decide whether you need a mortgage calculator with PMI or just a mortgage calculator with taxes.

Read More: Getting an Interest Only Mortgage this year? What You Need to Know

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.