Intro: What You Should Know About Mortgage Insurance Premium?

For many, purchasing a home is the American Dream. However, applying for a home loan can often be stressful.

The concerns of your credit score, which financial institution is the best to use, mortgage loan rates, and home insurance options are overwhelming. An additional unknown factor is the mortgage insurance premium (MIP), or premium mortgage insurance.

Mortgage premium insurance is a different kind of insurance that your lender may have dropped on you as a requirement.

In this article, we will address the question, “What is a mortgage insurance premium?” as well as what the benefits of mortgage premium insurance include and even how to calculate mortgage insurance premium costs.

Image source: Pixabay

What Is a Mortgage Insurance Premium?

In answering the question, “What is a mortgage insurance premium?” it’s a type of insurance that is meant to protect the lender. Anytime you, the buyer, purchases a home with less than 20 percent down, your lender is taking a huge risk in the event that you default on the loan. Covering the gap with premium mortgage insurance will close that gap – at least some.

A mortgage insurance premium does increase your chances of qualifying for a loan in most cases. It also increases your mortgage payment amount. Your home mortgage payment will include your monthly mortgage premium insurance. Sometimes, you may have it added in with your closing costs or combined between the two.

Just because a mortgage insurance premium is meant to protect the lender in the event of loan default does not mean that it will protect you in the event of foreclosure. You cannot just pick back up where the mortgage premium insurance left off. This will keep the foreclosure process going as well as affect your credit.

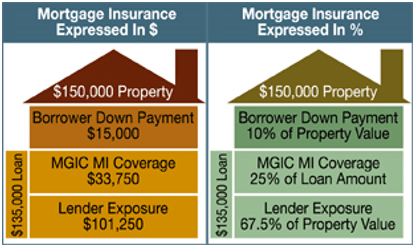

Below, you can see how mortgage insurance premium works:

Mortgage Insurance Premium

See Also: Want to Buy a House with Cash? – Get All the Facts! (Save Money, Cash Process & Review)

Mortgage Insurance Premium Types

There are two main mortgage insurance premium options. We want to help you understand the difference as they will likely reappear during your search on “What is a mortgage insurance premium?”

Private mortgage insurance (PMI): This mortgage insurance premium is required for a conventional loan if a buyer puts down less than a 20 percent down payment. A buyer typically does not need to pay an upfront mortgage fee. In certain situations, this mortgage premium insurance can be canceled automatically or per the buyer’s request when the criteria are met.

FHA mortgage insurance premium (MIP): This government-issued mortgage premium insurance is required for a Federal Housing Authority (FHA) loan if the buyer puts down less than 20 percent. An upfront mortgage fee is usually required and can be added to the monthly loan payments. This fee is set for the life of the loan.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Benefits of a Mortgage Insurance Premium

Those seeking more information to the question, “What is a mortgage insurance premium?” may wonder if there are any benefits at all. Although lender protection is the main concept, there are a few benefits of a mortgage insurance premium for homeowners.

Check out these seven benefits of mortgage premium insurance:

- Qualify for more of a home: A mortgage insurance premium may help you qualify for a loan that, under other circumstances, you would not be eligible for.

- Qualify for a low down payment program: There are many programs that try to make homeownership easier. These programs offer down payment assistance programs. If you have good credit, understanding what a mortgage insurance premium is can help you stay in the program.

- MIP is tax-deductible: According to TurboTax, you can deduct a mortgage insurance premium. If you refinanced your home or purchased after January 1, 2007, the tax deduction for mortgage premium insurance was extended through 2016. Keep in mind that certain requirements need to be met, such as having an adjusted gross income (AGI) under $109,000 ($54,500 if married and filing separately). You can refer to Publication 936 for more details.

- Keep more money in your pocket: Moving is not cheap. By putting down less money, you can use the money to pay off debt, help with home improvements or save it for a rainy day.

- Mortgage insurance premium refund: You will receive a partial refund of your mortgage premium insurance once the lender cancels it.

- Premium mortgage insurance cancellation: Depending on the situation, a mortgage insurance premium may be eligible for cancellation.

- Fixed monthly payments you can afford: Some homebuyers opt for programs such as adjustable-rate mortgages. This could increase mortgage payments when the fixed term ends. Once you have your mortgage insurance premium rates locked in, your monthly mortgage payment will never increase, and when canceled, the payments would go down.

Don’t Miss: Cost to Build a Home – What You Might Be Missing! (Typical Closing Costs, Estimated & Average)

Benefits of Using a Mortgage Insurance Premium Calculator

Similar to trying to calculate how much home you can afford, you should also check what the mortgage insurance premium rates are. A mortgage insurance premium calculator can help you do just that.

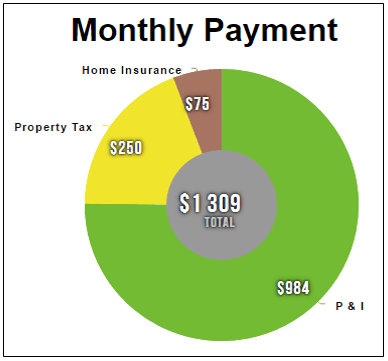

A mortgage insurance premium calculator will help you calculate more than just the mortgage insurance premium. You’ll also get estimates for property tax and home insurance. See the image below for more details.

Image Source: http://themortgagereports.com/mortgage-calculator/

This calculation is derived from entering the home’s purchase price, interest rate, length of the loan (in years), and the down payment amount. You can figure out your mortgage insurance premium and more by basing it on your income (what you can afford) or monthly payment (how much you want to spend each month).

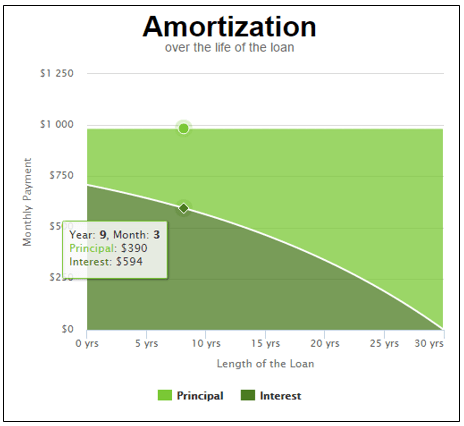

The mortgage insurance premium calculator will give you a full report, including how much it will take to pay off your loan, broken down by the principal and interest. You will see how much principal and interest will be applied individually, how much principal remains, and the interest paid to date.

Image Source: http://themortgagereports.com/mortgage-calculator/

The amortization report above shows you a breakdown of the payments applied during the life of the loan.

Related: Should I Pay off My Mortgage Early? Prepayment Penalty Definition!

How to Use a Mortgage Insurance Premium Calculator

While you are searching for information regarding what a mortgage insurance premium is, we also want to show you how to use a mortgage insurance premium calculator. Some calculators are easier to use than others.

The Mortgage Reports has a basic calculator. Others are available, such as the Zillow mortgage calculator, Bankrate’s mortgage calculator with taxes and insurance, and Radian’s mortgage insurance premium rate finder calculator. You will have to determine which one is best for you.

For the most part, using a mortgage insurance premium calculator is simple. Most calculators, such as The Mortgage Reports calculator, allow you to input specific but estimated figures.

Here is some information you may need to calculate a mortgage insurance premium for your future home:

- Home price

- Interest rate

- Length of the loan

- Down payment

- Home insurance

- Property tax

- Home Owner Association (HOA) dues

What Are Some of the Mortgage Insurance Premium Rates?

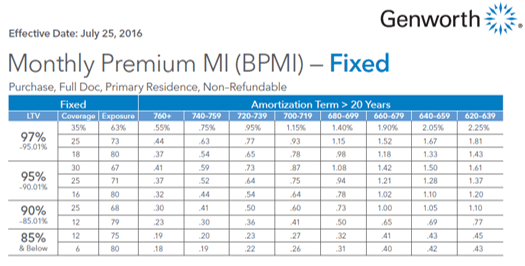

Another thing we would like to discuss regarding your search on mortgage insurance premiums is the mortgage insurance premium rates. This mortgage insurance premium rate finder calculator helps determine the best premium mortgage insurance rates available.

Mortgage insurance premium rates do vary. You will find that the rates are between 0.5 percent and 1 percent of the entire home loan amount.

Genworth updates on its website using rate cards. The cards allow you to view and print currently displayed rates in a convenient PDF format.

Image Source: mortgageinsurance

Genworth’s Rate Express lets you find and compare rates. This may be a helpful resource for you because it offers an on-site demonstration that shows you how to utilize the online quote to find mortgage insurance premium rates.

On Genworth’s site, to effectively calculate the mortgage insurance premium, you will input details, such as your loan amount and loan purpose. From there, you can compare up to four products, including:

- Monthly mortgage insurance premium (MI)

- Standard annual premium MI

- Level Annual Premium MI

- Split Premium MI

- Compare to the FHA mortgage insurance premium

Genworth also provides a mobile app to download for receiving your mortgage insurance premium rates, which you can also save as well a share the results via text or email. It is available via the Google Play Store and App Store.

Popular Article: What Is a Jumbo Loan? A Complete Guide (Loan Limit, Mortgage & Rates)

How the Mortgage Insurance Premium Compares on Four Loan Types

You will find that a mortgage insurance premium is associated with government-backed loans, like those vetted through the Federal Housing Administration (FHA) or the US Department of Agriculture (USDA). There are a few differences you will notice when comparing mortgage premium insurance rates and coverage inclusions. Consumer Finance discusses the different types of loans.

1. Conventional loans through a private bank have private mortgage insurance. These rates vary and are much lower than mortgage insurance premium rates.

- Conventional loans do not always require an initial mortgage insurance premium to be paid at the time of closing. The FHA mortgage insurance premium options may be required up front and at closing. If you cannot pay the entire amount up front, you can expect it to be rolled into your monthly mortgage payments.

- Conventional loan mortgage insurance premium amounts may vary based on your personal credit score. FHA loan mortgage premium insurance costs are the same, regardless of credit score.

2. FHA loans require the mortgage insurance premium to be paid directly to the FHA (the “lender”).

3. US Department of Agriculture (USDA) loans typically have a cheaper mortgage insurance premium than an FHA mortgage premium insurance.

4. The VA backs the Department of Veterans’ Affairs (VA) loans. Its guarantee takes the place of a mortgage insurance premium but works the same way as other mortgage premium insurance plans do.

This breakdown of loans should help those seeking to answer the question, “What is a mortgage insurance premium?” to understand how mortgage insurance premium payments can affect a particular loan.

The Best Way to Get Rid of a Mortgage Insurance Premium

As mentioned previously, you can cancel private mortgage insurance premium payments but not an FHA mortgage insurance premium. The reason behind this is due to how the FHA calculates the MIP throughout the duration of the loan. The best ways (and potentially only ways) to end FHA mortgage premium insurance payments are to:

- Get rid of your FHA loan

- Pay your loan off sooner

To get rid of your FHA loan, you must refinance. You do not necessarily have to refinance into a conventional loan either. Consider an FHA Streamline Refinance program. Tell your current lender that you have an FHA mortgage insurance premium and want to get rid of it.

Of course, the alternative is to get rid of your loan by paying it off sooner. If you can, start making bi-weekly payments on your loan instead of the regular monthly payments. Making bi-weekly payments will lower your principal balance and interest owed. According to this article, How to Make Bi-Weekly Mortgage Payments, you will find that this is a strongly suggested method to consider. Instead of making 24 payments a year, 26 payments would be made.

Before you set out to implement a plan to quickly eliminate your mortgage insurance premium on your own, you need to speak with your lender. You have to verify that he/she will allow you to make the bi-weekly payments before proceeding. A setup fee may be required to begin this process.

If you find that this situation of bi-weekly payments to eliminate your mortgage insurance premium will not work for you, simply put money aside in an interest-bearing savings account and make the extra payments yourself at the end of the year.

Free Wealth & Finance Software - Get Yours Now ►

Final Thoughts on Mortgage Insurance Premiums

We have discussed what a mortgage insurance premium is as well as how to calculate a mortgage insurance premium. As a potential homeowner researching, “What is a mortgage insurance premium?” we hope you now have more than enough information on how to find the best mortgage insurance premium rates for your specific situation.

Read More: Top Bad Credit Mortgage Lenders for Bad Credit Borrowers (Mortgage Lenders and Programs)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.