Introduction: Mortgage Loan Officer

If not for the presence of a professional and effective salesforce to market products and services to the public, most industries would never get out of the starting blocks.

In the mortgage industry, the front line is manned by loan originators and sales managers serving as mortgage loan officers.

The mortgage loan officer bridges the gap between the sales organization and the operational and administrative sides of a mortgage operation.

Mortgage loan officers work with underwriters to complete loan transactions and interact with the company’s loan administration staff to ensure borrowers are provided quality, ongoing customer service.

See Also: Top Mortgage Lenders – List of US Largest Mortgage Lenders (Reviews)

Mortgage Loan Officer Job Description

There are typically two primary roles that mortgage loan officers play in an organization. The first role is that of mortgage originator and relationship manager.

The second role, often later in the mortgage loan officer’s career path, is that of mortgage sales manager. Both types of mortgage loan officers are prevalent in the financial services industry, working in credit unions, banks and mortgage companies.

In addition, some home construction companies offer builder financing, and they typically employ mortgage loan officers as well.

Image source: Bigstock

Mortgage loan officers that serve as originators have lots of work on their hands. Their primary responsibilities often include:

- Identifying sales leads and converting those leads into closed loans

- Working directly with customers and helping them identify the best mortgage

- Assisting borrowers with applications, documentation, and understanding the mortgage process

- Completing paperwork and working with underwriters to complete mortgage transactions

- Assisting borrowers with any questions they may have during the term of the loan

- Serving on nonprofit boards and performing community service in the form of financial education classes and workshops

- Managing a sales office or managing the mortgage sales operation for a single bank/credit union branch

Mortgage sales managers often start as originators and are advanced in the organization as a result of their experience and success as an originator. A main focus for these home loan officers is on managing a sales force of other mortgage loan officers/originators. In some organizations, mortgage loan officers serve a dual role as both an originator and a sales manager. In others, sales managers do not originate new loans and only manage a salesforce.

Mortgage sales managers’ job responsibilities typically include:

- Managing the sales activities of several mortgage originators and/or multiple sales office/branch locations

- Lending educational support, human resources expertise, and administrative oversight while operating one or more profit centers within the organization

- Managing a budget as well as departmental profit and loss (P&L) activities

- Handling payroll, commission, and other compensation programs for their salesforce

- Serving as a member of local, regional, and corporate management teams and providing leadership expertise to the organization

Image source: Bigstock

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Mortgage Loan Officer License

The process for fulfilling the licensing requirements for a mortgage officer position can be a bit like navigating through a labyrinth. Mortgage loan officer licenses are issued at the state level, which means that rules vary depending on where you are located.

That being said, most of the regulations for mortgage loan officer license requirements come from the federal government.

To become a mortgage loan officer, one must fulfill the mortgage loan officer requirements as set forth by the U.S. Department of Housing and Urban Development (HUD) and administered through the Consumer Financial Protection Bureau (CFPB).

In addition to the federal requirements, some states have additional mortgage loan officer licensing requirements. In all states, to become a mortgage loan officer with the authority to originate loans, regulations require that the candidate complete an application and submit to a background and credit check as well as take and pass home loan officer test(s) before receiving their certification.

The Nationwide Mortgage Licensing System & Registry (NMLS) is the official tracking system for the mortgage industry. NMLS certifies and tracks all licensed mortgage loan officers in the U.S.

Don’t Miss: Best Mortgage Companies (Overview of the Top Mortgage Lenders)

Licensing Education Requirements for Home Loan Officers

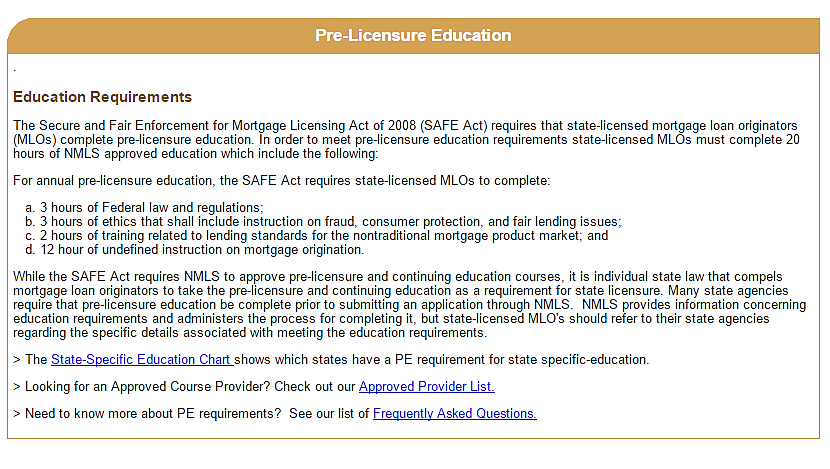

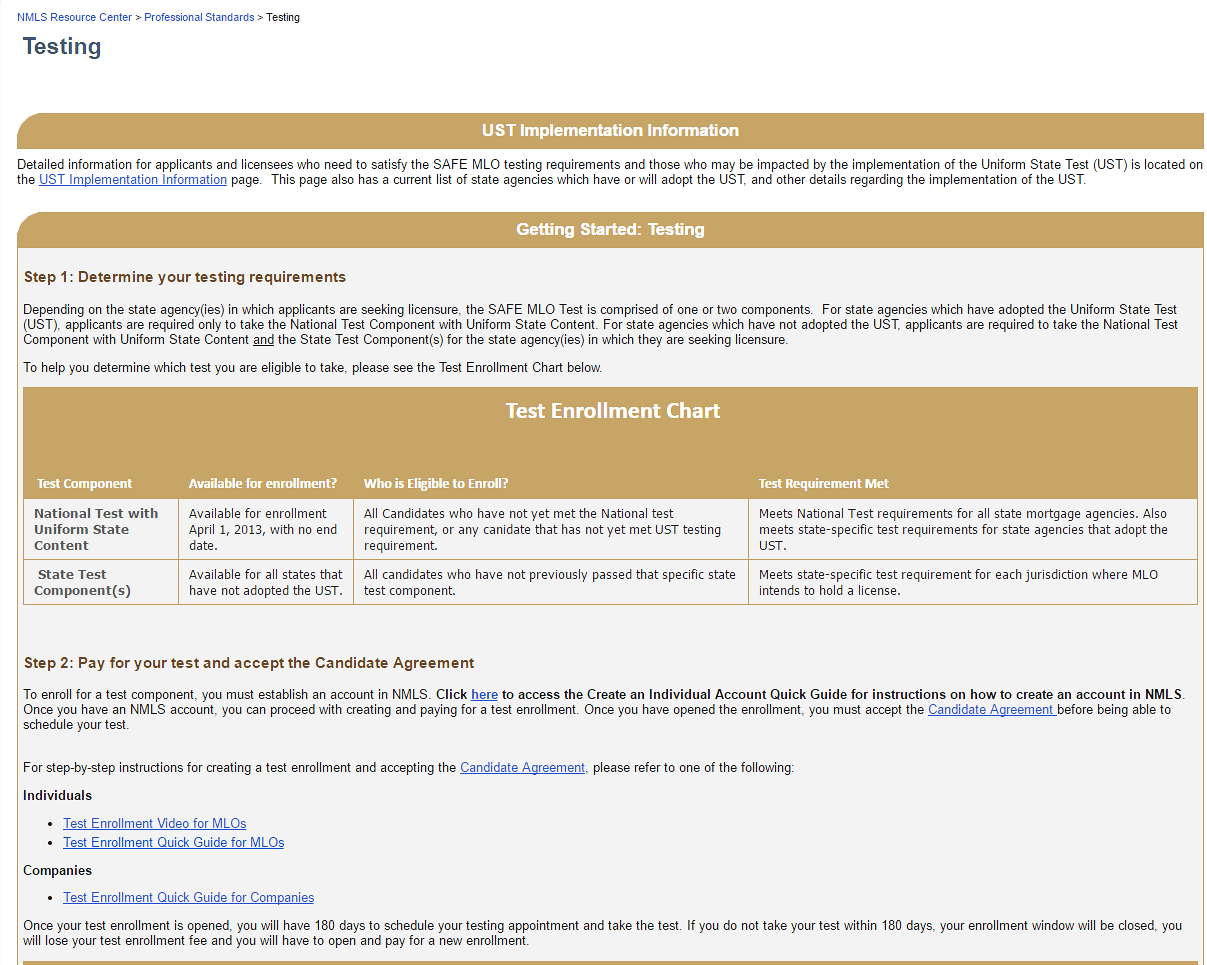

At a minimum, to fulfill the mortgage loan officer license requirements in any state, the candidate will need to take 20 hours of professional education and complete and pass the national standards test. This is according to the information provided by the NMLS Resource Center website.

A primary source for state and federal mortgage loan officer requirements and license information, the NMLS Resource Center is also a good source for other useful information as well. Whether you are about to become a mortgage loan officer or are already in the field, the NMLS Resource Center provides mortgage professionals with essential resources including:

- State licensing and educational requirements

- Industry news

- Information about workshops, seminars, and educational opportunities

- Industry data and reports as well as in-house analyses

- Information about professional and legal standards in the mortgage industry

Image source: NMLS Resource Center website

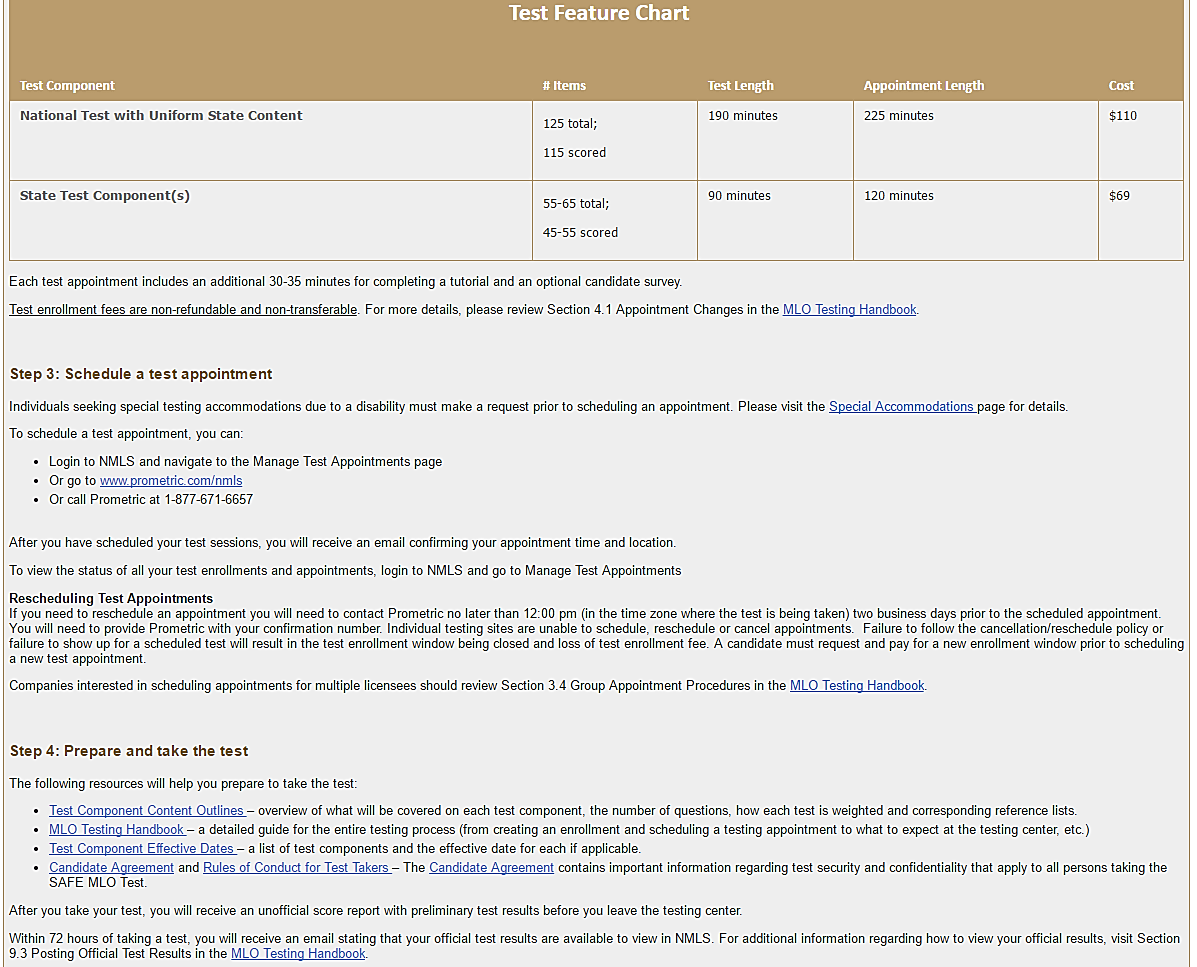

Image source: NMLS Resource Center website

Image source: NMLS Resource Center website

Ongoing Education and Professional Development

There are also entities out there claiming to provide quality education and support, but not delivering on their claims. We encourage you to perform your own due diligence when using any services and develop your own sources of information that you can trust. At the end of this article, we will provide a list of some recognized sources in the industry for you to consider.

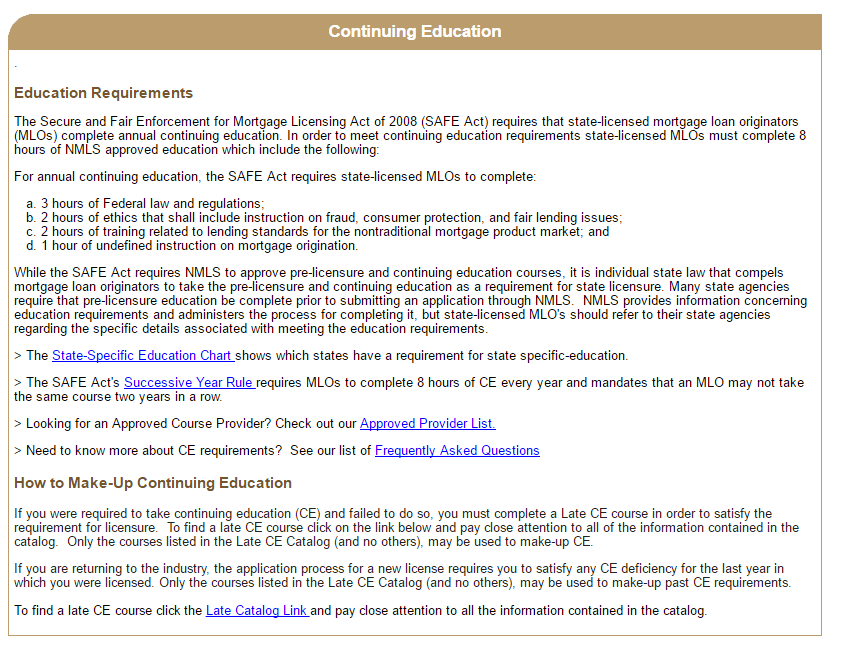

According to the NMLS Resource Center website, licensed mortgage loan officers are required to take eight hours of NMLS-approved training annually to maintain their license. In addition, mortgage officers often take additional classes, attend workshops and seminars, and participate in professional conferences to maintain their skills and to strengthen their professional and sales networks.

The information on continuing education requirements below comes from the NMLS Resource Center website:

Image source: NMLS Resource Center

The NMLS Resource Center also has a useful repository of information about optional training opportunities for mortgage loan officers.

Another good source of information on education and networking opportunities is the Mortgage Bankers Association (MBa). The MBa is a national membership organization with numerous local affiliates throughout the U.S. The professional organization’s mission is to support the resource needs of mortgage professionals and to be a public voice advocating for the issues important to them.

Related: Imortgage Reviews – What You Should Know (Complaints & Review)

Loan Officer Compensation

Mortgage loan officer compensation typically takes the form of a base salary plus commission. These arrangements help to drive sales activity in the mortgage organization by incentivizing the mortgage loan officer to generate more loan activity (i.e., close loans).

Through the underwriting process, potential borrowers and loans are vetted for creditworthiness and risk. In other words, loan officer compensation is based on closing loans, but the loans that the home loan officer brings in must be able to pass the underwriter’s test (underwriters are not compensated based on the volume of closed loans).

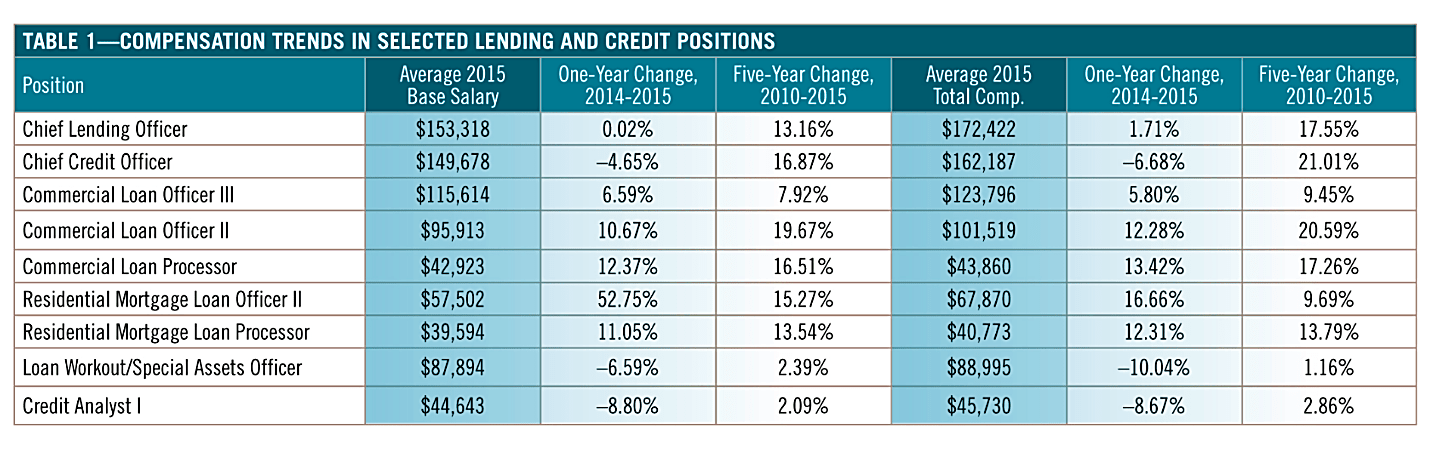

A 2015 compensation study done by the American Bankers Association (ABA) shows that a second-level mortgage loan officer has an average annual salary of nearly $58,000 and a typical bonus potential about $10,000. Expect total compensation for entry-level mortgage loan officers to run about 20% to 30% lower than the senior position (in the range of $48,000 to $55,000 for salary plus bonus).

Image source: ABA 2015 Compensation Survey

Mortgage loan officers who operate as sales managers are typically compensated with a base salary plus a bonus as well. However, the sales manager’s bonus is traditionally based on “roll ups,” bonus credit derived from the sales results of their salesforce. So, sales managers are incentivized to help originators move loan deals through the system. When an originator closes a loan, the sales manager gets bonus credit as well as the originator.

Job Prospects

Generally, job prospects for mortgage loan officers are good. Mortgage loan officers are employed in large numbers by banks and mortgage companies. Both sales managers and originators represent the front-line salesforce that is essential to market and close mortgage loans.

According to an article in U.S. News and World Report, the loan officer job ranked #20 among business positions. The article also noted that there are more than 24,000 loan officer jobs in the U.S. and that the median salary for a loan officer is nearly $63,000.

Job turnover among mortgage loan officers is fairly significant. According to a December 2015 article by Garth Graham in National Mortgage News, annual turnover among loan officers is 40%.

The mortgage loan officer position is one where many either move up or move out. Successful home loan officers typically advance in the organization and in the industry. Others do not adapt as well to the sales culture and opt to seek new jobs that are not based on commission.

The mortgage loan officer job is very challenging. For the right people, however, the income potential is significant as is the potential to advance professionally.

Popular Article: Best Bad Credit Mortgage Lenders for Bad Credit Borrowers (This year’s Mortgage Lenders and Programs)

Career Tracks

The mortgage loan officer position is a great job to learn and sharpen one’s sales skills while providing a service that helps make people’s dreams of home ownership come true.

Within the financial services industry, a significant portion of top-management positions go to people who have sales experience. Therefore, the mortgage loan officer position is truly an entry-level professional role that can grow into a long-term career in retail banking (branches and mortgages), corporate lending (to small and large companies), wealth management/investments, as well as management roles throughout the financial services industry.

Free Wealth & Finance Software - Get Yours Now ►

Rosources

We hope this information has been informative. For more information on mortgage loan officer jobs, education, and requirements, check out these web resources below:

Mortgage Bankers Association (MBa): https://www.mba.org

NMLS Resource Center: http://mortgage.nationwidelicensingsystem.org/Pages/default.aspx

Consumer Financial Protection Bureau (CFPB) Loan Originator Compensation Requirements Webpage:

Department of Housing and Urban Development (HUD) S.A.F.E. Mortgage Licensing Act of 2008 Webpage: http://portal.hud.gov/hudportal/HUD?src=/program_offices/housing/rmra/safe/sfea

Federal Deposit Insurance Corporation (FDIC) Loan Originator Compensation Rule Website:

https://www.fdic.gov/regulations/resources/director/technical/lo.html#two

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.