Intro – M&T Bank Review | Ranking & Online Banking Reviews

M&T Bank Company was recently ranked and reviewed by AdvisoryHQ as a top rated bank.

Firms on our top rated lists were selected after they successfully passed AdvisoryHQ’s ground-breaking four-step banks and credit unions selection methodology.

Click here for a step-by-step breakdown of our methodology process and selection process: AdvisoryHQ’s Methodology for Selecting Top Banks and Credit Unions.

Below we have provided a detailed review of M&T Bank, including the specific factors we used in our decision-making process.

Manufacturers and Traders Trust Company (M&T) Review

Established in 1856, Manufacturers and Traders Trust Company (M&T) has seen a thing or two (or two thousand) over the years.

Always operating as a community bank, today they are one of the 20 largest headquartered commercial banks in the U.S. A variety of banking services are available to commercial, business, and individual clients alike.

M&T has retail banking locations in New York, New Jersey, Connecticut, Pennsylvania, Maryland, Delaware, Virginia, West Virginia, and Washington D.C.

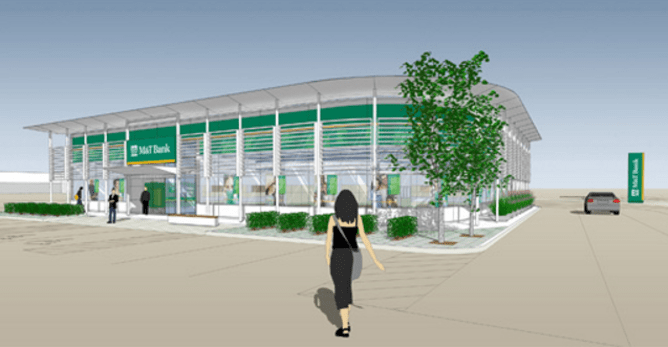

Photo courtesy of: M&T

Key Factors That Enabled This Firm to Rank as a Top Banking Firm

The following is an overview of the main factors that enabled M&T Bank to be included on our top banking firms list.

The Power of Credit in Your Hand (M&T Bank Review)

An M&T Bank card can be a versatile tool to help move you forward on your financial path.

With three different options and low introductory rates, choosing the benefits that fit your individual needs is much easier. Here’s an overview of credit cards available:

- M&T Visa Credit Card: 0% introductory APR, variable rates thereafter, no annual fee.

- M&T Visa Credit Card with Rewards: Unlimited point earnings, points bonuses, and no annual fees.

- M&T Visa Signature Credit Card: Earn 1.5% cash back on all purchases and a 10,000-point bonus with qualifying purchases.

Additional Lending Options (M&T Bank Review)

When you are looking for a loan with affordable rates and straightforward terms, you have several options with Manufacturers and Traders Trust Company, and they include:

- Home equity loans

- Personal loans

- Mortgages

- Overdraft protection

Simplified and Rewarding Checking Options (M&T Bank Review)

Choosing the right type of checking account might feel intimidating. Do you need all those bells and whistles? Sometimes! From basic checking to premium accounts, here are just some of your choices:

- EZChoice Checking: Easily avoidable monthly fees, no minimum deposit, and online banking for starters.

- MyChoice Plus Checking: All the benefits of an EZChoice account, with fee-free ATM access and interest-bearing features.

- MyChoice Premium Checking: The full package. Additional benefits include discounted rates on loans, special deposit interest rates, and interest-bearing features.

- M&T Classic Checking with Interest: An account for those 50 years and older that builds interest as you go with many added benefits.

Savings Options to Help You Grow (M&T Bank Review)

It’s never too early or too late to start saving. Whether you take the traditional route or venture into CDs and money market accounts, M&T is ready to help you grow.

Let’s take a look some of the most popular savings options available:

- M&T Starter Savings: Designed for savers under 18 and features no monthly maintenance charge.

- M&T e-Money Market: An online money market option with competitive rates and no monthly fees.

- MyChoice Money Market: Combine with your MyChoice Checking account for added benefits.

- Relationship Savings: When you want to save for something specific, this account gives you convenient insight into your money with no fuss.

- Certificates of Deposit: Offering fixed rates and convenient terms ranging from 6 months to 3 years.

The M&T Investment Group (M&T Bank Review)

Investment services from M&T allow you to keep your financial interests all in one convenient place – your bank.

It doesn’t matter if you are investing as an individual, a business, or a large corporation, there is an experienced and knowledgeable staff to back you up in all areas. Investment services include:

- Annuities

- Brokerage accounts

- Business valuation

- Business succession

- Investment advisory services

- Retirement planning

- Financial planning

- Wealth protection & transfers

- Education savings planning

Click any of the links below to browse exclusive reviews of all top rated banking firms:

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.