Intro – National Penn Bank Review & Ranking

National Penn Bank was recently ranked and reviewed by AdvisoryHQ as a top rated bank.

Firms on our top rated lists were selected after they successfully passed AdvisoryHQ’s ground-breaking four-step banks and credit unions selection methodology.

Click here for a step-by-step breakdown of the methodology process and selection process used during our National Penn Bank review: AdvisoryHQ’s Methodology for Selecting Top Banks and Credit Unions.

The below National Penn Bank review provides a detailed review of National Penn Bank, including some of the factors used by AdvisoryHQ in its ranking and selection process.

National Penn Bank Review

Combining the exceptional customer service you would expect from a small bank with the technology you want from the big guys allows National Penn Bank to offer their clients the best of both worlds.

Rooted in tradition, National Penn offers banking, borrowing, investing, and insurance services to all types of clients.

Additionally, as of April 1, 2016, National Penn Bank merged with BB&T. Information regarding the transition and important transition dates is available here for both current and new clients.

Image Source: National Penn Bank

Key Factors that Enabled This Firm to Rank as a Top Banking Firm

Below is a list of contributing factors that allowed National Penn Bank to rank on our list of top banking firms.

National Penn Bank Review: Your Investment Portfolio

National Penn believes that your investment portfolio should reflect your goals at each stage of your life.

Through a well-established investment team, you too can prioritize your investments and watch them yield increasingly more successful returns. Investment planning options include:

- Mutual funds

- Stocks

- Bonds

- Brokerage services

- Annuities

- Retirement plans

- Investment management

- Personal investment accounts

- Executor services

- IRAs

- Trusts

- Guardianships

National Penn Bank Review: Multiple Ways to Bank

Utilizing straightforward concepts and the latest technology allows National Penn to support their clients every step of the way. From checking and savings to CDs and more, here’s what to expect:

Checking

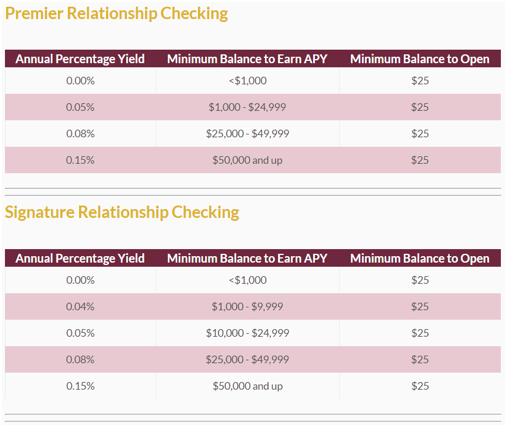

- Premier Relationship Checking: Lots of bonus features and interest-bearing options.

- Signature Relationship Checking: Interest-bearing with plenty of extras.

- Relationship Checking: For those who want just the basics, please.

- Student Checking: Student-friendly features including no monthly fees.

Image Source: National Penn Bank

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Savings

- Straight2Save: Take the pressure off and add automatic saving to your routine.

- Statement Savings: A simple savings account that helps you keep track of your earnings.

- Kid’s Account: Teach your kids young! A fee-free way to start them off right.

Other Banking Options

- Money market accounts

- CDs

- IRAs

National Penn Bank Review: Protect What Matters Most

National Penn is one of the industry’s leading independent insurance advisors with over 30 years of experience. A variety of policies are available, and multi-policy discounts always apply. Insurance coverage is offered for:

- Life insurance

- Homeowners

- Insurance for home-based businesses

- Umbrella liability

- Auto

National Penn Bank Review: Meeting All Your Borrowing Needs

Buying a home, a car, or simply taking out a loan can be a stressful process, but it doesn’t have to be!

National Penn is there to help you compare rates and pick the best loan for you from the following:

- Home loans

- Home equity loans

- Auto loans

- Lines of credit

- Mortgage loans

- Credit cards

- Commercial loans

- Real estate loans

- Commercial mortgage loans

Click any of the links below to browse exclusive reviews of all top rated banking firms:

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.