2017 Comparison Review: USAA Cash Rewards Credit Card vs USAA Preferred Cash Rewards Visa Signature® vs Navy Federal Credit Union Credit Cards

Military tradition in the United States runs deep. Many lending institutions value the members of our military who put their lives on the line to protect our country and ensure our freedom. The USAA and Navy Federal Credit Union are two of these lending institutions.

If you are a military member looking to secure a great credit card from companies that value our country’s strong military tradition, getting a USAA credit card or a Navy Federal credit card may be good options for you.

Over 167 American adults have a credit card, and if you are a military member who wants to become one of them, you may be wondering whether NFCU credit cards or USAA credit card offers are better. Navy Federal Credit Union Credit Cards have certain benefits, and there are also USAA credit card rewards to take into consideration.

If you are wondering whether it is better to get an NFCU credit card or a USAA credit card, then keep reading. Throughout this article, we will look at the difference between two Navy Federal Credit Union credit cards and two USAA credit card offers.

By breaking down the different features of each card, you can decide, based on your needs and preferences, which credit card to choose for your wallet: the USAA Preferred Cash Rewards Visa Signature® card, the USAA Cash Rewards Credit Card, the NFCU cashRewards Credit Card, or the Navy Federal Credit Union Platinum Card.

Why Open a Military Credit Card?

Having a credit card like an NFCU credit card has many benefits beyond allowing you to partake in the growing world of e-commerce. There are a variety of Navy Federal credit card rewards that make owning a card worthwhile. The USAA credit card rewards make their cards stand out as well.

These USAA and NFCU credit cards have no annual fees, which is one less expense to worry about over the course of the year.

They also have lower annual percentage rates than most credit cards offered by larger lenders and banks. This is a great feature if you are looking to carry a balance on an NFCU credit card.

When it comes to rewards, the Navy Federal credit card rewards are a great feature. The USAA credit card rewards also stand out, and you can earn cash back on every day purchases.

If you are looking for a way to earn cash rewards and build up your credit history as a member of the military, it is a good idea to open a credit card from USAA and the NFCU.

See Also: The Best Prepaid Cards for Good or Bad Credit | Guide | How to Find the Best Prepaid Cards

2017 Comparison Reviews

The list below is sorted alphabetically:

- Navy Federal Credit Union cashRewards Credit Card

- Navy Federal Credit Union Platinum

- USAA Cash Rewards Visa Signature®

- USAA Preferred Cash Rewards Visa Signature®

Source: Paycheck Chronicles

2017 Comparison Table

Credit Card Names | Annual Percentage Rate (APR) | Annual Fee | Type of Credit Needed | Sign-Up Bonus |

| Navy Federal Credit Union cashRewards Credit Card | 9.90-18.00% | None | Fair – Excellent | None |

| Navy Federal Credit Union Platinum | 8.24-18.00% | None | Fair – Excellent | None |

| USAA Cash Rewards Visa Signature® | 10.15-26.15% | None | Fair – Excellent | None |

| USAA Preferred Cash Rewards Visa Signature® | 12.15-26.15% | None | Excellent | None |

USAA Preferred Cash Rewards Visa Signature® vs USAA Cash Rewards Credit Card vs Navy Federal Credit Union cashRewards Credit Card vs Navy Federal Credit Union Platinum

When comparing USAA credit card offers to NFCU credit cards, it is important to know what you are looking for in a credit card. The best USAA credit card to you might not be the best USAA credit card to someone else. You might think the best Navy Federal credit card is the Platinum, while someone else thinks the best Navy Federal credit card is the cashRewards card.

When finding the best USAA credit card or best Navy Federal credit card, there are a few features that you must keep in mind. The most important points to consider when comparing credit cards are:

- Fees

- APRs & introductory offers

- Type of credit needed

- Cash back rewards

- Sign-up bonus

Though we go into more detail on each of the credit card features below, it is important to take each one of these factors into consideration. Then, base your decision on your individual needs, not which credit card might appeal most to the masses.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Fees

Credit cards come with fees as a way for issuers to make more money. These fees range from annual fees and foreign transaction fees to balance transfer and cash advance fees. Unfortunately, even military credit cards like NFCU credit cards come with fees.

If you are applying for NFCU credit cards or a USAA credit card, there are no annual fees. The two USAA credit cards on our list, the Cash Rewards Visa Signature® and Preferred Cash Rewards Visa Signature® do not come with annual fees, nor do the Navy Federal Credit Union credit cards on our list.

Balance transfer fees are the fees that are charged if you transfer a balance to your USAA credit card or Navy Federal Credit Union credit cards. For the Cash Rewards Visa Signature®, a USAA credit card, there is a 3% balance transfer fee; the Preferred Cash Rewards Visa Signature® USAA credit card comes with a 3% fee as well. Thankfully, the Navy Federal Credit Union credit cards do not come with a balance transfer fee.

There are also cash advance fees, which are charged when you withdraw cash with your credit card. The Navy Federal credit card, NFCU Platinum, charges no cash advance fee from an NFCU branch, but up to $1.00 elsewhere, and the Navy Federal Credit Union cashRewards Credit Card charges $0.50 to $1.00. The two USAA credit cards have a 3% cash advance fee, which is on the low end.

If you are in the military, chances are that you travel internationally at least once in a while. That is why you want a card without a foreign transaction fee. Neither the USAA credit cards nor the NFCU credit cards on our list have foreign transaction fees, which is a great feature.

When you are looking for a military credit card, be sure to choose the card that has fees that align with your preferences. If you want a card with no balance transfers fees, you may want to get a Navy Federal credit card. If you need a card that allows cash advances, a USAA credit card might be a good option.

Don’t Miss: Top Cheap Credit Cards | Ranking | Best Low Credit Card Interest Rates (Cheapest & Lowest)

APRs & Introductory Offers

An annual percentage rate (APR) is the annual rate charged for borrowing through a credit card. This percentage represents the yearly cost of funds borrowed over the course of a loan.

When you are looking for a military credit card like a USAA credit card or one of the NFCU credit cards, you want to look for a card that has a lower annual percentage rate. This means that if you carry a balance on your credit card, you will rack up less interest over time. It also means that if you only make minimum payments, you will pay your balance off faster than if you had a higher APR.

The Navy Federal Credit Union credit cards on our list have variable APRs, which means that your APR will be awarded based on your credit worthiness. For the Navy Federal cashRewards Credit Card, you will have a variable APR between 9.9% and 18%. The Navy Federal Credit Union Platinum has a variable APR between 8.24% and 18%.

The USAA credit card on our list, the Cash Rewards Visa Signature®, has a variable APR between 10.15% and 26.15%. The Preferred Cash Rewards Visa Signature® has a slightly higher APR, between 12.15% and 26.15%. Though these are higher than the APRs offered by the Navy Federal Credit Union credit cards, that doesn’t mean that a USAA credit card can’t be a good option for you.

Some companies also offer introductory APR periods, which allow you a certain amount of time without accruing interest on purchases or balance transfers. Unfortunately, none of the NFCU credit cards or USAA credit cards on our list has such an offer.

Type of Credit Needed

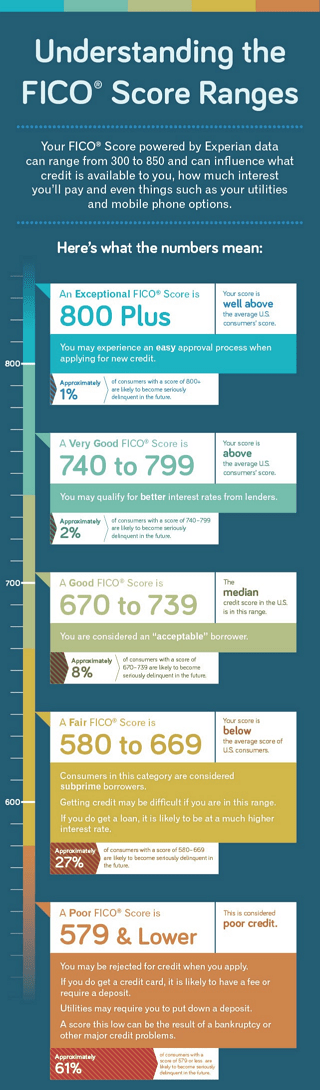

When you are looking to open aN NFCU credit card or USAA credit card, it is important to make sure you have the appropriate credit score to qualify. Before you look at what type of credit you will need for each card, you need to know how the credit score ranges work.

The chart below from Experian breaks down FICO credit score ranges. Anything lower than a 579 is considered a poor score, whereas anything over a 670 is a good score.

Source: Experian

You do not want to apply for a credit card, only to be denied. That is why it is important to consider what type of credit you have and what cards you actually qualify for.

For the Navy Federal Credit Union credit cards, you will need fair to excellent credit to qualify. That means your score will fall somewhere around 600, at minimum. Though credit unions are more likely to work with you if your score is low, 600 is a good starting point.

USAA’s credit card, the Cash Rewards Visa Signature®, will require fair to excellent credit. The Preferred Cash Rewards Visa Signature® is a USAA credit card that will require excellent credit. This means that you score will likely need to be over 800 to qualify.

Not knowing your credit score can hurt you, even if you aren’t applying for credit cards. Be sure that you check your score at least once a year.

Popular Article: Top Best Credit Cards in Canada | Ranking | Compare the Best Cash Back, Travel, and Top Cards

Cash Back Rewards

The average number of credit cards for an American adult is 3.7. That means issuers need to give you a reason to use their credit card over the competition. USAA and Navy Federal credit card rewards are offered as an incentive to use your USAA or NFCU credit card over another credit card that you might have in your wallet.

The Navy Federal credit card, the cashRewards Credit Card, offers you 1.5% cash back on every purchase that you make. This cash back will never expire and there is no limit to what you can earn. You can also redeem your Navy Federal credit card cash back as soon as you start earning it, which is a great bonus.

The Navy Federal Credit Union Platinum does not offer any cash back, which is certainly something to keep in mind. If you are looking for a Navy Federal credit card that offers cash back, this might not be a good credit card for you.

The USAA credit cards do offer cash back to credit card holders. The Cash Rewards Visa Signature® offers 1.25% cash back on all purchases. There are no limits on the amount to earn and no rotating categories to keep track off.

The USAA Preferred Cash Rewards Visa Signature® is a USAA credit card that also offers cash back. This card takes it a level higher with 1.5% cash back on all purchases. There’s also no limit on what you can earn, and you can redeem your points easily from your computer or mobile device.

If you are looking for cash back rewards, there are definitely some good options with the NFCU credit cards and USAA credit card.

Sign-Up Bonus

A sign-up bonus is something that is offered by some companies to get you to use their card. Americans have an increasing number of credit cards in their wallet each year, and by offering you an upfront incentive, companies can encourage you to apply for one of their cards, like a USAA credit card.

Think of it as their way of enticing you to get their card so that they can make money when you use your Navy Federal Credit Union credit cards.

Unfortunately, none of the military credit cards on our list offers a sign-up bonus. Neither of the NFCU credit cards offers one, and you won’t get a sign-up bonus on a USAA credit card either.

This isn’t a make or break when it comes to a credit card, but it is certainly a nice feature to have. Remember though, that other features like fees and cash back rewards stick with you for the life of your USAA credit card or Navy Federal credit card.

Conclusion: USAA Credit Card Offers vs Navy Federal Credit Union Credit Cards

When choosing between a Navy Federal credit card and a USAA credit card, it is important to do research on the particular cards before making a final decision. Do not just apply for the first credit card offer that you receive.

Instead, be sure that you consider the following features of each credit card:

- Fees

- APRs & introductory offers

- Type of credit needed

- Cash back rewards

- Sign-up bonus

After breaking down the features of each card, you then need to determine what matters most to you in an NFCU credit card or USAA credit card.

Do you want a card with good cash rewards like the USAA Cash Rewards Credit Card? Do you want to find an NFCU credit card or USAA credit card that has no annual fee? Does having no foreign transaction fees make a card the best Navy Federal Credit Card for you?

When it comes down to it, the best USAA credit card or Navy Federal Credit Card for you might not be the best card for someone else. Make sure that you choose the best one for you.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.