NetCredit Reviews – Get all the Facts before Using Netcredit.com

Summary

NetCredit is an online company that offers instant personal loans to residents of 13 U.S. states. If you need money fast, you can follow their quick application process and have access to an online loan as quickly as the next day.

Individuals seeking loans for bad credit may be tempted by this company’s simple application process and humanistic advertising campaign, which assures customers with poor credit that they are more than their credit score and deserve to be treated as such.

Be warned, however: if you are in a bad financial situation to begin, you may be charged exorbitant Annual Percentage Rates (APR) of up to 299%, depending on which state you live in. For those who are already struggling to make ends meet and need a sizeable loan, taking on a high APR will likely be more of a burden than a blessing.

However, when you browse through the many NetCredit reviews that have been posted online by NetCredit customers or consumers, you’ll get a wide range of opinions. For a lot of NetCredit reviewers, the expediency and small loan capacity offered makes NetCredit a good option for those who need money quickly, are willing to take on heavy interest, and can pay back their loans quickly.

The moral of the story is: read the fine print and ensure that you will be able to pay your loan back with interest before making any impulsive decisions.

Though there are a variety of NetCredit reviews online, here at AdvisoryHQ we hope to give you an exhaustive account of NetCredit loans, history, values, services, and customer reviews so you can make an informed decision before applying for your loan.

How It Works:

Image Source: NetCredit

History – Netcredit Reviews

The history of NetCredit extends all the way back to 1983, when Jack Doherty opened his first pawnshop in Irving, TX. Doherty’s business expanded into a national chain of pawnshops, Cash America, which later evolved into an international franchise. Fast forward to 2006, and Cash America purchased CashNetUSA, the online consumer lending company created by brothers Albert and Alexander Goldstein.

This online corporation, renamed Enova in 2011, opened their U.S. branch, NetCredit, in 2011 with the goal of offering their highest-ever loan amounts to customers regardless of their credit score. The company’s roots in the pawnshop industry are still visible in their current business model, where loans appear quickly in your hand but have a hefty price if you are not expedient to repay them.

Values

At NetCredit’s Youtube channel, you can find a variety of advertisements echoing similar themes. “You’re a person, not a credit score,” they say in one video. “We believe everyone should have access to credit,” they highlight in another.

Ultimately, many of the values espoused by NetCredit revolve around a people-centered, rather than strictly number-centered, approach.

Here’s our brief exploration of a few of the principles put forward on the “About Us” section of the company’s website:

“We Believe Everyone Deserves Access to Credit”

This company claims that the democratization of loan availability is what drives them. While this does seem to be true—that even those seeking for loans for poor credit may be eligible—this does not mean that everyone has equal access to a loan, as the interest rates still vary greatly (from 35% – 299% depending on your state and financial condition).

The other qualifications that might be added to “everyone” are state-based limitations, as NetCredit loans are only available to residents of 13 U.S. states (for more detailed information, check out our section on “Who’s Eligible?” below).

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

“We Believe Our Customers Come First”

NetCredit prides itself on customer service and clear communication. In reviews from both customers and professional review websites, few complaints come up about specific employee-customer interactions, which suggests that they follow through on this promise. They aim for transparency, which is why they employ their “ClearCost for MeTM” guarantee, which promises no “hidden fees.”

Their APR rates use a simple interest structure, which means that interest is not compounded but calculated only based on the remaining principal amount. Keep in mind, however, that repaying the principal itself can be difficult while also handling the high daily-accruing interest on a bi-weekly basis.

“We Believe It Should Be Easy”

One thing NetCredit does seem to have mastered is the ease of access to instant personal loans. This process is so efficient, in fact, that you could submit your eligibility check tonight, instantly receive an offer, sign an agreement, and have the loan money in your bank account by the next business day.

While this speed of access may be tempting in difficult situations, it also should be a little frightening, as one impulsive decision with a high APR rate could leave you paying back this loan for years. For customers with buyer’s remorse, however, the good news is that you can cancel the loan by 5pm CT the next day if you change your mind.

“We Believe Good Lenders Offer More Than Loans”

NetCredit also prides themselves on offering additional services beyond just the loan. By consistently making on-time payments, they say, you can build a higher credit score. They claim to record every payment and report them to two major credit unions—TransUnion and Experian—who in turn update your credit score.

Despite this promise under their “My CreditBuilder” tool, however, many online reviewers on CreditKarma.com write that their payments were either not reported or that the company was very slow in reporting, so you may want to seek clarification from a representative before accepting any loans for the purpose of credit building.

Keep in mind that if you are offered a plan with a high APR rate that you are unable to pay back consistently, this feature may just as easily work against your credit score, making it harder to pull yourself out of the mud. Another extra service NetCredit.com offers is financial advice via their blog, available for free to the public on their website.

Who’s Eligible for a NetCredit Loan?

Despite the romantic notion of not labeling people with numerical values, your overall “financial picture” does influence the terms of NetCredit loans.

When applying for your loan, you will be asked to provide identifying information and sources of income, which sorts you into one of three credit categories (gold, silver, and bronze).

Beyond this, loans are available only in the following 13 states, and each state has a different set of rates and terms:

- Alabama

- California

- Delaware

- Georgia

- Idaho

- Missouri

- New Mexico

- North Dakota

- South Carolina

- South Dakota

- Utah

- Virginia

- Wisconsin

If you are not a resident of one of these states, you will not be eligible for NetCredit loans. If you are a resident in one of these states, check out the NetCredit interest rate breakdowns below.

NetCredit Interest Rates

Before you consider applying for a loan, check out the types of NetCredit loans available in your state. Important factors you may want to consider are the maximum and minimum loan amounts, loan terms, and Annual Percentage Rate (APR). The maximum and minimum loan amount determines how much money you will be allowed to borrow.

Since NetCredit offers small personal loans, the lowest amount any state offers is $1,000 and the highest amount any state offers is $10,000. The loan term determines how long you have to pay back the loan. Generally, available loan terms vary between six months and five years, though a few states only offer a maximum terms of up to three or four years.

That last category, Annual Percentage Rate (APR), determines how much interest is added to your principal loan amount per year. NetCredit uses a daily simple interest system, which means that interest is calculated daily based on your remaining principal amount, rather than including interest into the total.

After you submit your initial eligibility check, NetCredit will respond offering you possible loan options. If accepted, they will place you in one of three categories gold, silver, and bronze. Gold customers currently receive a rate of 35% APR on loans. Silver customers by contrast receive between 59-110% APR, depending on the state.

The highest APR rates fall onto customers in the bronze category, with rates between 200-299%, which will double or triple the remaining principal amount every year. If you took out a $1,000 loan with an APR of 200%, you would pay $5.48 in pure interest per day. If you took out a $10,000 loan with the same 200% APR, by contrast, you would be paying $54.79 per day in interest without touching the principal amount you borrowed.

According to the Federal Reserve, the average interest rate on a 24-month personal loan was 10.87% for October 2015. According to a report by CreditCards.com, banks like CapitalOne and Citibank typically offer between 10.5%-17% APR. Comparing these numbers to even NetCredit’s gold group’s 35% APR reveals the vast disparity in interest rates.

To be fair, yes, many of these banks may employ a compounded interest system, rather than a simple interest system, but it is unlikely that this difference does much to account for the enormous gap.

Since these factors do vary greatly due to different state regulations, we have broken down the information into an accessible chart below to help you make your decision. This information is all available on NetCredit’s website under their “Rates and Terms” section, but you have to scroll to the bottom of the page and look at each state individually.

Term | Alabama | California | Delaware | Georgia | Idaho |

Min Loan Amount | $2,100 | $2,600 | $1,000 | $3,100 | $1,000 |

Max Loan Amount | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 |

Min Loan Term | 6 months | 6 month | 6 months | 6 months | 6 months |

Max Loan Term | 5 years | 4 years | 5 years | 5 years | 5 years |

APR | Alabama | California | Delaware | Georgia | Idaho |

Gold | 35% | 35% | 35% | 35% | 35% |

Silver | 90% | 85% | 88% | 59% | 88% |

Bronze | 200% | 200% | 210% | N/A | 210% |

State | Missouri | New Mexico | North Dakota | South Carolina | South Dakota |

| Min Loan Amount | $1,000 | $1,000 | $1,100 | $1,000 | $1,000 |

| Max Loan Amount | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 |

| Min Loan Term | 6 months | 6 months | 6 months | 6 months | 6 months |

| Max Loan Term | 5 years | 5 years | 5 years | 5 years | 5 years |

APR | Missouri | New Mexico | North Dakota | South Carolina | South Dakota |

| Gold | 35% | 35% | 35% | 35% | 35% |

| Silver | 110% | 88% | 110% | 110% | 88% |

| Bronze | 299% | 210% | 246% | 246% | 210% |

State | Utah | Virginia | Wisconsin |

| Min Loan Amount | $1,000 | $1,000 | $1,000 |

| Max Loan Amount | $10,000 | $10,000 | $10,000 |

| Min Loan Term | 6 months | 6 months | 6 months |

| Max Loan Term | 5 years | 5 years | 3 years |

APR | Utah | Virginia | Wisconsin |

| Gold | 35% | 35% | 35% |

| Silver | 88% | 88% | 90% |

| Bronze | 210% | 210% | 210% |

Information from NetCredit Rates & Terms

How to Apply For a Loan

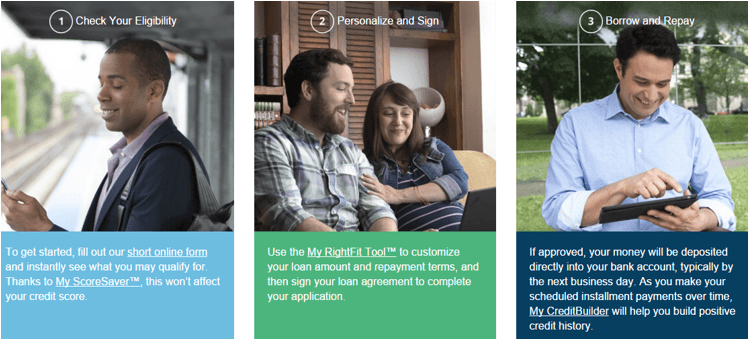

After you’ve checked to see if NetCredit loans are available in your state—and that your needs will be met by the available loan amounts, terms, and APR rates—you can take the following steps to apply for your NetCredit loan:

- Perform an Eligibility Check

Submitting an application to check your eligibility is a necessary step to getting your NetCredit loan, but you can also check your eligibility for free without negatively impacting your credit score or accepting the agreement. This is thanks to NetCredit’s “My ScoreSaverTM” tool, which they say gives you a soft report on your credit and protects you from any negative consequences.

The application process is all online and, as advertised, is a relatively quick and painless process. First, you have to request how much money you would like to borrow and for what purposes you intend to use it.

You then create an account using an email address and password before filling out identifying personal information and sources of income. Their program instantly analyzes your eligibility and provides you options for your loan.

- Customize the Terms of Your Agreement

After performing your eligibility check, you will instantly receive information on the loan options for which you qualify. By selecting the “Modify Loan Details” option, you can edit your loan amount and repayment schedule. Once you accept this agreement, you can receive your money as quickly as the next business day.

Image Source: BigStock

Image Source: BigStock

- Receive Funds and Begin Repayment Plan

You can have your funds in your bank account by the next business day after accepting the terms of your agreement. As mentioned above, however, this could easily lead to impulsive decisions, so we encourage you to carefully calculate your APR and consider your repayment schedule carefully before signing this contract.

Once your repayment schedule begins, you may choose to pay in advance or pay back your loan in full at any time without any fees, which is a nice feature of NetCredit. Extra payments less than the full amount, however, do not influence the amount required at the next payment period.

If for some reason you are unable to make your upcoming payment, you can call NetCredit’s Customer Support Team, who may be able to offer you a courtesy due date adjustment to give you extra time to pay it back. If done properly, paying back NetCredit loans may help you build your credit. But is the gain in the moment worth the long-term consequences?

Read other NetCredit customer feedback, and our overall NetCredit review below and decide for yourself.

NetCredit Customer Reviews and Feedback

Before concluding our NetCredit reviews and analysis, we thought it may be useful to provide you with a glimpse of some of the feedback that NetCredit customers have left.

From our search, NetCredit customer reviews are clearly polarized, often with either five-star or one-star reviews, going as far to describe the company as either “life-saving” or “loan sharks.”

Checking out what other customers have experienced may help you determine whether NetCredit is best for your situation. On the website CreditKarma.com, for example, the company received an overall 2.9 star ranking from 47 NetCredit reviewers. 36% of these reviewers gave NetCredit five stars, while 45% gave them only one star.

Many of the positive NetCredit reviews on CreditKarma emphasize that they had a good experience because they were in desperate need, received the money they needed quickly, and also paid off their loans quickly.

The negative NetCredit reviews, by contrast, emphasize the incredibly high APR rates and inconsistent reporting back to credit bureaus for improved credit scores.

Is NetCredit Right For You?

Important for any NetCredit.com review is a discussion of whether or not this service is recommended. All in all, it seems that one ought to tread with caution when taking out NetCredit loans.

Don’t be swayed by the humanistic, “You’re a person, not a credit score” advertising campaign or the quick-to-your-pocket application process. It is hard to imagine a situation that justifies taking out a bronze category loan with 200-299% APR.

If your situation is not desperate or you are simply looking to build credit, you may want to consider other options. If you need money quick, are willing to take on the massive interest, have read over the terms of your agreement carefully, and are confident in your ability to make payments, you may be able to make the NetCredit system work to your advantage.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.