Intro: New American Funding Reviews | What You Need to Know

When the time comes to research mortgage lenders in preparation for a new home purchase or a refinance option, take your time. Do your own research first, such as looking for New American Funding reviews.

It is important to assess your personal situation before viewing available loan options. Consider a full-service lender or one that has options to suit your personal financial situation. In addition, taking time to understand key terminology will help you make the best decision in choosing a mortgage loan company.

New American Fundings Review

Readers searching for New American Funding reviews want to know more about who the company really is and what New American Funding rates are offered. Readers also want to know what type of loan options are available and what key features make them stand out. What other reviewers have said about the lender is also important.

This New American Funding review article provides all that. We’ll also answer the question “Is New American Funding a Scam?” While this is not a 100-percent tell-all, you can gain general ideas and start your path to seeking out additional reviews from other knowledgeable sources as well.

See Also: Top Mortgage Lenders – List of US Largest Mortgage Lenders (Reviews)

Who Is New American Funding? (Review)

New American Funding seems to be more than just a standard mortgage lender. Licensed in many states across America and operating over 100 office locations, our New American Funding review shows that this company could have a lot to offer someone purchasing or refinancing a home.

New American Funding is headquartered in Tustin, CA, and was found in 2003. Besides offering many loan options, they are an FHA, Fannie Mae, Freddie Mac, VA, and Ginnie Mae approved lender.

Who Should Work with New American Funding?

As you are looking through the many New American Funding reviews on the web, you may stop and wonder if you’re an ideal candidate to work with them. The answer is yes – potentially. You see, New American Funding works with people, no matter their circumstances, who need a loan.

New American Funding has programs for those looking to:

- Purchase a home for the first time

- Take on a larger loan to purchase a larger home

- Purchase a second home (retirees included)

- Purchase vacation property

- Start investing in real estate

- Refinance

- Take out a home improvement loan

For anyone who needs a mortgage loan, this New American Funding review should help guide you in the right direction.

What Makes New American Funding Stand Out

So you may be wondering, “Why New American Funding?” Well, while researching for this New American Funding review we wanted to look at what really makes them stand out.

In the Scotsman Guide for 2012, New American Funding ranked #22 in the Top Overall Volume. In the 2015 guide, they ranked at #14. This impressive jump was noticed in our New American Funding review.

In regards to New American Funding’s wholesale volume, they came in at #17, another jump since their position was #22 in the 2012 guide.

Don’t Miss: Best Mortgage Companies (Overview of the Top Mortgage Lenders)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Answering Your Question: Can New American Funding Service My Loan?

When you take out a mortgage, it may not stay with that lender. The loan could be sold to another financial institution. If this happens, New American Funding would no longer handle the direct payments and management of your mortgage account.

Encountering a few issues along the way is a possibility. While conducting your own New American Funding review, you can also take advantage of this helpful mortgage glossary.

In our New American Funding review, we found a Black Knight Financial Services news release. New American Funding collaborated with Black Knight Mortgage Servicing Platform in 2014. A five-year service contract was signed.

In the New American Funding Continues to Provide “Best in Class” Service post, they discuss how they can provide comprehensive services to their customers including:

- Managing new loans

- Providing full customer service

- Reporting to all major credit bureaus

- Reporting defaults

- Managing disbursements and claims

- Reporting and posting payments

Upon these findings, you can answer the question of “Can New American Funding service my loan?” This particular lender has the necessary service packages in place to suit your needs.

New American Funding: One of the Industry’s Leaders

New American Funding is an industry leader in mortgage services. When gathering research for this New American Funding review, we found New American Funding was ranked in the Scotsman’s Guide’s Top Mortgage Lenders from 2012-2015.

They successfully closed 33,593 loans, of which 88% were retail. This also shows their growth from 2014, in which they only closed 18,880 loans. They do offer three lending divisions (retail-based, realtor-based, and wholesale). This shows the lender is capable of keeping up with industry competition.

Related: Imortgage Reviews – What You Should Know (Complaints & Review)

New American Funding Wholesale Division

We should also distinguish what the New American Funding wholesale division is about. Loan officers and independent mortgage brokers work together to originate loans. This happens on the retail side of things, directly with home mortgage borrowers. Once the deal is finalized, it is sent off to a wholesale mortgage lender for processing.

New American Funding: Types of Loans Available

New American Funding

As you read New American Funding reviews, also look into the loan types that New American Funding offers. According to the New American Funding Loan Options page, they offer a variety of loans. By contacting a lender, all of the options available for your situation should be discussed.

Some options include:

- Refinancing and Purchase Loan Options – free up-front credit approvals

- Fixed-Rate Loans – a secure type of loan offered as 15- and 30-Year Fixed Rate Loans

- FHA Loans – typically offered for those with low credit scores and limited funding

- Home Improvement Loans – for current homeowners who need funding to make improvements to their home

- Jumbo Mortgage – this type of mortgage allows a person to finance up to 89 percent of their new home, going over the amount you could be approved for a conventional loan

- Reverse Mortgage – an option for seniors over 62 years of age to convert the equity in their homes to income

- VA Loans – strictly available to veterans and active duty military personnel

- Home Affordable Refinance Program (HARP) – a program to allow homeowners under the past HARP program to refinance under the current lower interest rates

New American Funding claims they can lower your payments an average of $302 per month. Be sure to look through more New American Funding reviews yourself to make a personal assessment.

With the variety of loan options, we also looked at a LendingTree.com New American Funding review regarding their mortgage refinancing: “I worked with John Molavi to refinance my current loan. He was very responsive and answered all of my questions promptly. Always polite even when I had some stupid questions.”

The Pros of New American Funding

We have found both positive and negative comments as far as New American Funding reviews are concerned. We will start with the positive. For instance, being BBB accredited since 2004 (a year after they were founded) for 12 consecutive years certainly is a great accreditation.

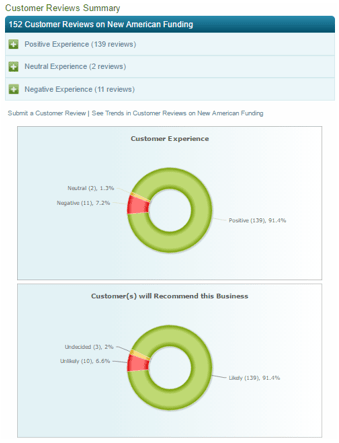

New American Funding is rated an “A” on a scale from A+ to F with the BBB. It shows the company has built trust with the mortgage lending community and shows transparency in their business actions. Of the 152 New American Funding reviews listed with the BBB, 139 were positive reviews, with 91.4% of customers saying they would recommend the lender.

New American Funding – BBB Review

One TrustLink.Org New American Funding review states:

“I believe that New American Funding knows well how to serve customers. They are all friendly and support me on every step. They do service better than all First Class Banks in this country. I greatly appreciate New American Funding Team.”

Popular Article: Best Bad Credit Mortgage Lenders for Bad Credit Borrowers (This year’s Mortgage Lenders and Programs)

Complaints against New American Funding

Of the 152 BBB New American Funding reviews, only 11 are negative at the time of this New American Funding review. One of the New American Funding complaints stated,

“Our business relationship with this company was a disaster from start to finish. We were repeatedly asked to provide endless years of tax returns, financial information, bank statements, and wages/W2’s, proof of employment and more for close to three months.”

Another negative New American Funding review stated, “This Company rips off customers. When you send a payment by mail, they refuse to accept that it was received on time and keep collecting late fees.”

However, it’s important to read all New American Funding reviews thoroughly, as we noticed one September 2015 review was filed as a negative experience, but the reviewer would recommend the business. “Amongst a few things stated, [an employee] recently helped us through our whole home buying process…He helped us overcome each and every challenge. I would highly recommend [this employee] to anyone out there in need of a loan agent.”

New American Funding: A Scam or Legit?

One popular question borrowers ask when searching for New American Funding reviews is this: “Is New American Funding a scam?” Well, Zillow.com has a thread where a homeowner asked that very same question because they were offered such a low FHA interest rate when compared to other mortgage lenders.

The reviews were positive and negative, but mostly showing New American Funding was not offering scam loan options. A few options on the “Is New American Funding a scam?” advice thread are as follows:

- “I just financed a rental property and my home with NAF. Because my loan balances were very low, my rate was what I could get anywhere else. However, they closed my loan in less than 30 days and the experience was much better than any bank I ever dealt with. They are definitely not a scam.”

- “Not a scam. I have done 3 loans with these guys as rates were coming down (all 30 year fixed). They are fast, friendly, professional and very competitive. In contrast I recently used Wells Fargo to obtain a builder credit and found them to be extremely slow and frustrating to work with.”

- “I applied with New American Funding. What a bad experience. There was absolutely no communication, but just a lot of waiting and no answers on their end. When I got fed up with waiting, I emailed and asked for a return email or call, but the only thing I got was a letter a few days later that my loan was declined and no explanation. What a sham…”

New American Funding did respond to some of the complaints found. One response was, “We encourage clients to shop around and to discuss their options with others as well. In doing so our clients have found that we did in fact offer honest and sincere advice with lower rates and lower fees.”

Read More: Types of Home Loans – What You Should Know (Different Types & House Loans)

Free Wealth & Finance Software - Get Yours Now ►

A Review of New American Funding Rates

For this New American Funding review, we also compared a current 30-year fixed mortgage rate analysis against New American Funding’s 30-year fixed-rate – finding that their rates start well below the market rate.

New American Funding Reviews: A Positive Light

New American Funding reviews published online are positive and negative, including on websites like Zillow, Facebook, Yelp, and Google to name a few.

A positive New American Funding review this past January 2016 on the Better Business Bureau (BBB) states,

“New American Funding proved me wrong. They keep you informed every step of the way and they will even answer the phone on the weekend, that’s a first for me… don’t hesitate any longer pick up the phone a give yourself a chance to be amazed.”

Of some of the Yelp New American Funding reviews, we found in May 2016 “Wilma and Andrew worked on closing two loans for me within 45 days. They were excellent in keeping me informed on what I needed and meeting the terms of the loan. Excellent customer services.”

Free Budgeting Software for AdvisoryHQ Readers - Get It Now!

Our Final Thoughts of New American Funding

In our New American Funding review findings, we saw a variety of New American Funding complaints. By searching for specific New American Funding complaints on Yelp.com and One TrustLink.Org, it does not appear that New American Funding is trying to defraud their way through reviews. The majority of them seem valid.

Still, the positives seem to outweigh the negatives. The New American Funding reviews shared on their website are mainly positive. There are positive New American Funding reviews across the web as well. Remember to explore the validity of a claim and source before believing it.

But you might still be hesitant. Even if you’ve had a bad experience with loans being sold, again and again, we like to think your question of “Can New American Funding service my loan?” has been answered in this review with a solid yes! New American Funding has a variety of products. The company is growing with increased closed loan numbers, more offices, and more employees. This shows the company has sound value, and it can be seen in the low New American Funding rates passed onto consumers.

Image Sources:

- https://www.bigstockphoto.com/image-61448960/stock-photo-mortgage-calculator-house%2C-noney-and-document-3d

- https://www.newamericanfunding.com/

- https://www.bbb.org/us/ca/tustin/profile/mortgage-broker/new-american-funding-1126-13216611

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.