Guide to Finding No-Credit-Check Loans for People with Bad Credit

Credit scores dictate more than we think they will throughout our lives. A poor credit score can keep you from securing a mortgage, automobile, credit card, and loans.

The unfortunate part is that just because you have bad credit, does not mean that you are not capable of managing and repaying a loan. However, it is very difficult to get loans for bad credit with no credit check.

It is even more difficult to find good loans for bad credit scores, due to predatory lending practices.

Most lenders in the home, automobile, and credit card industries require credit checks, and a score that falls below 600 will generally make a loan through those lenders hard to secure. For those looking for loans for a bad credit score, there are several questions to ponder:

- Are there no-credit-check loans for people with bad credit?

- What are some good loans for bad credit?

- Where can I get a loan with no credit?

- Can I get online loans for bad credit with no credit check?

While there are several options for getting loans with bad credit and no credit check, there are different factors that you need to consider. If you are asking yourself, “Where can I get a loan with no credit?” you need to keep reading. In our review of How to Get No-Credit-Check Loans for People with Bad Credit, we delve into the process of getting no-credit-check unsecured loans and what are considered good loans for bad credit.

See Also: How to Get Small Loans—Bad Credit Borrower | Tips| Small Loans for People with Bad Credit

What Do You Know About Credit Scores?

Credit scores are pesky little numbers that can keep you from securing the loans that you are looking for. Whether you want to buy a car, fix up your house, or are between jobs and need some cash, not having good credit can make it hard to get a loan. There are few loans for bad credit scores because most legitimate lenders require a credit check.

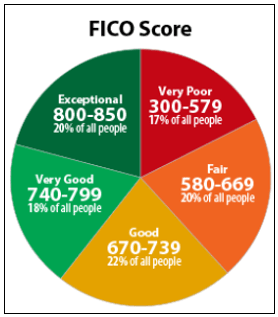

For anyone looking for good loans for bad credit, the first step is determining what constitutes a bad credit score. According to the credit reporting agency Experian, any score between 580 and 669 is considered “fair” credit. These are considered subprime borrowers, but you can still be approved. However, a credit score under 580 constitutes “very poor” credit. Applicants with a score that falls into this range may not be approved for credit at all.

No Credit Check Loans for People with Bad Credit

Interestingly enough, if you fall into these ranges, you do not lack for company. In fact, 20.2% of people in the United States fall into the “fair range,” and 17% fall into the “very poor” range of credit scores. This means that approximately 37% of the population may be looking to get loans for bad credit with no credit check.

If you have a credit score below 580, it will be very tough to get a loan. That is why it is important to know where to get no-credit-check loans for people with bad credit. By knowing how to get loans with bad credit and no credit check, you can secure the funds that you require to carry on with your life.

How to Improve Your Credit Score

Many lenders practice predatory lending practices on those with bad credit. If you cannot find good loans for bad credit, it is important to keep yourself from falling further into debt. If you can avoid taking out a loan with a high interest rate — or terrible terms — until you can improve your credit score, that is your best option. If this isn’t possible consider the following to improve you credit score:

- Pay your bills on time: By paying your current credit cards or loan repayments in full and on time, you will slowly increase your credit score. Delinquent payments severely affect your credit score.

- Maintain low balances: If you have high outstanding debt, you will have a lower credit score. Try paying off larger amounts.

- Don’t keep applying: It will not help increase your credit score if you keep applying for new accounts. Only open new accounts as needed.

- Pay off debt: Moving debt around won’t help your credit score. Consider paying it off to improve your score.

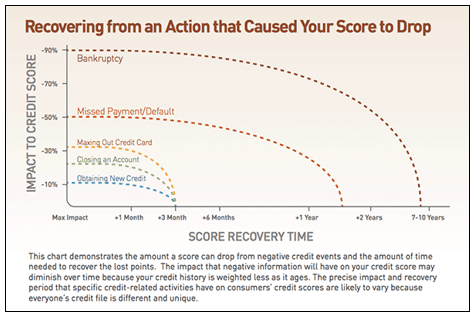

If you are able to follow these steps, you will see your credit score slowly improve over time and will no longer need to be looking for loans for a bad credit score. It is important to note that your score will not improve over night.

Where Can I Get a Loan with No Credit

However, if this is not an option, there are certainly options for no-credit-check unsecured loans and online loans for bad credit with no credit check.

Don’t Miss: How to Get VA Small Business Loans for Veterans | This Year’s Guide

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Things to Consider When Looking for Loans with Bad Credit and No Credit Check Required

When people look for no-credit-check loans for people with bad credit or no-credit-check unsecured loans, they’ll often leap at the first offer they receive. However, this is a mistake. There are several things to consider when looking for online loans for bad credit with no credit check, such as:

- What constitutes bad credit

- Interest rates

- Loan terms

- Additional fees

- Time to receive funding

- The loan amount

Technically, a “bad” credit score is only “bad” when it keeps you from accomplishing whatever you are hoping to achieve. This varies by lender and company, so you may want to do research on what the lender or credit company considers a bad credit score. Some lenders are more lenient than others are. This may help you obtain loans for a bad credit score, because certain lenders don’t actually consider your credit score bad enough to disqualify you.

No Credit Check Unsecured Loans

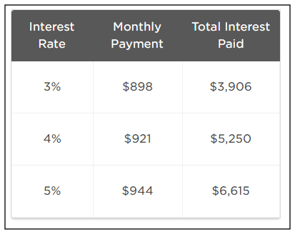

If after research you have determined that your credit score is in fact too bad for the lender you were considering, you now need to look at no-credit-check loans for people with bad credit or loans for a bad credit score. There is definitely one looming factor to consider: interest rates. Often, lenders that offer no-credit-check unsecured loans or secured loans have much higher interest rates than normal lenders. Their annual percentage rates can reach astronomical amounts for online lenders, and as shown below, even small differences in interest rates can have large financial implications.

You also need to consider what the loan terms are when looking for no-credit-check loans for people with bad credit. Loans vary in length, and you want to make sure that you can afford your monthly payments. Longer loan terms will mean smaller monthly payments but a higher total loan cost over the long run. Some loans might actually charge you an extra fee to pay them off early as well, so taking a longer loan and paying it off early may not save you either.

Loans for Bad Credit Score

Several fees exist and are generally prevalent when you are looking for loans for a bad credit score. These fees, such as origination fees, underwriting fees, processing fees, and appraisal fees, will only drive up the total loan cost or monthly payment. Also, make sure that when you are looking for good loans for bad credit that you only take out the amount that you need and don’t jump at offers for thousands more than you asked for.

If the fees, interest rates, and loan terms confuse you, you are not alone! Many people who are looking for loans with bad credit and no credit check are confused by what these all mean. The most important figure to look at is the Total Amount Repayable (TAR). This tells you exactly what the loan will cost you from your first payment to your last payment.

Where Can You Get Loans for Bad Credit With No Credit Check?

You might find yourself asking, “Where can I get a loan with no credit score?” or, “Where can I get no-credit-check unsecured loans?” You know that your credit score is not high enough to be granted a loan through a normal lender, and now comes the task of finding where you can get loans for bad credit with no credit check. There are a few options to consider when looking for no-credit-check loans for people with bad credit, including:

- Credit unions

- Personal loans

- Online lenders

A credit union should be your first step when looking for good loans for bad credit. They do require credit checks, but they are more flexible than banks, and some offer loans that cater to those with lower credit history. While it isn’t necessarily a no-credit-check loan for people with bad credit, the maximum annual percentage rate at a federal credit union is 18%, so you will save money in interest if you qualify.

For those looking for no-credit-check loans for people with bad credit, the pool of possibilities is limited. If you are not able to find a relative or close friend to loan you the money, your best bet is to turn to online lenders that have less strict requirements.

Related: How to Get a Small Business Loan for a New or Growing Business

Where to Get Online Loans for Bad Credit with No Credit Check

Fortunately, for those with computers, there are some sites where you can get online loans for bad credit with no credit check. Sites that require credit checks will have maximum interest rates around 36%, but no-credit-check lenders will often have annual percentage rates in the hundreds or even thousands. Here are some online lenders to consider when looking for loans for bad credit score or no-credit-check unsecured loans:

- One Main: They have no minimum credit score requirement and interest rates ranging from 12.99% to 35.99%. You can take a loan of up to $25,000.

- Bad Credit Loans: This site is not a lender, but it connects borrowers that have bad credit with willing lenders. Note that annual percentage rates range from 230% to 2,330% and you are under NO obligation to accept the terms.

Are There Other Types of No-Credit-Check Loans for People with Bad Credit?

The short answer is yes, there are no-credit-check loans for people with bad credit that come from other sources. However, these types of loans and the lenders who offer them often partake in predatory lending practices, and for that reason we cannot vouch for them.

Payday loans are usually the easiest way to get a small loan quickly, but they are not a good deal for you. Payday loans are no-credit-check unsecured loans, but according to the Consumer Finance Protection Bureau, they normally have annual percentage rates averaging about 400%. Auto title loans are an option, but they require you to put your car up for collateral and have interest rates that can range from 84% t0 300%.

When looking for loans for a bad credit score, to spot a bad credit scam, look for the following things:

- Guarantees: Legitimate lenders will not be able to guarantee a loan without knowing anything about you.

- Fishy Names: If the lender’s name closely mirrors a legitimate company’s name, you may want to think twice.

- Pushy Requests: Lenders will not push you to hand over personal information without even knowing anything about the loan. Be wary of this practice.

- Upfront Fees: It is strictly against the law for a lender to charge you a fee for filling out an application.

- Scare Tactics: Legitimate lenders will not push you to make a decision quickly. They understand that you need time to shop around and make an informed decision.

It is always important to take some time to check on a lender. A simply search on the internet should reveal reviews and unbiased information on the lender. Avoid these credit scams at all costs. While a guaranteed $1,000 loan paid in 24 hours sounds like a great option, that loan costing you $15,000 in the end doesn’t.

Popular Article: CashAdvance.com Review – What You Should Know Before Using CashAdvance.com

Conclusion

When looking for no-credit-check loans for people with bad credit, it is important to consider whether you really need the money. If you have bad credit, the last thing you want to do is fall into more debt.

Some lenders that do not require credit checks use predatory lending practices, and you may quickly find yourself on the back end of a loan. However, if waiting for your credit score to improve isn’t an option, there are options for loans for a bad credit score.

You can look at a local credit union, try to secure a personal loan, or turn to an online lender to find loans for a bad credit score.

Whichever method you decide to use, make sure that you are obtaining one of the good loans for bad credit. Avoid loan scams, high interest rates, hefty fees, and taking more of a loan than you actually need, or you may see yourself falling into an even worse financial situation.

Image Sources:

- https://www.experian.com/blogs/ask-experian/credit-education/score-basics/what-is-a-good-credit-score/

- https://abcnews.go.com/Business/long-improve-credit/story?id=33695732

- https://www.bigstockphoto.com/image-38505232/stock-photo-happy-woman-in-sweater-pointing-down

- https://www.nerdwallet.com/article/loans/personal-loans/5-things-to-know-before-first-loan-application

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.