Guide to the Best No Down Payment Home Loans

Getting a home loan can be one of the most exciting and stressful times in your life, especially when it comes to your financial situation.

Between the down payment, your closing costs, and all the usual fees associated with moving, the cost of your new home mortgage tallies up quickly. Is there a way to avoid some these upfront fees when it comes to purchasing a new home?

Consumers are beginning to question more and more whether it’s possible to find no down payment home loans. These so-called $0 down home loans promise the opportunity for home mortgage options that some individuals would otherwise be unable to afford.

We want to give you a starting point for what should come next if you’re interested in how to buy a house with no money down.

What do you need to do to find and qualify for no down payment home loans? In the coming sections, we’ll uncover which $0 down home loans are available today so you can determine the right fit for you.

See Also: The Best Ways to Get Quick Business Loans | Guide | Fast & Easy Online Business Loans

No Deposit Home Loans and Credit Score

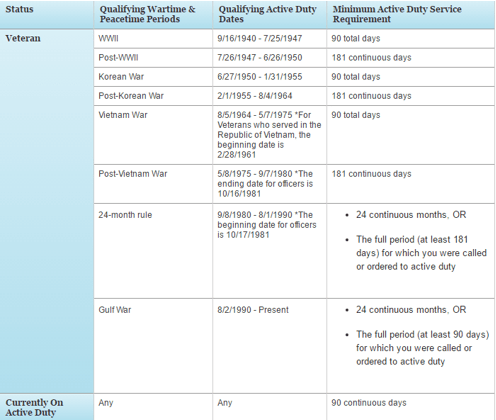

Home mortgage loans have always been picky about what your credit score looks like. Scores that are too low often don’t make the cut when it comes time for final approval.

When you want to buy a house with no money down, the standards can be even stricter depending on which of the no down payment home loans you’re applying for. In fact, experts state that most of the $0 down home loans require a credit score of 620 or higher.

How do you know where your credit score falls? It’s a good idea to find out before you start applying for home mortgage loans of any type. You can start by evaluating the sources that you already have access to.

First, make sure to check your credit report via annualcreditreport.com for accurate information. This could be a quick way to boost your score into an acceptable range for home mortgage lenders if there are inaccuracies you can correct.

Image Source: $0 Down Home Loans

Second, try to find a copy of your credit score itself. Credit card companies will sometimes provide free credit reporting, offering your FICO credit score on your monthly statement. Take a look here before you begin to commit to other avenues. Your FICO credit score is the one most often used by home loan companies to determine approval for no deposit home loans.

If it’s unavailable, you can view alternate versions of your credit score through sites like Credit Sesame and Credit Karma. They will provide you with a score that gives you an approximate idea of where your FICO score might be, along with recommendations and suggestions for ways to improve.

When you go to home loan companies requesting to buy a house with no money down, having your affairs and credit score in order is the easiest way to put your best foot forward. Knowing where you stand in this area can help you to see which loans you qualify for and which ones you don’t, without having to waste time with applications for those out of your reach.

Don’t Miss: Best Personal Loans | Guide | How to Get the Best Cash, Quick, Bank, or Pay Day Loans

VA Loans

One of the most popular sources for $0 down home loans are the home mortgage loans guaranteed through the Department of Veterans Affairs. These loans are guaranteed by a federally-backed program run by the VA, but the no down payment home loans are issued through private lenders. You can find them available through many of the major financial institutions, through online lenders, and through credit unions if you look hard enough.

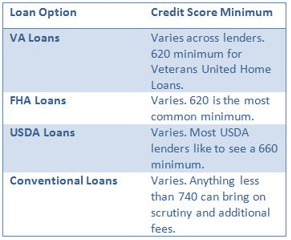

What do you need to do in order to qualify for a VA loan? If you want to buy a house with no money down through these types of no deposit home loans, you have to be either a retired or active duty service member.

This category also includes certain members of the National Guard and the Reserves as eligible for the $0 down home loans. You will have to qualify for a certificate of eligibility, often referred to as a COE.

The requirements for obtaining one of these COE documents are fairly specific, including various time periods, dates, and minimum active duty service requirements.

We’ve included a brief snapshot of these service requirements for the no deposit mortgage program, but you can view the full chart of who is considered an eligible candidate for the no down payment home loans here. Keep in mind that a spouse can also apply if the service member died either in service or due to a service-related disability, is missing in action or is a prisoner of war.

Image Source: VA Loan

The minimum credit score necessary to qualify for no down payment home loans is rather ambiguous. The VA prefers for lenders to review each loan on a case-by-case basis to determine if you qualify for a no down payment mortgage. It only lists the requirements as “suitable credit” and a “sufficient income.” However, other sources claim that there are benchmark scores that most lenders are looking for when you want to buy a house with no money down. The minimum socre that most lenders are looking for is 620.

Image Source: Veterans United

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Advantages and Disadvantages of a VA Home Loan

Some no down payment home loans are rather particular about what you can use a home loan to purchase. Fortunately, one of the many advantages of the $0 down home loans through VA mortgage loan program is the flexibility in purchase options:

- Buying a home or a condo in an approved project

- Building a home

- Purchasing and renovating a home

- Improving a home to be more energy-efficient

- Buying a manufactured home or lot

The upper limits on the home loan program are the same as the Federal Housing Finance Agency’s limits. However, each eligible veteran has a basic entitlement of $36,000, and lenders will often loan up to four times this amount for no down payment home loans.

Unfortunately, the major drawback to these no down payment home loans are the extra fees. Their funding fee is design to offset the cost of allowing you to a buy a house with no money down and no mortgage insurance.

This funding fee is issued on a relatively loose scale, depending on how many times you’ve used the $0 down home loans, what your down payment was, and the types of homes your purchase. For full details regarding what your projected funding fee may come to, take a look at this fee structure. Most range from 1 to 3.3 percent of the home’s value and can be rolled into your loan.

Related: Best Secured Business Credit Cards | Guide | How to Get Secured Business Cards

Navy Federal Home Loan

Along the same vein as the VA home loan, Navy Federal issues a loan that allows first-time homebuyers to buy a house with no money down. Of course, being a member of Navy Federal requires you to meet certain criteria in and of itself (Armed Forces member, DoD, Coast Guard or National Guard and their families).

It offers the option for a no down payment mortgage with its First-Time Homebuyer package. It also include pleasant perks, like free real estate assistance and money back after closing with RealtyPlus, the possibility of waiving private mortgage insurance (PMI), and rate lock or rate match options. Not to mention, you can buy a house with no money down through a fixed-rate mortgage loan or adjustable-rate mortgage loan.

All of its loans come with nationwide availability (as opposed to the USDA loans we’ll cover in the upcoming section), Navy Federal servicing through the lifetime of your loan, and personal guidance from first call to closing.

If you’re having trouble qualifying or finding a lender for the no down payment home loans issued through the VA, Navy Federal’s no down payment mortgage gives you an alternative for home loan companies with great programs.

USDA Mortgage Loan

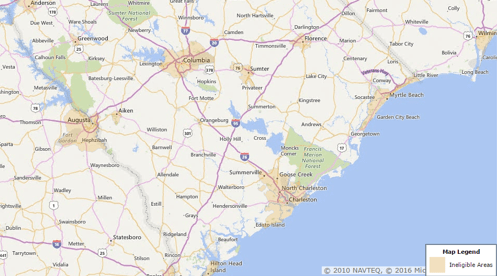

If you want to buy a house with no money down and you have some flexibility in where that home is located, the United States Department of Agriculture (USDA) may have something worthwhile to offer you. Its options are more geared towards low income home loans, and you have to meet stringent criteria in order to qualify. The biggest factor in whether or not you can use one of the USDA no down payment home loans is the eligibility of the property you are interested in.

Most of these homes are in rural areas, as the goal of the USDA Loan program is to help people with low income home loans, no down payment home loans, and ultimately to develop previously undeveloped areas.

That being said, many applicants are surprised to see that even some areas in the suburbs may qualify as no down payment home loans without much of a second thought. Generally, rural areas have a population of less than 35,000 people, but there may be exceptions to this rule as you take a closer look at the property eligibility website.

Image Source: USDA Home Loans

Much like the VA loans, USDA $0 down home loans are not available directly through the USDA. Instead, you must find a lender that offers these loans that are then guaranteed through the USDA. Again, large financial institutions and online lenders alike frequently offer the option of a USDA home loan to cater to the segment of their customer base interested in easy $0 down home loans.

There are two primary types of USDA Loans, known as Single Family Housing Guaranteed and Single Family Housing Direct.

Popular Article: Best Home Loans for People with Bad Credit | Ways to Get Poor or Bad Credit Home Loans

Single Family Housing Guaranteed

Single Family Housing Guaranteed offers low income home loans for those in a low to moderate income household. It is designed to help build, renovate, improve or relocate a home in an eligible rural area (determined by using the property eligibility map found here). The USDA will guarantee 90 percent of the loan in order to give lenders an incentive to risk lending the additional 10 percent for true no down payment home loans.

No down payment home loans through the Single Family Housing Guaranteed Program are relatively easy to qualify for:

- Meet the income eligibility guidelines (calculated through this program that takes your household size and income into account)

- Purchase the home as the primary residence of a US citizen, non-citizen national or qualified alien

- Be legally able to incur a loan

- Be eligible for federal program participation and be willing and able to meet the loan obligations

- Purchase a qualifying property

The benefit to its $0 down home loans is the flexibility you have in spending the funds. There is a lengthy list of what you can do with it, including covering closing costs, repairs, making a house handicap-accessible, essential household equipment, making the home more energy-efficient, installing fixed broadband service, and site preparation costs.

Single Family Housing Direct

The $0 down home loans in this category are geared more towards low and very low income applicants who want to reside in the same rural areas as in the type of USDA loan above. It may even provide homeowners with payment assistance to make their monthly payments more manageable, adjusted depending on family size and income. An income eligibility calculator will take all of those factors into consideration to determine if you are eligible.

However, there are also a few other requirements that each applicant must meet. You must currently be without decent, safe or sanitary housing and unable to obtain loans from other sources that would be able to meet your need for financing. This new home should be your primary residence as a citizen, and you must be legally able to incur a loan obligation as well as being eligible to participate in federal programs.

The no down payment home loans also exclude a few different types of properties from those that would otherwise be considered rural. Getting a home loan through the Single Family Housing Direct Program means that your new property must be less than 2,200 square feet without surpassing the value cap set on the area’s loan limit (different depending on your location). In addition, it cannot have a swimming pool and cannot be designed for income-producing activities.

Conclusion

Home loan companies don’t often advertise all of the options available for getting a home loan with no deposit down.

Fortunately for you, AdvisoryHQ noticed all of the consumer interest swirling around the elusive no down payment home loans and put together this guide of programs to help you get started. It is completely possible to buy a house with no money down if you meet certain criteria or have flexibility in what type of property you purchase.

No matter what your circumstances are, if you’re ready to buy a house with no money down, it is completely possible to do. You’re take a step towards a long investment in your future by purchasing a home, so we can understand your excitement in getting started as soon as possible.

Take the time to evaluate which, if any, of the criteria you meet to qualify for these no down payment home loans. Many of the programs have strict criteria that will only qualify a small segment of the population. Can you qualify for one of these $0 down home loans? If so, getting a home loan may have gotten a whole lot easier.

Read More: OnDeck vs. Kabbage Comparison & Ranking (Kabbage Competitors)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.